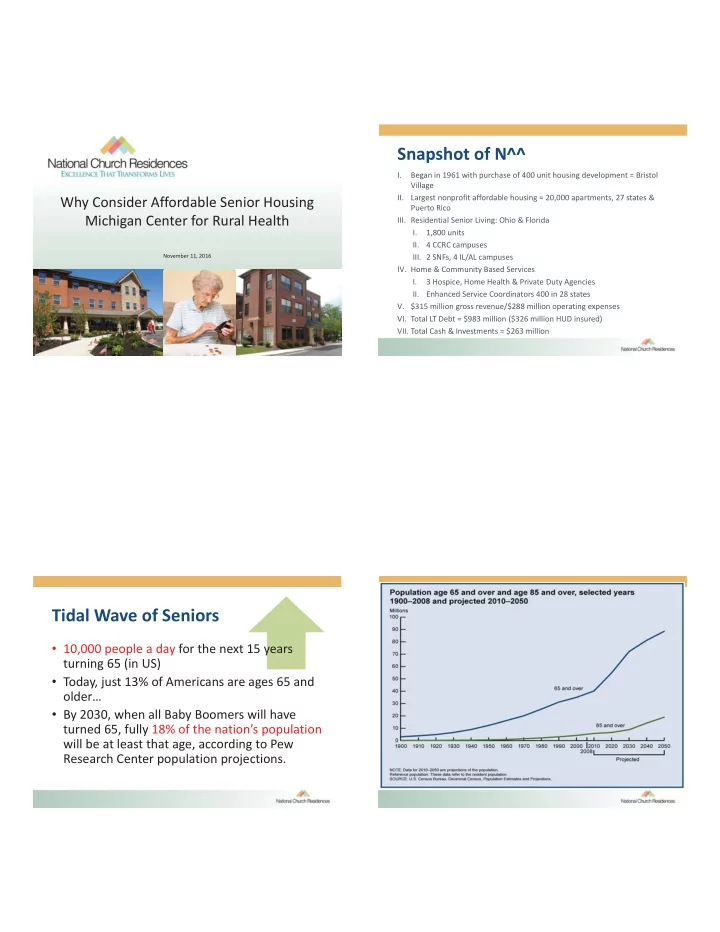

Snapshot � of � N^^ I. Began � in � 1961 � with � purchase � of � 400 � unit � housing � development � = � Bristol � Village II. Largest � nonprofit � affordable � housing � = � 20,000 � apartments, � 27 � states � & � Why � Consider � Affordable � Senior � Housing Puerto � Rico Michigan � Center � for � Rural � Health III. Residential � Senior � Living: � Ohio � & � Florida I. 1,800 � units II. 4 � CCRC � campuses November � 11, � 2016 III. 2 � SNFs, � 4 � IL/AL � campuses IV. Home � & � Community � Based � Services I. 3 � Hospice, � Home � Health � & � Private � Duty � Agencies II. Enhanced � Service � Coordinators � 400 � in � 28 � states V. $315 � million � gross � revenue/$288 � million � operating � expenses VI. Total � LT � Debt � = � $983 � million � ($326 � million � HUD � insured) VII. Total � Cash � & � Investments � = � $263 � million Tidal � Wave � of � Seniors • 10,000 � people � a � day � for � the � next � 15 � years � turning � 65 � (in � US) • Today, � just � 13% � of � Americans � are � ages � 65 � and � older… • By � 2030, � when � all � Baby � Boomers � will � have � turned � 65, � fully 18% � of � the � nation’s � population � will � be � at � least � that � age, � according � to � Pew � Research � Center � population � projections. �

Annual � Costs � of � Care Understanding � the � Costs � FACILITY � TYPE U.S. Michigan Midland “Most � people � don’t � realize � how � expensive � this � care � can � NH: � Private $92,376 $98,184 $94,896 NH: � Semi � private $82,128 $91,248 $91,248 be � until � a � parent � or � family � member � needs � it � … � And � then � Assisted � Living $43,536 $42,756 $43,536 Adult � Day � Care $17,676 $20,796 $17,676 it’s � a � real � shock.” Home � health � aide $46,332 $48,048 $46,332 – Joe � Caldwell, � Director � of � Long � Term � Services, � National � Council � on � Aging, � Home � health � care $45,756 $46,332 $43,476 Columbus � Dispatch � 4/10/15 https://www.genworth.com/dam/Americas/US/PDFs/Consumer/corporate/cost-of- care/179702_CofC_Monthly_060916.pdf Housing � is � a � Major � Determinant � of � What � is � Affordable � Housing? Better � Health �� • Target � individuals � with � low � to � very � low � incomes � (ex: � Huron � County, � MI) • Aging � in � place � = � Least � expensive – Median: � $52,600 • As � healthcare � needs � grow, � services � brought � to � – Extremely � low: � $24,250 � (30%) the � Senior � at � home � (service � coordination, �� – Very � low: � $27,100 � (50%) home � health, � primary � care � onsite) – Low: � $43,350 � (80%) • Quality, � safe, � affordable � housing � leads � to � • Rent � is � set � at � 30, � 50, � or � 60% � of � annual � income health � care � savings

