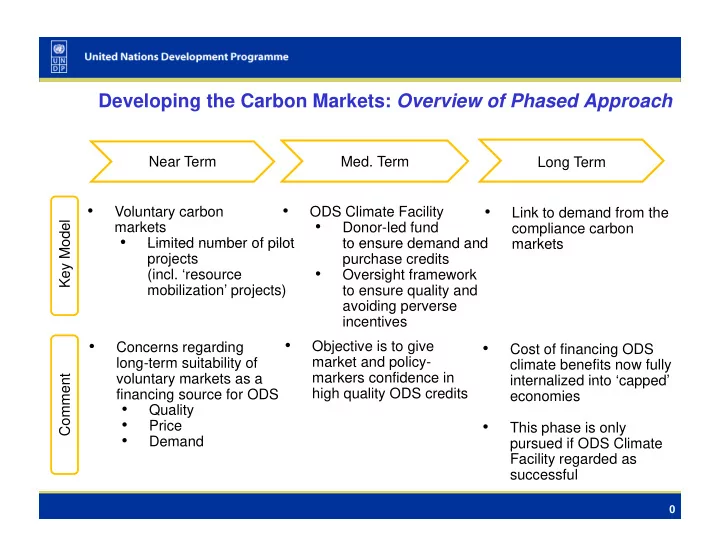

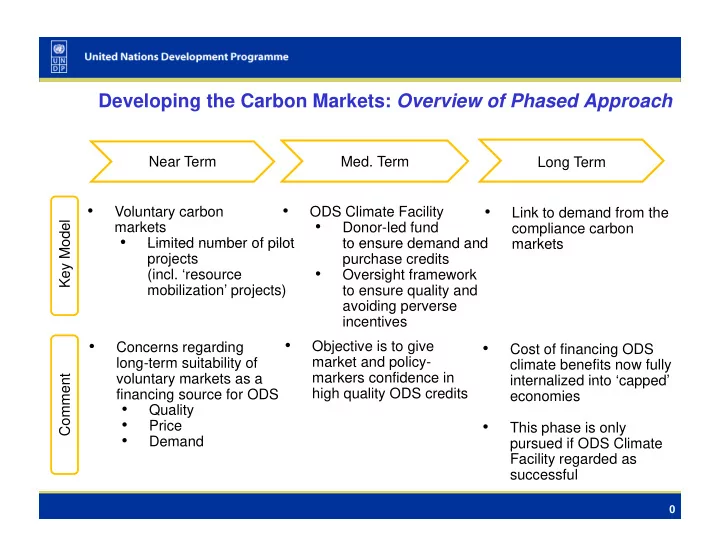

Developing the Carbon Markets: Overview of Phased Approach Developing the Carbon Markets: Overview of Phased Approach Near Term Med. Term Long Term • • • Voluntary carbon ODS Climate Facility Link to demand from the odel • markets Donor-led fund compliance carbon • • Limited number of pilot Limited number of pilot to ensure demand and to ensure demand and markets markets Key Mo projects purchase credits • (incl. ‘resource Oversight framework mobilization’ projects) to ensure quality and avoiding perverse g p incentives • • Objective is to give Concerns regarding • Cost of financing ODS market and policy- long-term suitability of climate benefits now fully markers confidence in markers confidence in voluntary markets as a voluntary markets as a nt internalized into ‘capped’ internalized into capped Commen high quality ODS credits financing source for ODS economies • Quality • Price • This phase is only • Demand pursued if ODS Climate p Facility regarded as successful 0

Voluntary Markets Concerns : Supply/Demand Voluntary Markets Concerns : Supply/Demand Estimated Annual Emissions Current from Developing Country ODS Banks – TOTAL (1) Low and Medium Effort (2) Low and Medium Effort ( ) Voluntary Market Voluntary Market 400 - t CO2e) 350 - 300 - missions (Mt 250 - 200 - 150 150 - Annual E 100 - 50 - 2007 2008 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 The voluntary market is unlikely to be able to absorb The voluntary market is unlikely to be able to absorb the supply of ODS credits. Source: (1) State of the Carbon Markets 2009. Project -based voluntary carbon markets; (2) TEAP Decision XX/7 Report , Phase 2. Combined ‘Total Appliances & Foams’ and ‘Other Refrigerants’ categories 1

ODS Climate Facility: Potential Architecture ODS Climate Facility: Potential Architecture Technical Oversight Demand Demand Supply Supply A Assistance i t /Quantification /Q tifi ti ODS Climate Facility ODS Climate Facility Credits Credits Credits Oversight Fund MLF Individual Framework Framework Implementing Implementing (MLF (MLF or MLF MLF projects (MP bodies) Imp. Agencies) Agencies $ $ $ $ $ $ $ Architectural components of ODS Climate Facility addressed in issues paper: • • Possible structural configurations Project types • • Fund’s investment approach Co-financing • • Oversight framework Timing 2

ODS Climate Facility: Considerations for ExCom ODS Climate Facility: Considerations for ExCom The ODS Climate Facility in a ‘Nutshell’ • A facility to develop and establish the compliance carbon markets as the source of financing for ODS climate benefits. It recognizes that the voluntary carbon markets may not be sufficient. • • Precedents exist e g UN REDD; Prototype Carbon Fund (CDM) Precedents exist, e.g. UN-REDD; Prototype Carbon Fund (CDM) For Donors • It is not an open commitment to fund all future costs of ODS climate benefits • • It is a limited fund to ‘prime the pump’ with the aim that the compliance carbon It is a limited fund to prime the pump , with the aim that the compliance carbon markets will subsequently finance ODS climate benefit costs • The fund will cover the climate benefit cost of a defined number of high quality, diverse demonstration carbon projects. Payment from the fund will be p j y incremental-cost based, in the form of the accounting units of carbon credits For A5 Parties • It will not require mandatory participation • It is an optional, non-obligatory, mechanism, similar to the CDM, whereby projects in A5 Parties can freely choose to fund activities through this financial incentive 3

Recommend

More recommend