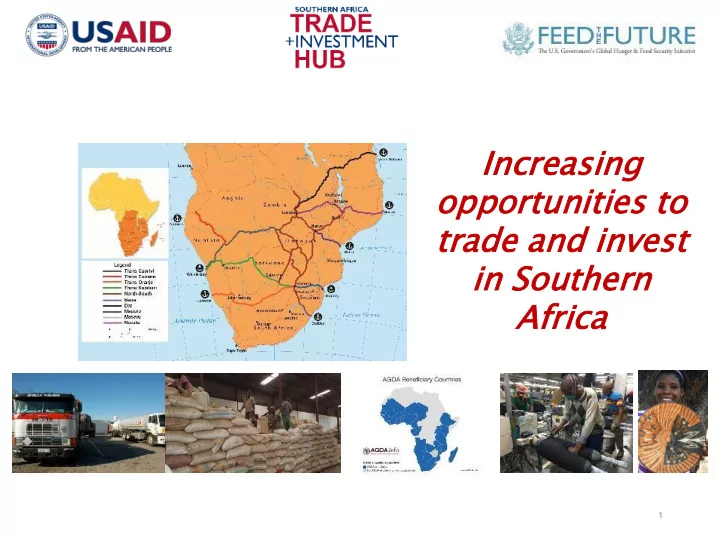

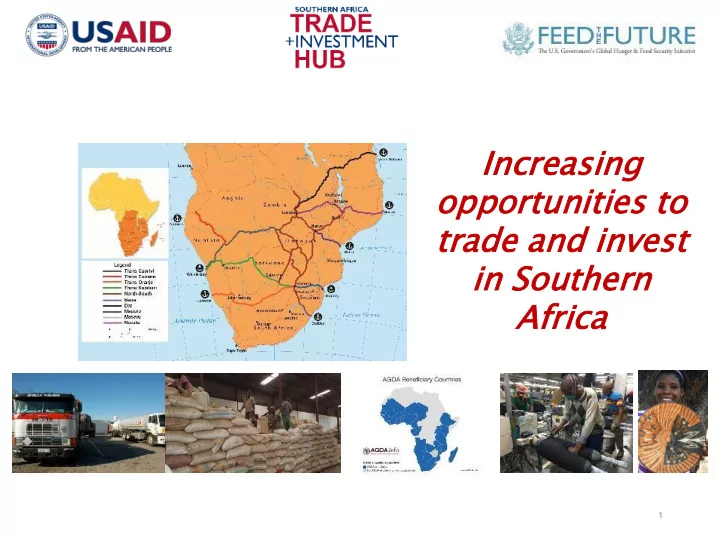

Increas creasing ing oppo port rtunities unities to tra rade e an and inve vest t in Southe uthern rn Af Afric rica a 1

Goals Go ls & & Objec ectiv tives es Enhanced food security & Increased trade and investment increased incomes Improved efficiency & reliability of Increased regional, Strengthened business environment international exports and strategic and trade financing partnerships 2

Priori iority ty Inter terventio ventions s by y Com omponen ponent Expor Ex ort t Com ompe petit itiven eness ess Agribu busi sine ness ss Increase exports to global Increase regional trade in markets and the U.S. under staple/non-staple foods and AGOA agricultural inputs and services Integrated Gender Strategy Enabl En bling ing En Environ onment nt & Trade de Finance ance & Invest estmen ent Facilit ilitati tion on Priority: ty: Increase capacity to Priority: ty: Implement trade facilitation export and trade higher agreements. Address NTBs to volumes and values through trade. Improve advocacy platforms. investment and financing of Support logistics improvements. SMEs, Coops

Market-driven strategy to improve trade competitiveness and investment Partner engagement Finance & Industry/ value Service Regional National Investment chain Providers • • • Transport • • Financial Consumer Cooperation, National • New institutions goods: reforms export • technologies Investors Apparel among SADC strategies • • ICT • Strategic Accessories/ Member AGOA • Marketing funds Leather States strategies organizations • • Specialty Reducing Trade policy • Trade shows foods constraints to reforms • • Agribusiness: trade Business Staple crops enabling Cash crops environment 4

Agr grib ibusiness usiness Trad ade Stra rateg egies es Output puts-Outco Outcome mes s • Support structured trading of quality Incre reased sed regiona nal trade de staple/non-staple food crops Imp mproved ed structure tructured d trade de: : Commodity dity exchanges nges/ / Warehouse ouse Receipt pt • Improve trade of inputs & services • Facilitate use of new agricultural technologies Syst stems/s ms/sta tandar ndards ds/t /testi esting ng • Leverage private partnerships including co- Stre rengthe ngthene ned d trade de in agricultur cultural input nputs and investment (PPPs) servi vices es New techno hnologies, gies, manageme ment nt practi tice ces s Stre rengthe ngthene ned d trade de associ ciati tions ns INTE TEGR GRATED TED GENDER DER STRATEG TEGY 5

Incr crea ease e Regiona onal l Trade, , Enhanc nce e Struc uctur tured ed Trade • Staples (Maize) Non staples: oilseeds eeds (sesame, soy, groundnuts) and pulses es (pigeon peas, • cow peas, soy) • Strengthen structured trade through warehouse receipt systems, with focus on Malawi, Mozambique and Zambia including a pipeline of transactions for ACE, MCX and ZAMACE • Develop marketing ting and training ning aimed at informing value chain stakeholders on the advantages of using a structured WRS • Improved Standards (testing, calibration, certification, inspection etc) Identi ntify fy mark rket t opportun tuniti ities es mark rketab table e surp rplus us: • Increase regional trade • Private sector investment and collaboration • Grow value chain in volume and value 6

