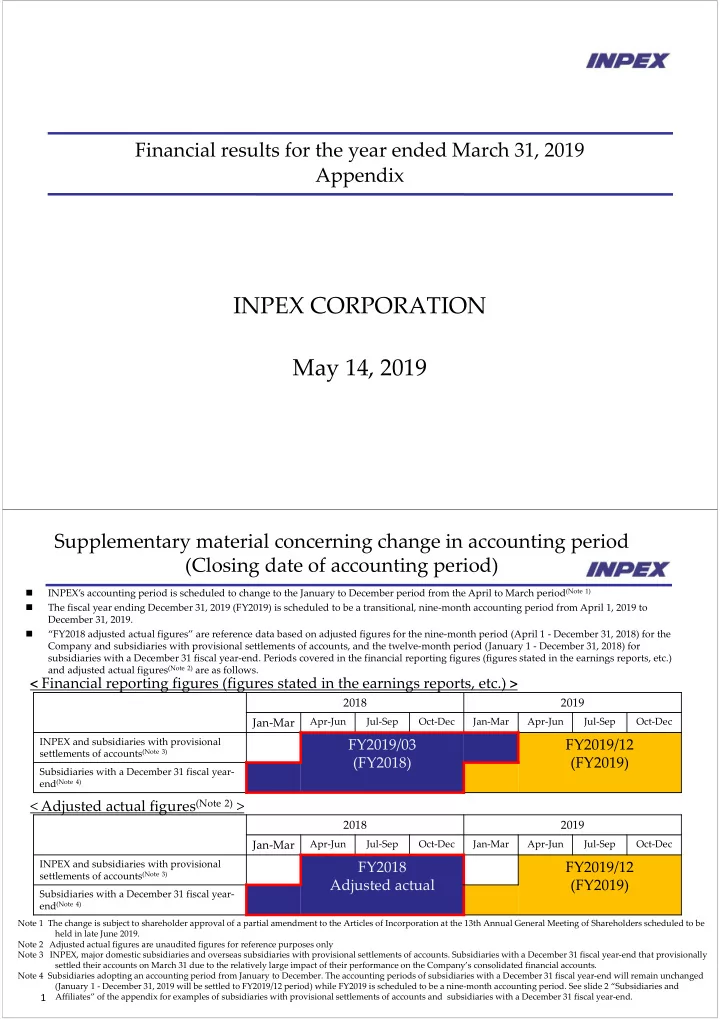

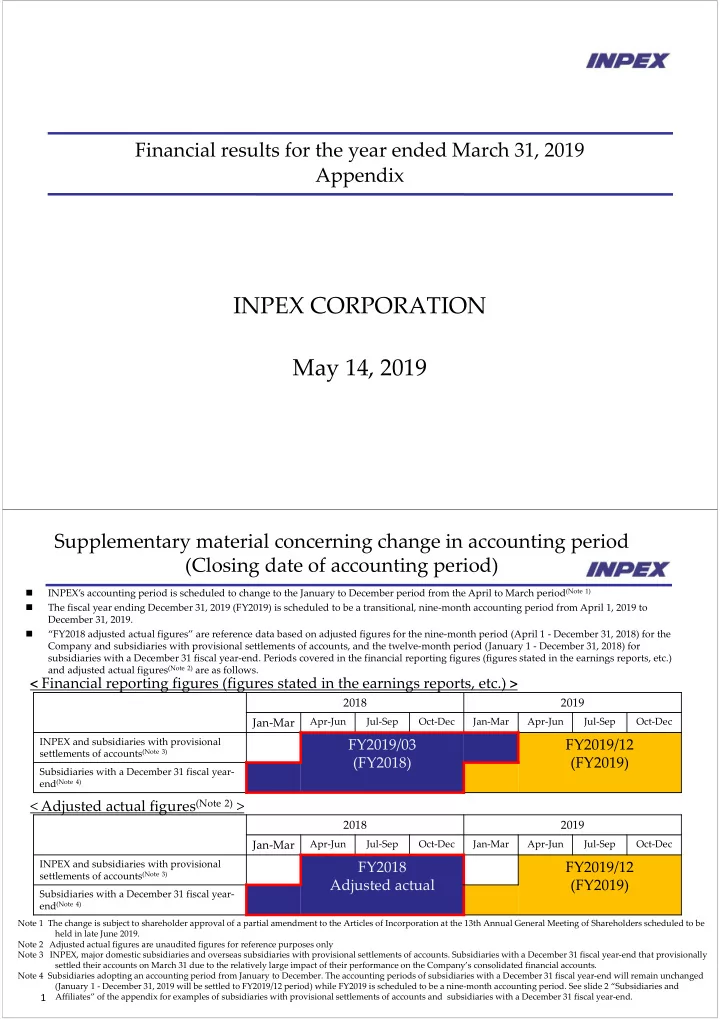

Financial results for the year ended March 31, 2019 Appendix INPEX CORPORATION May 14, 2019 Supplementary material concerning change in accounting period (Closing date of accounting period) INPEX’s accounting period is scheduled to change to the January to December period from the April to March period (Note 1) The fiscal year ending December 31, 2019 (FY2019) is scheduled to be a transitional, nine ‐ month accounting period from April 1, 2019 to December 31, 2019. “FY2018 adjusted actual figures” are reference data based on adjusted figures for the nine ‐ month period (April 1 ‐ December 31, 2018) for the Company and subsidiaries with provisional settlements of accounts, and the twelve ‐ month period (January 1 ‐ December 31, 2018) for subsidiaries with a December 31 fiscal year ‐ end. Periods covered in the financial reporting figures (figures stated in the earnings reports, etc.) and adjusted actual figures (Note 2) are as follows. < Financial reporting figures (figures stated in the earnings reports, etc.) > 2018 2019 Jan ‐ Mar Apr ‐ Jun Jul ‐ Sep Oct ‐ Dec Jan ‐ Mar Apr ‐ Jun Jul ‐ Sep Oct ‐ Dec INPEX and subsidiaries with provisional FY2019/03 FY2019/12 settlements of accounts (Note 3) (FY2018) (FY2019) Subsidiaries with a December 31 fiscal year ‐ end (Note 4) < Adjusted actual figures (Note 2) > 2018 2019 Jan ‐ Mar Apr ‐ Jun Jul ‐ Sep Oct ‐ Dec Jan ‐ Mar Apr ‐ Jun Jul ‐ Sep Oct ‐ Dec INPEX and subsidiaries with provisional FY2018 FY2019/12 settlements of accounts (Note 3) Adjusted actual (FY2019) Subsidiaries with a December 31 fiscal year ‐ end (Note 4) Note 1 The change is subject to shareholder approval of a partial amendment to the Articles of Incorporation at the 13th Annual General Meeting of Shareholders scheduled to be held in late June 2019. Note 2 Adjusted actual figures are unaudited figures for reference purposes only Note 3 INPEX, major domestic subsidiaries and overseas subsidiaries with provisional settlements of accounts. Subsidiaries with a December 31 fiscal year ‐ end that provisionally settled their accounts on March 31 due to the relatively large impact of their performance on the Company’s consolidated financial accounts. Note 4 Subsidiaries adopting an accounting period from January to December. The accounting periods of subsidiaries with a December 31 fiscal year ‐ end will remain unchanged (January 1 ‐ December 31, 2019 will be settled to FY2019/12 period) while FY2019 is scheduled to be a nine ‐ month accounting period. See slide 2 “Subsidiaries and 1 Affiliates” of the appendix for examples of subsidiaries with provisional settlements of accounts and subsidiaries with a December 31 fiscal year ‐ end.

