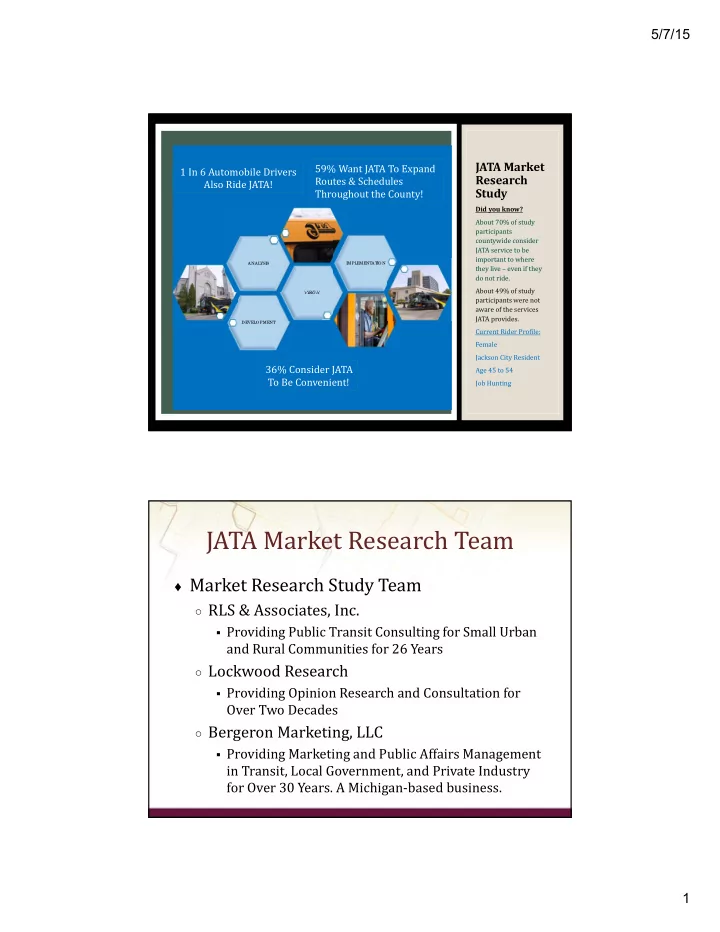

5/7/15 JATA Market 59% Want JATA To Expand 1 In 6 Automobile Drivers Research Routes & Schedules Also Ride JATA! Study Throughout the County! Did you know? About 70% of study participants countywide consider JATA service to be important to where ANALYSIS IMPLEMENT AT IO N they live – even if they do not ride. About 49% of study VISIO N participants were not aware of the services JATA provides. DEVELO PMENT Current Rider Profile: Female Jackson City Resident 36% Consider JATA Age 45 to 54 To Be Convenient! Job Hunting JATA Market Research Team ♦ Market Research Study Team ○ RLS & Associates, Inc. Providing Public Transit Consulting for Small Urban and Rural Communities for 26 Years ○ Lockwood Research Providing Opinion Research and Consultation for Over Two Decades ○ Bergeron Marketing, LLC Providing Marketing and Public Affairs Management in Transit, Local Government, and Private Industry for Over 30 Years. A Michigan‐based business. 1

5/7/15 JATA Market Research Tasks ♦ Initiated in Winter 2014/15 Task Number Task Description 1 Countywide Community Household and Business Survey 2 JATA Passenger Survey 3 Survey Results Report 4 Presentation of Survey Results to JATA Board 5 JATA Community Event – May 7, 2015 STRATEGY & SUCCESS 2

5/7/15 JATA’s Motivation for the Study ♦ Planning and Prioritizing for the Future of JATA ♦ Identifying the Primary and Ancillary Transportation Needs of Jackson Residents, Countywide ♦ Using the Community’s Perspective to Clarify the Focus of JATA Survey Successes ♦ Results are Proportionate to Population Distribution in 37 of 38 Jackson County Census Tracts ○ One Census Tract has 8 Addresses ○ None Participated ♦ Participation via Mail, Internet, and Phone ♦ Valid Passenger Survey Results 3

5/7/15 Survey Questionnaire Formation ♦ Survey Questions were Developed with Input from the Consulting Team and JATA Staff ♦ Pilot Tested ○ January 2015 ♦ Executed ○ February 2‐ March 17, 2015 4

