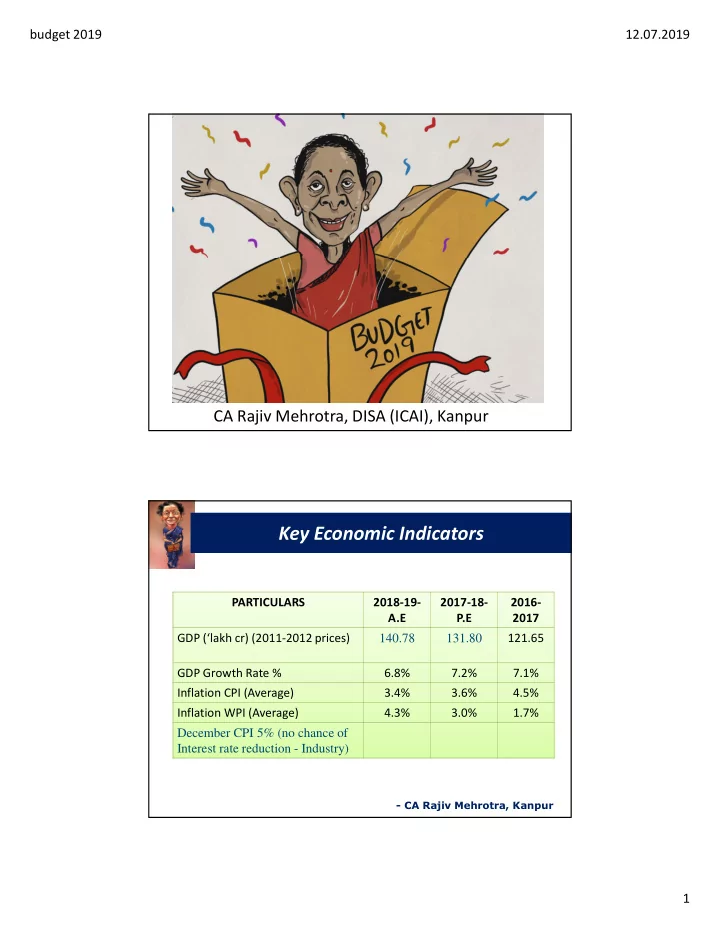

budget 2019 12.07.2019 CA Rajiv Mehrotra, DISA (ICAI), Kanpur Key Economic Indicators PARTICULARS 2018-19- 2017-18- 2016- A.E P.E 2017 GDP (‘lakh cr) (2011-2012 prices) 121.65 140.78 131.80 GDP Growth Rate % 6.8% 7.2% 7.1% Inflation CPI (Average) 3.4% 3.6% 4.5% Inflation WPI (Average) 4.3% 3.0% 1.7% December CPI 5% (no chance of Interest rate reduction - Industry) - CA Rajiv Mehrotra, Kanpur 1

budget 2019 12.07.2019 Estimates of Receipts(Budgeted) S.No Particulars Percent 1. Corporation Tax 21% 2. Income Tax 16% 3. Customs 4% 4. Union Excise Duties 8% 5. Borrowings and Other Liabilities 20% 6. G.S.T 19% 7. Non Tax Revenue and Other Capital Receipts 11% - CA Rajiv Mehrotra, Kanpur Estimates of Expenses (Budgeted) S.No Particulars Percent 1. States Share Of Taxes 23% 2. Interest Payments 18% 3. Central Sector Schemes 13% 4. Centrally sponsored Schemes 9% 5. Subsidies 8% 6. Defense 9% 7. Other Expenses 8% 8. Finance Commission and Others 7% 9. Pensions 5% - CA Rajiv Mehrotra, Kanpur 2

