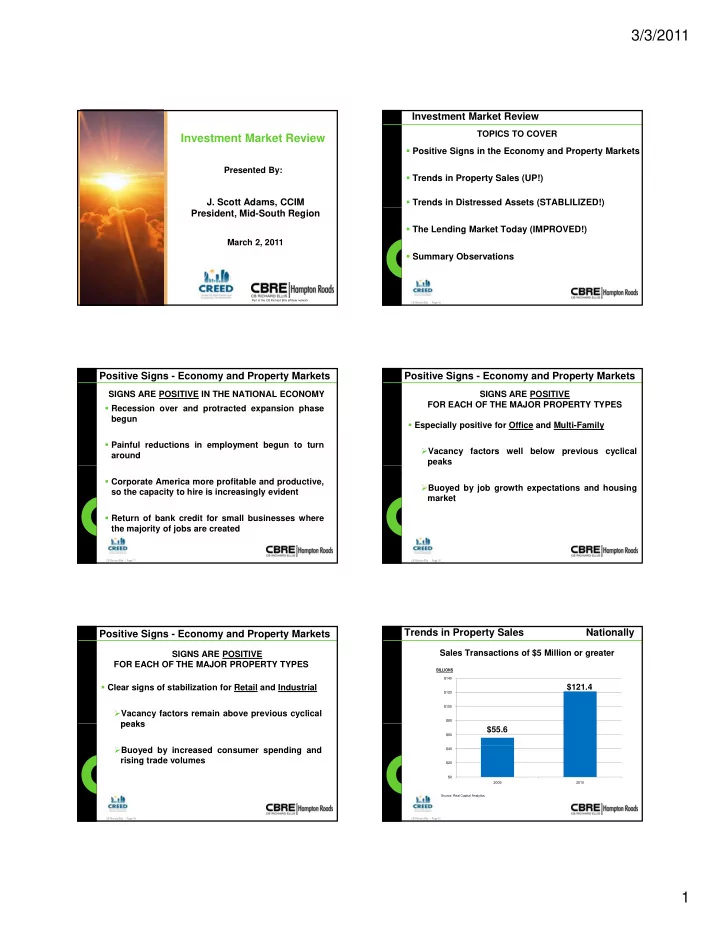

3/3/2011 Investment Market Review TOPICS TO COVER Investment Market Review Positive Signs in the Economy and Property Markets Presented By: Trends in Property Sales (UP!) Trends in Distressed Assets (STABLILIZED!) J. Scott Adams, CCIM President, Mid-South Region The Lending Market Today (IMPROVED!) March 2, 2011 Summary Observations Part of the CB Richard Ellis affiliate network CB Richard Ellis | Page 16 Positive Signs - Economy and Property Markets Positive Signs - Economy and Property Markets SIGNS ARE POSITIVE IN THE NATIONAL ECONOMY SIGNS ARE POSITIVE FOR EACH OF THE MAJOR PROPERTY TYPES Recession over and protracted expansion phase begun Especially positive for Office and Multi-Family Painful reductions in employment begun to turn Vacancy factors well below previous cyclical around p peaks Corporate America more profitable and productive, Buoyed by job growth expectations and housing so the capacity to hire is increasingly evident market Return of bank credit for small businesses where the majority of jobs are created CB Richard Ellis | Page 17 CB Richard Ellis | Page 18 Trends in Property Sales Nationally Positive Signs - Economy and Property Markets Sales Transactions of $5 Million or greater SIGNS ARE POSITIVE FOR EACH OF THE MAJOR PROPERTY TYPES BILLIONS $140 Clear signs of stabilization for Retail and Industrial $121.4 $120 $100 Vacancy factors remain above previous cyclical $80 peaks peaks $55.6 $60 Buoyed by increased consumer spending and $40 rising trade volumes $20 $0 2009 2010 Source: Real Capital Analytics CB Richard Ellis | Page 19 CB Richard Ellis | Page 20 1

3/3/2011 Trends in Property Sales Hampton Roads 2010 Top Local Sales Transactions: Multi-Family Alta Great Bridge Sales Transactions of $5 Million or greater MILLIONS $151.4 $160 $139.5 $140 $120 $100 $80 $60 $40 $20 $0 2009 2010 Source: CB Richard Ellis Market Research CB Richard Ellis | Page 21 CB Richard Ellis | Page 22 2010 Top Local Sales Transactions: Retail 2010 Top Local Sales Transactions: Multi-Family Prime Outlets Williamsburg Battlefield Woods Apartments CB Richard Ellis | Page 23 CB Richard Ellis | Page 24 2010 Top Local SalesTransactions: Retail 2010 Top Local Sales Transactions: Office Cape Henry Plaza Harbour View Medical Arts Building CB Richard Ellis | Page 25 CB Richard Ellis | Page 26 2

3/3/2011 2010 Top Local Sales Transactions: Office 2010 Top Local Sales Transactions: Office Southport Centre Battlefield Corporate Center CB Richard Ellis | Page 27 CB Richard Ellis | Page 28 Trends in Distressed Assets Trends in Distressed Assets WHAT IS A “DISTRESSED ASSET”? VOLUME OF DISTRESSED ASSETS HAS STABLIZED $250 A loan default has occurred or is imminent $200 $150 and/or $100 The owner/sponsor of the asset is bankrupt $50 or faces financial trouble $0 07Q1 08Q1 09Q1 10Q1 Outstanding Worked Out CB Richard Ellis | Page 29 CB Richard Ellis | Page 30 Summary Observations The Lending Market Today Industry has evolved from the phrase GREAT SIGNS IN THE COMMERCIAL REAL ESTATE LENDING MARKET “Survival of the Fittest” to “Most Success for the Fittest” Lending volume in 4Q 2010 was the highest quarterly increase since mid-2007 Property Types Physical Assets Overall lending volume in 2010 was 36% increase over Markets 2009 2009 Locations Real Estate Companies All types of lending sources show positive signs Service Providers Banks Insurance Companies Conduit Lenders CB Richard Ellis | Page 31 CB Richard Ellis | Page 32 3

3/3/2011 Summary Observations While much of the first phase of investment volume recovery has been in the “major markets”, Hampton Roads will increasingly participate More space absorption More rental rate growth Higher investment sales volume CB Richard Ellis | Page 33 4

Recommend

More recommend