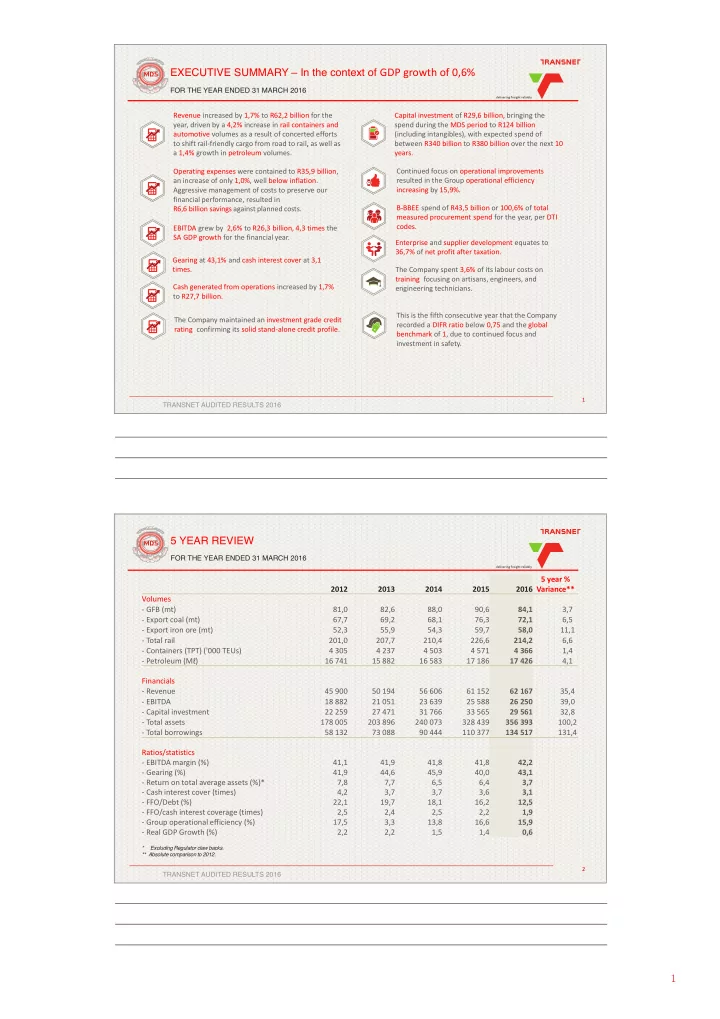

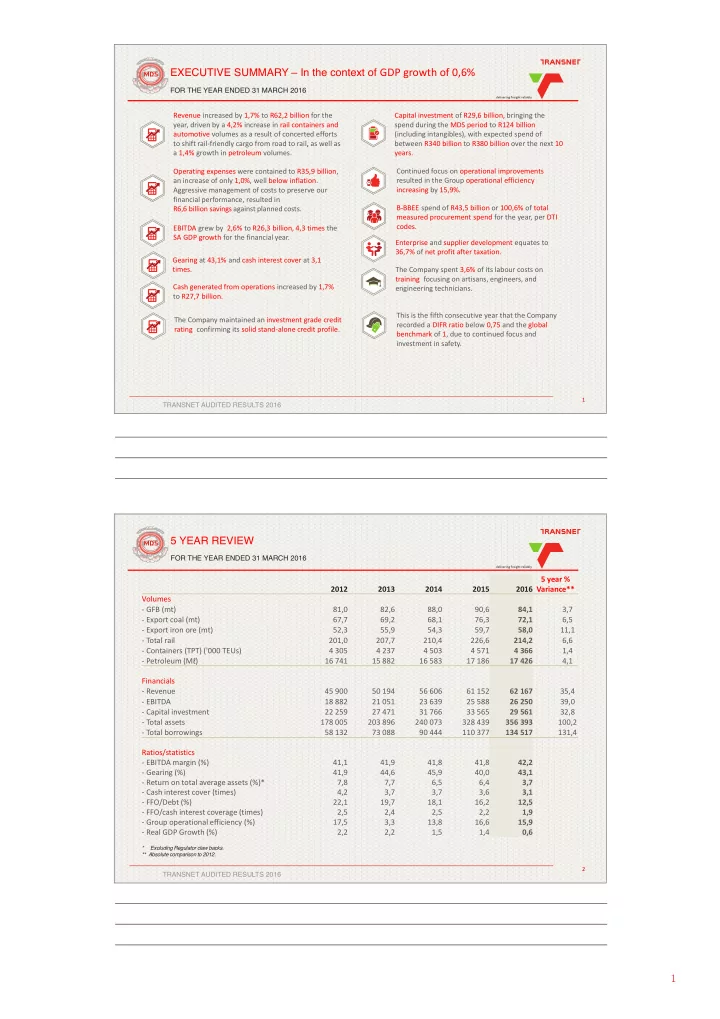

EXECUTIVE SUMMARY – In the context of GDP growth of 0,6% FOR THE YEAR ENDED 31 MARCH 2016 Revenue increased by 1,7% to R62,2 billion for the Capital investment of R29,6 billion, bringing the year, driven by a 4,2% increase in rail containers and spend during the MDS period to R124 billion automotive volumes as a result of concerted efforts (including intangibles), with expected spend of to shift rail-friendly cargo from road to rail, as well as between R340 billion to R380 billion over the next 10 a 1,4% growth in petroleum volumes. years. Operating expenses were contained to R35,9 billion, Continued focus on operational improvements an increase of only 1,0%, well below inflation. resulted in the Group operational efficiency Aggressive management of costs to preserve our increasing by 15,9%. financial performance, resulted in B-BBEE spend of R43,5 billion or 100,6% of total R6,6 billion savings against planned costs. measured procurement spend for the year, per DTI codes. EBITDA grew by 2,6% to R26,3 billion, 4,3 times the SA GDP growth for the financial year. Enterprise and supplier development equates to 36,7% of net profit after taxation. Gearing at 43,1% and cash interest cover at 3,1 times. The Company spent 3,6% of its labour costs on training, focusing on artisans, engineers, and Cash generated from operations increased by 1,7% engineering technicians. to R27,7 billion. This is the fifth consecutive year that the Company The Company maintained an investment grade credit recorded a DIFR ratio below 0,75 and the global rating, confirming its solid stand-alone credit profile. benchmark of 1, due to continued focus and investment in safety. 1 TRANSNET AUDITED RESULTS 2016 5 YEAR REVIEW FOR THE YEAR ENDED 31 MARCH 2016 5 year % 2012 2013 2014 2015 2016 Variance** Volumes - GFB (mt) 81,0 82,6 88,0 90,6 84,1 3,7 - Export coal (mt) 67,7 69,2 68,1 76,3 72,1 6,5 - Export iron ore (mt) 52,3 55,9 54,3 59,7 58,0 11,1 - Total rail 201,0 207,7 210,4 226,6 214,2 6,6 - Containers (TPT) ('000 TEUs) 4 305 4 237 4 503 4 571 4 366 1,4 - Petroleum (M ℓ ) 16 741 15 882 16 583 17 186 17 426 4,1 Financials - Revenue 45 900 50 194 56 606 61 152 62 167 35,4 - EBITDA 18 882 21 051 23 639 25 588 26 250 39,0 - Capital investment 22 259 27 471 31 766 33 565 29 561 32,8 - Total assets 178 005 203 896 240 073 328 439 356 