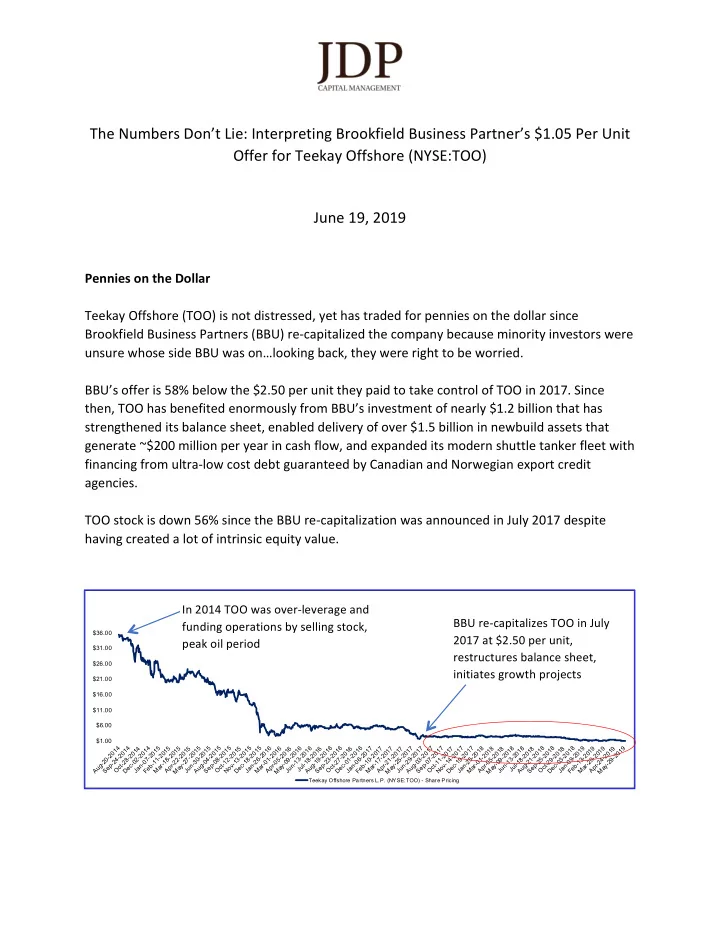

The Numbers Don’t Lie: Interpreting Brookfield Business Partner’s $1.05 Per Unit Offer for Teekay Offshore (NYSE:TOO) June 19, 2019 Pennies on the Dollar Teekay Offshore (TOO) is not distressed, yet has traded for pennies on the dollar since Brookfield Business Partners (BBU) re-capitalized the company because minority investors were unsure whose side BBU was on…looking back, they were right to be worried. BBU’s offer is 58% below the $2.50 per unit they paid to take control of TOO in 2017. Since then, TOO has benefited enormously from BBU’s investment of nearly $1.2 billion that has strengthened its balance sheet, enabled delivery of over $1.5 billion in newbuild assets that generate ~$200 million per year in cash flow, and expanded its modern shuttle tanker fleet with financing from ultra-low cost debt guaranteed by Canadian and Norwegian export credit agencies. TOO stock is down 56% since the BBU re-capitalization was announced in July 2017 despite having created a lot of intrinsic equity value. In 2014 TOO was over-leverage and BBU re-capitalizes TOO in July funding operations by selling stock, $36.00 2017 at $2.50 per unit, peak oil period $31.00 restructures balance sheet, $26.00 initiates growth projects $21.00 $16.00 $11.00 $6.00 $1.00 Aug-20-2014 Sep-24-2014 Dec-02-2014 Aug-04-2015 Sep-08-2015 Nov-13-2015 Dec-18-2015 Aug-19-2016 Sep-23-2016 Dec-01-2016 Aug-03-2017 Sep-07-2017 Nov-14-2017 Dec-19-2017 Aug-21-2018 Sep-25-2018 Dec-03-2018 Oct-28-2014 Jan-07-2015 Feb-11-2015 Mar-18-2015 Apr-22-2015 May-27-2015 Jun-30-2015 Oct-12-2015 Jan-26-2016 Mar-01-2016 Apr-05-2016 May-09-2016 Jun-13-2016 Jul-18-2016 Oct-27-2016 Jan-06-2017 Feb-10-2017 Mar-17-2017 Apr-21-2017 May-25-2017 Jun-29-2017 Oct-11-2017 Jan-25-2018 Mar-01-2018 Apr-05-2018 May-09-2018 Jun-13-2018 Jul-18-2018 Oct-29-2018 Jan-09-2019 Feb-13-2019 Mar-20-2019 Apr-24-2019 May-29-2019 Teekay Offshore Partners L.P. (NYSE:TOO) - Share Pricing