Limited � New � Housing HUD � 202 � Units � Allocated � Since � 1975 • No � increase � in � Section � 8 � Vouchers � for � low � income � seniors • 9% � Tax � Credit � program, � competitive, � limited • 4% � Tax � Credits � – less � equity • What � about � HUD � 202 � program? • USDA � Rural � Development � Funding Source: LeadingAge The � Critical � Need � for � The � Time � to � Act � is � Now! Senior � Affordable � Housing • Majority � of � low � income � households � aged � 65+ � currently � live � in � housing � that � is � considered � unaffordable. � – 73% � of � Seniors � with � annual � incomes � <$15,000, � and � Number � of � Low � Income � Seniors � rising � faster � than � – 48% � of � Seniors � with � incomes � $15,000 �� $30,000 � were � housing � cost � burdened � in � 2013. � ever � before • In � the � next � decade, � households � 65+ � earning � less � than � $15,000 � a � year � are � estimated � to � increase � by � 37% � to � 6.5 � million. Affordable � • Increase � in � homeless � seniors � – Corporation � for � Supportive � Housing, � a � Housing, � September � 2016 healthcare � solution, � dwindling � Source: � American � Community � Survey

Preservation The � Solution � is � Simple • Preserve � existing � seniors � housing • Many � aging � buildings � & � owners • Need � recapitalized • Build � new � with � available � programs • Poorly � managed • Combine � with � home � healthcare � to � • Retain � Section � 8 � vouchers � or � subsidy seniors – Project � based • Explore � Home � Choice � Program – Tenant � based • Advocate � for � new � programs: � CMS � & � HUD � • N^^ � has � funds � for � acquisition partner New � Construction/Rehab � 9% � Tax � Credits New � Construction/Rehab � 4% � Tax � Credits Compete for credit allocation based on Operate project in accordance with the tax credit State criteria requirements to rent to people at certain income Project Operate project in accordance with the tax credit Project levels; ongoing compliance with tax credit program requirements to rent to people at certain income Pay distributions to investors each year Issue tax exempt bonds under Section Levels; ongoing compliance with tax credit program File limited partnership tax return 42 of the IRS tax code that qualify for Depending on amount of tax credits Pay distributions to investors each year Low Income Housing Tax Bonds – May need a construction lender/perm File limited partnership tax return automatically lender to finance balance due to pay in schedule Get the tax credits ~ 30% of the eligible of the Equity at key trigger points costs State � Tax � Exempt � State � Volume � Lender Authority Bonds Cap Awards tax credits to project Limitation on amount of projects based on 10 year allocation That can be financed each year ~70% of eligible cost of the project Based on federal allocation to each state Sell tax credits to for-profit Sell tax credits to for profit Equity/ Equity/ Investors (banks, insurance cos.) Investors (banks, insurance cos.) They provide equity upfront based on tax They provide equity based on tax Investor Investor credits to be received over 10 years credits to be received over 10 years https://www.novoco.com/resource-centers/affordable-housing-tax-credits/lihtc- basics/about-lihtc

Partnering � with � Healthcare Home � Choice • CAHs � benefit � by � serving � growing � senior � population • Program � to � move � individuals � from � nursing � home � setting � to � something � more � home � like • Enhanced � service � coordination � bridges � housing � & � healthcare • Only � in � SNF � due � to � payment � method – N^^ � Care � Guide: � evaluate � seniors’ � health � status • Each � state � funds � or � does � not � fund � this � program � well – HUD � requires � service � coordination: � resident � empowerment • Ohio � is � very � proactive � in � moving � individuals � from � SNF � – Healthcare � & � geriatric � experience to � home � setting � – Health � assessments; � vulnerable � elderly � survey – Interventions – Wellness – Collaboration: � Preferred � Providers! � Campaign � for � Healthy � Aging: � SEAL Federal � Funding � Programs • SEAL: � Service � Enriched � Affordable � Senior � Housing • USDA � 515 � Housing � Program � – low � interest � • New � program � combines � CMS � & � HUD loans � for � rural � focused � projects – CMS � pays � for � healthcare – Higher � income � levels � than � tax � credits – HUD � pays � for � housing – More � difficult � to � maneuver � regulations • 7 � million � seniors � incomes � < � $14,353; � 74% � goes � to � • FHA/HUD � 221 � D � loan � program housing – Nonrecourse, � fixed � rate � debt • Expand � tax � credits � allocated � to � states – Can � partner � with � tax � credits • Expand � project � based � subsidy � – Very � low � cost � of � capital � today � – for � 40 � years • Evidence: � housing � + � services � = � better � outcomes, � – Upfront � costs smarter � spending, � increased � access � to � care

Recommend

More recommend