393 100,2 - Total borrowings 58 132 73 088 90 444 110 377 134 517 131,4 Ratios/statistics - EBITDA margin (%) 41,1 41,9 41,8 41,8 42,2 - Gearing (%) 41,9 44,6 45,9 40,0 43,1 - Return on total average assets (%)* 7,8 7,7 6,5 6,4 3,7 - Cash interest cover (times) 4,2 3,7 3,7 3,6 3,1 - FFO/Debt (%) 22,1 19,7 18,1 16,2 12,5 - FFO/cash interest coverage (times) 2,5 2,4 2,5 2,2 1,9 - Group operational efficiency (%) 17,5 3,3 13,8 16,6 15,9 - Real GDP Growth (%) 2,2 2,2 1,5 1,4 0,6 *** Excluding Regulator claw backs. ** Absolute comparison to 2012. 2 TRANSNET AUDITED RESULTS 2016 1

REVENUE AND VOLUMES FOR THE YEAR ENDED 31 MARCH 2016 Revenue (R million) Rail volumes (mt) +1,7% -5,5% Coal (-7%)* 226,6 Iron ore and manganese (-3%)* 61 152 62 167 214,2 Containers and automotive (+4,2%)* 90,4 Mineral mining and chrome (-1%)* 84,4 Steel and cement (-16%)* Agriculture and bulk (-13%)* 69,6 67,6 14,3 14,9 21,0 20,7 20,8 17,5 10,5 9,1 2015 2016 2015 2016 Port c ontainers (‘000 TEUs) Included in revenue above is R2,8 billion generated by Transnet’s Africa Strategy which extends business beyond the -4,5% borders of South Africa. 4 571 4 366 Revenue contribution by Operating Division** (%) TPL 5 TPT 2015 2016 14 Petroleum (M ℓ ) +1,4% 51 TFR TNPA 15 17 186 17 426 15 TE * Variance % to prior year. ** Excludes specialist units and intercompany eliminations. 2015 2016 3 TRANSNET AUDITED RESULTS 2016 OPERATING EXPENSES FOR THE YEAR ENDED 31 MARCH 2016 Net operating expenses (R million) Net operating expenses contribution by cost element (%) +1,0% Personnel costs 35 564 35 917 Electricity costs 26 Fuel costs Material and maintenance costs Other operating expenses 54 4 6 10 2015 2016 21 The operating expense were contained at a modest increase of 1,0%, well below inflation, despite: Increase in personnel costs of 5,9%; and Increase in electricity costs of 3,9%. These costs, which are largely fixed, constitute 64% of Transnet’s total operating expenses. R6,6 billion saving against planned costs, by implementing numerous cost-reduction initiatives: Moratorium on the filling of vacancies; Overtime limited to critical activities; Reduction in professional and consulting fees through price negotiations and reorganising non-critical projects and programmes; and Limit on discretionary costs as it relates to travel, accommodation, printing, stationary and telecommunications. 4 TRANSNET AUDITED RESULTS 2016 2

