How to gain value from M&A Mikkel Boe Grab and Go - 2 nd October - PowerPoint PPT Presentation

How to gain value from M&A Mikkel Boe Grab and Go - 2 nd October 2019 Agenda Winds of change Setting the scene Creating the M&A value case Think end-to-end M&A Post Merger Integration Q&A 2 2 Winds of change 3 Why are we

How to gain value from M&A Mikkel Boe Grab and Go - 2 nd October 2019

Agenda Winds of change Setting the scene Creating the M&A value case Think end-to-end M&A Post Merger Integration Q&A 2 2

Winds of change 3

Why are we all here? M&A activity continues to rise Global M&A volumes 2002-18 Percentage of organizations expecting an increase in the average number of bnUSD deals over the next 12 months 3,000 2,500 +7% 2,000 1,500 1,000 500 0 2002 2003 20042005 2006 2007 2008 200920102011 2012 2013 20142015 201620172018 Above 10bn $ Below 10bn $ Source: Dealogic Report 2002-2018, Deloitte M&A Trends 2019 4

Winds of Change We see headwinds as well as tailwinds – however, outlook remains positive Global Investments Economic and Political Uncertainty the economic policy uncertainty index hit at of the campaigns launched in the last 12 months record highs towards late last year and continues were global, up from 31% in 2014, with into 2019 significant growth in UK, Canada and Japan 69% High Private Equity Activity Easy access to financing of corporate respondents report more cash reserves a record level of M&A financing was raised from worth of deals were done by private equity in the bond markets in 2018 2018, the highest levels since 2007 #1 Regulatory pressures Disruptive M&A primary intended use of worth of mega-deals were withdrawn due to was spent by corporates in 2018 to acquire that cash is to regulatory or political pressure, the highest since disruptive technologies, the highest on record fund M&A deals 2016 and up by 28% from the previous year 5

Setting the scene 6

Most M&A transactions fail to deliver the expected results Almost two-thirds of all M&A transactions globally fail to deliver the synergies and value envisioned, and one in four transactions result in diminished value Management bias • Failure to reach integration targets Lack of accurate information • (company view) Weak analysis of potential targets • Incomplete due diligence process • Transaction Gap 30% Failure to take account of changes in We paid too much • the external environment 62% Lack of negotiation expertise • Failure to consider integration • complexity and costs in time Integration Gap The benefits weren’t 70% delivered! Inadequate integration planning (i.e. • not scaling the integration Failure to create shareholder value appropriately) (market view) Lack of programme leadership • Lack of a formal and fast decision- • making process Lack of executive alignment on merger • 60% rationale Too much time spent on organisation • politics Loss of focus on everyday operations • Merger synergies not driven through • Expected value True value Actual value quickly enough What we paid The maximum What we actually Customers get forgotten • we should have achieved paid Source: Deloitte, Merrill 7

What makes a deal successful? We have asked 1.000 executives 8 8

Creating the M&A value case 9

M&A is a lever for growth, innovation and improving the core business Growth options and strategic elements should be reviewed to understand and define the strategic rationale for M&A transactions Growth matrix Business model Predominantly assimilation New to industry Identify new uses or users 60% of investments Create Core (products, services, solutions, new markets or technologies) Customers/Market Leverage capabilities of Target; some New to you “reverse integration” Extend to new Expand the Adjacent geographies, value chain 30% of investments markets, segments Change the basis of competition Mix of capabilities; sometimes kept autonomous Existing Improve Core Extend products for focus New Operations and services 10% of investments Existing New to you New to industry Business model 10

The role of M&A in realizing the corporate strategy M&A transactions are a strategic way to disrupt and transform companies to strengthen their product portfolio, gain the benefits from economies of scale or simply get ahead in the digital game MOVE INTO CREATE AN IMPROVE THE ADJACENT ENTIRELY NEW CORE MARKET BUSINESS Increase scale & Acquire a new Acquire a new Acquire the Disrupt the Convergence Become the efficiency product capability disruptor adjacent market opportunity disruptor across sectors Buy a business Buy a business Acquire new A new player is Buy a business Buy a disruptive within your that enhances capabilities such disrupting the that will give you Buy a business business that existing market to your product as analytics, market but is not entry into an that allows you to could in future derive economies offering. digital etc. that yet at scale. established take advantage of transform your of scale and will significantly adjacency or the convergence industry and you decrease cost-to- enhance your core category. opportunities become the serve. business. across sectors. disruptor. 11

