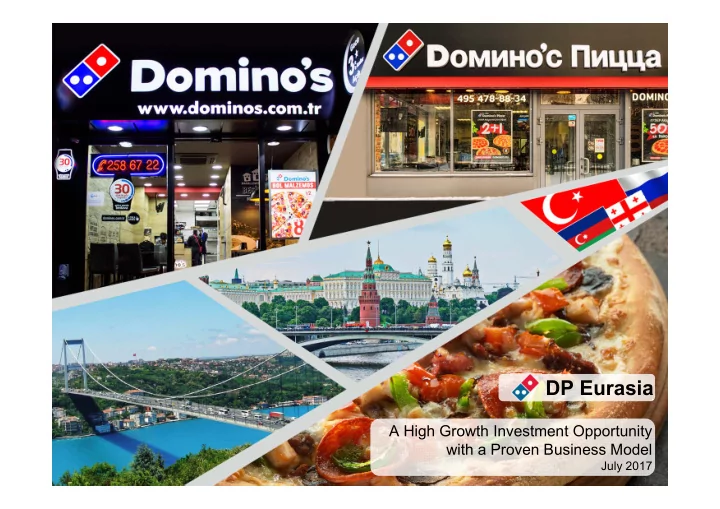

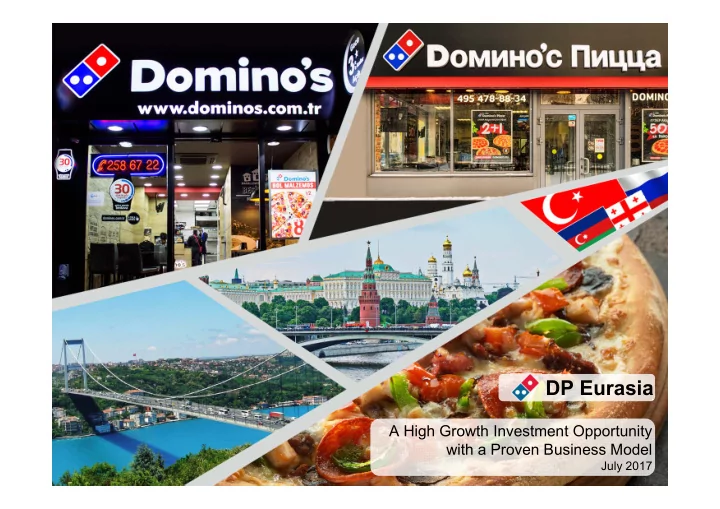

DP Eurasia A High Growth Investment Opportunity with a Proven Business Model July 2017

Disclaimer This Presentation is not an offer to buy or sell any securities. Save where otherwise indicated, the Company is the source of the content of this Presentation and, accordingly, although care has been taken to ensure that the facts stated in this Presentation are accurate and that the opinions expressed are fair and reasonable, no representation, warranty or undertaking, express or implied, is made by any of the Company, any of its directors, officers, employees, affiliates, advisors, shareholders or representatives as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or the opinions contained herein. Neither the Company nor any of its directors, officers, employees, affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this Presentation or its contents or otherwise arising in connection with the Presentation. Certain statements in this Presentation are not historical facts and are “forward looking” statements. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes”, “estimates”, “anticipates”, “expects”, “intends”, “plans”, “may”, “will” or “should” or, in each case, their negative or other variations or comparable terminology. None of the Company, the Shareholders or any of their respective members, directors, officers, employees, agents or advisors intend or have any duty or obligation to supplement, amend, update or revise any of the forward-looking statements contained in this Presentation or to update or to keep current any other information contained in this Presentation. The information and opinions contained in this Presentation are provided as at the date of this Presentation and are subject to change without notice. As a result, you are cautioned not to place undue reliance on such forward looking statements. 2

SECTION 1 Overview

DP Eurasia is a member of successful global network • With 571 stores across its network, DP Eurasia is the 5th largest master franchisee within the global Domino’s system and is consistently one of the best performing master franchisees globally • Domino’s is one of the most successful fast food brands and the global leader of home delivery with US$ 10.9 Bn sales in 2016 and 13,811 stores in 85 countries with 92 consecutive quarterly positive LfL internationally The four listed international Domino’s master franchisees have created 146% (8) shareholder value in the US$ terms in the last five years • The largest Domino's master franchisees worldwide Global presence of Domino's 5 largest master franchisees Domino’s Pizza Domino’s Pizza Jubilant Alsea DP Eurasia Enterprises Group (9) FoodWorks (10) Australia Mexico Belgium Colombia Turkey France UK Spain India Russia Countries Netherlands Ireland Argentina Sri Lanka Azerbaijan Germany Switzerland Chile Georgia New Zealand Brazil Japan Population 331 MM 491 MM 78 MM 1,349 MM 240 MM Served (1) Domino’s Pizza Major Starbucks Domino’s Pizza Portfolio Domino’s Pizza Burger King Domino’s Pizza Domino’s Pizza Dunkin’ Donuts Brands Vips Other (2) Domino’s 2,048 941 1,013 1,127 571 Store # (3) Other - 2,294 - 60 - Store # (3) Market $3,783 MM $3,051 MM $2,038 MM $952 MM n/a Cap (4) L5Y Share Price 49% 34% 18% (5%) n/a Domino’s Pizza Enterprises Domino’s Pizza Group (9) CAGR (5) Alsea System $1,431 MM $2,022 MM $1,364 MM $369 MM $215 MM Jubilant FoodWorks (10) DP Eurasia Sales (6),(7) EBITDA (7) $131 MM $277 MM $127 MM $44 MM $25 MM 4. Ordered by market cap as of 2 June 2017 5. As of 2 June 2017, in local currencies Source: Company Information for DP Eurasia, Annual Reports for Other Companies, CapIQ, 6. Group system sales as of latest financial year reported by the company. Total income figure used for Jubilant EIU via S&P Global Market Intelligence FoodWorks. 2016 figure for DP Eurasia Notes : 7. Converted at average FX rates of each companies’ 2016 financial year respectively– USDTRY of 3.01, USDINR of 1. Population figures for Belgium, Brazil, Colombia, France, Germany, Japan, Netherlands are 2016 actual and the rest are 2016 estimates 65.40, USDAUD of 1.37, GBPUSD of 1.36, USDMXN of 18.64. Adjusted EBITDA figure for DP Eurasia 8. Shareholder value represent the period between 2 June 2012 and 2 June 2017 2. Includes Chili’s, California Pizza Kitchen, P.F.CHANG’S, Pei Wei, Italianni’s, The Cheesecake Factory, El PorTon, Foster’s 9. Domino’s Pizza Group also has investments in Domino’s Iceland, Domino’s Sweden and Domino’s Norway Holywood, Canas y Tapas, Archie’s, Lavaca 4 3. As of December 2016 for Domino’s Pizza Enterprises, May 2017 for Jubilant FoodWorks, December 2016 for Domino’s (which will be consolidated once acquisitions of controlling interests is completed) Pizza Group, March 2017 for Alsea, March 2017 for DP Eurasia 10. Jubilant FoodWorks also has the exclusive rights to operate Domino’s Pizza brand in Bangladesh and Nepal

