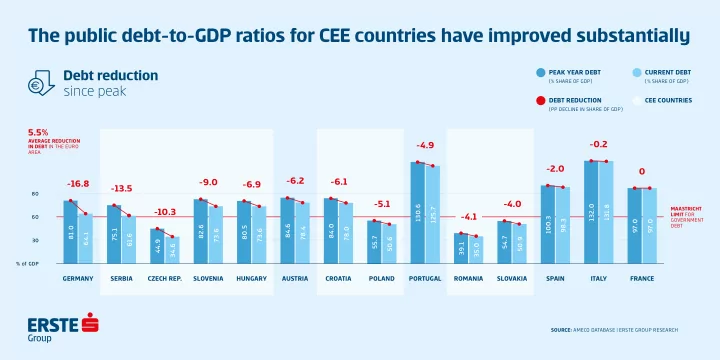

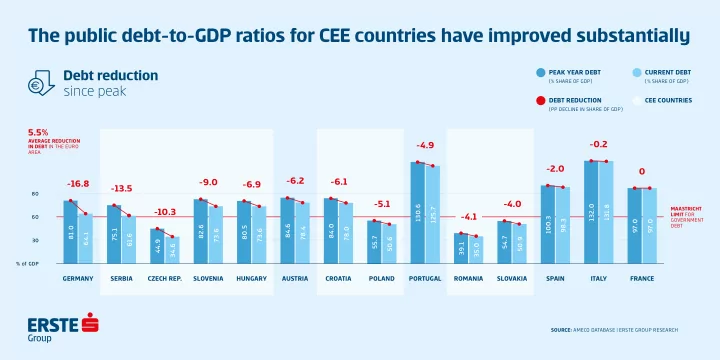

Tie public debt-to-GDP ratios for CEE countries have improved substantially Debt reduction PEAK YEAR DEBT CURRENT DEBT (% SHARE OF GDP) (% SHARE OF GDP) since peak DEBT REDUCTION CEE COUNTRIES (PP DECLINE IN SHARE OF GDP) 5.5 % AVERAGE REDUCTION -0.2 -4.9 IN DEBT IN THE EURO AREA -2.0 0 -6.2 -6.1 -9.0 -16.8 -6.9 -13.5 80 -5.1 -4.0 132.0 130.6 131.8 125.7 MAASTRICHT -10.3 LIMIT FOR -4.1 60 100.3 GOVERNMENT 98.3 97.0 97.0 84.6 DEBT 84.0 82.6 81.0 80.5 78.4 78.0 75.1 73.6 73.6 64.1 61.6 55.7 54.7 50.6 50.9 30 44.9 39.1 35.0 34.6 % of GDP GERMANY SERBIA CZECH REP. SLOVENIA HUNGARY AUSTRIA CROATIA POLAND PORTUGAL ROMANIA SLOVAKIA SPAIN ITALY FRANCE SOURCE: AMECO DATABASE | ERSTE GROUP RESEARCH

Risks to CEE region‘s medium-term debt sustainability appear relatively contained, with Romania an exception 2028 (EC FORECAST) 2017 CEE COUNTRIES Gross public debt (% of GDP) 132 131.8 125.7 109.5 108.5 108.2 AVERAGE FOR 98.3 97 EUROZONE (2017) 90 78 78.4 72.9 73.6 73.6 MAASTRICHT LIMIT 64.1 FOR PUBLIC DEBT 61 60.4 57.3 55.1 50.9 50.6 60 45.9 37.9 34.6 35 34 25.4 25.6 30 10.7 0 BULGARIA CZECH REP. ROMANIA POLAND SLOVAKIA GERMANY SLOVENIA HUNGARY CROATIA AUSTRIA FRANCE SPAIN PORTUGAL ITALY SOURCE: EC (ASSESSMENT OF CP/SP) | ERSTE GROUP RESEARCH

All CEE countries have lowered their budget defjcits, but some have relied mainly on lower interest costs and the cyclical rebound Cyclically adjusted Cyclical primary deficit balance components Contributions to defjcit reduction Interest costs Budget deficit (as % GDP, 2010-2017) balance 12 9 6 3 0 -3 GREECE PORTUGAL CROATIA SLOVAKIA SPAIN CZECH REP. POLAND SLOVENIA GERMANY EURO AREA ROMANIA AUSTRIA HUNGARY ITALY SWEDEN SOURCE: AMECO DATABASE | ERSTE GROUP RESEARCH

Recommend

More recommend