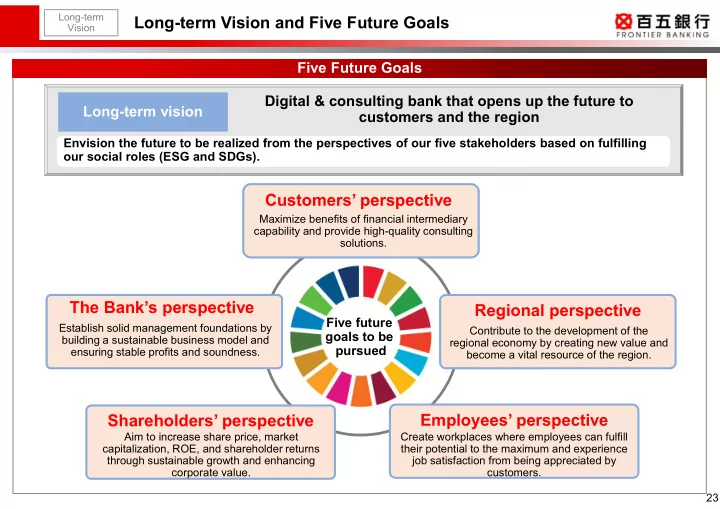

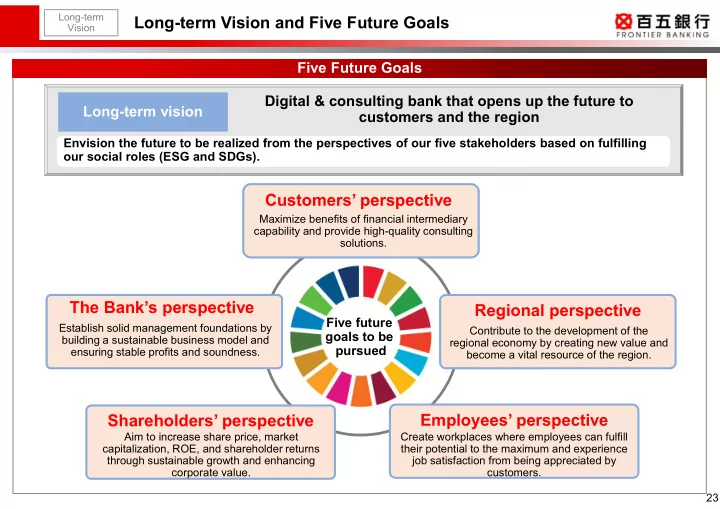

Long-term Long-term Vision and Five Future Goals Vision Five Future Goals Digital & consulting bank that opens up the future to Long-term vision customers and the region Envision the future to be realized from the perspectives of our five stakeholders based on fulfilling our social roles (ESG and SDGs). Customers’ perspective Maximize benefits of financial intermediary capability and provide high-quality consulting solutions. The Bank’s perspective Regional perspective Five future Establish solid management foundations by Contribute to the development of the goals to be building a sustainable business model and regional economy by creating new value and pursued ensuring stable profits and soundness. become a vital resource of the region. Shareholders’ perspective Employees’ perspective Aim to increase share price, market Create workplaces where employees can fulfill capitalization, ROE, and shareholder returns their potential to the maximum and experience through sustainable growth and enhancing job satisfaction from being appreciated by corporate value. customers. 23

Long-term Timeline for Realizing the Vision of the Bank within 10 Years Vision After three years building the foundation, the Bank will shift to a sustainable business model and realize the vision of the Bank within 10 years Vision of the Bank within 10 years (numerical targets) Item Core OHR Capital adequacy ratio Net income Targets In the 60% range 10% or more 15.0 billion yen or more After 10 Previous Medium- 2nd STAGE of 3rd STAGE of 1st STAGE of Innovation term Management years Plan Innovation Innovation Next Medium-term Management The 140th The 150th Plan (FY2019-2021) FY2022-2024 FY2025-2027 anniversary anniversary Tough external environment • Negative interest rates Realize the Vision of Course of events • Downsizing of regional market with innovation • Entries from other industries/shift to cashless society the Bank Impacts of Impacts of innovations on innovations on boosting boosting earnings earnings Natural course of events Factor for temporary profit decline Strategic IT investment Strategic IT investment to improve efficiency to improve efficiency First year Three years of building the Three years of adopting Three years of accelerating Sustainable of foundation aggressive strategies growth business model innovation 24

Long-term Milestones Toward Realizing the Long-term Vision Vision Steadily achieve the milestones set to realize the vision of the Bank within 10 years Previous After 1st STAGE of 2nd STAGE of 3rd STAGE of Timeline/ Medium-term 10 years Innovation Innovation Innovation Management Plan Target item The 150th The 140th FY2019-2021 FY2022-2024 FY2025-2027 anniversary anniversary FY2018 FY2021 FY2024 FY2027 FY2028 (actual) (targets) (targets) (targets) (targets) Net income 10.7 billion 10.0 billion 12.0 billion 14.0 billion 15.0 billion yen yen or more yen or more yen or more yen or more Less than Approx. Approx. In the 60 % 74.4 % Core OHR 79 % 75 % 70 % range Market share of 36.8 % 41 % or Approx. Approx. Approx. loans in Mie 39 % 40 % 41 % (*as of more Prefecture September 2018) Number of 300 450 600 650 161 personnel with persons or persons or persons or persons or professional persons more more more more qualifications Number of personnel with professional qualifications 1st Grade Certified Skilled Professional of Financial Planning, CFP, Small and Medium Enterprise Management Consultant Three years of Three years of building Three years of adopting aggressive the foundation accelerating growth strategies 25

