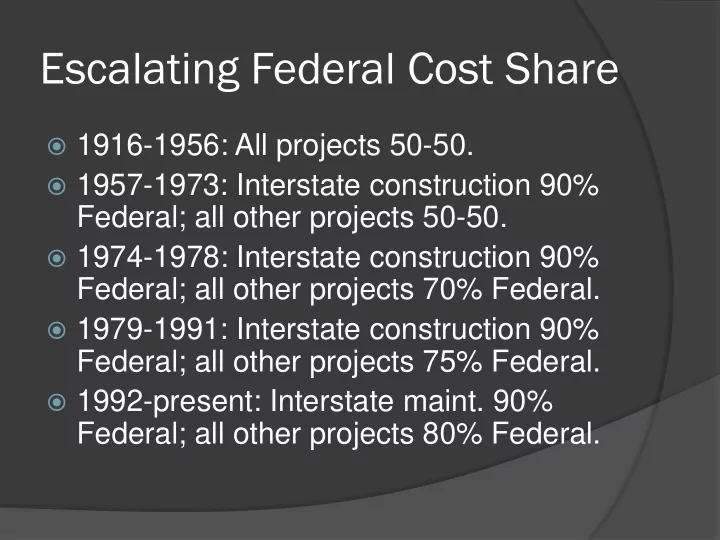

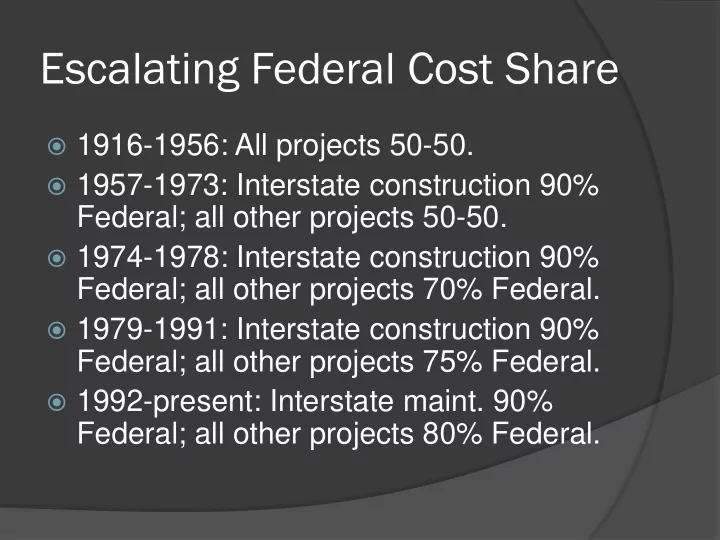

Escalating Federal Cost Share 1916-1956: All projects 50-50. 1957-1973: Interstate construction 90% Federal; all other projects 50-50. 1974-1978: Interstate construction 90% Federal; all other projects 70% Federal. 1979-1991: Interstate construction 90% Federal; all other projects 75% Federal. 1992-present: Interstate maint. 90% Federal; all other projects 80% Federal.

What is the Federal interest? Is the federal interest in building a new lane on U.S. 1 or U.S. 61 or U.S. 101 the same as the federal interest in resurfacing a back road? Is the federal interest in replacing a bridge carrying a U.S. highway over a major river the same as the federal interest in replacing a bridge that is not even on the federal-aid system? Then why are they all a standard 80% Federal cost share?

Incentives Via Different Share Surface reauthorization legislation may vary the federal cost shares of non- Interstate projects based on how core a federal interest they are. This would have to be accompanied by limits on flexibility between programs – you can’t trade $1 with a 80% match for $1 with a 50% match – they have to be scaled proportionately.

Future Revenue Sources Motor fuels taxes are dying. CAFE standards (55 mpg?), electric cars, etc. Telecommuting & transit vs. VMT. All other ideas to tax highway users involve the vehicle somehow (GPS- based VMT, odometer tax, registration tax, etc.).

Administration Costs Gas and diesel taxes incredibly cheap and easy to administer. Federal gas and diesel taxes paid at terminal rack. Less than 2,000 tax returns filed each quarter. Very few IRS employees needed to bring in $34 billion in taxes per year.

Administration Costs How to go from less than 2,000 taxpayers to 150 million taxpayers? IRS administrative costs of taxing cars or motorists individually would be huge. The most reasonable approach to federal taxation of cars or motorists is for the federal government to piggyback on state registration or taxation systems.

Recommend

More recommend