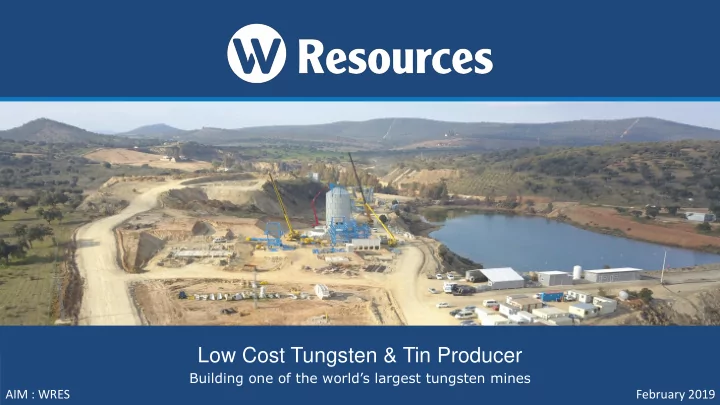

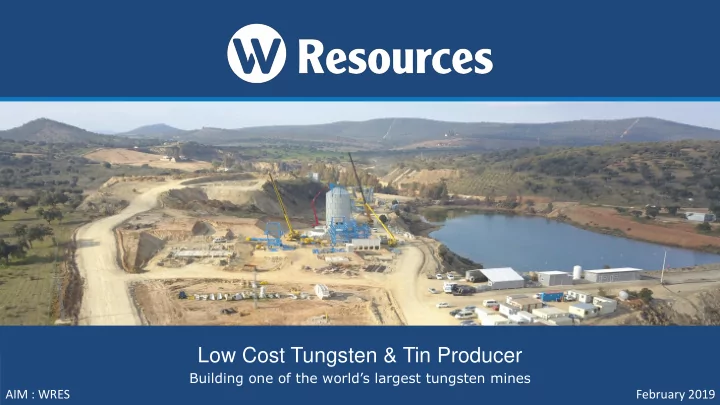

Low Cost Tungsten & Tin Producer Building one of the world’s largest tungsten mines AIM : WRES February 2019

Disclaimer This presentation was prepared by and is the property of W Resources Plc (“W Resources” or “the Company”) . No reproduction or distribution this material is permitted to companies or individuals outside of those for whom this is intended. No agents, brokers or investment banks are authorised to present this material to other parties for the purpose of soliciting potential clients or transactions of any kind without prior consent to do so. While the Company is not aware of any inaccuracies, no warranty or representation is made by the Company or their respective employees and representatives as to the completeness or accuracy of the information contained herein. The Company, JLSI and their respective employees and representatives expressly disclaim any liability for damages, direct or consequential, arising out of or related to this presentation or omissions there from, or any other information provided in writing, orally or otherwise regarding this potential transaction. Any party considering a transaction with the Company agrees to look solely to its own due diligence and any representations, warranties and/or covenants set forth in a fully-executed, definitive written agreement with the Company relative to the transaction. Certain matters discussed in this presentation are “forward -looking statements” . These forward-looking statements can often but not always be identified because the context of the statement will include words such as “the Company expects,” “anticipates” or words of similar import. Similarly, statements that describe the Company’s capabilities, future plans, objectives or goals are also forward-looking statements. Such forward looking statements are subject to significant risks and uncertainties, including the financial performance of the Company and the viability of its technology. These risks could cause actual results to differ materially from those currently anticipated. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can give no assurance that its expectations will be attained. Potential investors, customers, suppliers and other readers are urged to consider this factor carefully in evaluating any forward-looking statements. Forward-looking statements made herein are only made as of the date of this presentation and the Company undertakes no obligation to update such forward looking statements to reflect subsequent events or circumstances. Technical information in this presentation has been prepared and approved for inclusion by Mr Fernando de la Fuente, who is a “qualified person” in respect of the AIM Rules for Companies with over 44 years experience in the Exploration and Mining Geology industry. Mr de la Fuente holds a B.Sc. in Geology and a MSc in Geology from the University of Granada in Spain. He is also a member of the Spanish College of Geologists (Number 49), the Spanish Society of Mineralogy, founder member of the Spanish Society of Geology, member of the Spanish Association of Applied Geology to Mineral Deposits, member of the Society for Mining, Metallurgy and Exploration, Inc., member of PDAC. The press releases relating to the initial announcements of the technical disclosures in this presentation can be found on the Company website (www.wresources.co.uk). The relevant announcement dates are La Parrilla (25 August 2017, with full FID report on website), Régua (27 October 2015) and São Martinho (8 June 2016).The company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and, in the case of estimates of Mineral Resources or Ore Reserves, that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement. 2

