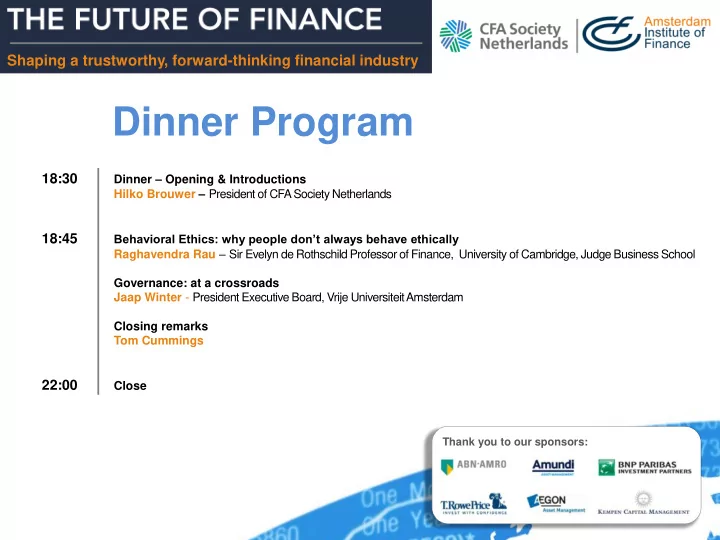

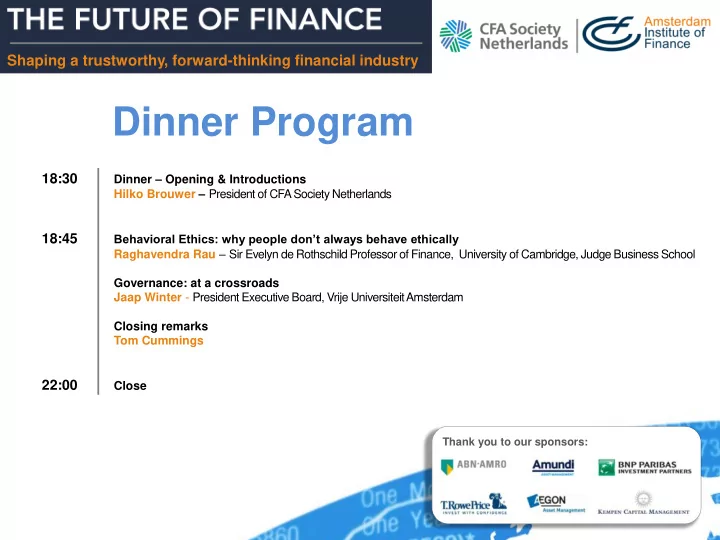

Shaping a trustworthy, forward-thinking financial industry Dinner Program 18:30 Dinner – Opening & Introductions Hilko Brouwer – President of CFA Society Netherlands 18:45 Behavioral Ethics: why people don’t always behave ethically Raghavendra Rau – Sir Evelyn de Rothschild Professor of Finance, University of Cambridge, Judge Business School Governance: at a crossroads Jaap Winter - President Executive Board, Vrije Universiteit Amsterdam Closing remarks Tom Cummings 22:00 Close Thank you to our sponsors:

GOVERNANCE AT THE CROSS-ROADS

THREE THEMES • Persistent governance themes for public companies Shareholders and (lack of) engagement • • Board performance • Regaining trust 3

SHAREHOLDERS DID NOT DISCIPLINE MANAGEMENT • Walker Review UK, European Commission: Lack of disciplining by shareholders contributed to excessive risk taking • More engagement needed • Really? • Shareholders push risk taking, believing they can hedge by diversifying • Company cannot hedge in same way • Recent proposal Shareholder Rights Directive to stimulate engagement,voting, disclosure of asset management arrangements 4

WHY ENGAGEMENT BY INSTITUTIONAL INVESTORS IS A MYTH • Excessive diversification (way beyond level relevant for reducing risk) • Prudent person: no concentration • Follow the market • Solvency rules, debt over equity • Excessive focus on liquidity • Mark to market of liabilities • Cognitive bias • Intermediation separates owners from assets • Fiduciary duty: don’t underperform • Better conventionally wrong than unconventionally right • No interest in engagement, unless cheap and effortless (OECD) • Forcing engagement useless (proxy voting) 5

UNDERSTANDING BOARD PERFORMANCE • Dominant paradigm agency theory • Shareholders principals, managers agents • Non- executives’ key role is to monitor agents • Independence • Expertise • Diversity Nr of board seats • • Incomplete grasp of board performance • Understanding uncertainty • Navigate • Direct and adapt • Key issue on boards in US (Lorsch) and EU (Van de Loo/Winter): roles of non-executives not clear 6

BOARD PERFORMANCE: INSIDE THE BLACK BOX • Clarifying roles through organisational role analysis, incl revealing (unconscious) perceptions • Focus on interaction between executives and non-executives • Board Reality Questionnaire • Group Dynamics • Biases • Group think • Personal traits • Looking good • Generating sense of responsibility, in action • Way beyond grasp of regulation 7

REGAINING TRUST • Knee-jerk response post crisis: regulate more • More and more rules make us less and less responsible • Barry Schwarz: more and more rules chip away our moral skills (and more and more incentives destroy our moral will) • Absolute horror: EBA and ESMA to develop technical standards for honesty and integrity (CRD IV) • What then? • Need to develop (learn again) conversations that reinforce personal access to morality, judgement and responsibility 8

TWO CONCEPTS GENERATING REAL CONVERSATIONS AND JUDGEMENTS • Virtue ethics • Aristotle • MacIntyre (After Virtue) • Virtues: acquired human qualities needed to achieve internal goods of a human practice and protect against domination of external goods • Requires reflection and judgement, not routinely following rules • Integrity honour your word, also when you will not keep it • Not normative, but about effectiveness, how to make our word work • Requires reflection: what is my word? What does it require now? Conversation without attack and defence 9

IT’S ALL ABOUT PRACTICE • Aristotle Practicing virtues • • Thomas Aquinas • Practicing prayer • Peter Sloterdijk • Anthropotechnik Denn da ist keine Stelle, die dich nicht sieht. Du musst dein Leben Ändern (Rilke) 10

Recommend

More recommend