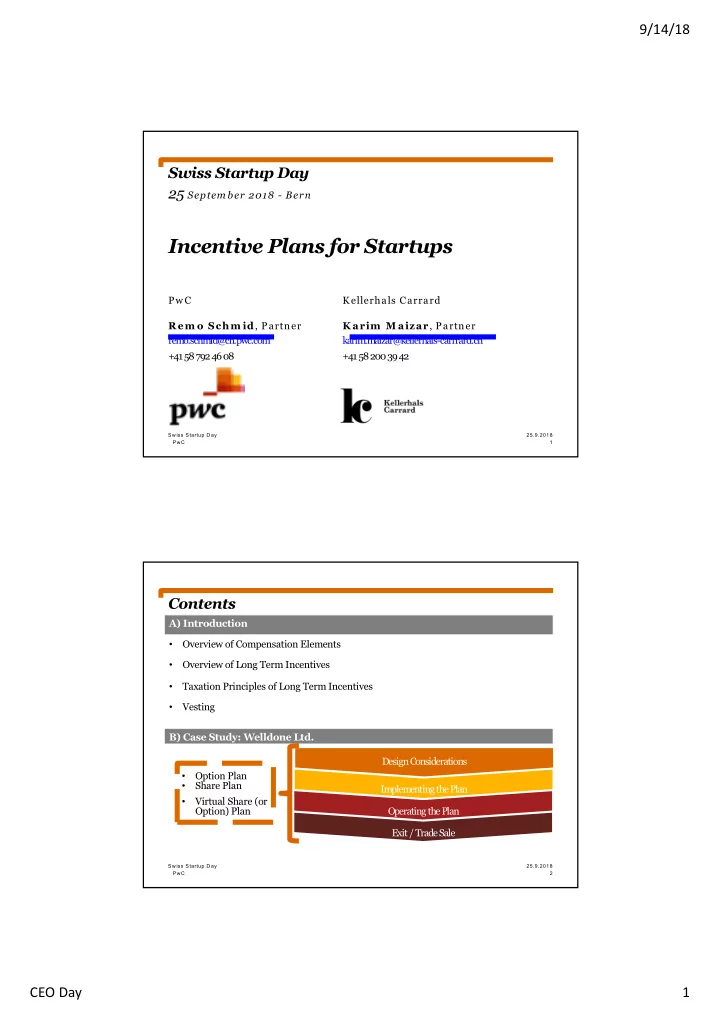

9/14/18 Swiss Startup Day 25 Septem ber 2018 - Bern Incentive Plans for Startups PwC Kellerhals Carrard R em o Schm id , Partner K arim M aizar , Partner remo.schmid@ch.pwc.com karim.maizar@kellerhals-carrrard.ch +41 58 792 46 08 +41 58 200 39 42 Swiss Startup Day 25.9.2018 PwC 1 Contents A) Introduction • Overview of Compensation Elements • Overview of Long Term Incentives • Taxation Principles of Long Term Incentives • Vesting B) Case Study: Welldone Ltd. Design Considerations • Option Plan • Share Plan Implementing the Plan • Virtual Share (or Option) Plan Operating the Plan Exit / Trade Sale Swiss Startup Day 25.9.2018 PwC 2 CEO Day 1

9/14/18 Contents A) Introduction • Overview of Compensation Elements • Overview of Long Term Incentives • Taxation Principles of Long Term Incentives • Vesting Swiss Startup Day 25.9.2018 PwC 3 Introduction Overview of Compensation Elements Long-term Prospective LTI Incentives (LTI) Variable long-term ( E q u i t y ) Short-term Incentive Retrospective Bonus (STI) Bonus short-term Direct ‘cash out’ for the company Base Fix Salary Pensions & Social Security Fringe Benefits Swiss Startup Day 25.9.2018 PwC 4 CEO Day 2

9/14/18 Introduction Overview of Compensation Elements W hen to create incentive plans? Stage Considerations • Founders often too busy for an ESOP • Key employees are given incentives on an ad hoc basis or based on a Pre-seed/ Seed letter of intent • Investors will almost alwaysrequest an incentive plan Early stage • Incentive planis created pre or post money • Startups at this stage begin to steadily ramp-up hiring and Laterstage compensationbut incentive plans still matter a lot (may lead to increasing the ESOP size) Swiss Startup Day 25.9.2018 PwC 5 Introduction Overview of Compensation Elements H ow m uch to grant? A typical distribution schedule Seniority Equity Allocation First 10 Em ployees 10% Next 20 Em ployees 5% Next 50 Em ployees 5% Early-stage equity grants are always a negotiation, but generally: –C-Level: 1-5% –Key Developer or Engineer: 1-2% –Other Functional Team M em ber: 0.5-1.5% –No non-founding m em ber of the senior team should receive over 10% Swiss Startup Day 25.9.2018 PwC 6 CEO Day 3

9/14/18 Introduction Design Considerations Eligibility and size Eligible employees Founders can be included (but rather uncommon) Top Mgmt Other key people Typically Other employees not eligible Swiss Startup Day 25.9.2018 PwC 7 Contents A) Introduction • Overview of Compensation Elements • Overview of Long Term Incentives • Taxation Principles of Long Term Incentives • Main Legal Issues Swiss Startup Day 25.9.2018 PwC 8 CEO Day 4

