The Effects of the Economic Crisis on the Older Population: Changes - PowerPoint PPT Presentation

The Effects of the Economic Crisis on the Older Population: Changes in Consumption and Expectations Michael D. Hurd RAND, NETSPAR, NBER and MEA Susann Rohwedder RAND and NETSPAR Data Health and Retirement Study Core survey 2006 and

The Effects of the Economic Crisis on the Older Population: Changes in Consumption and Expectations Michael D. Hurd RAND, NETSPAR, NBER and MEA Susann Rohwedder RAND and NETSPAR

Data • Health and Retirement Study – Core survey 2006 and 2008 – Internet survey April-June 2009 • Subsample of HRS • Access to Internet and agreed to survey – Key variable: Expectations • Changes in expectations in panel

Data (continued) • Consumption and Activities Mail Survey – Random sample of HRS – Complete measure of spending in prior 12 months – 2001, 2003, 2005, 2007 and 2009 – Compare change between 2007 and 2009 with earlier change in panel

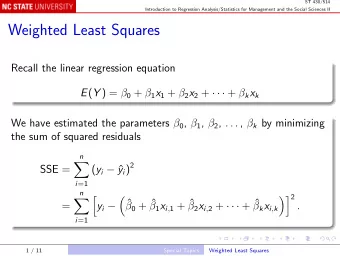

HRS 2006, 2008 and HRS Internet 2009 S&P 500 monthly closing prices 1800 1600 1400 1200 1000 800 600 400 200 0 2003 2004 2005 2006 2007 2008 2009 2010 HRS HRS 2006 HRS 2008 Internet

CAMS 2007 and 2009 S&P 500 monthly closing prices 1800 1600 1400 1200 1000 800 600 400 200 0 2003 2004 2005 2006 2007 2008 2009 2010 spending period covered

HRS 2008 and HRS Internet 2009 Case-Shiller House price index, 20-city average 250 200 150 100 50 0 2003 2004 2005 2006 2007 2008 2009 2010 HRS 2006 HRS 2008 HRS Internet

CAMS 2007 and 2009 Case-Shiller House price index, 20-city average 250 200 150 100 50 0 2003 2004 2005 2006 2007 2008 2009 2010

Impact depends on location Case-Shiller House price index 250 200 Phoenix 150 Los Angeles Denver 100 Detroit 50 0 2003 2004 2005 2006 2007 2008 2009 2010 Phoenix, Los Angeles, Denver, Detroit

HRS 2008 and HRS Internet U.S Unemployment Rate (%) 12 10 8 6 4 2 0 Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May 07 08 09 10 HRS 2008 HRS Internet

CAMS 2007 and2009 U.S Unemployment Rate (%) 12 10 8 6 4 2 0 Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May 07 08 09 10

Will show • Change in spending 2007-2009 based on CAMS • Change in subjective spending and expectations based on HRS 2008 and HRS Internet 2009

Change in actual spending • In older population expect spending decline because of life-cycle effects • Compare two-year change in “normal” times with two-year change 2007-2009 • “Normal” times: average of three transitions – 2001-2003 – 2003-2005 – 2005-2007

Two-year change in nondurable spending, means, panel 0 Age 51-64 Age 65+ -1 -2 -3 -4 2001-2007 -5 2007-2009 -6 -7 -8 -9 -10

Rest of results from HRS 2006, 2008 and HRS Internet 2009

HRS Internet April-June 2009. Household spending now compared with a year ago. % of households 35 30 25 20 Increased 15 Decreased 10 5 0 55-64 65-74 75+

Important reasons for spending decline (among those stating decline) • Worried about economic future: 85% • Lower income: 74% • Need to reduce debt: 70% • Stocks down: 59% • Lower house value: 52% • Worse employment: 47% • Age differences: less income, debt, employment among the oldest

House value • Self-reports in HRS • Compare with Case-Shiller 20 city average normalized to HRS 2006 values

HRS house value (thous.), panel and Case-Shiller normalized to 2006 HRS 350 -13% -28% 300 250 200 2006 150 2008 2009 100 50 0 Mean Case-Shiller mean Median Case-Shiller median

HRS house debt (thous.), panel 90 80 70 60 50 2006 2008 40 2009 30 20 10 0 Mean Median

Homeowners underwater (%) 8 7 6 5 2006 4 2008 2009 3 2 1 0 All homeowners Homeowners with debt

Expectations measured by subjective probabilities On a scale from 0 percent to 100 percent where 0 means that you think there is no chance and 100 means that you think the event is absolutely sure to happen, what do you think are the chances that by next year at this time your home will be worth more than it is today? Additional targets 10% and 20% up 10% and 20% down

Average subjective probability of gain in house prices 1 year from 5 years from now now Any increase 32.3 53.5 Increase by 10% or more 21.3 47.0 Increase by 20% or more 10.6 28.0 Decrease by 10% or more 18.5 13.7 Decrease by 20% or more 11.0 9.2 Estimated median change -4% +6% In 88% of one-year intervals between 1991 and 2009, housing prices increased. In all five-year intervals housing prices increased.

Average subjective probability of stock market gain, one-year horizon • HRS 2008: 52% • HRS Internet 2009: 41% Cumulative distribution across individuals

Cumulative distribution. Subjective probability of stock market gain one year ahead 100 90 80 70 Percentile 60 2008 50 2009 40 30 20 10 0 0 20 40 60 80 100 Subjective probability

Average subjective probability of bequest less than three target amounts Targets 2008 2009 10k 16.2 23.9 100k 36.0 44.1 500k 71.2 77.5 Mean expected bequest $535.5k $436.0k

Possible retirement responses to stock market and labor market • Stock market: increase retirement age • Labor market: possibly reduce retirement age – May become unemployed – Difficulty of finding another job – Social Security reported increase in claiming between ages 62 and 66

Average subjective probability of working past age 62 or 65 among those working in 2008, panel 70 60 50 40 HRS 2008 30 HRS 2009 Internet 20 10 0 Age 62 Age 65

Transition rate from working in HRS 2008 to not working in HRS 2009 Internet was 13.7%

Average subjective probability of working past age 62, among those working in 2008 by work status in 2009, panel 70 60 50 40 HRS 2008 30 HRS 2009 Internet 20 10 0 Working in 2009 Not working in 2009

Average subjective probability of working past age 65, among those working in 2008 by work status in 2009, panel 60 50 40 30 HRS 2008 HRS 2009 Internet 20 10 0 Working in 2009 Not working in 2009

Conclusions • Substantial spending reductions (measured) – about 7.6% among 51-64 year-olds over two years (deviation from “normal” times) – about 3.4% among 65+ • Self- reported: 29% of households reduced spending (17% increased) – but age 51-64: 33% reported decrease • Age differences – Retired population pretty well insulated – Although their children may have been affected

Conclusions (continued) • Small increase in housing debt at an age when it should be decreasing • Sharp increase in underwater 2008-2009 • Reduction in expected bequests – Allocation of losses in stock market and housing market (and possibly future earnings) between consumption and bequests • Considerable pessimism in house price and stock market expectations

Conclusions (continued) • Labor market – those working in 2009 expect to retire later than they did in 2008...wealth effect? – those not working in 2009 expect to retire earlier than they did in 2008...labor market effect? • Although recession is over (NBER) it is not over

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.