Overview Tungsten & tin - production, development & Régua, Portugal: Underground Focus: tungsten mine development - Tarouca, Portugal: Former exploration in Spain & Portugal 1,300 tpa tungsten / tin mine advanced exploration progressing JORC Resource of 5.46mt @ Major Tungsten - La Parrilla, Régua, Tarouca 0.28% WO 3 Projects: Copper Gold - São Martinho, Monforte-Tinoca SPAIN Porto W Resources Management Team +130 years of experience Régua La Parrilla Mine, Spain: Tarouca Open-pit tungsten mine development – 2,700 tpa Michael Masterman - Chairman (“T2”) expanding to > 4,000 Madrid Founding Shareholder & GM - Fortescue Metals Group tpa (“T3.5”) 8 Years - McKinsey & Company JORC Resource of 49mt @ CAA / Portalegre CEO - Po Valley Energy and CFO - Anaconda Nickel 0.100% WO 3 / São Martinho JORC Reserves of 29.8mt Fernando de la Fuente - Country Manager Spain total Lisbon • Monforte- Proven 1.2mt @ Anglo American Corporation Tinoca La Parrilla 0.0995% WO 3 Rio Algom (Rio Tinto) • Probable 28.6mt @ Phelps Dodge 0.0928% WO 3 • Total 29.8mt @ PORTUGAL Aaron Szumilak - Metallurgist & Process Engineer 0.0931% WO 3 Fortescue Metals Group Seville Syncrude Portalegre, Portugal: Composites Innovation Centre CAA - Advanced exploration Monforte-Tinoca, Portugal: São Martinho - 111,987oz Juan Garcia Valledor - La Parrilla Operations Manager Two former copper mines contained gold; significant with prospective tungsten upside Rio Tinto 3 Imerys Groups

Building a world class tungsten company LP Expansion (T3.5 mtpa) La Parrilla (T2 mtpa) Doubles EBITDA to US$40m p.a. • In production • Design embedded in T2 • T2 Complete Mar 2019 • EIA approval 3Q 2019 • Scale production 2Q 2019 • Trial Ore Sorting 2H 2019 Tungsten Tin Growth Low cost $ • Tarouca high-grade producer • Régua production 2019 • New licences 2019 4

La Parrilla - Near Completion / In Production • La Parrilla is being built on schedule and below budget • Production has commenced and will expand to 200 tonnes per month (US$3m p.m) • La Parrilla expansion creates the foundation for substantial EBITDA and value growth Full support from local authorities with a € 5.3m grant • 5

La Parrilla – Key parameters Large Scale Low Cost Long Life 49mt+ US$94/mtu 11+ years Simple Low First Ore European / USA Q1 2019 Offtake > 80% Cost processing 6

Tungsten - Worlds hardest metal with highest melting point One of the hardest man Highest melting point, made materials when lowest vapour pressure of mixed with carbon to form any naturally occurring cemented tungsten metal carbide Auto industry is a heavy Primarily used to make tungsten user - tire studs tungsten carbide for ball joints, brakes, crank cutting tools such as drill shafts & other parts that bits and machining tools see hard usage 7 Source: ITIA – Tungsten End Use Analysis 2017

High demand, tight supply Demand for tungsten Current global tungsten demand is has grown 4% per approximately year for the past 10 80,000tpa (1) years Supply shortages are China consumed 60% expected resulting in of world production in upwards trending 2016, up from 30% in 1996 (2) price 2022 & beyond (1) Source: International Tungsten Industry Association 8 (2) Source: Roskill

Historical pricing European Tungsten APT Price Dec16 to Nov18 LME Tin Price Aug16 to Dec18 US$ per mtu US$ per tonne 22,500 360 22,000 340 21,500 320 21,000 300 20,500 280 20,000 260 19,500 240 19,000 220 18,500 200 18,000 180 17,500 9 Source: Metal Bulletin

Low operating & capital costs Capital Costs - US$m Global Tungsten Production Cost Curve 450 300 250 2018 Average WO 3 Concentrate Price ($325 / mtu) (1) 250 200 La Parrilla 75 150 47 100 50 La Parrilla Barruecopardo Drakelands Núi Pháo 0 SPAIN UK VIETNAM SPAIN % of total output Nui Phao† China Molybdenum China by-product La Parrilla Unit Operating Costs - US$ / mtu China China Drakelands Los Santos 155 Minmetals Jiangxi Tungsten Ind Group Mittersill Chongyi Zhangyuan Xiamen Tungsten Panasquiera China China Source: Argus China 117 (1) Assuming a 20% discount to the 2018 average European APT tungsten price of US$325 / mtu (Source: Metal Bulletin) 94 85 Low Cost Drivers • Scaled and sensible staging • Excellent location • Primary infrastructure already in place • Open-pit mine – limited pre-strip Power connection • Low cost gravity separation circuit 7km to main highway Núi Pháo La Parrilla Barruecopardo Drakelands Quality water supply • “Fit for purpose” plant 10 VIETNAM SPAIN SPAIN UK

La Parrilla - Strategically located Initial Mining Area Operational Tailings Dam Process Plant Infrastructure • 7km from Seville / Madrid highway • Access to quality water supply • Established infrastructure Madrid / Seville • Facilities and on-site laboratory operational Highway • Connected to the Spanish power grid • Short trucking distance from Atlantic & Mediterranean ports 11

La Parrilla - Strategically located Initial Mining Area Crushing Circuit 12

Recommend

More recommend