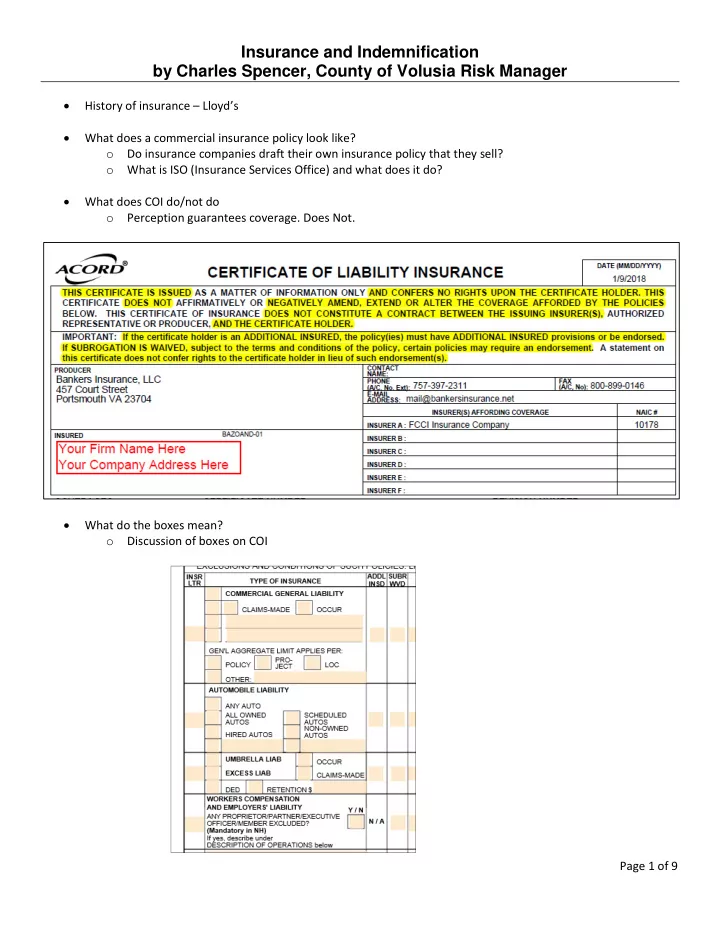

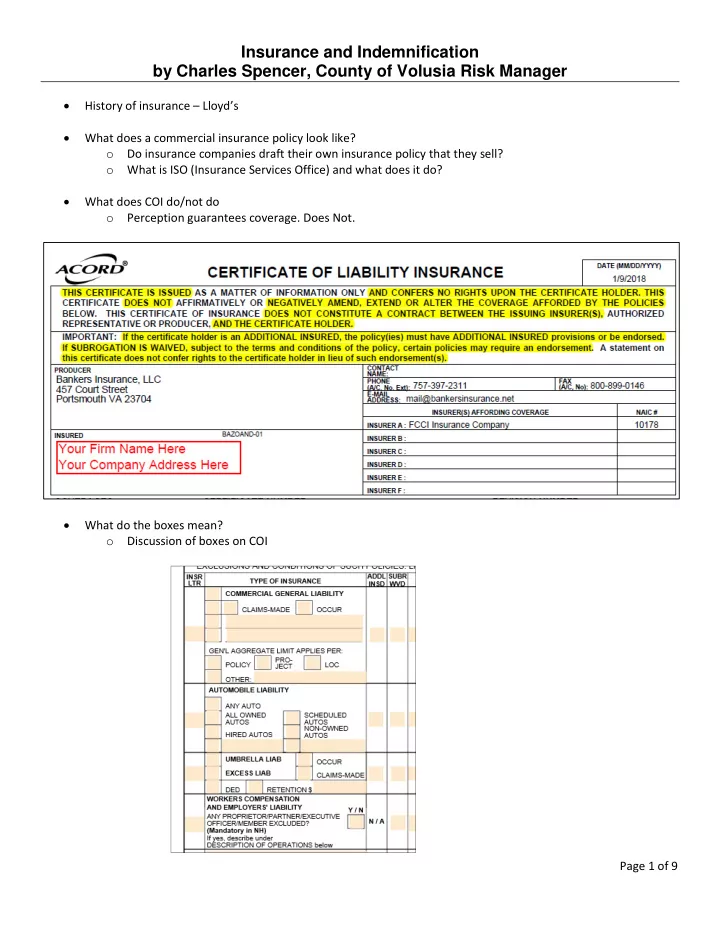

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager History of insurance – Lloyd’s What does a commercial insurance policy look like? o Do insurance companies draft their own insurance policy that they sell? o What is ISO (Insurance Services Office) and what does it do? What does COI do/not do o Perception guarantees coverage. Does Not. What do the boxes mean? o Discussion of boxes on COI Page 1 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager o Additional Insured with story (i.e. food vendor at on property) Other Insurance clause in CGL Policy-yours primary 4. Other Insurance If other valid and collectible insurance is available to the insured for a loss we cover under Coverages A or B of this Coverage Part, our obligations are limited as follows: a. Primary Insurance This insurance is primary except when Paragraph b. below applies. If this insurance is primary, our obligations are not affected unless any of the other insurance is also primary. Then, we will share with all that other insurance by the method described in Paragraph c. below. b. Excess Insurance (1) This insurance is excess over: (a) Any of the other insurance, whether primary, excess, contingent or on any other basis: (i) That is Fire, Extended Coverage, Builder's Risk, Installation Risk or similar coverage for "your work"; (ii) That is Fire insurance for premises rented to you or temporarily occupied by you with permission of the owner; (iii) That is insurance purchased by you to cover your liability as a tenant for "property damage" to premises rented to you or temporarily occupied by you with permission of the owner; or (iv) If the loss arises out of the maintenance or use of aircraft, "autos" or watercraft to the extent not subject to Exclusion g. of Section I – Coverage A – Bodily Injury And Property Damage Liability. (b) Any other primary insurance available to you covering liability for damages arising out of the premises or operations, or the products and completed operations, for which you have been added as an additional insured. Page 2 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager o What is an insurance policy “Endorsement”? Explanation: An insurance policy endorsement is similar to an addendum to a contract. Recommend Primary/Non-Contributory Endorsement Explanation: Contractor’s insurance 1 st and not the entity’s insurance being used 1 st with entity being additional insured THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY. PRIMARY AND NONCONTRIBUTORY – OTHER INSURANCE CONDITION This endorsement modifies insurance provided under the following: COMMERCIAL GENERAL LIABILITY COVERAGE PART PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PART The following is added to the Other Insurance Condition and supersedes any provision to the contrary: Primary And Noncontributory Insurance This insurance is primary to and will not seek contribution from any other insurance available to an additional insured under your policy provided that: (1) The additional insured is a Named Insured