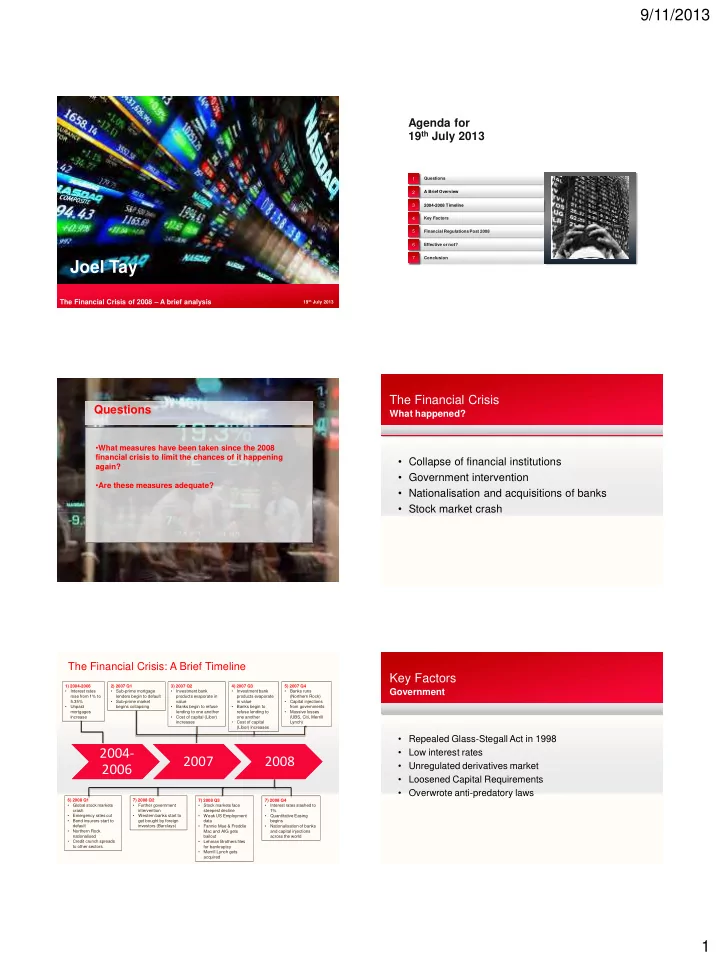

9/11/2013 Agenda for 19 th July 2013 1 Questions 2 A Brief Overview 3 2004-2008 Timeline 4 Key Factors 5 Financial Regulations Post 2008 6 Effective or not? 7 Conclusion Joel Tay The Financial Crisis of 2008 – A brief analysis 19 th July 2013 The Financial Crisis Questions What happened? • What measures have been taken since the 2008 financial crisis to limit the chances of it happening • Collapse of financial institutions again? • Government intervention • Are these measures adequate? • Nationalisation and acquisitions of banks • Stock market crash The Financial Crisis: A Brief Timeline Key Factors 1) 2004-2006 2) 2007 Q1 3) 2007 Q2 4) 2007 Q3 5) 2007 Q4 • • • • • Government Interest rates Sub-prime mortgage Investment bank Investment bank Banks runs rose from 1% to lenders begin to default products evaporate in products evaporate (Northern Rock) 5.35% • Sub-prime market value in value • Capital injections • Unpaid begins collapsing • Banks begin to refuse • Banks begin to from governments • mortgages lending to one another refuse lending to Massive losses • increase Cost of capital (Libor) one another (UBS, Citi, Merrill • increases Cost of capital Lynch) (Libor) increases • Repealed Glass-Stegall Act in 1998 2004- • Low interest rates 2007 2008 • Unregulated derivatives market 2006 • Loosened Capital Requirements • Overwrote anti-predatory laws 6) 2008 Q1 7) 2008 Q2 7) 2008 Q3 7) 2008 Q4 • Global stock markets • Further government • Stock markets face • Interest rates slashed to crash intervention steepest decline 1% • • • • Emergency rates cut Western banks start to Weak US Employment Quantitative Easing • Bond insurers start to get bought by foreign data begins • • default investors (Barclays) Fannie Mae & Freddie Nationalisation of banks • Northern Rock Mac and AIG gets and capital injections nationalised bailout across the world • Credit crunch spreads • Lehman Brothers files to other sectors for bankruptcy • Merrill Lynch gets acquired 1

9/11/2013 Key Factors Key Factors Banks Others • Unattractive low yields, asset managers looked towards • Mortgage lenders relaxing standards high yield of MBS • Customers not doing their own due diligence • Credit agencies rated junk bonds as AAA • Customers purchasing what they cannot afford • Highly leveraged • Created new products such as MBS, CDOs, CDS • Commercial banks involved themselves with these products as well Financial Regulations Financial Regulations Post-2008 Dodd-Frank Act of 2010 Aimed at reducing: • The chances of another financial collapse • The end of tax-payer bailouts • Better customer protection Analysing the Other Changes Dodd-Frank Investment Banks Act Increased Oversight Increased Limitations Customer Protection • Establishment of an • Increased capital • Proper disclosures to 1 2 3 Oversight committee requirements for banks customers • Largest 2 independent investment banking Goldman • • • Identification of Consent required for Penalties for credit acquisition of financial agencies that rate Sachs and Morgan Stanley became bank holding systematically companies financial instruments important financial incorrectly companies institutions • Stricter leverage limits • Increased insurance • Requires risk • Subject to stricter regulations from government bodies • Derivatives subject to limits committees regulation through • central channels Establisment of Bureau • No longer able to take high-risk positions • Stress tests of Consumer Financial • Volcker Rule: Ban on Protecion proprietary trading • No longer able to have high leverages • Higher capital requirements 2

9/11/2013 Effective or not? Effective or not? Implementation of rules Added Complexity • 70.1% of the total 398 rulemaking requirements missed • Overlapping authority • 99.6% of 280 rules requiring • Increased red-tape specified deadlines missed • Increased costs • Proposals for 64 of missed 175 rules still missing • Lack of clarity Effective or not? Effective or not? Gaming the system The Human Factor • • Unclear rules and complexity Short-term bias • Opportunities to game the system • Instant gratification • • Nomenclature issues Greed • Legal workarounds and loopholes (cat-and-mouse game) • Regulations may take years to be implemented Sources Discussion Questions • BBC • Can just a set of rules prevent yet another • Forbes • crisis? Wall Street Journal • Harvard Law School • London School of Economics Research • Congressional Research Services • Should there be any government bailouts • Wall Street Prep • NY Times in the first place? 3

9/11/2013 Appendix Global Regulation Chart Q&A 4

Recommend

More recommend