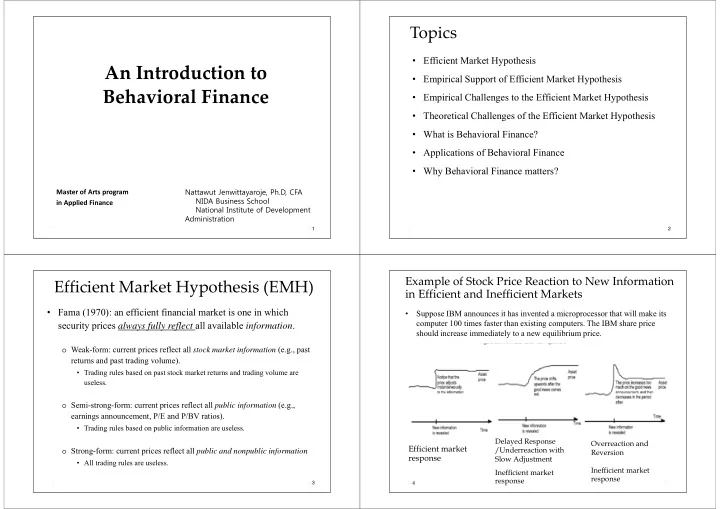

Topics • Efficient Market Hypothesis An Introduction to • Empirical Support of Efficient Market Hypothesis Behavioral Finance • Empirical Challenges to the Efficient Market Hypothesis • Theoretical Challenges of the Efficient Market Hypothesis • What is Behavioral Finance? • Applications of Behavioral Finance • Why Behavioral Finance matters? Nattawut Jenwittayaroje, Ph.D, CFA Master of Arts program NIDA Business School in Applied Finance National Institute of Development Administration 1 2 Example of Stock Price Reaction to New Information Efficient Market Hypothesis (EMH) in Efficient and Inefficient Markets • Fama (1970): an efficient financial market is one in which Suppose IBM announces it has invented a microprocessor that will make its • computer 100 times faster than existing computers. The IBM share price security prices always fully reflect all available information . should increase immediately to a new equilibrium price. o Weak-form: current prices reflect all stock market information (e.g., past returns and past trading volume). • Trading rules based on past stock market returns and trading volume are useless. o Semi-strong-form: current prices reflect all public information (e.g., earnings announcement, P/E and P/BV ratios). • Trading rules based on public information are useless. Delayed Response Overreaction and Efficient market o Strong-form: current prices reflect all public and nonpublic information /Underreaction with Reversion response Slow Adjustment • All trading rules are useless. Inefficient market Inefficient market response response 3 4

EMH Theory: Theoretical Arguments EMH Theory: Theoretical Arguments • Investors are rational and value securities rationally (i.e., • Samuelson (1965) and Mandelbrot (1966) show that in value securities for their fundamental value). competitive markets with rational investors, • Some irrational investors are random and cancel each other o Security values and prices follow random walks out without affecting prices. o Returns (i.e., price changes) are thus unpredictable • If investors are irrational in similar ways, rational arbitrageurs will exploit the actions of the irrational investors and thus eliminate their influence on prices. • Rational investors quickly respond to new information by bidding up (down) prices following good (bad) news. 5 6 EMH Theory: Theoretical Arguments: EMH Theory: Theoretical Arguments: Random Walk Random Walk The reasoning behind the random walk concept as it applies to the The reasoning behind the random walk concept as it applies to the • • stock market is as follows (con’t) stock market is as follows; o Tomorrow’s price changes reflect only tomorrow’s news. By definition, o Securities markets are flooded with thousands of intelligent, well paid and well educated professional investors and analysts. new information arrives at the marketplace in an independent and random fashion (i.e., news is unpredictable and random). o The more these professional investors, the faster the dissemination of relevant information and thus the more efficient the market becomes. o Price changes that result when news is released must also be o When information arises, news spreads very rapidly and tends to be unpredictable and random. quickly reflected in security prices. o Random walk theory assets that stock price movements do not follow o If the flow of information is unimpeded, all of today’s news is any pattern or trend. Thus, past price action cannot be used to predict reflected in today’s stock prices. future price movements. o Then neither buyers nor sellers have an informational advantage. In an efficient market, both buyers and sellers have the same information 7 8