under such other insurance; and (2) You have agreed in writing in a contract or agreement that this insurance would be primary and would not seek contribution from any other insurance available to the additional insured. Subrogation: Transfer of Rights of Recovery Against Others To Us Can your entity be sued by your vendor’s insurance carrier for claim payments it has made? Classic o example: vendor’s employee is injured while working on your property. If an insured has the right to pursue a claim against someone to recover for losses caused by that party, o that right is transferred to their insurance carrier in the event it makes a payment. You will see this on page 12 of 16, #8 ("Transfer of Rights of Recovery Against Others To Us") in the standard ISO CGL policy here: http://www.tmsic.com/pdfs/CommercialGeneralLiabilityCoverageForm_OccurrenceBasis.pdf 8. Transfer Of Rights Of Recovery Against Others To Us If the insured has rights to recover all or part of any payment we have made under this Coverage Part, those rights are transferred to us. The in- sured must do nothing after loss to impair them. At our request, the insured will bring "suit" or transfer those rights to us and help us enforce them. Page 3 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager Waiver of Subrogation o Explanation: “Waver of Subrogation" is a term of art in the insurance industry. The long winded version is "Waiver of Transfer of Rights of Recovery Against Others to Us". o Below is a good link explaining waiver of subrogation: https://www.irmi.com/articles/expert-commentary/subrogation-and-the-cgl-policy WAIVER OF TRANSFER OF RIGHTS OF RECOVERY AGAINST OTHERS TO US This endorsement modifies insurance provided under the following: COMMERCIAL GENERAL LIABILITY COVERAGE PART The TRANSFER OF RIGHTS OF RECOVERY AGAINST OTHERS TO US Condition (Section IV – COMMERCIAL GENERAL LIABILITY CONDITIONS) is amended by the addition of the following: We waive any right of recovery we may have against the person or organization shown in the Schedule above because of payments we make for injury or damage arising out of your ongoing operations or "your work" done under a contract with that person or organization and included in the "products-completed operations hazard". This waiver applies only to the person or organization shown in the Schedule above. o Example Waver of Subrogation for Commercial General Liability. The ISO form that would be endorsed to the CGL policy is CG 24 04. An example can be found here: http://www.mwsecurity.com/images/CG2404.pdfr o Example Waver of Subrogation for Worker Compensation. The form is WC 00 03. an example of the form can be found here: https://www.wcrb.org/forms/Endorsements/WC000313%20Waivers%20of%20Our%20Rights%20to %20Recover%20From%20Others%20Endorsement.pdf Indemnification (of the contract) o Defend Explanation: Duty to defend means hiring an attorney o Indemnify Explanation: Duty to indemnify means paying for losses o Hold harmless Explanation: Duty to hold harmless means contractor waives claims against entity (or visa versa) 1 INDEMNIFICATION OF ENTITY 1.1 