budget 2019 12.07.2019 Budget Financials 2018-2019 2019-2020 Particulars (Revised Estimates) (Budgeted) % Amount in cr Amount in cr % Revenue Receipts 1729682 1962761 Capital Receipts 727553 823588 Total Receipts 2457235 2786349 Fiscal Deficit 634398 3.4 703760 3.3 Revenue Deficit 410930 2.2 485019 2.3 Primary Deficit 46828 0.2 43289 0.2 - CA Rajiv Mehrotra, Kanpur Tax Revenue (Rs In Crores) 2018-2019 2018-2019 2019-2020 S.No Particulars (Budgeted) (R.E) (Budgeted) 1. Corporation Tax 621000 671000 766000 2. Income Tax 529000 529000 569000 3. Customs 112500 130038 155904 4. Union Excise Duties 259600 259612.20 300000 5. GST & Service Tax 743900 643900 663343 6. Other Taxes 5241.56 5342 6947.93 - CA Rajiv Mehrotra, Kanpur 3

budget 2019 12.07.2019 Expenditure Of Major items 2018-2019 2019-2020 S.No Items (R.E) (B) 1. Defense 405194 431011 2. Agriculture 75753 138564 3. Commerce and Industry 12338 11894 4. Education 83626 94854 5. Finance 865578 1005985 6. Interest 587570 660471 7. Transfer to States 141353 155448 8. Transport 78626 83016 Rs In Crores - CA Rajiv Mehrotra, Kanpur Growth In GVA MANUFA CONSTRU YEAR AGRICULTURE INDUSTRY SERVICE GVA CTURING CTION 2016-2017 4.9 5.6 7.7 7.9 1.7 6.6 2017-2018 2.1 4.4 8.3 4.6 3.6 6.1 2018-2019 2.9 6.9 7.5 6.6 MARKET PRICE 2011-2012 AS BASE INDEX - CA Rajiv Mehrotra, Kanpur 4

budget 2019 12.07.2019 Growth In Foreign Trade/Reserves/Investment Particulars 2016-17 2017-18 2018-19 Export Trade growth 5.4% 12.1% 12.5% Import Trade growth 0.5% 21.8% 15.4% Forex Reserves 370.00 409.37 395.6 Foreign Investment(FDI) 60.1 23.9 24.8 * Figures of 2018-2019 are only up to December 2018 * Forex Reserves and Foreign Investments are in USD Billions - CA Rajiv Mehrotra, Kanpur Current Economic Scenario GDP growth has fallen down to 6.8% in the first quarter of – fiscal year; which is lower due to the Impact of GST and overall mood including international slowdown. There is a difference between the projections and economic – survey. The budget projects 12% nominal growth minus inflation of 4% the real GDP comes at 8% whereas the economic survey projects at 7% and the actual number for Ist quarter is 6.8%. Banking sector/ NBFC’s in bad shape and MSME’s/ Real Estate – still struggling. Consumption slowing down with automobiles and other – luxury goods. - CA Rajiv Mehrotra, Kanpur 5

budget 2019 12.07.2019 Positives • Still one of the highest rate of growth as compared all major economies of the world. • World GDP growth is much lesser though there has been an up move in Europe and developed economies. Projected GDP 3-4%. • With a very large consumer base internal corrections also make a major impact. • Inflation under control. • A target to become $5 Trillion economy in next five years - CA Rajiv Mehrotra, Kanpur Positives There is a growth in services sector. • Make in India may improve due to hike in customs duty on • several products and across the board by cess. ISBC (Insolvency Act) may lead to units restarting. • Disinvestment process is being undertaken. • – Confidence in Insurance and banking sector, more FDI’s permitted. – FII & FDI are still favoring India. - CA Rajiv Mehrotra, Kanpur 6

