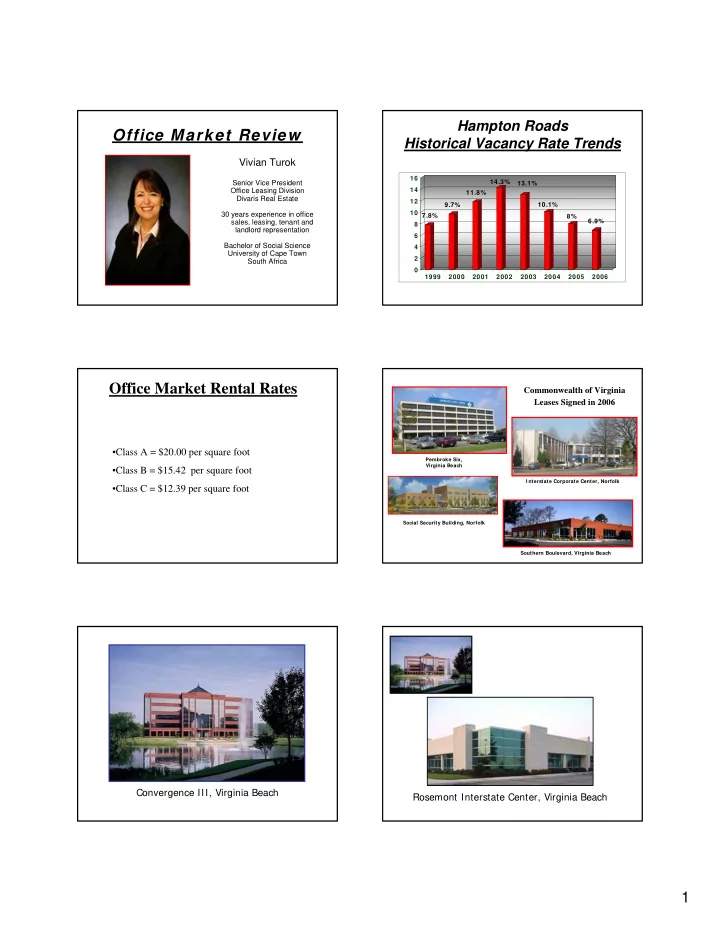

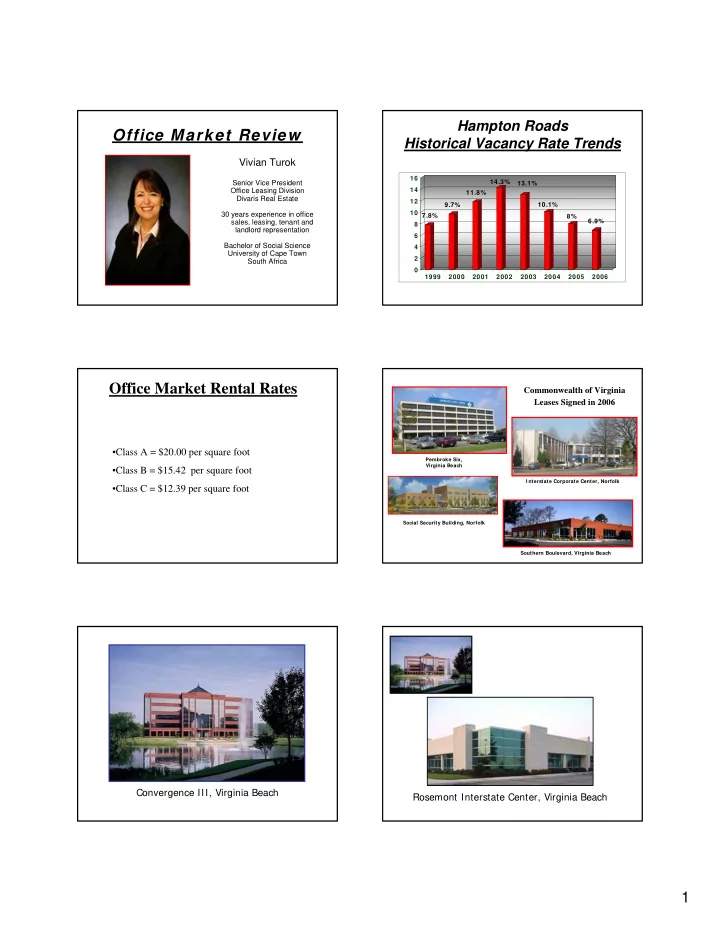

Hampton Roads Office Market Review Historical Vacancy Rate Trends Vivian Turok 16 Senior Vice President 14.3% 13.1% Office Leasing Division 14 11.8% Divaris Real Estate 12 9.7% 10.1% 10 30 years experience in office 7.8% 8% 6.9% sales, leasing, tenant and 8 landlord representation 6 Bachelor of Social Science 4 University of Cape Town 2 South Africa 0 1999 2000 2001 2002 2003 2004 2005 2006 Office Market Rental Rates Commonwealth of Virginia Leases Signed in 2006 •Class A = $20.00 per square foot Pembroke Six, Virginia Beach •Class B = $15.42 per square foot I nterstate Corporate Center, Norfolk •Class C = $12.39 per square foot Social Security Building, Norfolk Southern Boulevard, Virginia Beach Convergence III, Virginia Beach Rosemont Interstate Center, Virginia Beach 1

Amerigroup, Virginia Beach World Trade Center, Norfolk Chesapeake Leases Innovation Research Park Lockheed Martin Modeling Center 2006 Developments 2006 Developments Bridgeway Technology Center, Suffolk Central Center Office Building, Norfolk Amerigroup II, Virginia Beach HRRA Building, Chesapeake BECO Building, Chesapeake Gallery I and II, Virginia Beach Liberty III, Chesapeake 2

2006 2007 Developments Developments One City Center, Newport News Two Columbus Center, Virginia Beach Merchants Walk South, Newport News 2007 Developments 2008 Projects Commander Corporate Center, Norfolk Convergence III, Virginia Beach Dominion Enterprises, Norfolk Pavilion Center II, Virginia Beach Oakbrooke Professional Center, Chesapeake Harbourview Medical Building, Suffolk The Fairways at Lake Wright, Norfolk Wachovia Center, Norfolk Downtown Norfolk 3

Hampton Roads Market Conditions Bon Voyage Incentives � Rental rates are on the rise � Fewer landlord incentives � Lowest vacancy rates in 10 years LEED TM Market Transformation Office Market Forecast Buildings Consume October 2006 12% of potable water � 596 Certified Projects � Building construction will increase 39% of primary energy 40% of raw materials � 1,581+ Registered Projects 48% of US carbon emissions 70% of US electricity � Town Center developments Green Buildings Save: 30 – 50% of energy O v e r 3 0 , 0 � Healthcare and port-related users will play a role 0 35% of carbon emissions 0 L E E D A c 40% of water c r e d i t e in growing our market base P d r o f e 70% of solid waste s s i o n a l s ! � BRAC’s uncertainty effect on our military users HSMM Projects in all 50 States and 24 Countries g g n Bicycle n i i Hybrid l n c y a c e e parking R l c racks s n n e m i b e a r G r g o r p Liberty III, 1317 Executive Blvd, Chesapeake 4

Recommend

More recommend