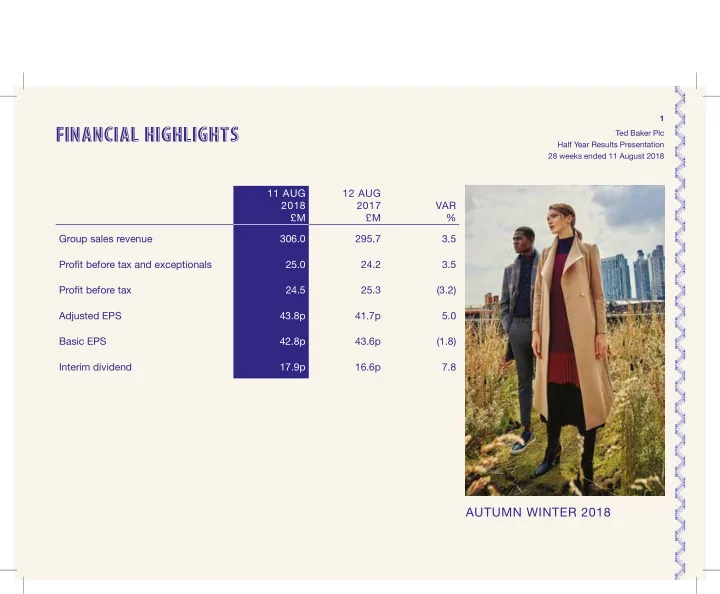

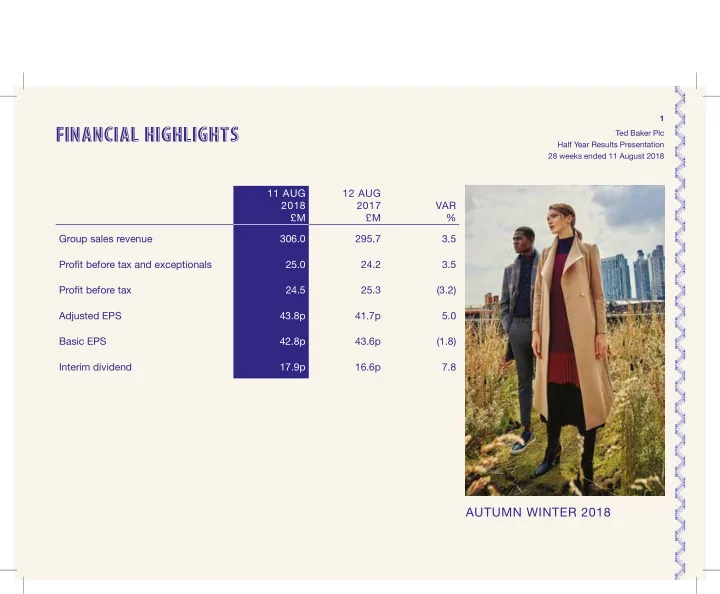

1 FINANCIAL HIGHLIGHTS Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 11 AUG 12 AUG 2018 2017 VAR £M £M % Group sales revenue 306.0 295.7 3.5 Profjt before tax and exceptionals 25.0 24.2 3.5 Profjt before tax 24.5 25.3 (3.2) Adjusted EPS 43.8p 41.7p 5.0 Basic EPS 42.8p 43.6p (1.8) Interim dividend 17.9p 16.6p 7.8 AUTUMN WINTER 2018

2 INCOME BY CHANNEL Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 11 AUG 12 AUG CONSTANT 2018 2017 VAR CURRENCY £M £M % VAR % Retail 220.1 217.7 1.1 2.9 Wholesale 85.9 78.0 10.1 12.8 SALES REVENUE 295.7 3.5 5.5 306.0 Licence income 10.9 9.7 11.7 TOTAL INCOME 316.9 305.4 3.7 – Retail sales up 1.1% to £220.1m (2.9% – Licence income increased by 11.7% to in constant currency), on an average £10.9m with both territorial and product square footage increase of 5.5% . licences performing well Unseasonable weather and challenging external trading conditions particularly in the UK have impacted performance Wholesale sales up 10.1% (12.8% in – constant currency) to £85.9m with a good performance from our UK business, a strong performance from our North AW18 MENSWEAR American business and the earlier timing of deliveries

