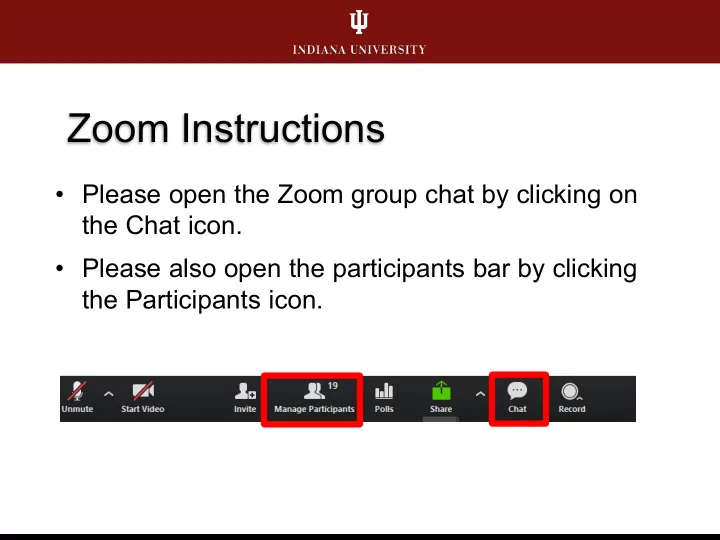

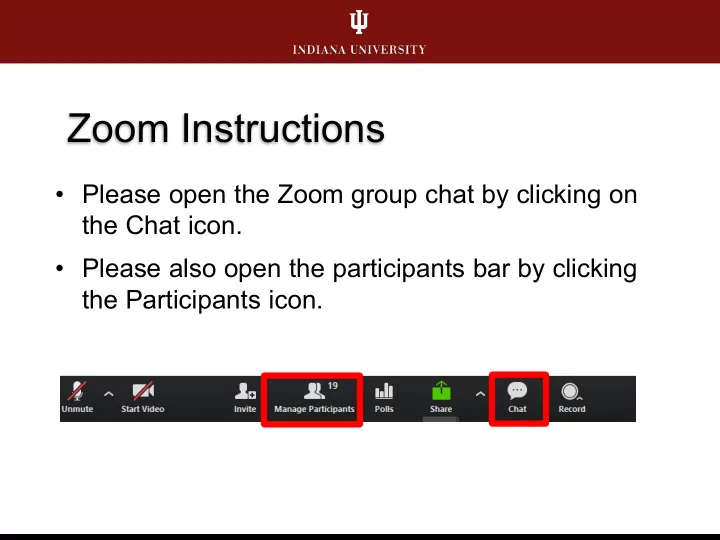

Zoom Instructions • Please open the Zoom group chat by clicking on the Chat icon. • Please also open the participants bar by clicking the Participants icon.

Zoom Instructions • Communicate via chat – type questions into chat box • Communicate via participant responses – raise hand to be unmuted to ask question verbally

Capital Asset Purchases in BUY.IU Joy Maddox Assoc. Director of Capital Assets

What you will learn today: • When equipment purchases should be capitalized • What costs can be capitalized with the equipment • What you need to know about making a capital purchase in BUY.IU • How to correctly fill out the asset configuration document

When is equipment capitalized? Equipment purchases are capitalized when: • the equipment is expected to be used for a period of one year or more, AND • the total capitalizable costs meet or exceed the capitalization threshold of $5,000 See CSOP 1.0 Capitalization Rules

What costs can be capitalized? Capitalized costs on moveable equipment • Cost of equipment • Freight/Shipping • Installation • Assembling/Preparing the site/asset for intended use • Training • In-transit insurance Unallowable costs on moveable equipment • Software licenses • Service/maintenance agreements or warranties

Object Codes Object Description Code 5200 Expendable Equipment 7000 Capital Equipment 4776 Service Maint Contracts 4616 Computer software purchases How do I know what object code to use???

Object Code Selection Is cost of equipment including all capitalizable costs (shipping, installation, etc.) $5,000 or more? • Yes – use object code 7000 • No – use object code 5200 Service agreements/warranties always use 4776 Software licenses always use 4616

Object Code Selection Scenario #1 OBJECT ITEM DESCRIPTION QTY UNIT COST EXTENDED COST CODE 1 Floor machine 1 $8,000.00 $8,000.00 7000 4776 2 Warranty 3 $500.00 $1,500.00 Additional Charges Shipping and Handling $1,100.00 $1,100.00 7000 INDIANA UNIVERSITY 9

Object Code Selection Scenario #2 OBJECT ITEM DESCRIPTION QTY UNIT COST EXTENDED COST CODE 1 Snare drum with stand 1 $1,000.00 $1,000.00 7000 2 Bass drum with pedal $2,500.00 $2,500.00 7000 1 Cymbal $400.00 $1,600.00 3 7000 4 Tom drum with stand $750.00 $1,500.00 7000 4 2 Warranty $600.00 $600.00 4776 5 1 Additional Charges Shipping and Handling $400.00 $400.00 7000 Asset Description: Drum set INDIANA UNIVERSITY 10

Object Code Selection Scenario #3 OBJECT ITEM DESCRIPTION QTY UNIT COST EXTENDED COST CODE 1 Freezer 1 $4,299.00 $4,299.00 7000 7000 2 Installation 1 $500.00 $500.00 Additional Charges Shipping and Handling $600.00 $600.00 7000 INDIANA UNIVERSITY 11

Object Code Selection Scenario #4 OBJECT ITEM DESCRIPTION QTY UNIT COST EXTENDED COST CODE 1 Freezer 1 $4,299.00 $4,299.00 5200 4776 2 Warranty 1 $500.00 $500.00 Additional Charges Shipping and Handling $600.00 $600.00 5027 INDIANA UNIVERSITY 12

Requisitions in BUY.IU • Lines with Capital Asset? checked must use capital object code or requisition will be returned

Requisitions in BUY.IU • To receive notification of returned requisitions, go to Notification Preferences in profile.

Requisitions in BUY.IU • Returned requisitions are displayed in the My Action Items section of the BUY.IU homepage

Requisitions in BUY.IU • Asset Configuration Document will appear in the KFS action list of individual listed as Prepared For

Asset Configuration Document (ACD) • Collects information for capital asset database -Asset description, manufacturer, location, etc. • Created in application called FUSE • Route stop added after PO created • Document must be completed before PO is sent to the supplier • All other CAMS documents still in KFS

Resources & Contact Information https://fms.iu.edu/capital-assets/capital-orders-buyiu/ CAMS Group Email capasset@iu.edu Theresa Cain Jason Lett CAMS Data Manager Capital Asset Inventory Coordinator tcain@iu.edu jmlett@iu.edu Joy Maddox Nicole Warweg Assoc. Dir. Capital Assets Capital Asset Control Analyst jemaddox@iu.edu dwarweg@iu.edu

Recommend

More recommend