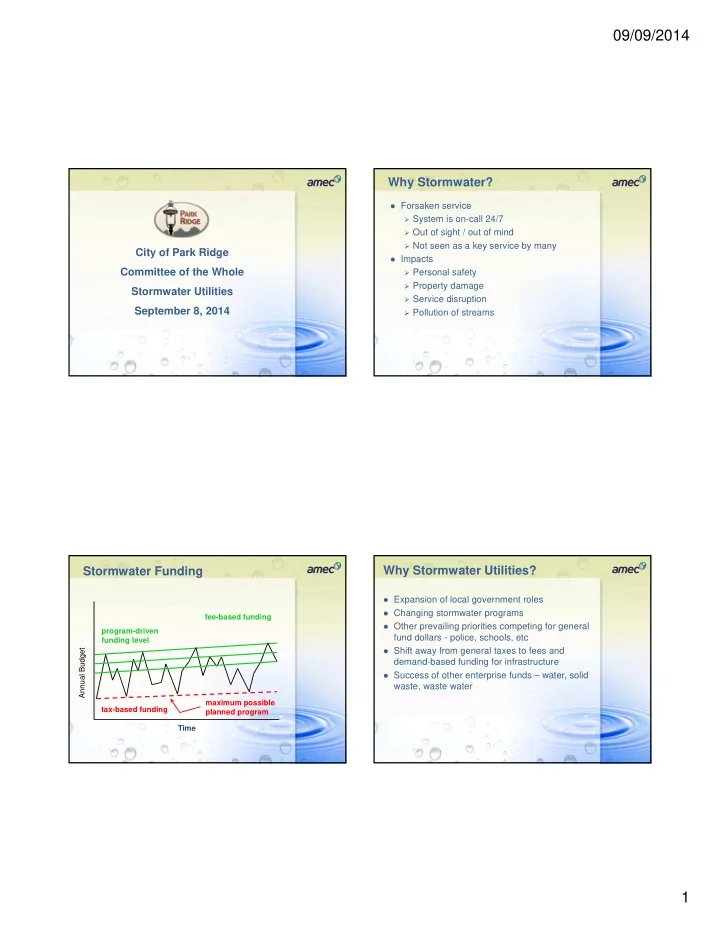

09/09/2014 Why Stormwater? Forsaken service System is on-call 24/7 Out of sight / out of mind Not seen as a key service by many City of Park Ridge Impacts Committee of the Whole Personal safety Property damage Stormwater Utilities Service disruption September 8, 2014 Pollution of streams Why Stormwater Utilities? Stormwater Funding Expansion of local government roles Changing stormwater programs fee-based funding Other prevailing priorities competing for general program-driven fund dollars - police, schools, etc funding level Shift away from general taxes to fees and Annual Budget demand-based funding for infrastructure Success of other enterprise funds – water, solid waste, waste water maximum possible tax-based funding planned program Time 1

09/09/2014 Why Stormwater Utilities? Growth of Stormwater Utilities Stormwater utility revenue is: Equitable – charges based on demand placed on the program / system Stable – reliable level of funding – not subject to multiple demands Adequate – program driven funding levels – can plan service level increases Flexible – single method – mix of methods 5 What Is A Stormwater Utility? Infrastructure Program Fees A stormwater utility can be any or all of the Consumption - based fees: following: Water Sewer A funding method Electric A program concept An organizational entity Capacity - based fees: Cable Local telephone Stormwater 7 2

09/09/2014 Why Capacity Based? Rate Basis Unpredictability of rainfall Developing parcels increased imperviousness Need for sustainable cash flow increased runoff Impracticality of metering runoff increased demand Need a simple basis for billing Rock Island decision Reflects the relative contribution / demand for service / evaporation Easy to explain / understand Defensible in court Imperviousness Imperviousness Village of Westmont Single Family Residential Imperviousness 6,000 Mean = 3,000 Median = 2,950 5,000 Max = 15,265 Impervious Area (sq ft) 4,000 3,000 2,000 1,000 0 1 5200 Residential Parcels 3

09/09/2014 Imperviousness Equivalent Residential Unit (ERU) Range of imperviousness per parcel 1 ERU = 2,500 square feet of impervious area 600 Impervious Area, Sq Ft (1000s) 500 = 3,000 sq ft impervious 1 ERU 400 Single Family Other 300 = 25,000 sq ft impervious 200 10 ERUs 100 0 Illinois Stormwater Rates Revenue Potential “Rule of Thumb” Lowest residential rate = $1.95 / month For every $1 dollar Highest rate = $21.83 / month (first bills in July) per month per house Most have flat rates for single family (and appropriate Some have tiers for single family charges to non- Most have credit programs residences), a A few have incentive programs stormwater utility can typically generate about $20 to $40 per acre per year. 4

09/09/2014 Illinois Stormwater Rates Stormwater credit programs Single Family Residential Rates What are credits? Municipality Monthly Rate* Aurora $ 3.45 A stormwater credit is a reduction in stormwater Bloomington $ 4.35 fees charged to a qualifying property in return Highland Park $ 6.00 for implementing qualifying on-site drainage Moline $ 3.75 controls Champaign $ 5.24 Downers Grove $ 8.94 Acknowledgement that on-site stormwater Morton $ 5.03 management may: Normal $ 4.60 Reduce the City’s operational costs Richton Park $ 5.63 Reduce the City’s compliance costs Rock Island $ 3.95 Rolling Meadows $ 3.36 Reduce the City’s capital costs Urbana $ 4.94 Winnetka $ 21.83 *Based on average single family property (ERU) Stormwater credit programs Statutory authority Two approaches in Illinois How do credits work? Home Rule Direct reduction of service charges Church of Peace v City of Rock Island Applied after service charges are calculated Illinois Compiled Statutes 65 ILCS 5/11-139-1 Must be applied for 65 ILCS 5/11-141-7 Criteria set by the City Conner v City of Elmhurst Maintenance of stormwater controls required On-going Alternative approaches Some expire periodically Statewide enabling legislation Failure to report may cause revocation Special legislation (DuPage / Peoria Counties) 5

09/09/2014 Rock Island lawsuit Stormwater Utility Components Definition of taxes and fees Expenditure plan A tax raises revenue for the general and non- Revenue plan specific purposes of government Billing plan A fee raises revenue to be used for a specific Outreach & education plan purpose, such as for stormwater management Three court criteria: tax v. fee Regulatory nature Rational nexus Voluntary nature Contact Information Questions ? Douglas Noel, P.E. AMEC Environment & Infrastructure douglas.noel@amec.com 317.713.1700 6

Recommend

More recommend