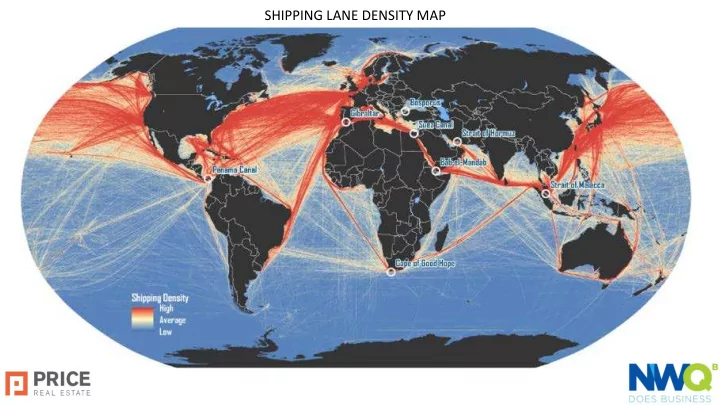

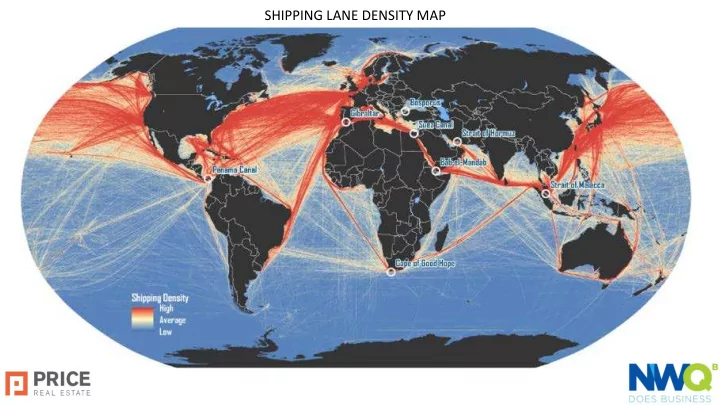

SHIPPING LANE DENSITY MAP

TOP 25 CONTAINER PORTS

UNION PACIFIC RAIL MAP

I-80 INTERSTATE MAP

CANAMEX INTERSTATE MAP

Wasatch Front Regional Malls

A tsu suna nami o of st stor ore e closur osures es is s about out t to o hit t the e US US — Hayley Peterson and d it's s exp expec ected ed t to o ec eclip ipse t se the e ret etail c il carna nage e of 2017 1/3/2018 Retailers are bracing for a fresh wave of store closures in 2018 that's expected to eclipse the rash of closures that rocked the industry last year. "Landlords are panicking," said Larry Perkins, CEO and founder of the advisory firm SierraConstellation Partners. "The last year was pretty apocalyptic from a retail standpoint, and the macro issues haven't changed. There will continue to be a high degree of bankruptcies and store closures.“ 2017 was a record year for both store closures and retail bankruptcies. Dozens of retailers including Macy's, Sears, and JCPenney shuttered an estimated total of 9,000 stores — far exceeding recessionary levels — and 50 chains filed for bankruptcy over the course of the year.

Hayley Peterson 1/3/2018 The loss of even one anchor tenant can trigger a decades-long downward spiral for mall owners. That's because the malls don't only lose the income and shopper traffic from that store's business. The closure often triggers co-tenancy clauses that allow the remaining mall tenants to exercise their right to terminate their leases or renegotiate the terms, typically with a period of lower rents, until another retailer moves into the vacant anchor space. That's good news for retailers looking to grow their physical assets — it means they are more likely to score low rent and favorable lease terms. But it's terrible news for retail landlords, some of whom are now trying to stop the bleeding by suing the companies that are closing stores. Mall owner ners a are e suing uing ret etailer ers t to keep eep stores es ope pen Simon Property Group, one of the biggest mall operators in the country, sued Starbucks this year after the coffee chain said it that it planned to close all 379 stores in its Teavana chain, 77 of which are located in Simon Property Group malls. The mall owner demanded that Starbucks keep running the tea shops located in its malls, arguing in part that their closure would reduce traffic to surrounding stores. A judge ruled in Simon Property Group's favor in December and ordered Starbucks to keep operating the Teavana stores in question. Whole Foods was also recently sued for a store closure. The grocery chain closed a Seattle-area store and the owners of the property sued the company for breaking its long-term lease. A judge has since ordered Whole Foods to reopen the store, which Whole Foods had closed in October. As mall operators become increasingly desperate to keep the lights on, many more retailers could find themselves in court, fighting to shut down dying stores. Not ot al all retai ailers an and sh shop opping m mal alls ar are doom oomed To be sure, there are still hundreds of high-performing shopping malls in the US that are expected to remain immune from the fallout of shrinking retailers. Only the lowest-performing malls — of which there are roughly 300 — are in danger of going out of business. There are also plenty of retailers, mostly discounters, that are growing their physical assets while others shrink. Dollar General, Dollar Tree, Lidl, Aldi, Ross Stores, and TJ Maxx are planning to open hundreds of new stores next year. "Retail isn't going away by any means," Perkins said. "We just got a little bit out of control with the volume of retailers and the number of stores."

Jobs everywhere! Except at stores by Chris Isidore @CNNMoney January 5, 2018: 1:18 PM ET The job market looks like it doing well right now. Unless you head to the mall. Record numbers of store closings and a surge in retail bankruptcies, as well as the shift to online shopping, have forced retailers to slash jobs even as other employers scramble to find qualified workers. The sector lost a total of 66,500 jobs in 2017. General merchandise stores, the segment that includes department stores, were hit the hardest, losing 90,300 jobs, according to the Friday's December jobs reportfrom the Labor Department. Clothing stores cut another 28,600 jobs. Drug stores lost 18,400. These job losses tend to hit the young, elderly, women and minorities the hardest. About 60% of department store employees are female, compared to 47% of workers overall. Minorities, the elderly and teenagers are also far more likely to find jobs in department and discount stores than they are elsewhere. T eenagers hold 8% of department store jobs, compared to 3% of jobs overall.

Recommend

More recommend