EBITDA FOR THE YEAR ENDED 31 MARCH 2016 EBITDA (R million) EBITDA growth compared to GDP growth (times) +2,6% GDP growth (%) EBITDA growth from YoY (%) 26 250 25 588 +8,2 +5,2 12,3 11,5 +5,8 8,2 +4,3 2015 2016 2,6 EBITDA growth of 2,6%, well in excess of 2,2 1,5 1,4 GDP growth of 0,6% and Transnet’s operating sector 0,6 GDP contracting by 0,1%. 2013 2014 2015 2016 EBITDA margin (%) EBITDA contribution by Operating Division** (%) * TPL + +0,4% 9 41,8 42,2 TPT 11 54 TFR 25 TNPA + 2015 2016 1 TE * Absolute variance. ** Excludes specialist units and intercompany adjustments. + Regulated entities contributed 34% to the overall EBITDA . 5 TRANSNET AUDITED RESULTS 2016 DEPRECIATION, IMPAIRMENT AND FINANCE COSTS FOR THE YEAR ENDED 31 MARCH 2016 Depreciation, derecognition and amortisation (R million) Depreciation, derecognition and amortisation of assets for the year increased by +39,5% 39,5% to R15,3 billion, due to the depreciation of revalued rail infrastructure, 15 275 recorded for the first time in the current year , port facilities and pipelines as well 10 951 as the capital investments for the year. This trend is expected to continue in line with the execution of the capital investment programme. 2015 2016 Impairment of assets (R million) +58,1% Impairment of assets, amounting to R1,5 billion relates primarily to property, plant and equipment as well as trade and other receivables due to the difficult 1 524 964 economic environment, impacting key customers. 2015 2016 Finance costs (R million) +19,0% Finance costs increased by 19,0%, in line with expectations, due to increased borrowings to fund the MDS. 7 481 6 287 2015 2016 6 TRANSNET AUDITED RESULTS 2016 3

ABRIDGED STATEMENT OF FINANCIAL POSITION FOR THE YEAR ENDED 31 MARCH 2016 2016 2015 R million R million ASSETS Property, plant and equipment 302 463 287 166 Investment properties 10 105 9 074 Other non-current assets 5 624 9 701 Non-current assets 328 192 305 941 Current assets 28 201 22 498 Total assets 356 393 328 439 EQUITY AND LIABILITIES Capital and reserves 143 290 142 328 Non-current liabilities 171 254 145 853 Current liabilities 41 849 40 258 Total equity and liabilities 356 393 328 439 7 TRANSNET AUDITED RESULTS 2016 PROPERTY, PLANT AND EQUIPMENT FOR THE YEAR ENDED 31 MARCH 2015 Property, plant and equipment (R million) +5,3% 29 561 (776) (16 099) PPE increased by 5,3% to R302,5 billion, mainly as a result of the capital investment for the year of R29,6 billion, with 3 505 (894) R11,1 billion being invested in the expansion of infrastructure 302 463 and equipment, while R18,5 billion was invested in maintaining existing capacity. 287 166 Transnet is committed to investing in an optimised capital portfolio that remains responsive to validated customer demand. 2015 Additions Devaluation Depreciation, Borrowing Transfers 2016 derecognition costs and other and impairment Return on total average assets (excluding capital work in progress) (%)** Return on total average assets at 3,7% is due to the difficult * -2,3% economic conditions that resulted in customers downscaling 6,0 their operations and consequently impacted Transnet’s profitability. In addition, there was an increase in depreciation, 3,7 recorded for the first time in the current year on the significant revaluation of rail infrastructure in the prior year. 2015 2016 * Absolute variance. ** Includes Regulator claw backs. 8 TRANSNET AUDITED RESULTS 2016 4

Recommend

More recommend