Analysis of system level market power Amelia Blanke Manager, - PowerPoint PPT Presentation

Analysis of system level market power Amelia Blanke Manager, Monitoring & Reporting Department of Market Monitoring Market Surveillance Committee Meeting General Session June 7, 2019 ISO PUBLIC ISO Public DMM analysis of structural

Analysis of system level market power Amelia Blanke Manager, Monitoring & Reporting Department of Market Monitoring Market Surveillance Committee Meeting General Session June 7, 2019 ISO PUBLIC ISO Public

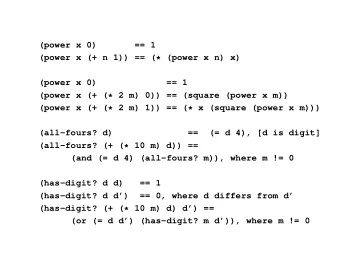

DMM analysis of structural market power Hours with RSI < 1 (2018) A/S bids without energy removed With Without virtual supply virtual supply Input bids Transmission losses Self-scheduled exports A/S bids without energy bids No No Virtual supply No RSI 1 < 1 5 34 RSI 2 < 1 18 100 RSI 3 < 1 45 305 Comments on CAISO’s Analysis of Structural System-Level Competiveness, Department of Market Monitoring, May 20, 2019 http://www.caiso.com/Documents/DMMComments-SystemMarketPowerAnalysis.pdf ISO Public Page 2

DMM analysis of structural market power updated to include ancillary service bid segments without overlapping energy bids. Hours with RSI < 1 (2018) A/S bids without energy removed A/S bids without energy not removed With Without With Without virtual virtual supply virtual supply virtual supply supply Input bids Transmission losses Self-scheduled exports A/S bids without energy bids No No Virtual supply No No RSI 1 < 1 5 34 5 31 RSI 2 < 1 18 100 17 91 RSI 3 < 1 45 305 43 272 ISO Public Page 3

Average net cleared virtual bids in 2018 8,000 Virtual supply (cleared) Virtual supply (offered) Virtual demand (cleared) Virtual demand (offered) Net virtual (cleared) 6,000 4,000 2,000 MW 0 -2,000 -4,000 -6,000 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 ISO Public Page 4

Analysis of uncompetitively high priced supply and “almost” self -scheduled exports. Average hourly MW of high price supply and exports during 272 hours with RSI3 < 1 High priced supply (MW) High priced Total high priced Import Import AS Total supply exports (MW) supply + exports Gas PDR/RDR Bid price range energy $1000 to $990 404 67 58 17 545 198 744 $1000 to $750 614 137 71 17 839 232 1,071 $1000 to $590 665 146 118 17 946 264 1,210 ISO Public Page 5

Market competitiveness – 2018 Annual Report • CAISO’s energy markets were generally competitive in 2018. • Prices in the day-ahead market were significantly in excess of competitive levels in some hours when net load that must be met by gas-fired units is highest. • Market for capacity needed to meet local requirements is structurally uncompetitive in all local areas. 2018 Annual Report on Market Issues and Performance , DMM. http://www.caiso.com/Documents/2018AnnualReportonMarketIss uesandPerformance.pdf ISO Public Page 6

Net sellers supply bids vs. default energy bids for gas units (July 24, 2018 hour 20). $1,000 Day-ahead bid price $900 Default energy bids $800 $700 Price ($/MWh) $600 $500 $400 $300 $200 $100 $0 -$100 -$200 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 Cumulative incremental MW ISO Public Page 7

Net buyers supply bids vs. default energy bids for gas units (July 24, 2018 hour 20). $1,000 Day-ahead bid price $900 Default energy bids $800 $700 $600 Price ($/MWh) $500 $400 $300 $200 $100 $0 -$100 -$200 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 Cumulative incremental MW ISO Public Page 8

Price-cost markup based on system marginal prices with cost-based bids for gas units (2018) $90 System marginal energy cost Base-case Load-weighted average price ($/MWh) $80 Competitive scenario (gas at minimum of DEB, bid-price) $70 $60 $50 $40 $30 $20 $10 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 ISO Public Page 9

Average hourly price-cost markup is highest in evening ramping hours (HE 17-21). $3.0 2017 2018 $2.5 Price-cost-markup ($/MWh) $2.0 $1.5 $1.0 $0.5 $0.0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 ISO Public Page 10

Duration curve of highest hourly price-cost markups $140 2018 price-cost markup ($/MWh) $120 Price-cost markup ($/MWh) 2017 price-cost markup ($/MWh) $100 $80 $60 $40 $20 $0 0 50 100 150 200 Hours ISO Public Page 11

Markup based on highest cost gas-fired unit dispatched each hour in day-ahead market (2017-2018). $700 2018 Price-cost markup ($/MWh) $600 2017 Price-cost markup ($/MWh) $500 Price-cost markup ($/MWh) $400 $300 $200 $100 $0 0 50 100 150 200 Hours ISO Public Page 12

Comparison of competitive baseline price with day- ahead prices (using day-ahead market software). $90 Competitive scenario - gas at DEBs $80 Average load-weighted day-ahead price $70 Average price ($/MWh) Average load-weighted base case price $60 $50 $40 $30 $20 $10 $0 Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2017 2018 ISO Public Page 13

System market power recommendations (2017 – 2018) • ISO should begin to consider various actions that might be taken to reduce/mitigate potential system market power. • DMM recognizes that this recommendation involves major market design and policy issues, including the possible development of new market design options to mitigate potential system market power. • DMM recognizes that the competitiveness of the ISO’s markets is heavily affected by the procurement decisions of the state’s load -serving entities and policies of their local regulatory authorities. • Because of the potential severity of the impact of market power, DMM made this recommendation at this time so that the ISO, stakeholders and regulatory entities can give thorough consideration to this issue and potential options to address it. ISO Public Page 14

Potential measures to reduce the potential for or mitigate the effect of system market power: • Begin consideration of options for system market power mitigation. • Set local and system resource adequacy requirements sufficiently high to ensure reliability (which may also reduced likelihood of non-competitive market outcomes). • Reexamine resource adequacy provisions relating to imports (e.g. must offer obligation in day-ahead only, resource or system backing RA imports, etc.) • Strengthen the penalties and the enforcement of the penalties for must-offer obligations. • Carefully track and seek to limit out-of-market purchases of imports at above-market prices, which can encourage economic and physical withholding of available imports. • Closely monitor for potential errors or software issues affecting market power mitigation. ISO Public Page 15

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.