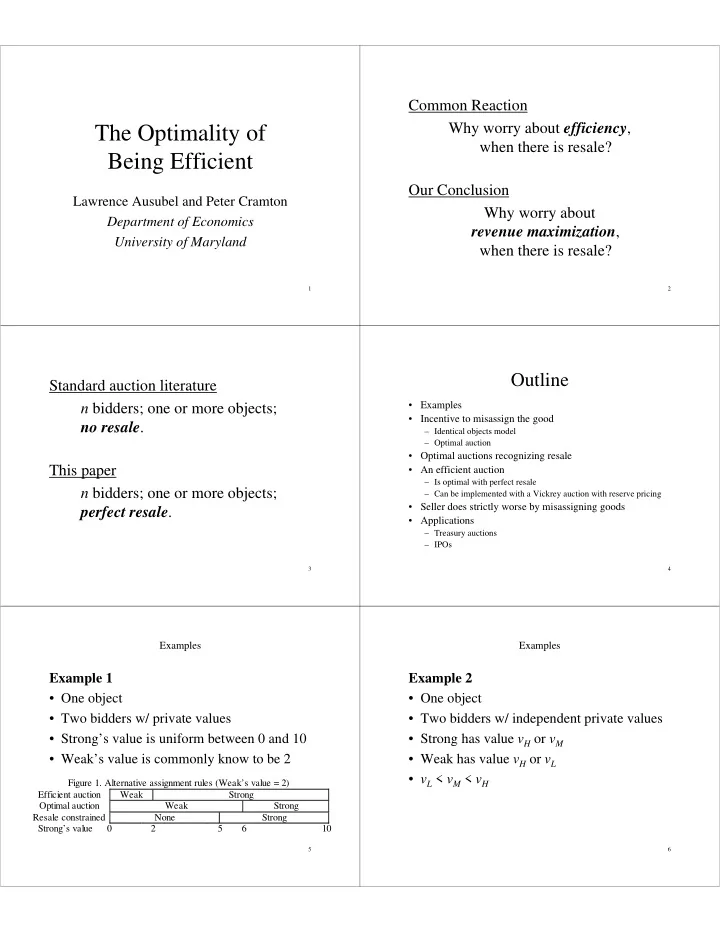

Common Reaction Why worry about efficiency , The Optimality of when there is resale? Being Efficient Our Conclusion Lawrence Ausubel and Peter Cramton Why worry about Department of Economics revenue maximization , University of Maryland when there is resale? 1 2 Outline Standard auction literature • Examples n bidders; one or more objects; • Incentive to misassign the good no resale . – Identical objects model – Optimal auction • Optimal auctions recognizing resale This paper • An efficient auction – Is optimal with perfect resale n bidders; one or more objects; – Can be implemented with a Vickrey auction with reserve pricing • Seller does strictly worse by misassigning goods perfect resale . • Applications – Treasury auctions – IPOs 3 4 Examples Examples Example 1 Example 2 • One object • One object • Two bidders w/ private values • Two bidders w/ independent private values • Strong’s value is uniform between 0 and 10 • Strong has value v H or v M • Weak’s value is commonly know to be 2 • Weak has value v H or v L • v L < v M < v H Figure 1. Alternative assignment rules (Weak’s value = 2) Efficient auction Weak Strong Optimal auction Weak Strong Resale constrained None Strong Strong’s value 0 2 5 6 10 5 6

Example Example Optimal auction, for some parameter values, takes the form: Optimal auction, for some parameter values, takes the form: Weak v H v L Weak v H Either Strong v H v L Strong Bidder v H Either Strong v M Weak Weak Strong Bidder Strong v M Weak Weak Now introduce sequential bargaining as a resale mechanism, following the auction. Whenever Weak suboptimally wins the good, his value is v L , and Strong’s value is v M. . Can trade at ( v L + v M ) / 2. Inefficient allocation is undone! Seller’s revenues are strictly suboptimal (Theorem 5) 7 8 Identical Objects Model (cont.) Identical Objects Model • Seller has quantity 1 of divisible good (value = 0) Marginal value v i ( t , q i ) satisfies: • n bidders; i can consume q i ∈ [0, λ i ] • Value monotonicity q = ( q 1 ,…, q n ) ∈ Q = { q | q i ∈ [0, λ i ] & Σ i q i ≤ 1} – non-negative • t i is i ’s type; t = ( t 1 ,…, t n ); t i ~ F i w/ pos. density f i – increasing in t i • Types are independent – weakly increasing in t j • Marginal value v i ( t , q i ) – weakly decreasing in q i • Value regularity : for all i , j , q i , q j , t − i , t i ′ > t i , • i’s payoff if gets q i and pays x i : z 0 v i ( t i , t − i , q i ) > v j ( t i , t − i , q j ) ⇒ v i ( t i ′ , t − i , q i ) > v j ( t i ′ , t − i , q j ) q i − ( , ) v t y dy x i i 9 10 Identical Objects Model (cont.) Revenue Equivalence • Bidder i ’s marginal revenue: Theorem 1 . In any equilibrium of any auction marginal revenue seller gets from awarding game in which the lowest-type bidders additional quantity to bidder i receive an expected payoff of zero, the seller’s expected revenue equals − − ∂ L O 1 ( ) ( , ) 1 z F t v t q = i i i i n ( , ) ( , ) MR t q v t q M P ∑ ( ) q t ∂ i i i i i N Q ( , ) E MR t y dy ( ) f t t t i i i i 0 = i 11 12

