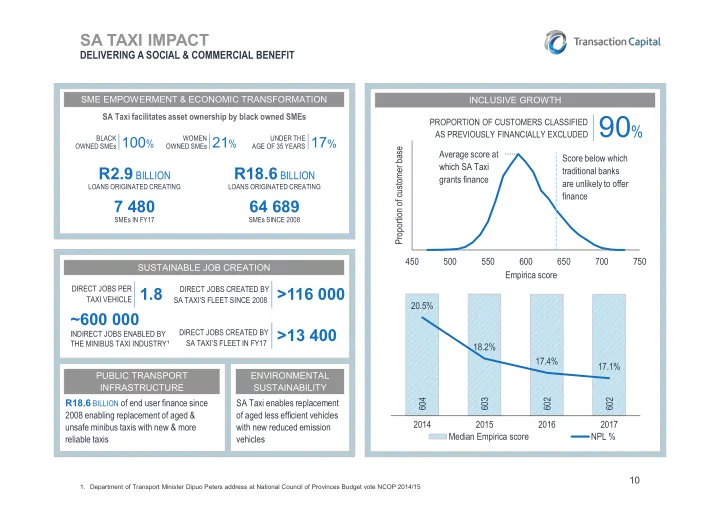

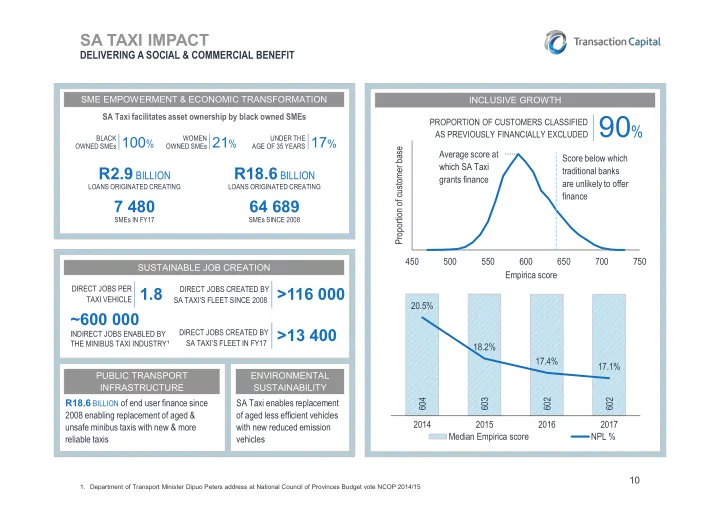

SA TAXI IMPACT DELIVERING A SOCIAL & COMMERCIAL BENEFIT SME EMPOWERMENT & ECONOMIC TRANSFORMATION INCLUSIVE GROWTH SME EMPOWERMENT & ECONOMIC TRANSFORMATION INCLUSIVE GROWTH AS PREVIOUSLY FINANCIALLY EXCLUDED 90 % SA Taxi facilitates asset ownership by black owned SMEs PROPORTION OF CUSTOMERS CLASSIFIED OWNED SMEs 100 % BLACK OWNED SMEs 21 % WOMEN AGE OF 35 YEARS 17 % UNDER THE Proportion of customer base Average score at Score below which which SA Taxi R2.9 BILLION R18.6 BILLION traditional banks grants finance are unlikely to offer LOANS ORIGINATED CREATING LOANS ORIGINATED CREATING finance 7 480 64 689 SMEs IN FY17 SMEs SINCE 2008 450 500 550 600 650 700 750 SUSTAINABLE JOB CREATION Empirica score DIRECT JOBS PER DIRECT JOBS CREATED BY TAXI VEHICLE 1.8 SA TAXI’S FLEET SINCE 2008 >116 000 20.5% ~600 000 >13 400 DIRECT JOBS CREATED BY INDIRECT JOBS ENABLED BY SA TAXI’S FLEET IN FY17 THE MINIBUS TAXI INDUSTRY ¹ 18.2% 17.4% 17.1% PUBLIC TRANSPORT ENVIRONMENTAL INFRASTRUCTURE SUSTAINABILITY R18.6 BILLION of end user finance since SA Taxi enables replacement 604 603 602 602 2008 enabling replacement of aged & of aged less efficient vehicles 2014 2015 2016 2017 unsafe minibus taxis with new & more with new reduced emission Median Empirica score NPL % reliable taxis vehicles 10 1. Department of Transport Minister Dipuo Peters address at National Council of Provinces Budget vote NCOP 2014/15