Taking advantage of a low stock price and a recent distressed block sale of TOO stock by former owner Teekay Corporation (NYSE:TK), BBU is trying to buy the remaining public stub for approximately 76% less than its historical LTM EV/EBITDA valuation over the last 10 years. With BBU’s capital injection and financial discipline, TOO is now much stronger than it has ever been. BBU Offer is Unreasonably Low on Multiple Metrics +461% $7.00 $5.89 $6.00 +319% +271% $5.00 $4.40 $3.90 $4.00 $3.00 $2.00 $1.05 $1.00 $0.00 Free Cash Peer Comp BBU Offer EBITDA 2 Flow 1 Average 3 1) TOO Historical LTM EBITDA Less Maintenance Capex, JDP Estimate 2) TOO Historical LTM EBITDA, last 10-years ending March 2019, JDP Estimate 3) Historical NTM EBITDA Average, JDP Estimate of public peers, CapIQ: SBM Offshore (AMS:SBMO), KNOP Offshore (NYSE:KNOP), BW Offshore (FRA:XY81), MODEC (TYO:6269) A Very Bad Deal For Minority Public Investors Implied TOO Upside From Historical Multiple 1 Equity Price BBU Offer TOO Historical LTM EBITDA Less Capex 11.2x $3.90 271% TOO Historical LTM EBITDA 8.1x $4.40 319% Peer Group Historical LTM EBITDA 9.9x $7.61 624% Peer Group Historical NTM EBITDA 9.5x $5.89 461% Average $5.45 419% 1) 10-Year average, 1Q 2009 - 1Q 2019, CapIQ

TOO has never traded close to BBU's 5x EBITDA offer 18.00x 16.00x 14.00x 12.00x 10.00x 8.00x 6.00x 4.00x 2.00x 0.00x Historical 10 Year Teekay Offshore LTM EBITDA Hypothedical Valuation Full Year 2019E EBITDA Multiple 6.0x 7.0x 8.0x 9.0x 10.0x EBITDA (2019, JDP Est.) $719 $719 $719 $719 $719 Implied share price $2.53 $4.29 $6.04 $7.80 $9.55 Upside from BBU offer 141% 308% 475% 642% 809% Total Shares (millions) 410 410 410 410 410 Net Debt $3,275 $3,275 $3,275 $3,275 $3,275

Translating BBU's $1.05 Offer Equity to EBITDA Multiple of EV/ EBITDA (TTM) 4.50x 0.59x Implied Yield 22.2% Implied Yield: 59.9% EV/ Unleveraged Cash Flow 6.44x Implied Yield 15.5% BBU’s outrageously low offer would drive a very attractive leveraged-return for them at Equity/ EBITDA 0.59x the expense of TOO minority unit holders Implied Yield 169.5% Equity/ Leveraged Cash Flow 1.67x Much of TOO’s buyout value is in the attractive Implied Yield 59.9% balance terms that could now support much more debt and/or a large dividend-re-cap at Equity/ Unleveraged Cash Flow 0.85x the HoldCo level that would not be acceptable Implied Yield 117.6% for a public company Unsecured debt/ Leveraged 2.71x Cash Flow Traditional business valuation metrics severely Implied Yield 36.9% mask Cash-on-Cash earning power of TOO’s leasing model, which uses project-like debt for JDP Estimated Payback Period much of its capital structure. 3 Years! for BBU's Unsecured Debt BBU will make a fortune at the expense of minority investors In our opinion, taking TOO private allows Brookfield to extract higher “cash on cash” return metrics through the use of internal leverage. BBU most likely will also add more debt and sell assets to maximize their IRR before possibly taking TOO public again under a different name, domicile and structure.

Ripe for the picking BBU’s offer implies an equity value of only 12% of TOO’s total capital structure. With very attractive long-dated debt, cash flow for equity owners is set to rise quickly. Avgerage Remaining Capital Structure $MM % of Total Maturity ECA debt "Equity-Similar" $414 11% 12 Years Non-Recourse Debt $918 25% 5 Years Other Secured Debt $822 22% 3 Years Unsecured $700 19% 3 Years Preferred Stock $389 10% Perpetual Equity @ $1.05 per unit $431 12% Minority Interest $35 1% Enterprise Value $3,709 100% Earnings Profile (TTM) $MM Revenue $1,200 EBITDA $719 Maintenance CapEx $216 Unleveraged Cash Flow $503 Unleveraged Cash Flow Per Unit $1.23 Preferred Interest $35 Cash Interest $225 Tax $0 Leveraged Cash Flow $243 Leveraged Cash Flow Per Unit $0.59 *410.3 million units outstanding as of June 5, 2019

Recent Management Presentations Contradicts Low BBU Take-Under Offer On March 6, 2019 Teekay Offshore CEO Ingvild Saether performed an on-stage presentation to a small group of institutional investors at the DNB Oil Offshore Shipping Conference in Oslo pitching how well the company is doing. JDP attended the event and was sitting in the front row. The Oslo presentation was never made public… Slide #5 demonstrating TOO’s growing EBITDA that is not correlated with Brent Oil See below for the full DNB Oslo presentation that was never made public:

Recommend

More recommend