Empirical Support of EMH EMH Theory: Implication • Implication o Investor should not make money by trading on stale information, Dow Jones reaction to the Federal since stock prices accurately reflect everything that is known and is Reserve’s (unexpectedly large rate expected to occur. cut of 3Jan2001) announcement • Buying and selling in an attempt to outperform the market will effectively be a game of chance rather than skill. o Stock prices instantaneously and fully change when new information comes to the market, but new information cannot be anticipated and there is no way for investors to gain an edge (i.e., outperform a benchmark). o When new information about the value of a security hits the market, stock price should neither under-react nor over-react. o Price should not change in demand or supply of a security that is This response is consistent with the semi-strong-form EMH. not accompanied by news about its fundamental value. 9 10 Empirical Support of EMH Are Stock Returns Predictable? • Statistical Tests of Independence Autocorrelation Tests are the tests of the correlations between the current • return ( r t ) and the returns on day t-1, t-2,…..,t-n ( r t-1 ,r t-2 ,….r t-n ). Under EMH, insignificant correlations for all such combinations would be • expected. A positive correlation (between r t and r t-1 ) indicates price continuation • (i.e., momentum). A negative correlation (between r t and r t-1 ) indicates price reversal (i.e., • contrarian). CARs to shareholders of targets of takeover attempts around the announcement date: Keown and Pinkerton (1981) Journal of Finance 12 11

US Evidence International Evidence Empirical Challenges to the EMH • Overreaction Contrarian Strategy • Underreaction Momentum Strategy • Use of stale/known public information o Small firm effects o Price-Earnings ratio and Market-to-Book ratio effects o Index addition/deletion effects o etc. Fama (1965) 13 14 Overreaction: Contrarian Strategy Overreaction: Contrarian Strategy • De Bondt and Thaler (1985) argue that investors’ behaviour is far from being rational. Investors tend to overreact to new information. • In the long run, overreaction causes return reversal. • Their results show that past winners become losers and past losers become winners. • The difference in returns cannot be explained by differences in risk (i.e., beta) using CAPM. Cumulative Average Residuals for Winner and Loser Portfolios Debondt and Thaler 1985 (Journal of Finance) 15 16

Underreaction: Momentum Strategy Underreaction: Momentum Strategy Main Results: • Subsequently, Jegadeesh and Titman ( Journal of Finance , Returns of all zero-cost (i.e., • 1993) find evidence of momentum in stock returns. buy minus sell) portfolios are positive and almost all • They show that movements in individual stock prices over a are significant. period of 3-12 months predict future price movements in the Most successful zero-cost • same direction. strategy is to selects stocks based on their returns over o Recent winners keep winning, and recent losers keep losing the previous 12 months and over the next 3-12 months. then holds them for 3 months • Following this evidence, arguments from the psychology -> 1.31% per month. literature were increasingly employed to justify potential biases on the part of investors. 18 17 Size, Price to Earnings, and Market to Book Size, Price to Earnings, and Market to Book effects effects Small stocks achieve much higher return than large stocks. • High E/P outperforms low E/P • Firms with large, positive B/M ratios earn a premium over firms • with low, positive B/M ratios. High cash-flow-yield firms earn substantially higher return than • low cash-flow-yield firms. Chan et al (1991) Fundamentals and stock returns in Japan, Journal of Finance 19 20

Index effects – International evidence Counterargument from EMH • Data snooping (data mining) o The process of examining data affect the likelihood of finding empirical results that are inconsistent with EMH. o Authors in search of an interesting research paper are likely to focus attention on ‘surprising’ results. o Solution: • Test on an independent sample: other countries, prior time periods, (if sufficient time elapses after the discovery of an anomaly) subsequent data can also be used. • Improper risk adjustment • Survivorship bias (sample selection bias) Nattawut (2014) Index Effects: A Review and Comments, Chulalongkorn Business Review 21 22 Theoretical Challenges of EMH Theoretical Challenges of EMH • If the trading strategies of irrational investors are random (i.e., • Are investors rational? unsystematic), then prices can remain close to fundamental • Evidence also suggests investors are not rational in the way value. suggested by neoclassical economic theory. • However, there is considerable evidence to suggest that • There are psychological biases in people’s assessment of deviations from the rational view are not random, and probable outcomes. therefore trades by irrational investors have an effect on • Investors’ psychological biases play an important role in the prices. mispricing • Rational arbitrageurs, however, can eliminate the influence of o Overconfidence, representativeness, anchoring, and so on irrational investors on prices. o Prospect theory o A simple example of an arbitrage trade would be the simultaneous purchase and sale of the “same” security at different prices 23 24

Recommend

More recommend