Creating the M&A value case It starts with a clear and validated picture of where the value that the deal should bring comes from Rationale Example questions to consider Will the merger enable a premium price point (e.g., through valuable • brands or higher quality)? Revenue Synergies (e.g., economies of scope, Will the combined product offering increase cross-sell to existing • geographic expansion) customers? Will the combined firm have access to new customers? • Traditional Economic Synergies Will the gross margin increase as a result of economies of scale? • Will infrastructure costs decrease (e.g., HQ/SG&A)? • Cost Synergies (e.g., economies of Can employee costs be reduced? • scale in market access) Can procurement spend be streamlined? • Merger Can assets be made more productive? • Value Creation Logic To what extent are the geographies/product offerings/target • customers/R&D pipelines of the two organizations complementary vs. Risk Mitigation via redundant? Diversification (e.g., business cycle risk) To what degree are the sales of the two organizations correlated to the • Forward- economic climate? Looking Competitive Do the companies possess proprietary processes/ intellectual • Synergies property/technology that have value? Knowledge Generation Are there valuable personnel acquisitions to be made? - Will they stay • (e.g., access to post-merger? capabilities and talent) Does complementary knowledge and expertise exist in the two • organizations? 12

Think end-to-end M&A How it all needs to be connected across the deal cycle 13

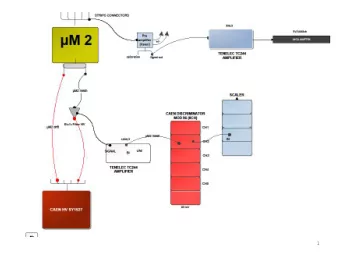

The high-level end-to-end M&A process (buy-side) An end-to-end perspective is needed to derive value from M&A M&A Target Screening & Selection Transaction Execution Strategy Due Diligence Post Merger Integration Integration Integration Planning incl. Tax Post Merger Integration & Business Case strategy & Day 1 readiness structuring Functional integration blueprint implementation M&A Target Confirmatory Strategy Screening & Due Prepare Development Identification Diligence Transitional Preliminary Synergy and initial offer & Negotiate Purchase Financial Service Due Value Driver negotiate Final Price Value Realization Modelling Agreements Diligence Analysis Letter of Transaction Allocation (TSA) Intent Management Management Completed Term DAY 0 DAY 1 DAY 2 Approval Approval Letter of sheet Final Closing / Integration Intent Purchase Transfer of Completed Agreement Ownership (SPA/ATA) 14

Post Merger Integration 15

Key integration challenges Challenges should be addressed in the integration programme Integration governance not set up in Ineffective or weak leadership programme time or inefficiently Transaction- and integration teams don’t talk Exodus of key talent (from both acquirer to each other and target) before and after Day 1 Need to mitigate these Deal rationale and future operating model not Integration planning approach is too clear and shared complex risks to ensure a successful Merger synergies not fully identified and value Poorly executed Day 1 sets the wrong integration and left on the table tone for the integration value realization Business as usual gets forgotten and Slow IT and systems integration puts performance in both businesses suffers brakes on the programme Weak communications and people Decisions are taken too slowly engagement leads to drop in morale (or not at all!) 16

Key levers for success Our experience shows that early and effective planning and discipline in managing any integration is a key lever for success 1 Gain effective control of the businesses and stabilize the CONTINUITY merged entity 2 Identify, quantify and deliver the synergies DELIVER 3 Position for transformation beyond the deal GO BEYOND 17

Key success factors for integrations Our experiences have taught us to keep focus throughout a complex process Top Alignment on Focus on management the target culture, Focus on Do anchoring picture and employee value transformation and integration transition realization afterwards dedicated strategy and retention resources 18

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.