budget 2019 12.07.2019 Negatives – Interest accounts for about 33.36% of Gross Revenue Receipts. Interest and repayment of loans account for over 45% of the Total Revenue receipts. – Agricultural Production down in the last three years, manufacturing and industrial production down. – Increasing disparities between rural and urban incomes. – No real push for infrastructure/healthcare/education as regards budget allocation. – Most of the items emphasized are off budget items. - CA Rajiv Mehrotra, Kanpur Stock Market • No real push for any industry • FPI’s will be taxed at 42.74% • Holding of promoters to be reduced from 75-65% will give a lot of shares in the market. • High Disinvestment target will take a lot of liquidity of Government Institutions • Rs 70,000 cr of bank funding may not be enough. • Meeting of Fiscal deficits and revenue targets seems difficult • Companies facing demand recession and do not expect a good Q1. - CA Rajiv Mehrotra, Kanpur 7

budget 2019 12.07.2019 ����������������� ���� ����������� ��������� - CA Rajiv Mehrotra, Kanpur Personal Taxation- Rates Ind.upto 60 Ind. with age Ind.aged above Particulars years of age between 60-80 Remarks 80 years and HUFs years Basic exemption limit Rs.2.50 Rs.3.00 lacs Rs.5 Lacs No change lacs Income between basic 5% 5% N.A. No change exemption limit and Rs.500000/- Income- between 5-10 lakhs 20% 20% 20% No change Income Over Rs.10 Lacs 30% 30% 30% No change Surcharge 10%- If income more than 50 Lacs and less than 1 Cr 15%- if income more than 1 Crore upto 2 crores 25%- if income more than 2 Crore upto 5 crores 37%- 15%- If income more than 5 Crore. Cess 4% Health and education cess on Income Tax - CA Rajiv Mehrotra, Kanpur 8

budget 2019 12.07.2019 Rate of Taxation-Resident Companies • Companies with turnover/gross receipts of upto Rs.250 crores in F.Y.2016-17- 25% • Other Companies – 30% • Surcharge (No change): – if net income > Rs. 1 Crore but less than Rs.10 Crores- 7% – If net income > Rs.10 Crore- 12% • Health and Education Cess- 4% of tax amount - CA Rajiv Mehrotra, Kanpur Rate of Taxation-Resident Firms and LLPs Tax rate– 30%- No change • Surcharge (No change): • – If net income > Rs.1 Crore- 12% • Health and Education Cess- 4% of tax amount - CA Rajiv Mehrotra, Kanpur 9

budget 2019 12.07.2019 Effective Rate of Tax Income Income Income between 1 between 2 Particulars exceeding crores to 2 crores to 5 5 crores crores crores For individuals/ HUFs 35.88% 39% 42.744% Long term capital gain (if 23.92% 26% 28.496% assesse’s total income, including such capital gain exceeds the slab limits Maximum marginal rate 42.744% 42.744% 42.744% - CA Rajiv Mehrotra, Kanpur Amendments through the Interim Budget Income Tax slabs remain the same for FY 2019-20. Tax Rebate Limit under 87A increased from Rs. 3.5 lakhs to Rs. 5 lakhs for taxpayers. The maximum limit of the tax rebate increased to Rs.12,500 from the present limit of Rs. 2,500. TDS limit hiked from Rs 10,000 to Rs 40,000 on Post Office Savings and Bank Deposits. TDS threshold on rent increased from Rs 1,80,000 to Rs 2,40,000 Standard Deduction for the salaried class increased from Rs.40,000 to Rs.50,000. - CA Rajiv Mehrotra, Kanpur 10

budget 2019 12.07.2019 Amendments through the interim Budget No tax on notional rent of second Self-occupied House under • “Income from House Property” (up to two self-occupied house properties) to be considered for exemption. Section 54 exemption now available on the second house property, • provided the capital gains is less than or equal to Rs. 2 crores – to be availed only once in a lifetime. Benefits under Section 80-IBA to be extended for one more year – • to the housing projects approved till 31 March 2020. Period of exemption from levy of tax on notional rent, on unsold • inventories is extended from one year to two years, starting from the end of the year in which the project is completed. - CA Rajiv Mehrotra, Kanpur ������������� ������������ �������� - CA Rajiv Mehrotra, Kanpur 11

Recommend

More recommend