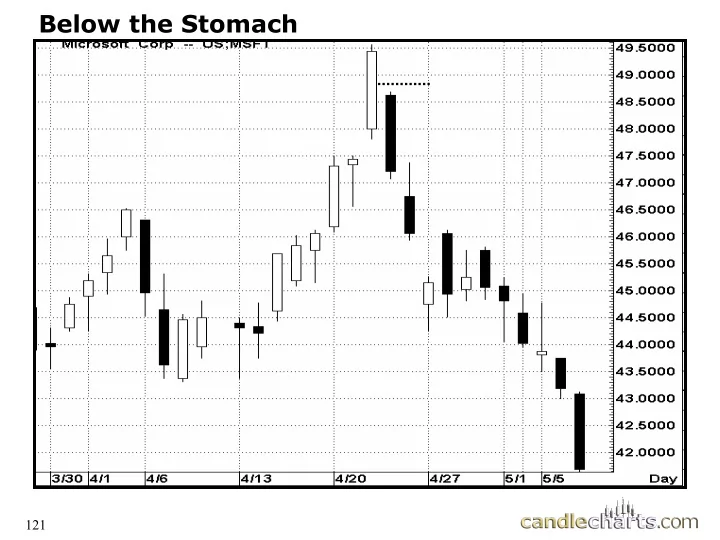

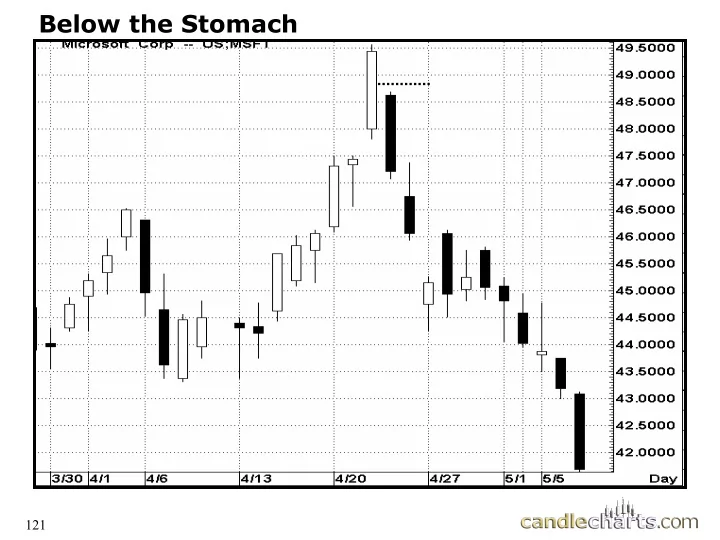

Below the Stomach 121

Counter Attack Lines close close Bearish Bullish Bearish Bullish 122

Not Counter Attack Lines Second session did not open high enough Both sessions were not long real bodies 123

Bullish Counter Attack 124

Volume – Counter Attack 125

Bullish Counter-attack First sign of a turn was bullish counter- attack 126

Convergence of Clues- Counter Attack Bearish counter Bearish engulfing attack pattern doji 127

Bearish Counter-attack Counter- attack also confirming resistance Why does this candle hint bears’ are not in complete control in spite of the large price drop? What happened the next session? 128

The “Phantom” method The “Phantom” method What was support before this session? 129 129

Phantom method Phantom method 130

Phantom Phantom 131

Phantom method – – where’s R1? where’s R1? (slide 1 of 2) Phantom method (slide 1 of 2) 132

Phantom method (slide 2 of 2) Phantom method (slide 2 of 2) 133

Using Candles in a “Box” Range 134

Box range Box range Do the bears or bulls have the greater control? 135

Box Range Box Range Do the bears or bulls have the greater control? 136

Intraday Techniques Intraday Techniques Intraday Techniques Intraday Techniques � Flexibility reading candle signals � Combining intraday signals with longer time frame support or resistance. � Harnessing intraday charts for signals not available on daily charts 137

Bearish engulfing pattern and Intraday charts We are less strict with the definition of some patterns on intra-day charts. Classic bearish engulfing pattern has open above prior session close. With intraday open can = prior close. 138

Intra-day candle patterns Although open and al close are the same, view this as dark cloud Bullish engulfing pattern Open and closings are about the same, still view this as a morning star 139

Windows on intraday Most intraday windows will be between the last candle yesterday and the first candle today 140

Recommend

More recommend