Subsidiaries and Affiliates 65 consolidated subsidiaries Major subsidiaries Country/region Ownership Stage Accounting term March (provisional Japan Oil Development Co., Ltd. UAE 100% Production settlement of account) JODCO Onshore Limited UAE 51 % Production December JODCO Lower Zakum Limited UAE 100% Production December Timor Sea Joint Petroleum INPEX Sahul, Ltd. 100% Production December Development Area March (provisional INPEX Ichthys Pty Ltd Australia 100% Production settlement of account) March (provisional INPEX Southwest Caspian Sea, Ltd. Azerbaijan 51% Production settlement of account) March (provisional INPEX North Caspian Sea, Ltd. Kazakhstan 51% Production settlement of account) INPEX Oil & Gas Australia Pty Ltd Australia 100% Production December 21 equity method affiliates Major affiliates Country/region Ownership Stage Accounting term MI Berau B.V. Indonesia 44% Production December Angola Block 14 B.V. Angola 49.99% Production December INPEX Offshore North Campos, Brazil 37.5% Production December Ltd. March (provisional Ichthys LNG Pty Ltd Australia 66.245% Production settlement of account) 2 Segment information For the year ended March 31, 2019 (April 1, 2018 through March 31, 2019) (Millions of yen) Reportable segments Eurasia Adjustments *1 Consolidated *2 Asia & Middle East Japan (Europe & Americas Total Oceania & Africa NIS) Sales to third 140,311 96,440 116,718 614,420 8,308 976,199 (4,810) 971,388 parties Segment income 29,210 27,336 31,405 412,064 (8,751) 491,264 (16,983) 474,281 (loss) Segment assets 291,284 2,971,494 600,987 530,432 42,317 4,436,516 357,029 4,793,545 Note: 1. (1) Adjustments of segment income of ¥(16,983) million include elimination of inter ‐ segment transactions of ¥13million and corporate expenses of ¥(16,996) million. Corporate expenses are mainly amortization of goodwill that are not allocated to a reportable segment and general administrative expenses. (2) Adjustments of segment assets of ¥357,029 million include elimination of intersegment transactions of ¥(1) million and corporate assets of ¥357,030 million. Corporate assets are mainly goodwill, cash and deposit, investment securities and assets concerned with the administrative divisions not attributable to a reportable segment. 2. Segment income is reconciled with operating income on the consolidated statement of income. 3

