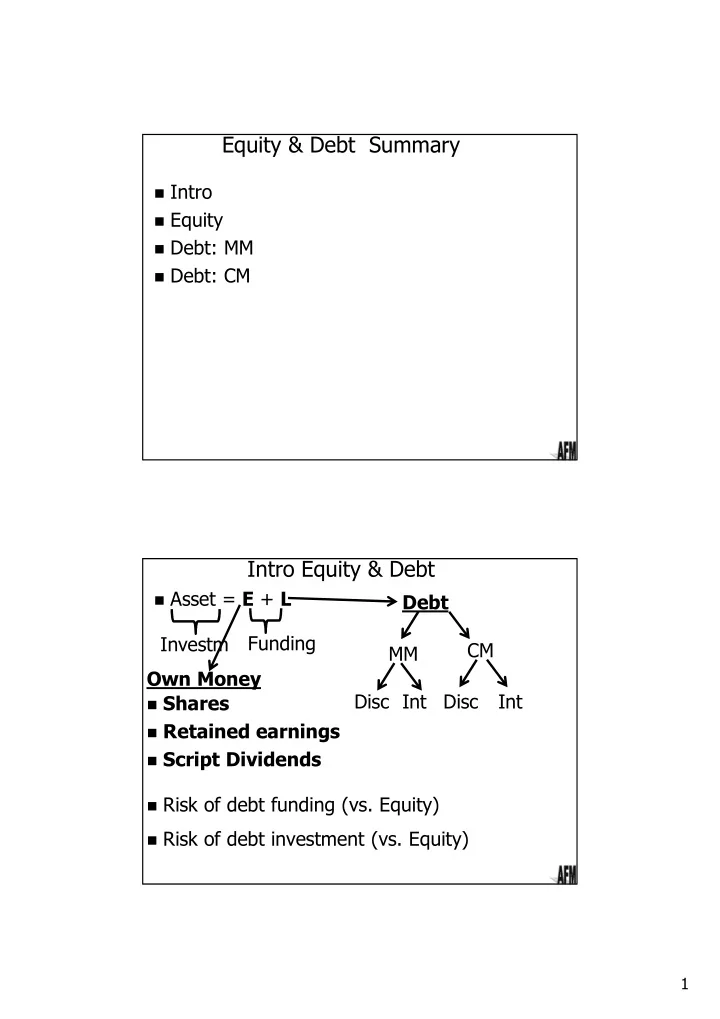

Equity & Debt Summary � Intro � Equity � Debt: MM � Debt: CM Intro Equity & Debt � Asset = E + L Debt Funding Investm CM MM Own Money Disc Int Disc Int � Shares � Retained earnings � Script Dividends � Risk of debt funding (vs. Equity) � Risk of debt investment (vs. Equity) 1

Equity � Share types � Ordinary � N-shares � Prefs � Other equity related securities � Valuation � P/E or EY � DY � Gordon Model Equity � Gordon Valuation Next DPS Expected P = (COE – Expected DPS% Growth) = Risk free rate + β x (Equity Mkt Risk Premium) % Return Equity Risk Premium = 17% - 10% = 7% Equity return in general = 17% Risk free = 10% = COE in general 2

Debt: MM � Classification Retail MM Discount TB Wholesale PN Int. rate NCD Repo � Disc ≈ salary cut (e.g. 10%) R90 � 10/90 x 100 = 11.1% Disc. Rate on FV vs. int. rate on PV Debt: MM (TB) TB TB MM SARB ABSA UT Cash Cash � TB calcs 3

Debt: MM (NCD) John Cash House Sue Cash Investec NCD Cash MM UT � MM works on TRUST � NCD calcs Debt: MM (Repo) SARB SARB Bonds Cash + Int Bonds Cash ABSA ABSA +1 Week Today � Repo vs. BsB 4

Debt: CM � Classification Disc CM Fi Int Fl � Fi – Inverse Relationship yield vs. value 10% Coupon � 100 000 10% = R1 mil 100 000 20% = R500 000 � CM – role in economy Debt: CM � Secondary Mkt Yields on RSA Gvt Bonds (10 yrs & +) � The above are viewed as (credit) risk free yields, used to price other asset classes (e.g. equity at ± 6% premium in LT) 5

Debt: CM � Some terminology e.g. R186 � Face value � Coupon rate, amounts R52 500 + R52 500 R52 500 R1 mil Maturity Listed 21/12/15 21/06/16 21/12/26 1/04/98 We are here � Par, discount, premium bonds (Ex. 8) R186 is……….? � Settlement � LDR, Cum, Ex Int � Pricing – Too advanced (need certain parameters) e.g. AIP = R103.6652214% CM: Securitisation � Make non-tradable assets tradable securities US Fin Crises US sub prime home owner Pay? US Bank FNB Home Cash loans SPV CM Cash Securities Investors 6

Recommend

More recommend