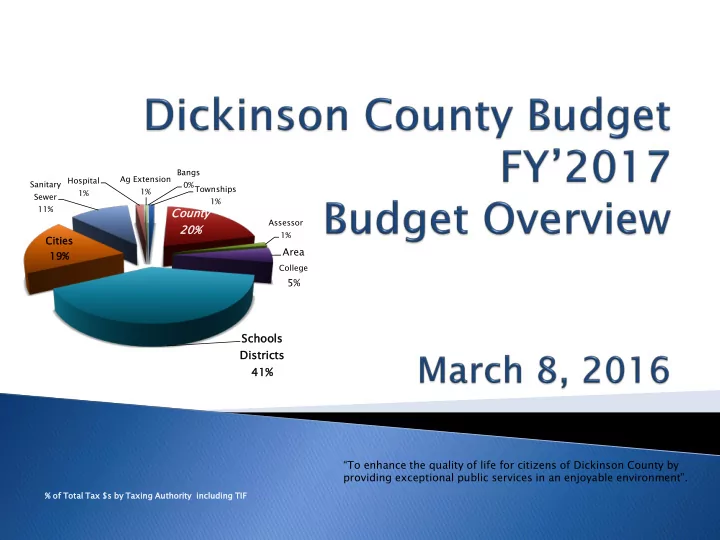

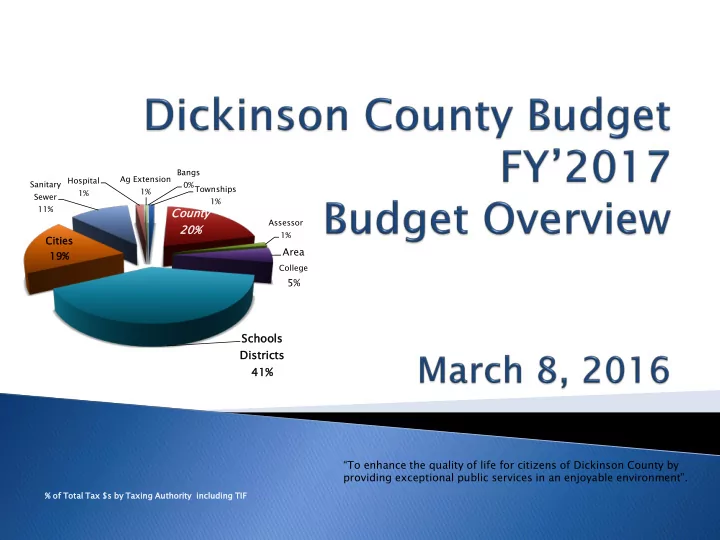

Bangs Ag Extension Hospital Sanitary 0% Townships 1% 1% Sewer 1% 11% Count unty Assessor 20% 20% 1% Cities Area 19% 19% College 5% Scho hools Dist strict cts 41% 41% “To enhance the quality of life for citizens of Dickinson County by providing exceptional public services in an enjoyable environment”. % of Total al Tax $s by Taxing g Auth thority ty including TIF

Page year - chart Index dex Title Page General Fund Expense & 1. 28. Revenues Index 2. Utility Expenses - chart FY 2017 017 29. Positive Impacts 3. Rural Basic Fund 30. Negative Impacts 4. Budget dget Rural Fund Expense & Legislation concerns 31. 5. Revenues - data Taxable Valuation data – 6. Rural Basic Expense & Presen entat atio ion: 32. history to present Revenue by Type by Year – Taxable Valuation graph chart 7. Taxable Values by Property Secondary Road Expenses 8. 33. Class Secondary Road Revenue 34. Taxable Values in TIF 9. State Reports 35. Districts Budget Revenue Sources 36. TIF Districts map – color 10. coded by city and county Budget Expense Uses 37. Ending fund balances by Explanation of Expenditure 11. 38. Fund by Yr. – data & graph Use Categories Fund Balances – all funds Notice of Public Hearing- 12. 39. except LMI & UR State Form Budget requests/ Levy Rates & Dollars Levied 13. 40. Discretionary funding Tax Levy Rates – Data 41. Payroll & Benefits 14. Tax Levies – Chart 42. Wage increases 15. Tax Dollars Levied - Data 43. Payroll history by dept by 16. Tax Dollars Levies – Chart 44. fund – data Assessed Value vs. Taxable 45. Payroll history totals chart 17. Lowest 10 Countywide levies 46. Payroll - General Fund by 18. in the State dept - chart Highest property taxes in the 47. Health/Dental Insurance cost 19. State history by fund - data Budget & Levy Goals 48. Health/Dental Insurance 20. costs all funds – chart Budget Levy Results 49. Property Tax Calculation – General Services expenses by 50. 21. Residential year - data General Fund Expenses by Budget Savings for 22. 51. Consideration Dept by Year - data General Fund Expense by Fiscal Cliff perspective 52. 23. Dept by Year – chart Your County Piece of the Pie 53. General Fund Revenue by 24. Type by Yr. – Data & Charts General Fund Expenses vs. 25. Rev. – chart Courthouse General Services 26. General Services expenses by 27. 2

Positive itive impac pact on n the propo posed sed 201 017 Budge get: Taxable Valuations increased by $194,270,164 for FY17. The Urban area had additional growth of $98,528,150. The Rural area had additional growth of $95,742,014 in taxable value. FY16 is forecasted to end with $312,837 more carryover than was budgeted. $10,758,800 gross valuation increased due to the wind turbine value phase in (5% increase per turbine per yr. until it reaches 30% of the total value). The 29 turbines owned by Flying Cloud Partnership have been at 30% since 2010. The 7 turbines owned by Iowa Lakes Electric & the 61 turbines owned by Lost Lakes Wind Farm are both at 25 %. Sourc rce – Assessor r & Dept Dept 3 of Manage gement