Optimal Auction Optimal Auction is Inefficient • MR monotonicity – increasing in t i • Assign goods to wrong parties – weakly increasing in t j – High MR does not mean high value – weakly decreasing in q i • MR regularity : for all i , j , q i , q j , t − i , t i ′ > t i , • Assign too little of the good MR i ( t , q i ) > MR j ( t , q j ) ⇒ MR i ( t i ′ , t − i , q i ) > MR j ( t i ′ , t − i , q j ) – MR turns negative before values do Theorem 2 . Suppose MR is monotone and regular. Seller’s revenue is maximized by awarding the good to those with the highest marginal revenues, until the good is exhausted or marginal revenue becomes negative. 13 14 Three Seller Programs Three Seller Programs 1. Unconstrained optimal auction 2. Resale-constrained optimal auction (standard auction literature) (Coase Theorem critique) Select assignment rule and pricing rule to Select assignment rule and pricing rule to max E[Seller Revenue] max E[Seller Revenue] s.t. Incentive Compatibility s.t. Incentive Compatibility Individual Rationality Individual Rationality Efficient resale among bidders 15 16 1. Unconstrained optimal auction Three Seller Programs 3. Efficiency-constrained optimal auction (Coase Conjecture critique) Select assignment rule ( ) to q t L O = z Select assignment rule and pricing rule to n M P ∑ ( ) q t i N Q max ( , ) E MR t y dy max E[Seller Revenue] t i ∈ 0 ( ) q t Q i 1 s.t. Incentive Compatibility = { All feasible assignment rules.} Q Individual Rationality Efficient resale among bidders and seller 17 18

1. Unconstrained optimal auction 3. Efficiency-constrained optimal auction (two bidders) price R Select assignment rule ( ) to q t L O = z S n M P ∑ ( ) q t i N Q max ( , ) E MR t y dy t i ∈ R 0 ( ) q t Q i 1 = R p 2 { Ex post efficient assignment rules.} Q D MR 0 q 1 quantity MR 2 MR 1 d 1 d 2 19 20 3. Efficiency-constrained optimal auction 2. Resale-constrained optimal auction (two bidders) price R Select assignment rule ( ) to q t L O = z S p 1 n M P ∑ q ( ) t i max N ( , ) Q E MR t y dy t i ∈ 0 R ( ) q t Q i 1 = R { Resale -efficient assignment rules.} Q D 0 q=1 quantity MR 2 MR 1 d 1 d 2 21 22 2. Resale-constrained optimal auction Theorem 4 . In the two-stage game (auction (two bidders) price followed by perfect resale), the seller can do no better than the resale-constrained optimal auction. Proof. Let a ( t ) denote the probability measure on S p 1 allocations at end of resale round , given reports t . Observe that, viewed as a static mechanism, a ( t ) must satisfy IC and IR. In addition, a ( t ) must be resale-efficient. � MR R D 0 q R 1 quantity MR 2 MR 1 d 1 d 2 23 24

