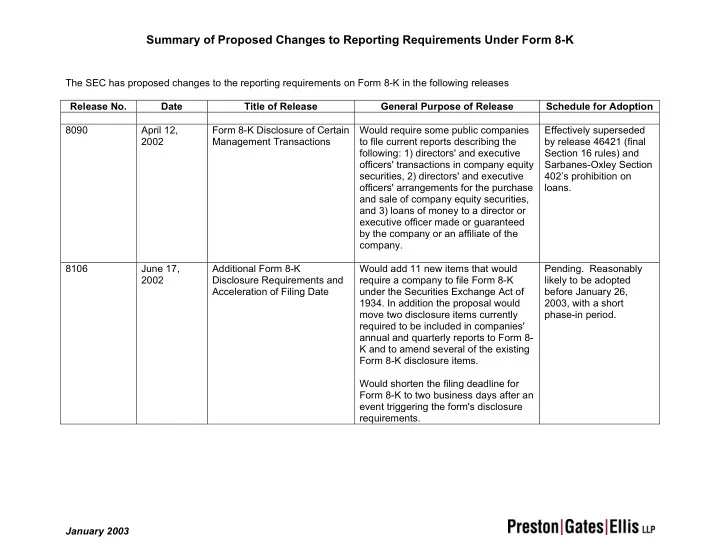

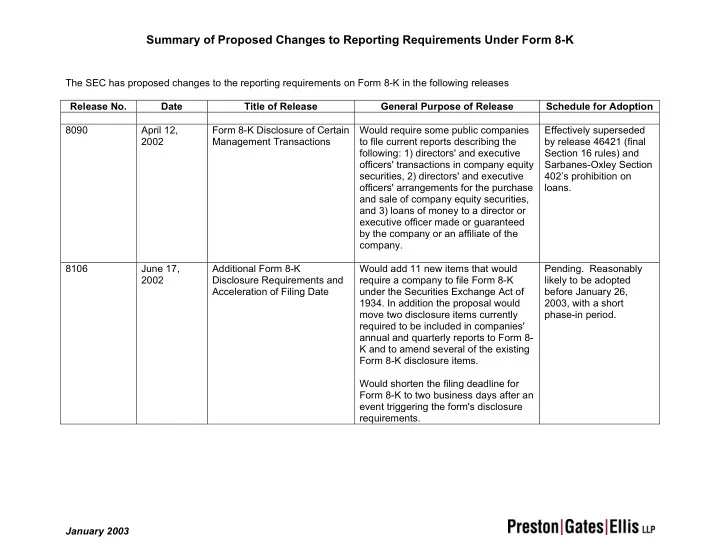

Summary of Proposed Changes to Reporting Requirements Under Form 8-K The SEC has proposed changes to the reporting requirements on Form 8-K in the following releases Release No. Date Title of Release General Purpose of Release Schedule for Adoption 8090 April 12, Form 8-K Disclosure of Certain Would require some public companies Effectively superseded 2002 Management Transactions to file current reports describing the by release 46421 (final following: 1) directors' and executive Section 16 rules) and officers' transactions in company equity Sarbanes-Oxley Section securities, 2) directors' and executive 402’s prohibition on officers' arrangements for the purchase loans. and sale of company equity securities, and 3) loans of money to a director or executive officer made or guaranteed by the company or an affiliate of the company. 8106 June 17, Additional Form 8-K Would add 11 new items that would Pending. Reasonably 2002 Disclosure Requirements and require a company to file Form 8-K likely to be adopted Acceleration of Filing Date under the Securities Exchange Act of before January 26, 1934. In addition the proposal would 2003, with a short move two disclosure items currently phase-in period. required to be included in companies' annual and quarterly reports to Form 8- K and to amend several of the existing Form 8-K disclosure items. Would shorten the filing deadline for Form 8-K to two business days after an event triggering the form's disclosure requirements. January 2003

Summary of Proposed Changes to Reporting Requirements Under Form 8-K Page 2 Release No. Date Title of Release General Purpose of Release Schedule for Adoption 8138 October 22, Disclosure Required by Companies would be required to Final rules must be 2002 Sections 404, 406 and 407 of disclose whether they have adopted a adopted by January 26, the Sarbanes-Oxley Act of code of ethics that covers their 2003. 2002 principal executive officers and senior financial officers, or if they have not, an explanation of why they have not, as well as amendments to, and waivers from, the code of ethics relating to any of those officers. 46778 November 6, Insider Trades During Pension Would clarify the application and Section 306 goes into 2002 Fund Blackout Periods prevent evasion of Section 306(a) of effect on January 26, Sarbanes-Oxley. Section 306(a) 2003. The proposed prohibits the directors and executive rule is likely to be officers of an issuer from, directly or adopted and go into indirectly, purchasing, selling or effect before that date. otherwise acquiring or transferring any equity security of the issuer during a pension plan blackout period that prevents plan participants or beneficiaries from engaging in equity securities transactions, if the equity security was acquired in connection with the director or executive officer's service or employment as a director or executive officer. January 2003