5/7/15 Mixed‐Mode Survey Methodology ♦ Mailing Postcards ○ Toll‐Free Phone Number ○ Paper Survey Mailed Upon Request ○ URL to an On‐Line version of the Survey ○ Stratified Random Sample Telephone Survey ♦ Passenger Survey ○ Trained and Experienced Surveyors ○ Intercepted Passengers at Key Bus Stops ○ Paper Survey Format Number of Participants ♦ Postcards = 922 Approach Responses Completed Surveys On ‐ Line Surveys 688/648 Started/Completed ♦ Random Household Calls = 370 Completed Paper Survey Mailed 178/93 Upon Surveys Request/Completed ♦ Passenger Survey = 397 Completed Toll ‐ Free Phone Number 181 Completed Surveys Random Household 370 ♦ TOTAL: 1,689 Calls On ‐ Board Passenger 316 Survey 5

5/7/15 PASSENGER SURVEY Frequency of Riding JATA 66% OF R ESPONDENTS R IDE JATA 11 OR M ORE T IMES P ER M ONTH (F REQUENT R IDERS ) 19% R IDE 6 TO 10 T IMES / M ONTH 15% R IDE 1 TO 5 T IMES / M ONTH 6

5/7/15 Frequency By Trip Purpose F REQUENT R IDERS U SE JATA FOR A LL P URPOSES One‐Way Commute 30%+ C OMMUTE 45 TO 90 M INUTES 26% C OMMUTE 30 TO 44 M INUTES 28% C OMMUTE 15 TO 29 M INUTES 11% C OMMUTE L ESS THAN 15 M INUTES 7

5/7/15 Distance to Bus Stop 40% L IVE L ESS T HAN O NE B LOCK FROM A B US S TOP 34% T RAVEL 3 OR M ORE B LOCKS TO A B US S TOP Transfers 8

5/7/15 Vehicle Availability Customer Satisfaction Rating Rating Service Topics Service Topics Average Average Bus stops are Close to My Home Hours of Service 4.71 4.06 Sometimes I Miss My Connection Days of Service 3.77 4.37 I Can Quickly Go Where I Want JATA Information is Easy to Find 4.45 4.72 Drivers are Courteous Schedules are Easy to Read 4.68 4.88 Buses are Clean Bus Fares are Reasonable 4.74 4.81 Meets Needs of Rural Residents Buses are usually On ‐ Time 4.46 4.30 JATA is a Valuable Resource Buses come Frequently Enough 5.10 4.62 I Feel Safe & Secure Using JATA 5.06 Overall JATA Service Satisfaction 4.99 9

5/7/15 Top 3 Priorities for 3 Years Response Response Priority Topics Percent Count Extend hours 68% 218 Expand route and schedule in county 58% 187 Expand route and schedule in city 55% 175 Reduce cost ‐ ‐ be more effective 32% 104 Improve quality and on time performance 20% 64 Improve public awareness 17% 54 Improve fleet and facilities 15% 48 Improve information/website/signage 12% 37 Improve safety and security 12% 38 THE PEOPLE OF JACKSON COUNTY 10

5/7/15 Socio‐Economic Characteristics R ESPONDENTS WITH L OWER I NCOME R IDE JATA M ORE F REQUENTLY THAN R ESPONDENTS WITH H IGHER I NCOME R ESPONDENT I NCOME : 18% U NDER $15K 13% ‐ $15K TO $25K 23% ‐ $25K TO $50K 31% ‐ $50K OR M ORE Demographic Characteristics M OST R ESPONDENTS W ERE A GE 35 OR O LDER 11

5/7/15 Socio‐Economic Characteristics Socio‐Economic Characteristics 12

5/7/15 JATA Passenger Profile What Do We Think We Know About JATA Riders? Mostly Female Job Seeking Lower‐Income One‐Person Household IMPORTANCE AND AWARENESS OF TRANSIT 13

5/7/15 Importance of Transit Here 7 Of 10 Consider It Important To Have Transit Services Where They Live Availability of Transit Here 43% OF R ESPONDENTS S AID T RANSIT I S N OT A CCESSIBLE TO T HEM / 36% S AID T RANSIT I S A CCESSIBLE T O T HEM 47% OF T HOSE W HO S AID P UBLIC T RANSIT O PTIONS ARE E ASILY A CCESSIBLE A RE N OT JATA R IDERS 14