Facili litate tate the Transfe fer r of N f New w Technol nologi ogies es and Adopti ption on of f Improved ed Inputs ts • Partner with agribusinesses to scale the use of quality seed, fertilisers, equipment and services • Assess Market Information Systems and Warehouse Receipts Systems to leverage successes in Southern Africa • Support development of a private sector-led regional market information system • Facilitate private sector technology transfer through use of the strategic partnership fund • Strengthen regionally focused Cooperatives and Trade Associations and Seed Trade Associations 7

Public blic Pri riva vate te Par artner nership ships • Olam: Cotton/maize/rotational pulses outgrower scheme with off- take agreement (mobile phones – climate/fertilizer application/ maize seed) ; WRS in Mozambique; expansion into Malawi • Export Trading Group (ETG) – Feed processing plant; Ethiopian sesame seed intro to Mozambique; WRS • JSE Johannesburg Stock Exchange with ZAMACE to increase utilization of the WRS certifications and futures trades • AFAP — Regional Fertilizer Policy study focused initially on Mozambique, Malawi and Zambia

Export port Competitive mpetitivenes ess Output puts-Outco Outcome mes s Stra rateg egies es • Increased export from AGOA countries to US • National AGOA Strategies and Action plans and global markets • Support industry associations for international export promotion • Linkages between buyers and sellers • Firm level technical assistance for increased created or strengthened • Increased competitiveness meeting exports of processe cessed d foods ds, ingre gredie dients nts, , international standards appare rel, , access ssorie ries, s, leathe her r goods • Trade Shows, Buyers Missions and B2B Events • International Standards improved, including certifications • Leverage private sector partnerships (PPPs) INTE TEGR GRATED TED GENDER DER STRATEG TEGY 9

Target Ex Expect cted d Resul sults ts Buil ild d Capacity pacity to Develop lop Moz ozamb ambiq ique and d Namib ibia ia AGOA A 3 AGOA Strategies completed Strat rateg egies ies and Ac Actio ion Plans Inc ncrease ease AGOA GOA Revi view and d Up Updat date e Mala lawi i AGOA A Strat ateg egie ies s Malawi AGOA Strategy Utili liza zatio ion and d Ac Actio ion Plans reviewed/updated and Action Plan developed Develop lop and impl mpleme ement t Zamb mbia ia AGOA A Zambia AGOA Action Plan Ac Action tion Plan developed Selected activities implemented Suppor ort t Impl mplem emen entat tatio ion of Bot otsw swana a AGOA A Botswana AGOA Action Plan Action Ac tion Plan finalized Selected activities implemented Sec ector or-sp spec ecif ific ic trai ainin ings s and wo workshop hops s on 1 AGOA Strategy launch AGOA A strat ateg egic ic utilization ization (Strateg egy launch, , 3 AGOA and Action Plan sector or-sp spec ecif ific ic AGOA A awar aren eness ess and action tion Awareness workshops plan wor workshops) hops). . Coordinate & support on Mozambique AGOA strategy Train 400 on updated market competitiveness requirements

AGOA Natio ional al Respo ponse nse St Strategi gies es and Pla lans Strategy, Action Plan Workshops, Committees Botswana Complete – Public launch Nov 2016 - June 2017 pending Malawi In development April - July 2017 Mozambique Support, collaboration June - August 2017 Zambia drafted Jan - June 2017 Lesotho Refresh August 2017

Results: ults: Textiles es & Ap Apparel parel More than ten company assessments in Lesotho & South Africa Technical assessments (social compliance, production capacity) of 8 companies to propose technology and investment in Lesotho MAGIC trade show – 3 pre-MAGIC workshops. At MAGIC supported 11 companies with over 50 B2B linkages + 10 assisted via SAFLEC/DTI. Attendance from Minister of Trade in Lesotho and collaborated with the other two Trade and Investment Hubs on the Africa Pavilion Set up Africa Advantage website which is being used to promote manufacturers for all the 3 Hubs Identified factories that require investment support Coordination, promotion, exhibits at Source Africa

Re Results: ults: Af Africa a Fine e Foods ds • USD 120.5 .5 bn (US mark rket et) • 58 of 61 special alty y foods s categorie ories s saw Factory assessments in South Africa, double le-di digit git growth in 2015 Swaziland, Mozambique, Namibia, Zambia, • Gulfood ood Dubai Februa uary 2017 and Malawi (41 companies) • Fancy y Food od Show June e 2017 Gulfood Show support (6 companies; 4 countries). More than 40 B2B linkages. Fancy Food Show (NYC) 8 companies exhibiting. Consultative meetings with investment agencies in South Africa, Zambia, Malawi, and Swaziland (over 6 companies) – Identified areas of collaboration supporting Workshop on processed foods in Zambia to discuss export/buyer requirements, trade show prep and participation (attended by 53 participants: 41 private sector companies and 12 support institutions) Meeting with Malawi Organic Growers Association and 7 members Research on export potential of macadamia, cashews, pulses, and sesame (South Africa and Mozambique)

Speci cialty lty and Processed ocessed Foods ds

Co Connecting necting companies panies to markets rkets

Recommend

More recommend