9/14/18 Introduction Overview of Long Term Incentives D efinition of instrum ents Instrum ents Definition The employee receives (or can buy at preferential conditions) shares of the company and thus becomes a shareholder of his employer. Shares He has full shareholder rights, including voting and dividend rights. The right of an employee to acquire shares of the company during a period of time in the future at a fixed price. Options Until the exerciseof options, the employee has no shareholder rights whatsoever. The right of an employee to receive a cash payment in the future whereas the benefitis linked to the company value development. Virtual shares / options (SARs) The employee can benefit either from the full value of the virtual share that was granted to him (phantom share) or from the value created since the date of grant only (SAR = share appreciation right) Swiss Startup Day 25.9.2018 PwC 9 Introduction Overview of Long Term Incentives Quick com parison (1/2) Topic Shares Options Virtual shares / virtual options Number of shareholders will usually not grow as Shareholder Number of shareholders No effects on options are typically structure will grow immediately shareholder base exercised later, e.g. at exit Fully dilutive on capital Upon exercise, fully Fully dilutive on value Dilution and voting rights dilutive on capital and only voting rights Upon exercise, new New shares need to be shares need to be issued Cash-based, hence no issued (capital increase) (capital increase) or special funding required Funding or existing shares need existing shares need to (other than having cash to be transferred be transferred via reserves available) company Swiss Startup Day 25.9.2018 PwC 10 CEO Day 5

9/14/18 Introduction Overview of Long Term Incentives Quick com parison (2/2) Topic Shares Options Virtual shares / virtual options At grant, shares need to At exercise, shares need No valuation issues for Valuation issues be objectively valued for to be objectively valued tax purposes tax purposes for tax purposes Usually none under the Usually none under the Accounting Claim of employees may Swiss Code of Swiss Code of issues be or become a liability Obligations Obligations Shares are subject to tax Payments are subject to and social security Options are subject to Taxes and social tax and social security charges (unless they are tax and social security security charges charges purchased at full tax charges upon exercise value) at acquisition General High High Medium com plexity Costs High Medium Low-medium Swiss Startup Day 25.9.2018 PwC 11 Contents A) Introduction • Overview of Compensation Elements • Overview of Long Term Incentives • Taxation Principles of Long Term Incentives • Main Legal Issues Swiss Startup Day 25.9.2018 PwC 12 CEO Day 6

9/14/18 Introduction Taxation Principles of Long Term Incentives Taxation of share plans • Taxation of the shares at the date of acquisition (tax value): Difference between the tax value at acquisition and the lower purchase price = taxable employment income of the employee • Realization of value increase of the employee-shares is a tax-free capital gain resp. loss grant sale of shares of shares tax-free capital gain value taxable income at grant (in case no price paid) time Swiss Startup Day 25.9.2018 PwC 13 Introduction Taxation Principles of Long Term Incentives Taxation of share plans (continued) • With pre-approval of the tax authorities, the income tax can be levied on a formula value (e.g. based on EBIT, EBITDA, revenue or other financial indicators). This leads to a reduction of the taxable amount (for startups, the formula value is almost always lower than the fair market value) • In case of a later sale, only the increase of the formula value will be considered tax-free private capital gain, while any exceeding proceeds will be taxed as employment income • Company must have a right to buy back (or at least a ROFR) the shares at the formula value (in case a formula is used despite the availability of a fair market value) grant sale grant sale of shares of shares of shares of shares taxable income tax-free at sale capital gain value value tax-free capital gain taxable income Taxable income at grant at grant (in case (in case no no price paid) price paid) time time Swiss Startup Day 25.9.2018 PwC 14 CEO Day 7

9/14/18 Introduction Taxation Principles of Long Term Incentives Taxation of stock options • Stock options are taxable at the time of exercise • No possibility for a tax-free capital gain for the employee (on the options) grant exercise sale of option of option of shares Tax-free capital gain fair m arket value value Taxable incom e at exercise Exercise price tim e Swiss Startup Day 25.9.2018 PwC 15 Contents A) Introduction • Overview of Compensation Elements • Overview of Long Term Incentives • Taxation Principles of Long Term Incentives • Vesting Swiss Startup Day 25.9.2018 PwC 16 CEO Day 8

9/14/18 Introduction Vesting Vesting schedule • Vesting = Earning the instrument over time (and/or based on performance) - A vesting period describes a period of time, during which an employee has to earn the grant of e.g. an option - Vesting period is usually between 2 and 4 years with a one-year cliff and thereafter vesting based on e.g. a monthly basis - What happens if an employee leaves during or after the vesting period? - Before the cliff: Typically lapse of all shares/options - After the cliff: - Good leavers typically can keep vested options and loose unvested ones - Bad leavers typically loose all shares/options - Shares after the vesting period: Typically, the company has a purchase right at fair market value (good leaver) or at a lower value (bad leaver) - Accelerated vesting is typical upon Liquidity Event (single-trigger/double-trigger) Swiss Startup Day 25.9.2018 PwC 17 Introduction Vesting Exam ple: standard vesting w ith a cliff • New hire • Granted options for 1’000 shares • 4-year vesting schedule with 1-year cliff 1’000 shares - At 12 months earns 200 shares 800 shares - Then earns ~22 shares per month V ested O ptions 600 shares M o n th ly v e s tin g 400 shares 200 shares T h e c liff 0 m onth 12 m onth 24 m onth 36 m onth 48 m onth M o n th s o n th e jo b Swiss Startup Day 25.9.2018 PwC 18 CEO Day 9

Recommend

More recommend