Moral Hazard and Efficiency J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 1 / 75

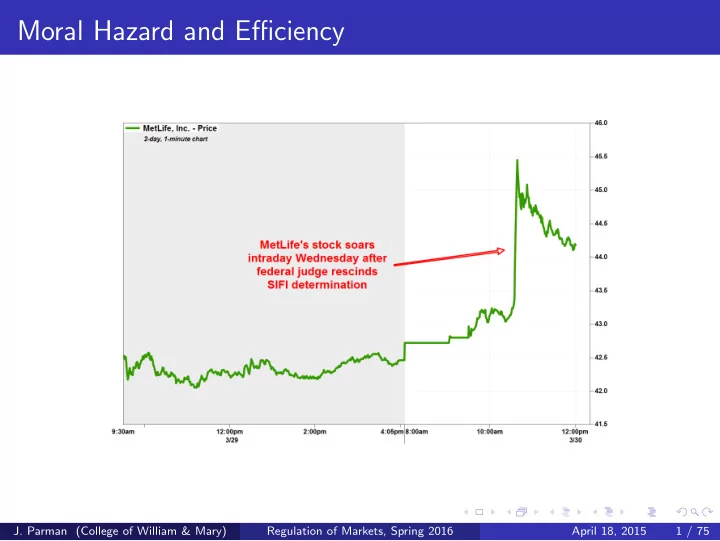

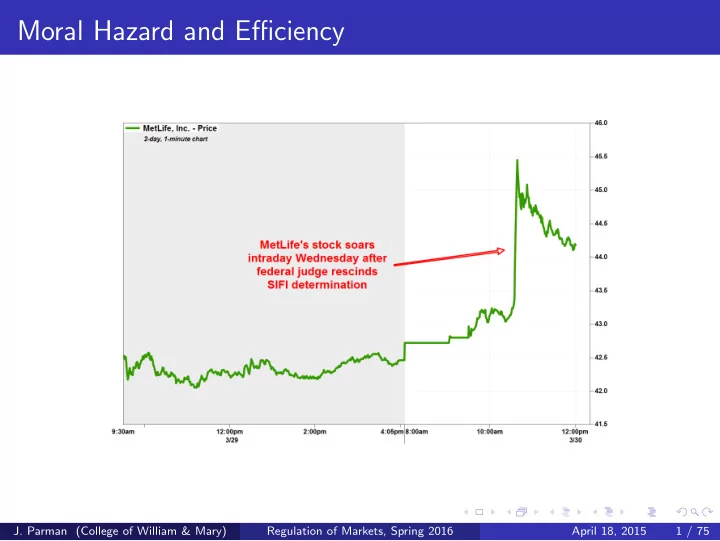

Moral Hazard and Efficiency The notion of moral hazard leading to inefficiency in workplace safety gives us a nice segue into financial regulation One of the main issues people have worried about recently is the possibility of financial institutions taking excessive risk Consider the concerns over the notion of ’too big to fail’ J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 2 / 75

Moral Hazard and Efficiency J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 3 / 75

Moral Hazard and Efficiency J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 4 / 75

Moral Hazard and Efficiency J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 5 / 75

Moral Hazard and Efficiency J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 6 / 75

Moral Hazard and Efficiency J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 7 / 75

Moral Hazard and Efficiency So if a firm thinks it will be deemed too big to fail, it will take on inefficiently risky assets This is a standard moral hazard problem that arises when agents are insulated from risk It’s not the only efficiency issue with too big to fail First, there are social benefits from financial sector stability (think of our externality discussions) Also there may be economies of scale (think of our natural monopoly discussions) But there are also other social costs (more highly correlated risk in the system) J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 8 / 75

Why Regulate Financial Markets? J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 9 / 75

Why Regulate Financial Markets? We certainly regulate what Madoff did, this is why Madoff has a 150-year sentence (his lawyers asked for 7) We have a complicated set of regulations specifying accounting standards, what needs to be reported to investors, what information can be used for trading, and so on However, to a large extent these regulations are about fairness Are there any issues of efficiency in play? Without MB and MC on units of output, need a slightly different notion of efficiency J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 10 / 75

Why Regulate Financial Markets? $36 billion was invested with Madoff $18 billion was returned to investors, $18 billion was not Over half of Madoff’s investors were net winners According to Madoff’s cooked account numbers, $57 billion was owed to investors So what is the loss to society here, the ∆ TS ? Is it the $18 billion unreturned? The theoretical $57 billion minus the $18 billion returned? Is it zero? J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 11 / 75

Why Regulate Financial Markets? Hewlett-Packard stock price relative to electronic technology sector, 2008-2013 http://www.youtube.com/watch?v=Wo Ejfc5hW8 J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 12 / 75

Why Regulate Financial Markets? Apple stock price relative to electronic technology sector, 2008-2013 J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 13 / 75

Why Regulate Financial Markets? American Airlines stock price relative to transportation sector, 2008-2013 J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 14 / 75

Why Regulate Financial Markets? Delta Airlines stock price relative to transportation sector, 2008-2013 J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 15 / 75

Why Regulate Financial Markets? The big economic value of financial markets is getting financial capital to the firms that need it Given that there is a finite amount of financial capital out there, we want it to go to where it will be put to best use In theory, financial markets help do that for us Another thing markets accomplish for society in terms of efficiency is solving an issue of timing J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 16 / 75

Why Regulate Financial Markets? J. Parman (College of William & Mary) Regulation of Markets, Spring 2016 April 18, 2015 17 / 75

Recommend

More recommend