5/7/15 Awareness of Reserve‐A‐Ride 51% OF THE S AMPLE W AS A WARE THAT P EOPLE C ALLING JATA P ROVIDES THE T OLL F REE # D EMAND R ESPONSE WERE M ORE T RANSPORTATION L IKELY TO BE A WARE OF THE S ERVICES (63%) P EOPLE O N ‐L INE WERE M ORE L IKELY TO SAY THEY W ERE N OT A WARE OF THE S ERVICE (53%) Sources for JATA Information 4 OUT OF 5 C OUNTY R ESIDENTS D ID N OT R ESPOND TO THE Q UESTION ABOUT S OURCES OF I NFORMATION S UGGESTING A L ACK OF K NOWLEDGE OR T HOUGHT ABOUT W HERE I NFORMATION C AN BE F OUND 15

5/7/15 MOBILITY Transportation Mode 9% W HO W ERE U SING A P ERSONAL A UTO A LSO R ODE JATA 1 TO 5 T IMES IN AN A VERAGE M ONTH 16

5/7/15 Transportation Mode 49% OF THE H OUSEHOLDS THAT U SED JATA B US AND Half of the Households that Used JATA Had No Vehicle in the Household 42% THAT U SED R ESERVE ‐A‐R IDE H AD N O V EHICLE IN THE H OUSEHOLD Transportation Mode JATA B US R IDERS : 43% H AD 1 L ICENSED D RIVER 26% H AD 2 L ICENSED D RIVERS 26% H AD 0 L ICENSED D RIVERS 17

5/7/15 Need for Travel Assistance 74% for Personal Trips 72% Non‐Emergency Medical 25% Work 10% School 17% Other SERVICE RATINGS 18

5/7/15 JATA Service Ratings 8 OF 10 F IXED R OUTE R IDERS ARE S ATISFIED 7 OF 10 R ESERVE ‐A‐R IDE R IDERS ARE S ATISFIED T HE M OST F REQUENT R IDERS WERE ALSO T HE M OST S ATISFIED R IDERS JATA Service Ratings Scale of 1‐5 19

5/7/15 JATA Service Ratings Scale of 1‐5 JATA Service Ratings Scale of 1‐5 20

5/7/15 Likely To Use Reserve‐A‐Ride If It Were Expanded Overall: Most were “Neutral” to “Very Unlikely” to Use Expanded Reserve‐A‐Ride Those who “Never” Ride JATA were “Very Unlikely” (35%) to Use Reserve‐A‐Ride Frequent JATA Riders were “Very Likely” (40%) to Use Reserve‐A‐Ride Those Who Need Assistance were “Very Likely” (40%) to Use Reserve‐A‐Ride PRIORITIES 21

5/7/15 Top 3 Priorities for 3 Years CONCLUSIONS 22

5/7/15 Conclusions ♦ Highest Level of Agreement with the Statement: JATA is a valuable resource for the county. ♦ Lowest Level of Agreement with the Statement: JATA Service meets the needs of rural residents. Conclusions & Recommendations ♦ Support Exists for JATA Service Expansions But It Could Be Strengthened ○ Half of County Residents Do Not Know Enough About JATA to Answer Detailed Questions About Service ○ One‐Third Felt JATA Information Was Easy To Find Many Have Not Sought Out Information 23

5/7/15 Conclusions & Recommendations ♦ If JATA Is Able To Expand, The Information Piece Will Become Even More Important As County Residents Will Need to Know Where and How to Ride Passenger Feedback: Top 3 Priorities for 3 Years Response Response Priority Topics Percent Count Extend hours 68% 218 Expand route and schedule in county 58% 187 Expand route and schedule in city 55% 175 Reduce cost ‐ ‐ be more effective 32% 104 Improve quality and on time performance 20% 64 Improve public awareness 17% 54 Improve fleet and facilities 15% 48 Improve information/website/signage 12% 37 Improve safety and security 12% 38 24

5/7/15 Community Feedback: Top 3 Priorities for 3 Years Questions? Please Ask Questions Throughout the Morning or Call / Email Us Later At Laura Brown, RLS & Associates, Inc. – Project Manager: (813) 482‐8828 or lbrown@rlsandassoc.com Tammy Lockwood, Lockwood Research – Community Survey: tammy@lockwoodresearch.com Ed Bergeron, Bergeron Marketing, LLC – Marketing: Edward.Bergeron@charter.net 25

5/7/15 Breakout Sessions Outside Meeting Rooms: Tables 2 and 10 The Greenery: Tables 6 and 14 26

Recommend

More recommend