Summary of Proposed Changes to Reporting Requirements Under Form 8-K Page 3 Item-by-Item Listing of Proposed changes in 8-K Reporting Requirements Item No. Item Title History and Trigger Event Comment Source Item 1.01 Entry into a Proposed in If the registrant has entered into an Obligations to disclose negotiations under Material Release 8106 agreement that is material to the registrant 10b-5 or other provisions not affected by Agreement and not made in the ordinary course of the this item. A new registrant's business, or into any material requirement amendment of such agreement. A Form 8-K filing to disclose a merger agreement does not eliminate the need to file pursuant to Rule 165, Rule 14d-2(b) and Rule 14a-12. Item 1.02 Termination Proposed in If a definitive material agreement, or other Obligations to disclose negotiations under of a Material Release 8106 material agreement or instrument, which 10b-5 or other provisions not affected by Agreement was not made in the ordinary course of the this item. A new registrant's business and to which the requirement registrant is a party, is terminated and If the company is not the terminating party, termination of the agreement is material to it would not have to disclose information the registrant. until it receives a written termination notice from the terminating party, unless the agreement provides for notice in some other manner, and all material conditions to termination other than those within the control of the terminating party or the passage of time have been satisfied. January 2003

Summary of Proposed Changes to Reporting Requirements Under Form 8-K Page 4 Item No. Item Title History and Trigger Event Comment Source Item 1.03 Termination Proposed in If the registrant becomes aware that a The test is similar to the test in Item or Reduction Release 8106 customer has terminated or reduced the 101(c)(1)(vii) of Regulation S-K. of a scope of a business relationship with the Business A new registrant and the amount of loss of Relationship requirement revenues to the registrant from such with a termination or reduction represents an Customer amount equal to 10% or more of the registrant's consolidated revenues during the registrant's most recent fiscal year. Item 1.04 Results of Proposed in If a registrant, or any person acting on its Non-public information made public in an Operations Release 8145 behalf, makes any public announcement or earnings call need not be filed: and Financial release (including any update of an earlier Condition A new announcement or release) disclosing (i) If the earnings release is filed under Item requirement material non-public information regarding 1.04 and the earnings call is within 48 the registrant's results of operations or hours of the filing. financial condition for a completed quarterly or annual fiscal period. (ii) The financial and other statistical information contained in the presentation is provided on the registrant's website. January 2003

Summary of Proposed Changes to Reporting Requirements Under Form 8-K Page 5 Item No. Item Title History and Trigger Event Comment Source Item 2.01 Completion Proposed in If the registrant or any of its majority-owned There is a disconnect between this item of Acquisition Release 8106 subsidiaries has completed the acquisition and proposed item 1.01. Item 1.01 or or disposition of a significant amount of requires disclosure if the agreement is Disposition Substantially assets, other than in the ordinary course of material. Item 2.01 requires disclosure only of Assets similar to business. if the transaction exceeds a 10% threshold. existing Item 2. The SEC recognizes that agreements to Changes from acquire or dispose of assets may be the existing item reportable under Item 1.0,1 but the include: consummation of such agreements may (i) no disclosure not be reportable under Item 2.01. about the nature of acquired business; (ii) more precise disclosure about source of funds. January 2003

Summary of Proposed Changes to Reporting Requirements Under Form 8-K Page 6 Item No. Item Title History and Trigger Event Comment Source Item 2.02 Bankruptcy Proposed in If a receiver, fiscal agent, or similar officer or Release 8106 has been appointed for a registrant or its Receivership parent in a proceeding under the Essentially the Bankruptcy Act or in any other proceeding same as existing under State or Federal law in which a court Item 3 or governmental authority has assumed jurisdiction over substantially all of the assets or business of the registrant or its parent, or if such jurisdiction has been assumed by leaving the existing directors and officers in possession but subject to the supervision and orders of a court or governmental authority. If an order confirming a plan of reorganization, arrangement or liquidation has been entered by a court or governmental authority having supervision or jurisdiction over substantially all of the assets or business of the registrant or its parent. January 2003

Summary of Proposed Changes to Reporting Requirements Under Form 8-K Page 7 Item No. Item Title History and Trigger Event Comment Source Item 2.03 Creation of a Proposed in If the registrant or any third party enters Disclosure would be required only when the Direct or Release 8106 into a transaction or agreement that creates company enters into a definitive agreement Contingent any material direct or contingent financial that is unconditional or subject only to Financial A new obligation to which the registrant is subject. customary closing conditions. Obligation requirement That Is Requires disclosure of the creation of Material to financial obligations, including direct the obligations such as registered sales of debt Registrant securities, private placements and bank loans or credit facilities, and contingent obligations such as guarantees, keepwell agreements, obligations to purchase assets that are unconditional or conditioned on certain events, and similar financial obligations. Disclosure is tied to a "materiality" standard rather than a specific financial threshold. January 2003

Recommend

More recommend