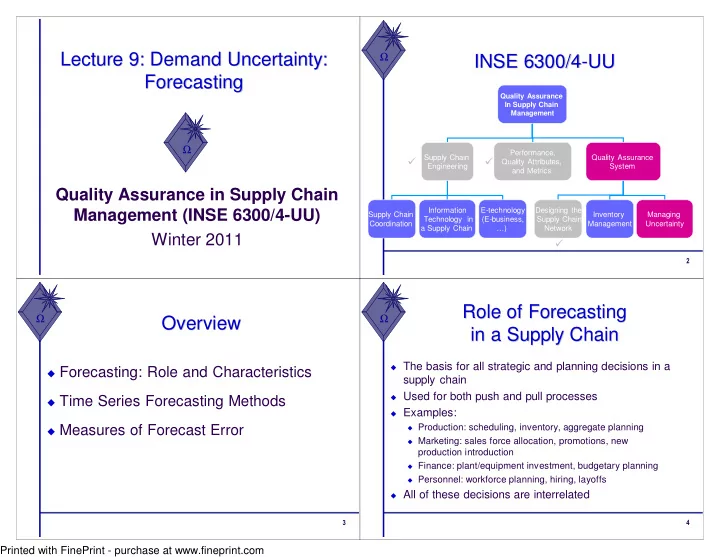

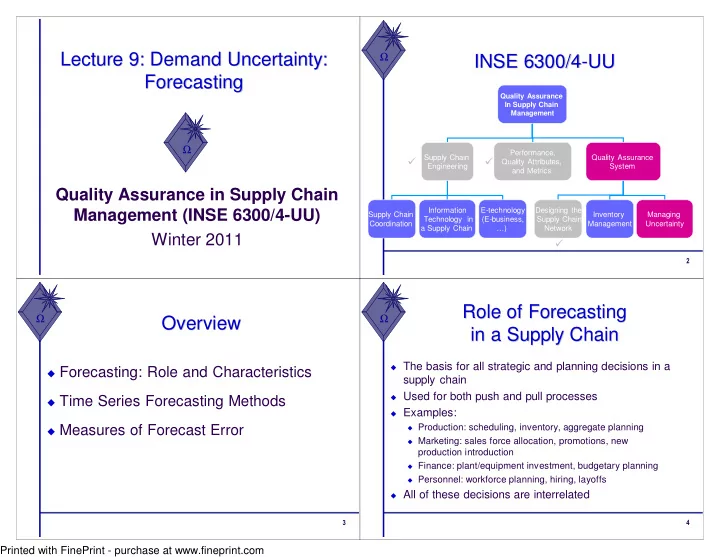

Lecture 9: Demand Uncertainty: Demand Uncertainty: Lecture 9: Ω INSE 6300/4- -UU UU INSE 6300/4 Forecasting Forecasting Quality Assurance In Supply Chain Management Ω Performance, Supply Chain Quality Assurance � � Quality Attributes, Engineering System and Metrics Quality Assurance in Supply Chain Information E-technology Designing the Management (INSE 6300/4-UU) Supply Chain Inventory Managing Technology in (E-business, Supply Chain Coordination Management Uncertainty a Supply Chain …) Network Winter 2011 � � Role of Forecasting Role of Forecasting Ω Ω Overview Overview in a Supply Chain in a Supply Chain � The basis for all strategic and planning decisions in a � Forecasting: Role and Characteristics supply chain � Used for both push and pull processes � Time Series Forecasting Methods � Examples: � Production: scheduling, inventory, aggregate planning � Measures of Forecast Error � Marketing: sales force allocation, promotions, new production introduction � Finance: plant/equipment investment, budgetary planning � Personnel: workforce planning, hiring, layoffs � All of these decisions are interrelated � � Printed with FinePrint - purchase at www.fineprint.com

Ω Ω Characteristics of Forecasts Forecasting Methods Characteristics of Forecasts Forecasting Methods � Qualitative: primarily subjective; rely on judgment � Forecasts are always wrong. Should and opinion include expected value and measure of � Time Series: use historical demand only error � Static � Long-term forecasts are less accurate � Adaptive than short-term forecasts (forecast � Causal: use the relationship between demand horizon is important) and some other factor to develop forecast � Aggregate forecasts are more accurate � Simulation than disaggregate forecasts � Imitate consumer choices that give rise to demand � Can combine time series and causal methods � � Components of an Components of an Basic Approach to Basic Approach to Observation Ω Ω Observation Demand Forecasting Demand Forecasting Observed demand (O) = Systematic component (S) + Random component (R) � Understand the objectives of forecasting � Integrate demand planning and forecasting Level (current deseasonalized demand) � Identify major factors that influence the demand Trend (growth or decline in demand) forecast � Understand and identify customer segments Seasonality (predictable seasonal fluctuation) � Determine the appropriate forecasting technique � Establish performance and error measures for • Systematic component: Expected value of demand (Prediction) the forecast • Random component: The part of the forecast that deviates from the systematic component (Estimation) • Forecast error: difference between forecast and actual demand � � Printed with FinePrint - purchase at www.fineprint.com