3 REVENUE BY COLLECTION Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 11 AUG 12 AUG 2018 % OF 2017 % OF VAR £M SALES £M SALES % Womenswear 191.3 62.5 177.4 60.0 7.8 Menswear 114.7 37.5 118.3 40.0 (3.0) SALES REVENUE 306.0 100.0 295.7 100.0 3.5 – Womenswear was positively received – Menswear sales were down 3.0% with sales up 7.8% , representing 62.5% impacted by challenging trading of total sales conditions within our UK business, representing 37.5% of total sales – The growth in the womenswear mix refmected the increased mix of online sales, where womenswear represents a higher proportion of sales AW18 WOMENSWEAR

4 REVENUE BY TERRITORY Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 – In the UK & Europe retail sales increased 11 AUG 12 AUG CONSTANT 2018 2017 VAR CURRENCY 1.0% (0.7% in constant currency) to UK & EUROPE £M £M % VAR % £147.1m (2017: £145.6m) despite challenging trading conditions. The Retail 147.1 145.6 1.0 0.7 wholesale business increased 9.8% to Wholesale 54.9 50.0 9.8 9.8 £54.9m (2017: £50.0m). This refmected a good performance from sales to trustees Sales Revenue 202.0 195.6 3.3 3.1 NORTH AMERICA – In North America, sales from our retail division increased 1.8% (8.1% in Retail 61.8 60.7 1.8 8.1 constant currency) to £61.8m (2017: Wholesale 31.0 28.0 10.7 18.0 £60.7m) driven by our continued Sales Revenue 92.8 88.7 4.6 11.3 expansion. Wholesale increased by 10.7% (18.0% in constant currency), REST OF WORLD to £31.0m (2017: £28.0m) refmecting Retail 11.2 11.4 (1.8) 1.8 a strengthening relationship with Wholesale - - - - key trustees Sales Revenue 11.2 11.4 (1.8) 1.8 – Across the Rest of World, sales GROUP decreased 1.8% (increased 1.8 % in constant currency) to £11.2m (2017: UK & Europe 202.0 195.6 3.3 3.1 £11.4m). We continue to refjne and North America 92.8 88.7 4.6 11.3 develop our strategy for success in this market Rest of World 11.2 11.4 (1.8) 1.8 306.0 295.7 3.5 5.5 Sales Revenue * Rest of World includes: Asia and Africa

5 RETAIL REVENUE Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 11 AUG 12 AUG CONSTANT 11 AUG 12 AUG CONSTANT 2018 2017 VAR CURRENCY REST OF 2018 2017 VAR CURRENCY UK & EUROPE WORLD £M £M % VAR % £M £M % VAR % Stores 104.5 110.9 (5.8) (6.2) Stores 9.5 10.3 (7.8) (3.5) E-commerce 42.6 34.7 22.8 22.9 E-commerce 1.7 1.1 54.5 50.4 Retail revenue 147.1 145.6 1.0 0.7 Retail revenue 11.2 11.4 (1.8) 1.8 Sales per sq ft £395 £439 (10.0) (10.4) Sales per sq ft £313 £341 (8.2) (4.4) Average sq ft 264,393 252,484 4.7 Average sq ft 30,351 30,053 1.0 NORTH AMERICA GROUP Stores 53.1 53.8 (1.3) 4.6 Stores 167.1 175.0 (4.5) (2.7) E-commerce 8.7 6.9 26.1 35.8 E-commerce 53.0 42.7 24.1 25.7 61.8 60.7 1.8 8.1 220.1 217.7 1.1 2.9 Retail revenue Retail revenue Sales per sq ft £416 £457 (9.0) (3.5) Sales per sq ft £396 £437 (9.4) (7.8) Average sq ft 127,599 117,776 8.3 Average sq ft 422,343 400,313 5.5 – In the UK & Europe, retail sales increased despite the – In North America, retail sales growth was driven by continued unseasonable weather and tough trading conditions where expansion and a strong performance from our e-commerce trade has been impacted by the well publicised challenges business facing some of our trading partners – In Rest of World, we continue to refjne and develop our strategy – E-commerce sales increased, demonstrating how e-commerce for success in this market sales are an integral part of the retail proposition in the UK and European markets