DP Eurasia overview Growing regional expansion from an established strong base in Turkey (1) … …combined with strong growth in System Sales… TRY MM Moscow 5 71 647 Russia 543 470 199 160 Georgia 3 Turkey 4 x4 2014 2015 2016 Q1 2016 Q1 2017 347 141 Azerbaijan Franchise stores Corporate stores Commissaries Source: Management Accounts …resulted in accelerating Adjusted EBITDA (3) performance DP Turkey DP Russia TRY MM Market Position ‘16 5% 6% 12% 10% 11% #1 #1 #1 #3 (by number of stores) Number of Stores Q1 ’17 488 4 3 76 75 Corporate 141 - - 71 Franchise 347 4 3 5 34 25 21 Number of Commissaries Q1 ‘17 4 - - 1 15 System Sales 13% 96% CAGR ‘14-’16 2014 2015 2016 Q1 2016 Q1 2017 Average LfL (2) 6% 40% ‘14-’16 Adj. EBITDA Margin (Adj. EBITDA / System Sales) Source: Company Information, Management Accounts Source: IFRS Combined and Consolidated Financial Information, Management Accounts Notes : 1. Number of stores as of Q1 2017 2. LfL calculation includes stores which are operational for more than 52 weeks and aren’t considered as split stores for the underlying period. Arithmetic average of non-split LfL for 3 years (’13-’14, ‘14-’15 and ’15-’16); excluding Azerbaijan and Georgia due to no LfL stores in the period 5 3. Adjusted for activities that are not part of the normal course of business and are non-recurring including share-based incentives, IPO costs and severance costs for Turkey and Russia

SECTION 2 Key Investment Highlights

Attractive investment opportunity with high growth potential and proven business model 1 Leading market positions 2 Highly attractive, underpenetrated markets with substantial growth potential in the Group’s addressable segments 3 Strong online capabilities underpin DP Eurasia’s growth 4 Globally proven business model successfully applied and adapted to DP Eurasia’s local markets 5 Simple and scalable, asset-light business model 6 Highly attractive customer proposition and strong brand equity 7 Track record of resilient and profitable growth as well as strong cash conversion 8 Founder-led, experienced management team 7

Leading market positions 1 Turkey Benefits of wide store Leading the pizza market, Domino’s… …having increased market share significantly network Chained pizza in Turkey, number of stores, Q1 2017 Chained pizza in Turkey, market share by value 488 4x larger than #2 player 30 minute delivery guarantee 119 86 85 77 38 32 20 16 p.p. Lower purchasing cost increase 51% Operating leverage Source: DP Turkey Company Information on Competitors …is #2 player in the fast food market… 35% Comprehensive area Number of stores, Q1 2017 coverage 587 488 Well-invested infrastructure 253 168 119 113 90 85 Superior technology compared to competition 2010 2016 Source: DP Turkey Company Information on Competitors Source: Management estimates based on Turkstat, Euromonitor International, EIU via S&P Global Market Intelligence Delivery focused players 8

Leading market positions (cont’d) 1 Russia DP Eurasia has become a strong challenger …increasing market share significantly over Benefits of wide store to the top 2 players… the last couple of years network Chained pizza in Russia, number of stores Chained pizza in Russia, market share by value 6.2x 167 140 123 1.6x 30 minute delivery guarantee 117 4.0x 98 86 76 2.1x 62 49 27 23 19 Lower purchasing cost 3.6x increase in market share ‘14 Q1’17 ‘14 Q1’17 ‘14 Q1’17 ‘14 Q1’17 ‘14 Q1’17 ‘14 Q1’17 9% Operating leverage Source: DP Russia Company Information on Competitors …and is the largest pizza player in Greater Moscow (1) … Comprehensive area coverage Number of stores, Q1 2017 76 Well-invested infrastructure 52 2% 41 38 Superior technology compared to competition 2014 2016 Source: DP Russia Company Information on Competitors Source: Euromonitor International Notes : Delivery focused players 1. Includes Moscow and Moscow regions 9

Recommend

More recommend