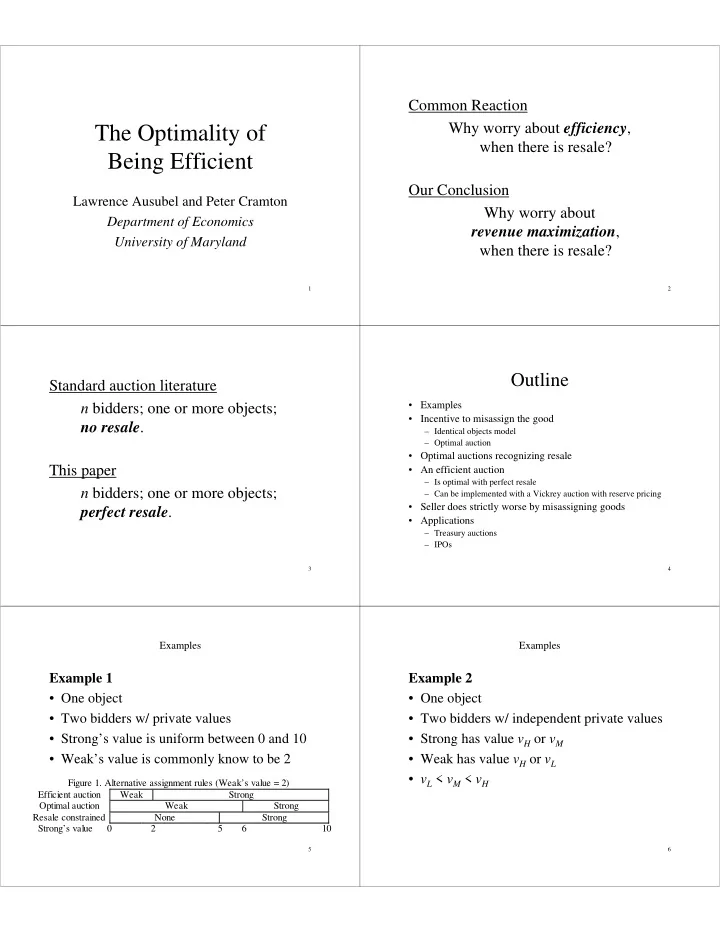

Vickrey auction with reserve pricing Can we obtain the upper bound Seller sets monotonic aggregate quantity that on revenue? will be assigned to the bidders, an efficient assignment q * ( t ) of this aggregate quantity, resale process is coalitionally-rational against and the payments x * ( t ) to be made to the individual bidders if bidder i obtains no seller as a function of the reports t where more surplus s i than i brings to the table: * ( ) ∫ q t s i ≤ v ( N | q , t ) – v ( N ~ i | q , t ). = * i ˆ ( ) ( ( , ), , ) , where x t v t t y t y dy − − i i i i i 0 { } That is, each bidder receives no more than = ≥ ˆ ( * t t , ) y inf t | q t t ( , ) y . − − i i i i i i 100% of the gains from trade it brings to the t i Bidders simultaneously and independently table. report their types t to the seller. 25 26 Can we attain the upper bound on Examples revenue? • Example 3 • Strong’s value is uniform between 0 and 20 Theorem 5 (Ausubel and Cramton 1999). Consider the two-stage game consisting of • Weak’s value is uniform between 0 and 10 the Vickrey auction with reserve pricing • MR s ( s ) = 2 s – 20 followed by a resale process that is • MR w ( w ) = 2 w – 10 coalitionally-rational against individual bidders. Given any monotonic aggregate • Assign to Strong if s > w + 5 and s > 10 assignment rule , sincere bidding followed • Assign to Weak if s < w + 5 and w > 5 by no resale is an ex post equilibrium of the • Keep the good if s < 10 and w < 5 two-stage game . 27 28 Figure 3. Alternative Assignment Rules Can the seller do equally well by Optimal Assignment Efficient Assignment 10 10 Weak Weak Weak Strong misassigning the goods? Strong Weak Weak’s Weak’s Strong 5 5 Value Value Weak None Strong Strong Strong 0 0 0 10 20 0 10 20 Strong’s Value Strong’s Value Non-monotonic Assignment Resale-Constrained Assignment 10 10 Weak Weak Strong Strong Strong None 6.2 Weak’s Weak’s 5 Value Value None None Strong Strong 0 0 0 10 20 0 10 20 Strong’s Value Strong’s Value 29 30

Can the seller do equally well by Setup for “strictly less” theorem: misassigning the goods? • Multiple identical objects • Discrete types NO! The seller’s payoff from using an inefficient auction format is strictly less than from using the efficient auction. 31 32 Setup for “strictly less” theorem (continued): Theorem 6 . Consider a monotonic auction • Monotonic auction : The quantity assigned to each followed by strictly-individually-rational, bidder is weakly increasing in type. perfect resale. If the ex ante probability of • Value regularity : Raising one’s own type weakly resale is strictly positive, then the seller’s increases one’s ranking in values, compared to expected revenues are strictly less than the other bidders. resale-constrained optimum. • MR monotonicity : Raising one’s own type weakly increases everybody’s MR. • High type condition : The highest type of any agent is never a net reseller. 33 34 Application 1 Treasury Auction In the model without resale, the revenue ranking of: Get it right the first time, Pay-as-bid auction or it will cost you! Uniform-price auction Vickrey auction is inherently ambiguous. 35 36

Recommend

More recommend