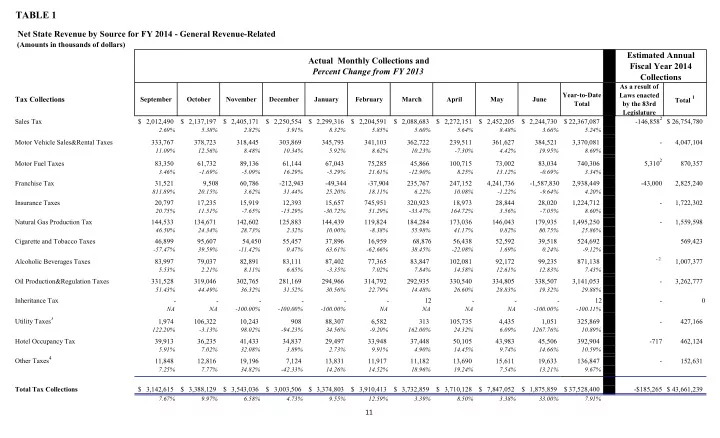

TABLE 1 Net State Revenue by Source for FY 2014 - General Revenue-Related (Amounts in thousands of dollars) Estimated Annual Actual Monthly Collections and Fiscal Year 2014 Percent Change from FY 2013 Collections As a result of Year-to-Date Laws enacted Total 1 Tax Collections September October November December January February March April May June Total by the 83rd Legislature -146,858 2 Sales Tax $ 2,012,490 $ 2,137,197 $ 2,405,171 $ 2,250,554 $ 2,299,316 $ 2,204,591 $ 2,088,683 $ 2,272,151 $ 2,452,205 $ 2,244,730 $ 22,367,087 $ 26,754,780 2.69% 5.38% 2.82% 3.91% 8.32% 5.85% 5.60% 5.64% 8.48% 3.66% 5.24% Motor Vehicle Sales&Rental Taxes 333,767 378,723 318,445 303,869 345,793 341,103 362,722 239,511 361,627 384,521 3,370,081 - 4,047,104 11.09% 12.56% 8.48% 10.34% 5.92% 8.62% 10.23% -7.30% 4.42% 19.95% 8.69% 5,310 2 Motor Fuel Taxes 83,350 61,732 89,136 61,144 67,043 75,285 45,866 100,715 73,002 83,034 740,306 870,357 3.46% -1.69% -5.09% 16.29% -5.29% 21.61% -12.90% 8.25% 13.12% -0.69% 3.34% Franchise Tax 31,521 9,508 60,786 -212,943 -49,344 -37,904 235,767 247,152 4,241,736 -1,587,830 2,938,449 -43,000 2,825,240 811.89% 20.15% 3.62% 31.44% 25.20% 18.11% 6.22% 10.08% -1.22% -9.64% 4.20% Insurance Taxes 20,797 17,235 15,919 12,393 15,657 745,951 320,923 18,973 28,844 28,020 1,224,712 - 1,722,302 20.75% 11.51% -7.65% -15.29% -30.72% 51.29% -33.47% 164.72% 3.56% -7.05% 8.60% Natural Gas Production Tax 144,533 134,671 142,602 125,883 144,439 119,824 184,284 173,036 146,043 179,935 1,495,250 - 1,559,598 46.50% 24.34% 28.73% 2.32% 10.00% -8.38% 55.98% 41.17% 0.82% 80.75% 25.86% Cigarette and Tobacco Taxes 46,899 95,607 54,450 55,457 37,896 16,959 68,876 56,438 52,592 39,518 524,692 569,423 -57.47% 39.59% -11.42% 0.47% 63.61% -62.66% 38.45% -22.08% 1.69% 0.24% -9.12% - 2 Alcoholic Beverages Taxes 83,997 79,037 82,891 83,111 87,402 77,365 83,847 102,081 92,172 99,235 871,138 1,007,377 5.53% 2.21% 8.11% 6.65% -3.35% 7.02% 7.84% 14.58% 12.61% 12.83% 7.43% Oil Production&Regulation Taxes 331,528 319,046 302,765 281,169 294,966 314,792 292,935 330,540 334,805 338,507 3,141,053 - 3,262,777 51.43% 44.49% 36.32% 31.52% 30.56% 22.79% 14.48% 26.60% 28.83% 19.32% 29.88% Inheritance Tax - - - - - - 12 - - - 12 - 0 NA NA -100.00% -100.00% -100.00% NA NA NA NA -100.00% -100.11% Utility Taxes 3 1,974 106,322 10,243 908 88,307 6,582 313 105,735 4,435 1,051 325,869 - 427,166 122.20% -3.13% 98.02% -94.23% 34.56% -9.20% 162.00% 24.32% 6.09% 1267.76% 10.89% Hotel Occupancy Tax 39,913 36,235 41,433 34,837 29,497 33,948 37,448 50,105 43,983 45,506 392,904 -717 462,124 5.91% 7.02% 32.08% 3.89% 2.73% 9.91% 4.90% 14.45% 9.74% 14.66% 10.59% Other Taxes 4 11,848 12,816 19,196 7,124 13,831 11,917 11,182 13,690 15,611 19,633 136,847 - 152,631 7.25% 7.77% 34.82% -42.33% 14.26% 14.52% 18.96% 19.24% 7.54% 13.21% 9.67% Total Tax Collections $ 3,142,615 $ 3,388,129 $ 3,543,036 $ 3,003,506 $ 3,374,803 $ 3,910,413 $ 3,732,859 $ 3,710,128 $ 7,847,052 $ 1,875,859 $ 37,528,400 -$185,265 $ 43,661,239 7.67% 9.97% 6.58% 4.73% 9.55% 12.59% 3.39% 8.50% 3.38% 33.00% 7.91% 11

