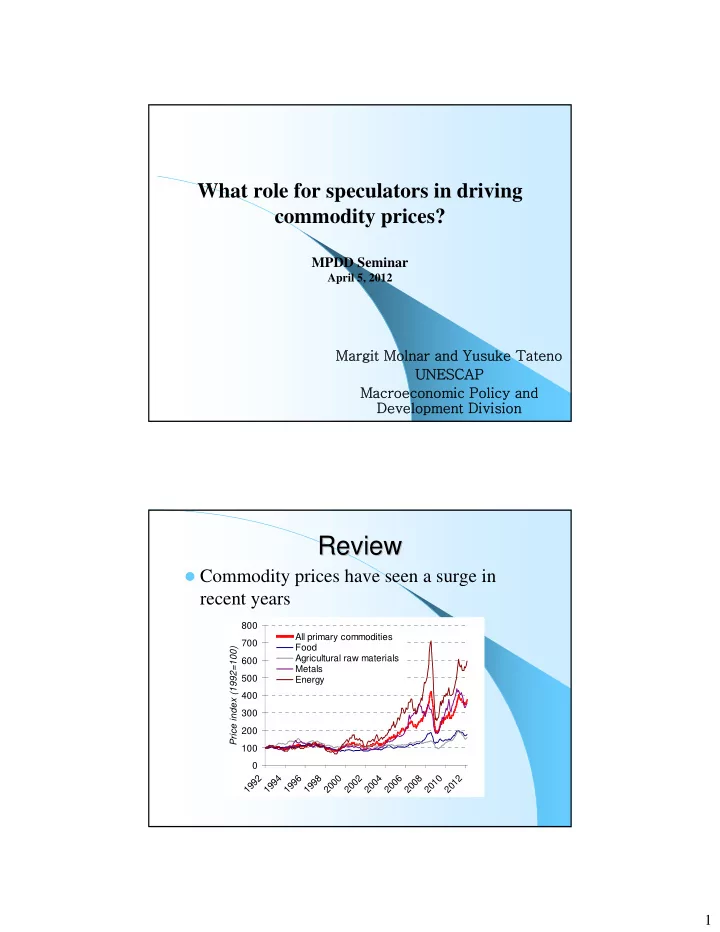

What role for speculators in driving commodity prices? MPDD Seminar April 5, 2012 Margit Molnar and Yusuke Tateno UNESCAP Macroeconomic Policy and Development Division Review Review Commodity prices have seen a surge in recent years 800 All primary commodities 700 Food Price index (1992=100) Agricultural raw materials 600 Metals 500 Energy 400 300 200 100 0 2 4 6 8 0 2 4 6 8 0 2 9 9 9 9 0 0 0 0 0 1 1 9 9 9 9 0 0 0 0 0 0 0 1 1 1 1 2 2 2 2 2 2 2 1

Review Review Economic fundamentals do not fully explain commodity price hikes Physical demand factors have limited role 16% 600 Commodity price index (1992=100) Food imports 14% 500 Fuel imports 12% Food price index (right scale) Import shares 400 Fuel price index (right scale) 10% 8% 300 6% 200 4% 100 2% 0% 0 8 0 2 4 6 8 0 2 4 6 8 0 8 9 9 9 9 9 0 0 0 0 0 1 9 9 9 9 9 9 0 0 0 0 0 0 1 1 1 1 1 1 2 2 2 2 2 2 Review Review What else? – Supply-side constraints – Export restriction – Financial investors 2

Financialisation of commodities of commodities Financialisation Flight to simplicity (exodus from ABS etc. complicated products) Monetary easing – (at lower interest rates producers have lower incentives to increase production so that the proceeds can be invested in high-yield instruments) Speculators Speculators investors not actually holding commodities but seeking arbitrage opportunities in commodities futures and options markets – hedge funds – financial institutions – commodity trading advisors – commodity pool operators – associate brokers – introducing brokers – floor brokers – and other non-commercial traders 3

Do speculators play a role? Do speculators play a role? How to pin down their effect? comparing the price changes in commodities with and without organised futures markets . If speculators play a role, commodity with futures markets should have different price behaviour from non- speculatable commodities. Correlation of price changes Correlation of price changes 0.8 0.6 0.4 0.2 0 -0.2 -0.4 2 4 6 8 0 2 4 6 8 0 9 9 9 9 0 0 0 0 0 1 9 9 9 9 0 0 0 0 0 0 1 1 1 1 2 2 2 2 2 2 Average correlation of speculatable commodities Average correlation of non-speculatable commodities 4

Do speculators play a role? Do speculators play a role? How to pin down their effect? comparing the price changes in commodities with and without organised futures markets . If speculators play a role, commodity with futures markets should have different price behaviour from non- speculatable commodities. Due to substitution and other effects, also non- speculatable commodity prices tend to rise if those with organised futures markets rise, though it should happen with a lag . Korniotis (2009) shows that the comovement between metals with and without futures contracts has not weakened in recent years as speculative activity has risen How to pin down speculators ’ How to pin down speculators ’ effects effects (cont.) (cont.) look at the changes in positions in futures and options markets of non-commercial traders . To what extent position changes by non- commercial traders, in particular hedge funds etc. are associated with price changes? 5

An additional idea An additional idea Framework: cointegration among commodity price inflation, non- commercial trader positions and monetary/financial market conditions Test for the absence of cointegration by determining whether there exists error correction for individual panel members or for the panel as a whole. The tests are general enough to allow for a large degree of heterogeneity, both in the long-run cointegrating relationship and in the short-run dynamics, and dependence within as well as across the cross-sectional units. The relationship exists for several choices of monetary/financial market conditions (currency in circulation, M1, M2, M3, credit, exchange rate, stock price indices) evidence of cointegration for the panel as a whole and for a number of lag choices VECM: check the short- and long-term impacts of speculators on commodity price inflation Estimated equation Estimated equation ln p ln m ln s ln m ln s [ s ](ln p { s } ln m i , t i , t 5 0 1 i , t 1 i , t 1 1 i , t 1 i , t 1 2 , 3 , 4 , 1 2 i t i t i t s T ) T i i , t 2 i , t 1 3 i where p indicates price of a commodity, m is a monetary variable, s is speculation, all in logarithmic forms and T is the time trend. Panel dataset of 9 commodities over Jan 2009-May 2011 6

Preliminary results Preliminary results non- non-commercial reported mzm m3 SP500 mzm Short-term coefficients Money supply (growth) + + + Speculators' net position (change) + + + Money supply (level) - + Speculators' net position (level) + + + + Time trend + + Dynamic coefficient - - - - Long-term coefficients Money supply -(14%) + Speculators' net position + + + +(12%) Trend +(14%) + Interaction term coefficients Speculators' np - price +(15%) + Speculators' np - Money supply + + + Summary – – What What ’ s role for speculators? Summary ’ s role for speculators? Boost commodities prices both in the short and in the long run Tighten the link between monetary/financial variables and commodity prices In some cases decelerate the speed of adjustment of prices back to equilibrium after experiencing a shock 7

Future directions Future directions Demand control – World production biggest demand from countries with low production efficiency Extension of time series and coverage of commodities Explore cross-market linkages and regional dimension Thank you! 8

Recommend

More recommend