Gateway to the Overview of the New Medium-term Management Plan Future Overview of the Medium-term Management Plan “KAI-KAKU 150 1st STAGE—Gateway to the Future” comprising three reform measures and 14 basic strategies Three innovation measures 14 basic strategies (1) Strengthen topline (loan income) Profit Structure (2) Strengthen topline (fees and commissions) Profit Structure (3) Develop new businesses/new fields innovation (4) Rebuild securities portfolio (14) Initiatives for ESG/SDGs (5) Thoroughly review cost structure Strengthen Integrate physical consulting (face-to-face sales) (6) Reform organizational culture (promote And digital channels solutions Organization/ diversity) personnel Create new value (7) Increase efficiency of organization/personnel Improve productivity (8) Develop professional human resources further (9) Strengthen business management system Organizational/ IT & digital personnel (10) Mobile channel strategy innovation IT & digital innovation (11) New business strategy Streamline (12) Operations digitization strategy organization/ personnel (13) Branch office digitization strategy (manpower savings) 26

Gateway to the Numerical Targets (General) Future We set numerical targets designed to further strengthen the Bank’s management structure over three years in order to build the foundation while looking 10 years into the future. Numerical Targets of the Medium-term Management Plan Final year Item FY 3/19 (actual) FY 3/22 (target) Profitability 10.7 billion yen 10.0 billion yen or more Net income Target achievement indicator Capital efficiency indicators ROE (Shareholders’ equity base) 4.32% 3.7% or more indicator 74.43% Less than 79% OHR (Core gross operating profit base) Efficiency indicator Soundness 9.74% 9.5% or more Capital adequacy ratio indicator 5,230 billion yen or Average balance of total deposit 4,992.9 billion yen more (including negotiable certificates of deposit) Performance evaluation 3,700 billion yen or 3,246.2 billion yen Average balance of total loans Growth indicator more Loan-to-deposit ratio (average indicators 65.0% 70.8% or more balance base) Operating income from services 1.5 billion yen 3.7 billion yen to customers Profit indicator Corporate solutions fees 941 million yen 2,000 million yen Number of personnel with Human resources 161 persons 300 persons professional qualifications development indicator 27

Profit Structure Innovation Gateway to the Strengthening Loan Income (General) Future Increase average balance of loans, such as loans to local medium-sized companies/SMEs and consumer loans, by approx. 500 billion yen. JPY-denominated loans Average balance plan Total loans Average balance plan Loans to medium-sized companies (Unit: 100 million yen) Consumer loans (Unit: 100 million yen) and SMEs in the region JPY-denominated Foreign currency (Unit: 100 million yen) Housing loans Unsecured loans loans -denominated loans + 458.1 +111.6 +347.2 14,102 37,043 billion yen billion yen billion yen 11,841 Average 492 annual rate: 2,146 +10.7% 10,630 10,725 32,462 13,610 Average 372 annual rate: Average 1,617 Average +10.9% annual rate: 10,258 annual rate: +3.4% +10.8% 34,897 30,845 FY 3/19 FY 3/22 FY 3/19 FY 3/22 Average annual rate: Foreign currency-denominated loans Average balance plan +4.3% • Increase average balance of loans by approx. 50.0 billion yen by further strengthening the operation system and based upon careful risk analysis. • Provide loans for excellent floating-rate loan deals that offer reasonable FY 3/19 FY 3/22 spreads. Improve loan-to-deposit ratio FY 3/22 FY 3/19 (actual) Comparison with FY 3/19 (final year of the Medium-term Management Plan) Loan-to-deposit ratio 65.0% 70.8% or more +5.8P or more 28

Profit Structure Innovation Strengthening Loan Income Gateway to the Future (Loans to Medium-sized Companies and SMEs) Deepen business feasibility assessment to further strengthen financial intermediary capability and increase market share for loans. Toward More Sophisticated Business Feasibility Assessments Change in volume of loans to medium-sized Client supporting project companies/SMEs in the region (average balance) (Unit: 100 million yen) Improve level of business feasibility Loans to medium-sized companies/SMEs in Aichi Prefecture 11,841 assessment activities (average balance during the fiscal year) 3,755 Loans to medium-sized companies/SMEs in Mie Prefecture (average balance during the fiscal year) Previous business feasibility assessment activities 10,725 10,289 3,354 Place emphasis on identifying current status ・ Business feasibility 3,166 9,925 8,086 Prepare the business feasibility assessment sheet/ assessment 2,957 support improving financial position ・ One-on-one client 7,371 Allowing execution of loans based on different support activity 7,123 criteria ・ Cash flow support loans, 6,968 etc. Support for core Win support businesses FY 3/17 FY 3/18 FY 3/19 FY 3/22 Change in the loan balance based on business Become their Propose solutions for enhancing main bank feasibility assessment and number of clients who corporate value received a business feasibility assessment Branches Head office External Establish institutions Group Balance of loans based on sustainable 2,167 clients (Unit: 100 million yen) the business feasibility assessment business Number of clients who received a Collaboration transactions business feasibility assessment FY 3/19 1,635 clients Average yield on 3,721 loans based on 1,051clients business 3,068 Achieve differentiation and superiority in loan 630 clients feasibility transactions 2,389 assessment 1.26 % 1,616 JPY-denominated loans Expand share of Strengthen loan (average yield) 0.91% loans income FY 3/16 FY 3/17 FY 3/18 FY 3/19 29

Recommend

More recommend