ENVIRONMENT & MARKET CONTEXT MINIBUS TAXI INDUSTRY IS RESILIENT, DEFENSIVE & GROWING DESPITE SA’S ECONOMIC CLIMATE TRAIN 1 MILLION ▼ >30% COMMUTER TRIPS DAILY MINIBUS TAXI PUBLIC TRANSPORT COMMUTERS RELY OVER 15 MILLION ▲ RECEIVES 44 % ON MINIBUS TAXI GIVEN ITS ACCESSIBILITY, COMMUTER TRIPS DAILY OF GOVERNMENT SUBSIDY AFFORDABILITY, RELIABILITY & FLEXIBILITY ~3 180 KM NATIONAL NETWORK COMMERCIALLY SELF-SUSTAINABLE • 40% of South Africans use public transport RECEIVES NO GOVERNMENT SUBSIDY ~500 TRAIN STATIONS • Minibus taxi is the dominant form of public transport • Minibus taxi is an essential service & spend is >200 000 MINIBUS TAXIS non-discretionary >2 600 TAXI RANKS ~15 BILLION KM TRAVELLED (per year) GROWING MINIBUS TAXI USAGE • Since 2013, minibus taxi usage ( ▲ >15% ) • 69% of all households use minibus taxis ( 59% in 2003) BUS BUS RAPID TRANSPORT (BRT) • 75% of all work & educational public transport trips < 1 MILLION ~120 000 ▼ 1% • Population growth ( ▲ 7% ) COMMUTER TRIPS DAILY COMMUTER TRIPS DAILY • Increasing commuter density due to urbanisation • Transformation of minibus taxi industry due to RECEIVES 56 % OF GOVERNMENT SUBSIDY ▲ regulation & capitalisation, attracting a more >19 000 REGISTERED BUSES 3 METROPOLITANS sophisticated taxi operator >100 BUS STATIONS <700 REGISTERED BUSES • New passenger vehicle sales ▼ 20% (FY13 to FY17) ~1 BILLION KM TRAVELLED (per year) ~100 BUS STATIONS; <100 ROUTES SOURCE: Stats SA Land Transport Survey July 2017 | NAAMSA Sales Results | National Treasury Public Transport & Infrastructure system report | 12 Department of Transport - Transport Infrastructure report | Passenger Rail Agency of SA | SA Bus Operators Association | FIN 24 – “New public transport system” 14/10/2017 | Websites: Rea Vaya, MyCiTi, Rustenberg Rapid Transport

ENVIRONMENT & MARKET CONTEXT SA TAXI FLEET MOVEMENT IN AN INTEGRATED PUBLIC TRANSPORT NETWORK MINIBUS TAXI IS THE DOMINANT MODE OF PUBLIC TRANSPORT Taxi rank Bus station Train station SA Taxi exposure Railway lines Major highways Secondary highways Minibus taxi serves as a trunk service in parallel with train & bus, & is also the feeder into these modes 13 13 SOURCE: SA Taxi fleet movement on 28 October 2017