Indemnification. The Contractor shall indemnify, defend and hold harmless the ENTITY, including its districts, authorities, separate units of government established by law, ordinance or resolution, partners, elected and non-elected officials, employees, agents, volunteers, and any party with whom the ENTITY has agreed by contract to provide additional insured status from and against all claims , damages, losses, and expenses, including, but not limited to attorney’s fees, arising out of, resulting from, or incident to Contractor’s performance of its obligations in whole or part of this Agreement, unless suc h injury or damage is occasioned solely by the fault, negligence, or willful misconduct of the ENTITY. 1.2 In all claims against ENTITY, no indemnification obligation shall be limited in any way by any limitation on the amount or type of damages, compensation or any benefits payable by or for Contractor, or its employees, agents, contractors, or subcontractors. Page 4 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager Indemnification vs. Additional Insured o Are they the same? o Are insurance requirements independent of or dependent upon indemnification requirements? o Policy limits limitation for Additional Insured (third party claims) https://northstarmutual.com/UserFiles/File/forms/policyforms/Current/CG%2020%2010%2004%20 13.pdf Page 5 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager o Policy limitations for entity claims against vendor https://www.northstarmutual.com/UserFiles/Documents/forms/policyforms/Current/CG%2000%20 01%2004%2013.pdf page 1, 1.a. Insurance policies limits are rendered not relevant with contract indemnification language Indemnification vs. Scope of Work (SOW) o Scope of Work may precede indemnification contract section. For instance, if SOW states Contractor of temporary employees is not responsible for entity vehicles damaged to temporary employees Page 6 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager Types of policies o Types of policies and coverages per project. o Policies you want to be additional insureds on and don’t/why. Many PL policies are not ISO forms, but this language is common in most PL policies. Most PL policies will not allow an additional insured, but some (i.e. Med-Mal) will. The exclusion will likely be in those policies, but you have to weigh the benefit in those situations. At the jail where we have a vendor providing medical services to the inmates, the benefit far outweighs any detriment. Page 7 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager Insurance Company Ratings o Are all insurance companies equal? o A.M. Best Ratings http://www.ambest.com/home/default.aspx o Financial Strength Rating A-F, What does it mean? http://www.ambest.com/ratings/guide.pdf Page 8 of 9

Insurance and Indemnification by Charles Spencer, County of Volusia Risk Manager o Financial Size Category http://www.ambest.com/ratings/fsc/default.asp o Assuming the insurance company has an “A++” rating and its Financial Size Category is XV, does that mean it cannot go bankrupt? Page 9 of 9

Recommend

More recommend