CORPORATE PRESENTATION October 2015

Executive summary Wild Bunch is a leading pan-European content gatekeeper ideally positioned to benefit from the structural growth coming from the digital revolution Founded in 2003 solely as an international sales company, it is today a unique independent player with a pan European presence and leading positons in France, Italy, Spain, Germany and Austria It recently consolidated its presence in Germany through the merger with Senator Entertainment and became a listed entity in February 2015 Since inception, it has delivered profitable growth driven by adequate capital allocation, acquisitions and a high level of creativity (specifically, FilmoTV was the first VOD/SVOD service launched in France in 2008) One of the largest independent film libraries with c. 2,200 titles (including The Artist, Drive, The King’s Speech) Excellent bargaining power across the content spectrum from providers to consumers and towards major new players like Netflix or Amazon Future positioning of the company driven by: Access to complementary and attractive markets driven by high growth and pool of talents to add scale and synergies The digital revolution through the proliferation of devices to consume content anywhere at anytime, and the change in consumption patterns will benefit Wild Bunch on its own or through partnerships as it is already well positioned The Company is willing to play a pivotal role in the consolidation of the fragmented content distribution landscape and create value through accretive acquisitions Best-in-class management team coming from StudioCanal with a proven track record and capital markets experience 2 Company presentation – October 2015

AGENDA COMPANY OVERVIEW BUSINESS MODEL MARKET POSITIONING AND STRATEGY FINANCIALS AND OUTLOOK 3 Company presentation – October 2015

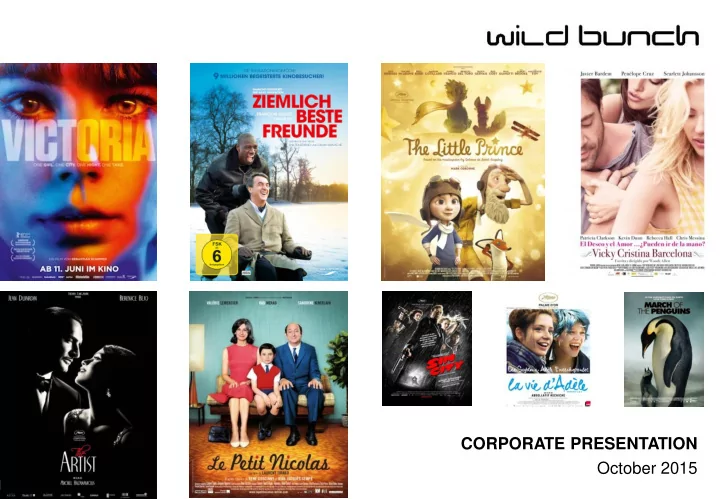

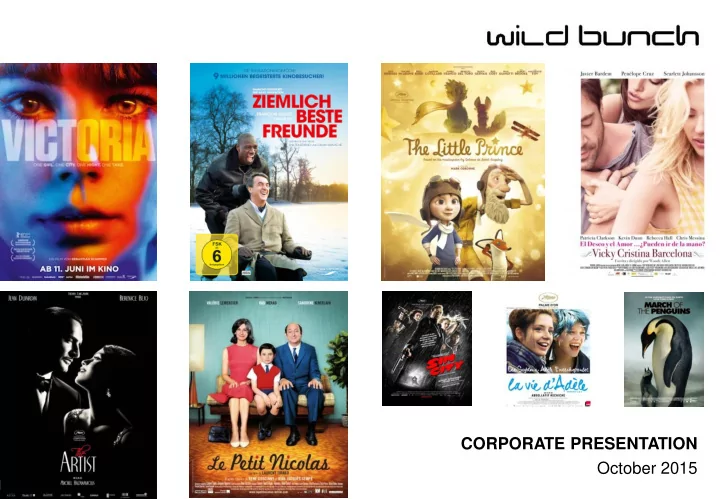

Company overview Wild Bunch is a leading European filmed entertainment content company Group overview Key financials The company covers the complete filmed entertainment value chain . Specifically 21% Segment “Distribution” It finances, co-produces and acquires filmed FY2014 entertainment content revenue: Segment “International Sales” € 163,2m* It monetizes the rights on a multi domestic distribution * Derived from the single entity statements of network across Europe on all media both through Senator Entertainment AG and Wild Bunch S.A . 79% traditional and innovative ways It monetizes the rights over the rest of the world Selected award winning film releases It owns one of the largest film libraries (c. 2,200 titles) including The Artist, Drive, The King’s Speech) In addition it co-finances and/or distributes up to 100 new independent films per year to enhance the long term value of the library Strategy driven by: Content growth through the acquisition of new rights for movies and other programs (TV, Web…) Increasing customer reach in new geographies and/or through new platforms Delivering value to shareholders through profitable growth and accretive acquisitions 4 Company presentation – October 2015

Company overview Wild Bunch is an entrepreneurial success and an established player today Date 2003 2014* Direct distribution France, Italy, Spain, Germany and None countries Austria Employees 14 178 c. 2,200 titles with up Library 78 titles to 100 new added annually 5 Oscars for best movie, Award-winning movies 25 5 Golden Palms, 2 Golden Lions, etc. since 2003 Sales ( € m) 25 163 Others, 7% International Others; 11% sales, 21% Theatrical, 26% Activities (by revenue) TV, 19% Video/VoD/ SVoD, 27% International sales; 89% * 2014 : Senator Entertainment + Wild Bunch SA 5 Company presentation – October 2015