Analysis of Net Sales Increase for the year ended March 31, 2019 (Billions of Yen) 1,200 Crude Oil (4.4) Crude Oil (77.6) Natural Gas (including LPG) (0.2) Natural Gas (including LPG) (21.6) 2.6 139.1 1,000 (4.7) 800 (99.3) Crude Oil +154.5 Natural Gas (including LPG) ( 15.4) 600 971.3 933.7 400 200 0 Net Sales Decrease in Increase in Exchange rate Net Sales Others Apr. ‘17 ‐ Mar. ‘18 Sales Volume Unit Price (Appreciation of Yen) Apr. ‘18 ‐ Mar. ’19 4 LPG Sales Apr. ‘17 ‐ Mar. ‘18 Apr. ‘18 ‐ Mar. ‘19 Change %Change Net sales (Billions of yen) 6.0 1.5 (4.5) (75.1%) Sales volume (thousand bbl) 1,186 204 (982) (82.8%) Average unit price of overseas 45.42 66.18 20.76 45.7% production ($/bbl) Average unit price of domestic 75.38 76.62 1.24 1.6% production (¥/kg) 0.56yen 0.5% Average exchange rate (¥/$) 112.06 111.50 Appreciation Appreciation Sales volume by region Apr. ‘17 ‐ Mar. ‘18 Apr. ‘18 ‐ Mar. ‘19 Change %Change (thousand bbl) 5 4 (1) Japan (23.6%) (0.5 thousand ton) (0.4 thousand ton) ( ‐ 0.1 thousand ton) Asia & Oceania 1,181 200 (981) (83.1%) Eurasia (Europe & NIS) ‐ ‐ ‐ ‐ Middle East & Africa ‐ ‐ ‐ ‐ Americas ‐ ‐ ‐ ‐ Total 1,186 204 (982) (82.8%) 5

Other Income/Expenses Apr. ‘17 ‐ Apr. ‘18 ‐ (Billions of Yen) Change %Change Mar. ’18 Mar. ’19 Other income 55.2 70.9 15.6 28.3% Interest income 6.4 7.6 1.1 18.0% Dividend income 4.7 6.7 1.9 41.5% Equity in earnings of affiliates 4.1 28.3 24.1 576.6% Reversal of allowance for doubtful accounts 0.1 8.3 8.1 ‐ Mainly attributed to gain on Gain on reversal of allowance for recoverable reversal of allowance for 17.5 ‐ (17.5) (100.0%) accounts under production sharing Kashagan Compensation income 12.6 7.4 (5.1) (40.6%) Compensation for termination of Ecuador’s Foreign exchange gain ‐ 1.9 1.9 ‐ Block 18 Other 9.4 10.3 0.8 9.4% Other expenses 25.3 25.9 0.5 2.2% Interest expense 7.0 17.3 10.2 145.0% Provision for allowance for recoverable accounts ‐ 1.4 1.4 ‐ under production sharing Provision for exploration projects ‐ 0.2 0.2 ‐ Foreign exchange loss 10.4 ‐ (10.4) ‐ Other 7.8 6.9 (0.8) (11.4%) 6 EBIDAX Apr. ‘17 – Apr. ’18 – Change Note (Millions of yen) Mar. ’18 Mar. ’19 40,362 96,106 55,744 Net income attributable to owners of parent P/L Net income (loss) attributable to non ‐ controlling (42,462) 677 43,139 P/L interests 153,030 146,786 (6,244) Depreciation equivalent amount Depreciation and amortization 92,805 106,899 14,094 C/F Depreciation under concession agreements and G&A 6,760 6,760 ‐ Amortization of goodwill C/F Recovery of recoverable accounts under 53,465 33,127 (20,338) C/F Depreciation under PS contracts production sharing (capital expenditures) (16,201) 13,350 29,551 Exploration cost equivalent amount 1,327 11,679 10,352 Exploration expenses P/L Exploration expense under concession agreements Gain on reversal of allowance for recoverable (17,528) ‐ 17,528 P/L Exploration expense under PS contracts accounts under production sharing Provision for allowance for recoverable P/L Exploration expense under PS contracts ‐ 1,468 1,468 accounts under production sharing ‐ 203 203 Provision for exploration projects P/L Exploration expense under PS contracts 92,066 21,529 (70,537) Material non ‐ cash items 1,048 (2,660) (3,708) Income taxes ‐ deferred P/L 11,048 (1,047) (12,095) Foreign exchange loss (gain) C/F 79,970 25,236 (54,734) Impairment loss P/L Net interest expense after tax 430 6,975 6,545 P/L After ‐ tax interest expense minus interest income 227,225 285,423 58,198 EBIDAX 7

Recommend

More recommend