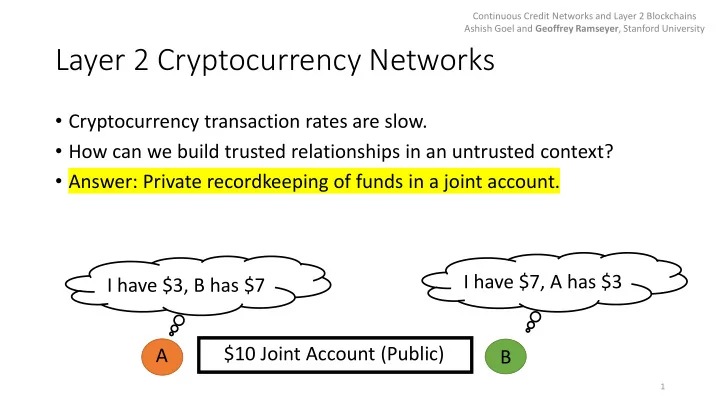

Continuous Credit Networks and Layer 2 Blockchains Ashish Goel and Geoffrey Ramseyer , Stanford University Layer 2 Cryptocurrency Networks • Cryptocurrency transaction rates are slow. • How can we build trusted relationships in an untrusted context? • Answer: Private recordkeeping of funds in a joint account. I have $7, A has $3 I have $3, B has $7 $10 Joint Account (Public) A B 1

Continuous Credit Networks and Layer 2 Blockchains Ashish Goel and Geoffrey Ramseyer , Stanford University Cost vs. Performance in Layer 2 Networks • Agents can run out of money – no network settles every transaction • Larger shared accounts mean higher cost but fewer failed transactions • How can we compare different network structures? I have $10, A has $0 I have $0, B has $10 $10 Joint Account (Public) A B 2

Continuous Credit Networks and Layer 2 Blockchains Ashish Goel and Geoffrey Ramseyer , Stanford University Liquidity in Layer 2 Networks • Model transactions as coming from an external, stochastic process • Hence, network configuration evolves randomly • Induces non-uniform distribution on configurations • Liquidity of a transaction is the chance a transaction is feasible, given this randomness C Can I (A) send money to E in this configuration? 2 B D B:2, D:0 A E 3

Continuous Credit Networks and Layer 2 Blockchains Ashish Goel and Geoffrey Ramseyer , Stanford University Summary of Results 1. Compute liquidity in an efficient manner – via reduction to electrical resistance 2. Efficient configuration sampling algorithm – via reduction to sampling from distribution on a convex set in ℝ 𝑜 3. Liquidity is monotone : Adding edges cannot hurt liquidity (in many cases of interest) – via connection to generating polynomials and Kirchhoff's Laws 4. Results apply to the “Credit Network” model, of which Layer 2 cryptocurrency networks are one instance. 4

Recommend

More recommend