Negativ gative e impact pact on n the e propo posed sed 2017 017 Budget dget: 2017 General Fund budgeted to spend $605,196 more than revenues collected. TIF Districts have increased by $18,849,305 Mental Health Property tax dollars are still capped at the 1997 property tax dollars. The County health insurance rates increased by 15% even after a 5% wellness credit was earned by the insured employees. Commercial/Industrial realty decreased in taxable value because of the new commercial rollback of 86.25%. The State is supposed to reimburse the Counties for the lost revenue. The rumor is that those State funds will be used for something other than the reimbursement to the Counties. Sourc rce – Assessor r & 4 Budge get t mtgs,

Legisla gislatio ion of Inter teres est: t: Property Tax Reform: Reform 1 of the bill creates a new property tax credit for commercial, industrial and railway properties. The credit is applicable to taxes due and payable after 7/1/14. There is to be reimbursement from the State . Reform II reduces the permissible taxable valuation from 4% to 3% in addition to implementing a rollback of 95% for assessment 2013 year and 90% in 2014 assessment yr., then an additional 3.75% each year thereafter until 2022, There is to be reimbursement from the State . Reform III creates a new classification for multi-residential property. This classification will have the same roll-back as residential and no reimbursement from the State. Reform IV provides for a property tax exemption of a specified amount of the 2014 assessed value of telecommunications property – No replacement for these lost dollars Road and Bridge Funding HF2241: Requires County Engineers and the DOT to provide an annual report on the use of road use tax fund moneys to replace or repair structurally deficient bridges under county jurisdiction. Mental Health: SF2125 – Ending Medicaid Manage Care SF2236 – Change in the county funding of mental health Water Quality District HF 2339: An act allowing benefited recreational lake districts and water quality districts to become member of watershed management authorities. Water Quality Funding HSB601 succeeded by HF2382: An act relating to water quality by providing funding for water quality financial assistance programs, extending the period of time for collecting sales tax for deposit in the secure and advanced vision for education fund and modifying allocation of state sales and use tax revenue collections. Governor’s SAVE for the Future supporting our Education Infrastructure & Water Quality Efforts: Current Law: The Secure an Advanced Vision for Education (SAVE) program was enacted on July 1, 2008. These dollars are currently being utilized for school infrastructure needs & school district property tax relief. The SAVE fund expires on December 31, 2029. SAVE funding has provided Iowa school districts with more than $3.2 billion for school infrastructure since 2008. By sharing SAVE funding growth, this plan will provide a long-term source of funding for school infrastructure and water quality and will not raise taxes. 10 Cent Redemptions HSB 507 (Died first Funnel): An act relating to the refund values paid upon return of beverage containers. Bottle Bill Repeal HSB 510 (Died first Funnel): An act repealing the beverage containers control program Source – ISAC Update date newslette tters 5

Taxa xable ble Valua luatio tions s by Year Taxable Valuations over the years in Dickinson County (including gas & electric utility valuations) Tax Year Total County Value Rural Value TIF Value FY 2006 1,174,367,658 512,681,973 165,378,028 FY 2007 1,419,639,922 597,753,797 175,790,806 FY 2008 1,398,707,166 606,306,251 242,344,129 FY 2009 1,696,352,409 685,121,863 237,161,803 FY 2010 1,822,067,565 721,958,073 213,205,100 FY 2011 1,880,416,906 769,769,752 253,482,869 FY 2012 1,971,065,942 806,166,480 234,133,212 FY 2013 2,058,974,077 827,590,691 228,414,996 FY 2014 2,148,369,605 869,574,608 236,810,349 FY 2015 2,205,566,281 895,966,063 242,701,141 FY 2016 2,269,335,385 923,754,145 231,137,706 FY 2017 2,444,756,244 1,028,217,326 249,987,011 Source – Dept t of Man anag agement 6

Dick ckin inson son Cou ounty ty Proper erty ty Tax axabl able e Valuat luatio ions ns by year incl cluding g gas s & elec c utilities es 3,000,000,000 Countywi wide de Value, , 2,444,756,2 ,244 2,500,000,000 2,000,000,000 Urban an Value, , 1,416,538,9 ,918 1,500,000,000 Rural l Value, , 1,028,217,3 ,326 1,000,000,000 500,000,000 TIF Value, 249,987,011 0 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 Source – Dept t of Man anag agement 7

FY 2017 017 Tax axabl able Valua luatio tions s by Class ss Railroad oad Utiliti ties s Mulire ireside sident ntial ial 0% 0% with thou out t Indus ustrial rial g & e g Other 1% 1% Commercia cial 1% 1% 0% 0% 4% 4% Militar tary y Exempt ption on 10% 10% 0% 0% Agric icult ultural ural Blds 0% 0% Agric icult ultural ural Land 9% 9% Reside ident ntia ial l Propert rty 75% 75% Significan ant t changes from om FY16 Reside denti tial increased d by $142.8M Ag Land d increased d by $21.8M Comm mmercial al decreased d by $23.8M New Multi ti-residenti tial value $32.6M Total Taxable Value increased d by $194.2M Source – Dept t of Man anag agement 8

Recommend

More recommend