ENVIRONMENT FOR MINIBUS TAXI OPERATORS MINIBUS TAXI OPERATORS REMAIN RESILIENT DESPITE THE CURRENT CHALLENGING ECONOMIC ENVIRONMENT VEHICLE & OPERATING COSTS STRUCTURAL ELEMENTS For the period 1 Oct 2015 to 30 Sep 2017 AGEING FLEET: demand for minibus vehicles exceeds supply TOYOTA MINIBUS TAXI PRICE SA REPO RATE DOMINANT MODE OF PUBLIC TRANSPORT CAGR ▲ 8 % ▲ 75 bps Integrated component of public transport network For the 12 months ended 30 Sep 2017 Public transport spend is non-discretionary FINANCE INSTALMENTS & INSURANCE PREMIUMS DRIVER WAGES Receives NO government subsidy ; commercially self-sustainable ▲ 9 % ▲ 6 % CONTINUED HIGH LEVELS OF UNEMPLOYMENT VEHICLE MAINTENANCE COSTS FUEL PRICE¹ (per litre) Marginal ▲ ▲ 6 % petrol ▲ 7 % diesel >27 % OPERATOR PROFITABILITY : PROFITABLE & RESILIENT TAXI OPERATORS TAXI FARES HIGHER UTILISATION OF MINIBUS TAXIS IMPROVING CREDIT METRICS ~ 1.5 BILLION KM travelled by the SA Taxi fleet in 2017 For the 12 months ended 30 Sep 2017 Credit loss ratio CAGR NPL ratio CAGR (FY13 to FY17) (FY13 to FY17) - Increasing commuter density due to urbanisation ▲ 7 % ▲ 5 % ▼ 12 % ▼ 17 % short distance long distance Preferred mode of public transport 26 % (competitively priced; convenient; accessible) repeat clients over the last 12 months New passenger vehicle sales ▼ 20 % (FY13 to FY17) 16 SOURCE: NAAMSA Sales Results 1. www.energy.gov.za: 12 month rolling average petrol price

ENVIRONMENT & MARKET CONTEXT STRUCTURALLY DEMAND FOR MINIBUS TAXI VEHICLES > SUPPLY TOTAL ADDRESSABLE MARKET DEMAND: AN AGEING NATIONAL FLEET REQUIRING RELACEMENT & RECAPITALISATION IN SOUTH AFRICA THERE ARE 70 000 - 80 000 FINANCED & INSURED ~150 000 TAXI OPERATORS >200 000 MINIBUS TAXIS ~200 000 TAXI DRIVERS 120 000 - 130 000 UNENCUMBERED & HENCE AGED ~3 BILLION LITRES OF FUEL PURCHASED EACH YEAR >9 YEARS OLD ON AVERAGE 1 200 TAXI ASSOCIATIONS DRIVING HIGHER DEMAND FOR VEHICLES, FINANCE & ALLIED SERVICES SUPPLIED BY SA TAXI SUPPORTING A LARGE COMMUTER MARKET SUPPLY: MINIBUS TAXI SUPPLY IN SOUTH AFRICA TOYOTA SESFIKILE NISSAN NV350 Most prevalent vehicle in the industry Steadily gaining acceptance >15 MILLION COMMUTER TRIPS DAILY TOYOTA PRE-OWNED MERCEDES SPRINTER Predominantly SA Taxi refurbished vehicles Mainly used for long distance routes >9.9 MILLION HOUSEHOLDS USING MINIBUS TAXIS TOYOTA SESFIKILE >40% RETAIL SALES SA TAXI’S SHARE OF ~1 000 PER MONTH MONTHLY RETAIL SALES ( 36% in 2015) ~R50 BILLION ANNUAL ESTIMATED REVENUE • Improved credit performance as SA Taxi is selective on credit risk, due to 50 MINUTES AVERAGE TIME SPENT TRAVELLING TO WORK limited supply • Improved recoveries as asset retains value due to demand exceeding supply • Liquid market for high quality & affordable SA Taxi pre-owned vehicles SOURCE: National Land Transport Strategic Framework 2015 | Passenger statistics from 17 Arrive Alive & StatsSA noting individuals can take more than one mode of transport National Household Transport Survey 2013 | Reuters 2017 | Industry information

Recommend

More recommend