Time Series Time Series ٠٠Overview Overview � A time series is a sequence of data points, measured typically at successive times, � � Forecasting: Role and Characteristics spaced at (often uniform) time intervals � Time series analysis comprises methods that � Time Series Forecasting Methods attempt to understand such time series to understand the underlying theory of the data � Measures of Forecast Error points � Where did they come from? what generated them?, � Time series method is used to make forecasts (predictions) � �� Time Series Time Series Time Series Time Series ٠٠� Time series prediction is the use of a model to predict � Once the pattern is established, we can interpret future events based on known past events: and integrate it with other data (i.e., use it in the � To predict future data points before they are measured � Two Main Goals: theory of the investigated phenomenon, e.g., � (a) identifying the nature of the phenomenon represented by seasonal commodity prices) the sequence of observations, � Regardless of the depth of the understanding � (b) forecasting (predicting future values of the time series variable) and the validity of the interpretation (theory) of � Both of these goals require that the pattern of the phenomenon, we can extrapolate the observed time series data is identified and more identified pattern to predict future events or less formally described �� �� Printed with FinePrint - purchase at www.fineprint.com

Time Series Time Series Ω Ω Forecasting Methods Forecasting Methods Time Series Patterns Time Series Patterns � Goal is to predict systematic component of demand � Multiplicative: (level)(trend)(seasonal factor) � Additive: level + trend + seasonal factor � Mixed: (level + trend)(seasonal factor) � Static methods � Adaptive forecasting �� �� Static Methods Static Methods Ω Ω Forecasting Methods Forecasting Methods � Static � Assume a mixed model: � Level, trend, and seasonality do not vary as new Systematic component = (level + trend)(seasonal factor) demand is observed F t+l = [L + ( t + l )T] S t+l � Estimation based on historical data forecast in period t for demand in period t + l � Using the same values for all future forecasts L = estimate of level during period 0 (the deseasonalized � Adaptive demand) � Moving average T = estimate of trend (increase or decrease in demand) � Simple exponential smoothing S t = estimate of seasonal factor for period t � Holt’s model ( with trend ) D t = actual demand in period t � Winter’s model ( with trend and seasonality ) F t = forecast of demand in period t �� �� Printed with FinePrint - purchase at www.fineprint.com

Time Series Forecasting Time Series Forecasting ٠٠Static Methods Static Methods Forecast demand for the Quarter Demand D t next four quarters. II, 1998 8000 III, 1998 13000 � Three steps: IV, 1998 23000 I, 1999 34000 � Estimating level and trend II, 1999 10000 III, 1999 18000 � Estimating seasonal factors IV, 1999 23000 I, 2000 38000 � Estimating the forecast II, 2000 12000 III, 2000 13000 IV, 2000 32000 I, 2001 41000 �� �� Time Series Forecasting Time Series Forecasting Estimating Level and Trend Estimating Level and Trend ٠٠� Before estimating level and trend, demand data must be deseasonalized 50,000 � Deseasonalized demand = demand that 40,000 would have been observed in the absence 30,000 of seasonal fluctuations (each season is given equal weight) 20,000 10,000 � Periodicity ( p ) 0 � The number of periods after which the seasonal cycle repeats itself 2 3 4 1 2 3 4 1 2 3 4 1 , , , , , , , , , , , , 7 7 7 8 8 8 8 9 9 9 9 0 � for demand at Tahoe Salt: p = 4 (average of 9 9 9 9 9 9 9 9 9 9 9 0 demand of p consecutive periods) �� �� Printed with FinePrint - purchase at www.fineprint.com

Deseasonalizing Demand Demand Deseasonalizing Ω Ω Deseasonalizing Demand Demand Deseasonalizing [D t-(p/2) + D t+(p/2) + Σ 2D i ] / 2p for p even For the example, p = 4 is even For t = 3: (sum is from i = t+1-(p/2) to t-1+(p/2)) D3 = {D1 + D5 + Sum(i=2 to 4) [2Di]}/8 = {8000+10000+[(2)(13000)+(2)(23000)+(2)(34000)]}/8 D t = = 19750 Σ D i / p for p odd D4 = {D2 + D6 + Sum(i=3 to 5) [2Di]}/8 (sum is from i = t-[(p-1)/2] to t+[(p-1)/2]) = {13000+18000+[(2)(23000)+(2)(34000)+(2)(10000)]/8 = 20625 The average of demand from period l+1 to l+p is the deseasonalized demand for l+(p+1)/2 �� �� Time Series of Demand Time Series of Demand Ω Ω Deseasonalizing Demand Demand Deseasonalizing �� �� Printed with FinePrint - purchase at www.fineprint.com

٠٠Deseasonalizing Demand Demand Linear Regression Deseasonalizing Linear Regression Then include trend � linear regression is a regression method of D t = L + t T modeling the conditional expected value of where D t = deseasonalized demand in period t one variable y given the values of some other variable or variables x L = level (deseasonalized demand at period 0) T = trend (rate of growth of deseasonalized demand) � Linear regression is called "linear" because Trend is determined by linear regression using the relation of the response to the deseasonalized demand as the dependent variable explanatory variables is assumed to be a and period as the independent variable (can be done linear function of some parameters in Excel) (Tools-Data Analysis-Regression) �� �� Deseasonalizing Deseasonalizing Demand Demand ٠٠Linear Regression Linear Regression In the example, � Input Y Range: C5:C12 � Input X Range: A5:A12 L = 18,439 and T = 524 Y = a + bX �� �� Printed with FinePrint - purchase at www.fineprint.com

Recommend

More recommend