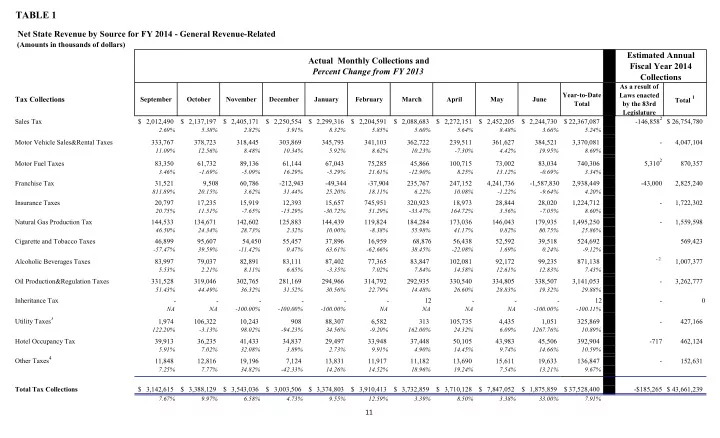

TABLE 1 (continued) Net State Revenue by Source for FY 2014 - General Revenue-Related (Amounts in thousands of dollars) Estimated Annual Actual Monthly Collections and Fiscal Year 2014 Percent Change from FY 2013 Collections As a result of Year-to-Date Laws enacted Total 1 Revenue By Source September October November December January February March April May June Total by the 83rd Legislature Total Tax Collections $ 3,142,615 $ 3,388,129 $ 3,543,036 $ 3,003,506 $ 3,374,803 $ 3,910,413 $ 3,732,859 $ 3,710,128 $ 7,847,052 $ 1,875,859 $ 37,528,400 -$185,265 $ 43,661,239 7.67% 9.97% 6.58% 4.73% 9.55% 12.59% 3.39% 8.50% 3.38% 33.00% 7.91% Licenses,Fees,Permits,Fines&Penalties 88,369 118,699 119,205 96,494 175,371 151,355 122,846 119,729 133,763 98,840 1,224,671 105,645 1,328,477 35.41% 64.62% 22.93% 31.79% 10.82% 31.46% 31.12% 37.72% 29.96% 27.33% 29.99% Interest and Investment Income 5,444 141,350 70,323 70,388 72,744 68,585 73,112 71,064 71,152 70,502 714,666 12,787 833,490 43.67% 5377.95% -72.03% -13.17% -9.47% -69.71% -19.75% -13.95% -15.87% -68.92% -36.79% Lottery Proceeds 119,961 85,072 83,539 81,100 106,182 80,184 93,411 96,407 90,424 110,209 946,489 - 1,035,518 2840.54% 9.19% 11.19% -12.85% 9.84% 7.05% 16.34% 2.63% 1.28% -16.66% 15.78% Sales of Goods and Services 9,976 11,025 9,054 6,604 12,872 9,560 9,547 12,327 8,984 9,136 99,084 - 117,314 18.67% 35.15% -2.96% -14.58% 25.75% -12.84% 1.33% 34.20% -4.90% -17.26% 5.49% Settlements of Claims 916 1,947 11,014 467,537 2,788 18,009 1,324 37,085 6,161 437 547,218 - 529,158 -14.25% 71.35% 1896.08% -0.34% -598.89% 946.50% 26.70% 148.22% -92.62% 141.58% -4.45% Land Income 2,947 4,594 2,789 3,439 4,091 4,382 2,690 3,186 4,468 4,013 36,599 - 14,055 48.43% 94.10% 36.28% -17.14% 58.28% 51.45% -23.95% -37.60% 31.74% 13.19% 15.79% Contributions to Employee Benefits 7 8 8 8 8 7 13 5 6 6 76 - 112 -27.14% -10.73% -10.56% -10.57% -11.41% 409.41% 101.73% -23.70% -15.51% -15.51% 3.46% Other Revenue Sources 101,627 191,017 58,265 83,176 178,541 33,907 195,411 198,450 60,215 284,555 1,385,164 26,402 1,713,024 64.11% -66.35% -73.90% 12.47% 1.66% -38.32% 199.83% -30.13% -369.66% 24.06% -19.17% Total Net Revenue $ 3,471,861 $ 3,941,842 $ 3,897,233 $ 3,812,252 $ 3,927,400 $ 4,276,402 $ 4,231,214 $ 4,248,382 $ 8,222,224 $ 2,453,556 $ 42,482,367 -$40,431 $ 49,232,387 13.27% 3.38% -2.16% 3.87% 8.98% 7.99% 6.99% 6.31% 3.54% 17.32% 6.00% 1 -From the December 2013 Certification Revenue Estimate. Includes the impact of laws enacted by the 83rd Legislature. 2 -Values do not include SB 559 which reversed the speed-up of some tax collections, as well as the delay of motor fuel allocations. The repeal of the above actions occurred prior to any implementation such that the overall pattern of collections/allocations remained unchanged. 3 - Includes public utility gross receipts assessment; gas, electric and water utility tax; and gas utility pipeline tax. 4 - Includes the cement and sulphur taxes and other occupation and gross receipt taxes not separately identified. Note: Totals may not sum because of rounding. 12 SOURCE: Susan Combs, Texas Comptroller of Public Accounts.

Recommend

More recommend