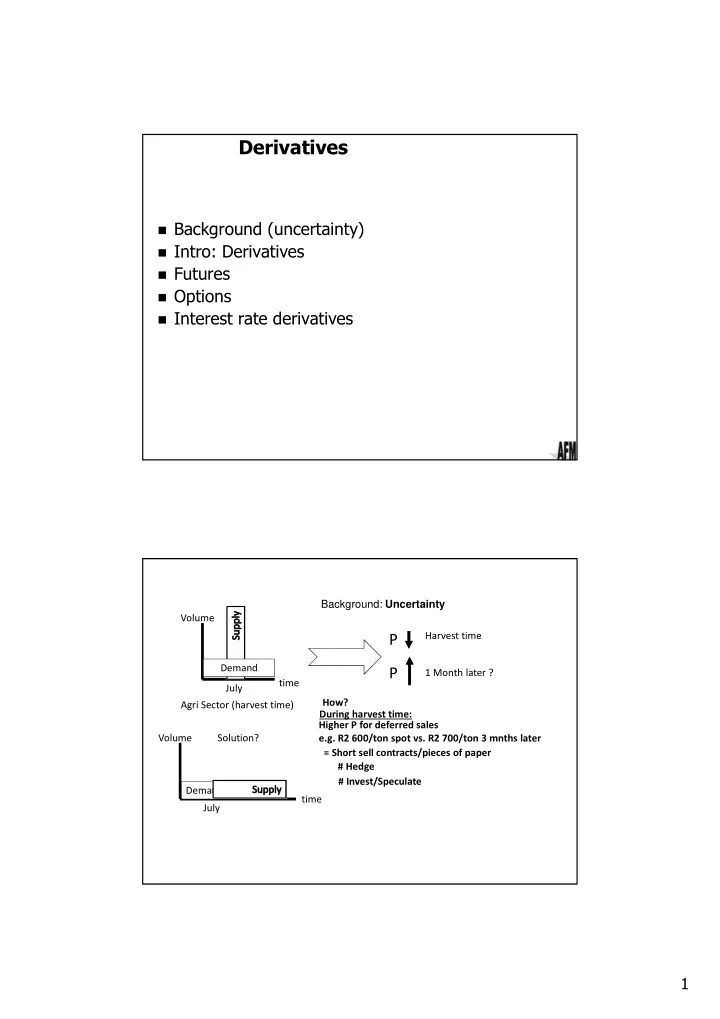

Derivatives � Background (uncertainty) � Intro: Derivatives � Futures � Options � Interest rate derivatives Background: Uncertainty Volume Harvest time P Demand P 1 Month later ? time July How? Agri Sector (harvest time) During harvest time: Higher P for deferred sales Volume Solution? e.g. R2 600/ton spot vs. R2 700/ton 3 mnths later = Short sell contracts/pieces of paper # Hedge # Invest/Speculate Demand time July 1

C A Intro: Derivatives � Defin B D � Long vs. short You are currently @ A & expect (fear) trend A to B for a specific share price Would you go long/short at: • A • B? You are currently @ B & expect (fear) trend B to C for a specific share price Would you go long/short at: • B • C? Repeat the above for expectations/fears about option premiums Repeat the above for expectations/fears about future prices Intro Derivatives � First seller (“issuer”) = short = bearish (or fear that) � Long = bullish (or fear that) � Every long pos. has short pos. � Misconceptions Derivatives � Derivatives uses – Hedging or Investments 2

Intro Derivatives � Future vs. Option St.P Possible trade @ St.P (long decides) FP Definite trade @ FP (long & short) Spot Price Today + e.g. 3 months No cost, but IM (possible VM) OTC = Full Premium (long pays) Listed = Partial Premium via IM � Open positions on maturity => possible/defin trade � Close out prior to maturity => No trades on maturity Futures � Fwd contract with a few “wrinkles” � Pricing General FP CoC Spot P Pricing Ex. 4 Extra question: If the actual FP was R11 000/ fine ounce at the beginning, was it over or under valued relative to FFV? 3

Futures � SSF Example At 10:00 on 1 Feb, Mr Seb went long on 3 BHP futures @ R265/share (spot price = R260/share). At the end of the day the BHP future MTM was R264.50/share . The IM was R2000/contract. 1. Compare the initial capital outlay - underlying vs. futures (ignore V.Margin) on 1 Feb 2. Show his CF on the future on the first day (ignore VM) 3. Say the mkt value of BHP was R278.25 at close out, calculate his overall futures profit (loss) 4. What was his max potential loss on 1 Feb? 5. If he had a short position on 1 Feb, what was his max potential loss? 6. What was his gearing (x times) on 1 Feb? Futures � Index future (newspaper clipping) No delivery = No trade on maturity Calculate exposure for 1 long futures Calculate exposure for 1 short futures 4

Option � Parties Option Writer Holder Short Long Premium � Health warning long party Wasted asset (see pricing) � Calls vs. Puts � Call example (notes) + sketch � Terminology neutral e.g. ITM, OTM, ATM, etc Option � Example 6 � Additional questions � Capital outlay – long 100 Billiton vs. long 100 SBN � Max loss on the above? 5

Interest rate derivatives � Exposure (underlying) = int. rates � To benefit/hedge @ rising int. rates: � Buy FRAs � Buy IRS 6

Recommend

More recommend