6 GROSS MARGIN BY CHANNEL Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 – Retail gross margin fell by 140bps to 11 AUG 12 AUG 2018 2017 VAR 64.2% (2017: 65.6%) as a result of a % % POINTS measured increase in promotional activity in response to challenging external Retail 64.2% 65.6% (140bps) trading conditions Wholesale 43.4% 40.2% 320bps – Wholesale gross margin increased by Group 58.3% 58.9% (60bps) 320bps to 43.4% (2017: 40.2%) refmecting a higher mix of sales to trustee partners 70 which carry a higher margin compared to retail licence partners and some foreign 65 exchange benefjt – Composite gross margin decreased to 58.3% (2017: 58.9%) 60 Gross margin % 55 50 Retail Gross Margin 45 Wholesale Gross Margin Group Gross Margin 40 9-Aug-14 15-Aug-15 13-Aug-16 12-Aug-17 11-Aug-18

7 GROUP INCOME STATEMENT Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 11 AUG 12 AUG 2018 2017 VAR £M £M % Revenue 306.0 295.7 3.5 Gross profjt 178.5 174.1 2.5 Gross margin 58.3% 58.9% (60bps) Operating expenses (162.7) (159.3) (2.1) Licence income 10.9 9.7 11.7 Other operating income 0.0 0.7 (94.1) OPERATING PROFIT BEFORE 26.7 25.2 6.0 EXCEPTIONAL ITEMS % of revenue 8.7% 8.5% 20bps Net fjnance expense (2.0) (1.2) (65.5) Share of joint venture profjt 0.3 0.2 55.0 PROFIT BEFORE TAX 25.0 24.2 3.5 AND EXCEPTIONAL ITEMS Exceptional items (0.5) 1.1 (150.3) UKRAINE: OCEAN PLAZA KIEV PROFIT BEFORE TAX 24.5 25.3 (3.2)

8 OPERATING EXPENSES Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 11 AUG 12 AUG CONSTANT 2018 2017 VAR CURRENCY £M £M % VAR % Distribution costs* (79.8) (78.8) (1.3) (2.5) Administrative costs* (17.7) (17.7) (0.0) (1.9) Depreciation (12.9) (12.3) (4.9) (7.1) Payroll (52.3) (50.5) (3.6) (5.5) Performance related bonus - - - - TOTAL OPERATING EXPENSES (162.7) (159.3) (2.1) (3.7) Operating exp as a % of sales 53.1% 53.9% 80bps – Distribution costs increased by 1.3% – Dual running costs in respect of IT and as a percentage of sales were 25.7% systems were £1.3m (2017: £1.2m). (2017: 26.6%). The decrease refmects We would expect further costs of the variable elements of costs in our £1.1m in the second half business model – Administrative costs remained level on last year and as a percentage of sales were 5.8% (2017: 6.0%). This decrease was a result of a measured and controlled TED BAKER: approach to multiple cost saving initiatives COLOUR BY NUMBERS across central functions * Distribution and administrative costs exclude depreciation, payroll, bonus and exceptional items

9 GROUP CASH FLOW Ted Baker Plc Half Year Results Presentation 28 weeks ended 11 August 2018 – The net decrease in cash and cash 11 AUG 12 AUG 2018 2017 VAR equivalents of £24.4m (2017: £30.6m) £M £M £M primarily refmected an increase in working capital, further capital expenditure to Cash generated from operations* 37.8 38.7 (0.9) support our long-term development and Working capital movement (13.9) (22.8) 8.9 the payment of the full year dividend Interest paid (1.8) (1.5) (0.3) Capital expenditure of £18.5m (2017: - Income taxes paid (5.7) (6.3) 0.6 £19.1m) comprised the costs of opening and refurbishing stores, concessions and TOTAL 16.4 8.1 8.3 outlets. It also refmected the on-going Capital expenditure (18.5) (19.1) 0.6 investment in business-wide systems to support our continued growth. Repayment of term loan (3.0) (3.0) - We expect full year capital expenditure Dividends paid (19.4) (17.2) (2.2) to be in line with previous guidance of £30.0m , subject to the timing of Other 0.1 0.6 (0.5) planned openings Net decrease in cash (24.4) (30.6) 6.2 Opening net cash (59.3) (36.7) (22.6) Exchange rate movement 0.5 (0.1) 0.6 Closing net cash (83.2) (67.4) (15.8) *Excluding working capital movement, interest paid and income taxes paid

Recommend

More recommend