Company overview Two independent players in Europe’s filmed entertainment content industry joined forces Creation of Continental Launch of Wild February 2015: Successful completion of Films: Venture backed Bunch Germany Senator/Wild Bunch merger brings benefits: by Citigroup, dedicated #2 pan-European independent film distributor to acquisition of feature Synergies to be derived from consolidated films presence in Germany 1 Listing on the German stock exchange to Acquisition of a majority allow for future growth through acquisitions stake in BIM, Italia Strong backing from key shareholder Acquisition of Sapinda that controls c 66% 2 Launch of Wild Side, VOD/SVOD France service Founding of Exception Acquisition of a Creation of (FilmoTV) Wild Bunch (renamed majority stake Insiders and Wild Bunch in 2006) in Vértigo eCinema (Spain) 1986 1999 2003 2004 2005 2007 2008 2009 2011 2012 2014 2015 Founding of Joint Berlin IPO Venture with Wild on the Bunch (Central Neuer Markt films) segment Successful restructuring after large impairments for Founding of Senator 2013; start of Entertainment AG HSW GmbH acquires negotiations on (1979: Senator Film 50.1% of the share capital merger with Verleih GmbH) after insolvency filing Wild Bunch 6 Company presentation – October 2015

Company overview Experienced management team holding c. 25% stake in Wild Bunch Management Board Members Vincent Maraval Markus Maximilian Sturm Vincent Grimond Brahim Chioua Since Feb. 2015 COO Since Feb. 2015 CCO Since Feb. 2015 CEO Since March 2013 CFO Entrepreneurship History Entrepreneurship History Entrepreneurship History Entrepreneurship History Co-Founder and COO of Co-Founder and CCO of Co-Founder, Chairman and Managing Director of sports Wild Bunch Wild Bunch CEO of Wild Bunch segment companies of Constantin Medien AG Senior Executive Vice Executive Vice President for Founded foreign sales label President, Universal Production and Distribution Wild Bunch as a department Executive Vice President for Studios at StudioCanal of StudioCanal corporate planning and Group controlling at COO of Le Studio Canal+ UGC International Sales Founder and Chairman and Constantin Executive CEO of StudioCanal Accountant Director at La 5 Medien AG Expertise CFO of Cap Gemini Sogeti Auditor at Arthur Andersen Controlling and Finance CFO of Club Méditerranée 20 years of feature film Expertise Manager of Junior Web acquisition and sales; one of Expertise Strong media-business Expertise the strongest acquisition and Outstanding knowledge and manager, who has worked distribution professional Extensive knowledge in network in worldwide media with the most influential worldwide financing and restructuring business producers and filmmakers of media companies 7 Company presentation – October 2015

Company overview Established presence in most of Europe’s largest markets Domestic distribution channels Established presence across four of the five key European territories (France, Italy, Spain, Germany and Austria), collaborations for UK in place France Berlin Theatrical distribution via Wild Bunch Distribution Germany Paris Video and VOD distribution via Wild Side France VOD/SVOD via FilmoTV Germany Wild Bunch Germany (combined German business of Senator and Wild Bunch) for direct distribution Central Film Verleih, X Verleih International Sales Italy Indirect distribution model: Wild Bunch, Elle Driver All direct distribution activities via BIM Distribuzione and Versatile as value-added intermediary selling Spain rights to local distributors All direct distribution activities via Vértigo and VOD International sales helps to control financial risk by distribution via Filmin deciding on direct or indirect distribution Insiders is a new vehicle that allows Wild Bunch to be exposed to big-budget US movies without taking financial risk 8 Company presentation – October 2015

Company overview Wild Bunch has an extensive and well diversified content library Catalogue by number of titles Breakdown of the catalogue by distribution territory* Acquisition of 2500 2207 5% Senator (Germany) Acquisition of 8% 2000 1701 1826 1793 1812 Vértigo (Spain) 24% Acquisition of 1147 1223 1300 1423 BIM (Italy) 19% 1500 Acquisition of 1000 Wild Side (France) 44% 396 436 496 500 80 105 Direct Distribution 0 International Sales France Italy Spain Germany Breakdown of the catalogue by production date* Breakdown of the catalogue by origin* 13% 33% 31% 43% 16% 14% 26% 24% EU ROW USA/CANADA 2006- … Before 60' 60'-70' 80'-90' 2000-05 * Excluding Senator’s catalogue as of 2014 9 Company presentation – October 2015

AGENDA COMPANY OVERVIEW BUSINESS MODEL MARKET POSITIONING AND STRATEGY FINANCIALS AND OUTLOOK 10 Company presentation – October 2015

Business model Filmed entertainment content and distribution are closely linked to grow and create value Content Distribution Diverse editorial policy Robust direct and multi- Proven access to quality domestic distribution network Worldwide sales capability movies Content Growing film catalogue Direct electronic distribution requires service distribution Physical and Development and Co financing and Marketing and Trading electronic production production packaging delivery Distribution requires content Scale Reach 11 Company presentation – October 2015

Recommend

More recommend