Default Cascades in Scale-free Networks Assessing the role of - PowerPoint PPT Presentation

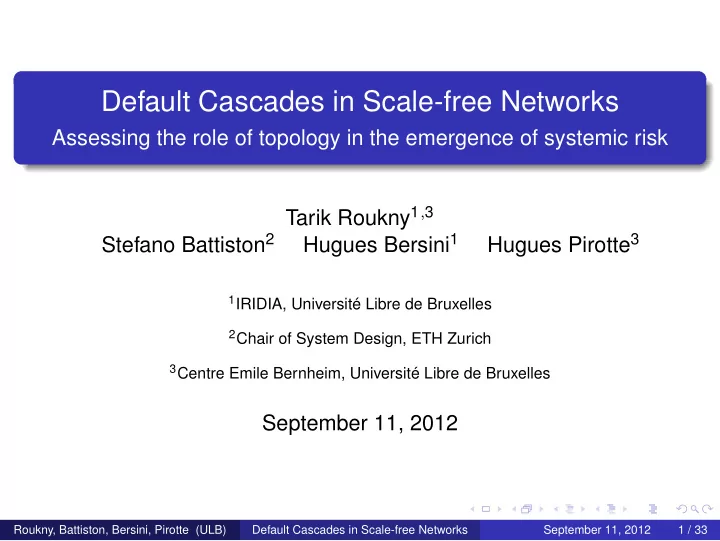

Default Cascades in Scale-free Networks Assessing the role of topology in the emergence of systemic risk Tarik Roukny 1 , 3 Stefano Battiston 2 Hugues Bersini 1 Hugues Pirotte 3 1 IRIDIA, Universit Libre de Bruxelles 2 Chair of System Design, ETH

Default Cascades in Scale-free Networks Assessing the role of topology in the emergence of systemic risk Tarik Roukny 1 , 3 Stefano Battiston 2 Hugues Bersini 1 Hugues Pirotte 3 1 IRIDIA, Université Libre de Bruxelles 2 Chair of System Design, ETH Zurich 3 Centre Emile Bernheim, Université Libre de Bruxelles September 11, 2012 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 1 / 33

Outline Introduction 1 The Model 2 Contagion Dynamics Market’s structure Experiments and Results 3 Validating the model Out-degree distribution Liquidity level Conclusion 4 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 2 / 33

Introduction "The Economic Crisis is a Crisis for Economic Theory" “[...] systematic warnings over more than a century [...] have been ignored and we have persisted with models which are both unsound theoretically and incompatible with data . It is suggested that we drop the unrealistic individual basis for aggregate behavior and the even more unreasonable assumption that the aggregate behaves like such a rational individual . We should rather analyse the economy as a complex adaptive system , and take the network structure that governs interaction into account.” Kirman, 2010 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 3 / 33

Introduction Complex Systems and Networks in Complex Systems The inner structure can have an influence on the system’s stability Epidemics The Internet Power Grids Albert, Albert, Albert, Jeong, Nakarado Barabasi, Pastor-Satorras, Vespignani, 2004 2000 2000 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 4 / 33

Introduction Our Question In Financial Systems What influence can the network’s structure have on default contagion and systemic risk? Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 5 / 33

Introduction Background Litterature Review Empirical studies and stress-test analysis 1 Italy: (Mistrulli 2005), (Iori et al. , 2007) Austria: (Boss et al. , 2004) USA: (Furfine et al. , 2003) Belgium: (Degryse & Nguyen, 2007) Brazil: (Cont et al. , 2011), (Cajueiro& Tabak, 2008) Germany: (Upper & Worms, 2002) etc. Default contagion dynamic models 2 From models of social influence: (Granovetter, 1978), (Watts, 2002) (Eisenberg & Noe, 2001): fictitious default sequence (Gai & Kapadia, 2010), (Battiston et al. , 2012), (Cont et al. , 2011) Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 6 / 33

Introduction In this work Overview of the Model Agent-based model Agents: financial institutions Interactions: credit ties Network: market’s structure From the analytical model introduced in (Battiston et al ., 2012) a Default cascades in credit networks (e.g. interbank market) 2 channels of contagion: Direct 1 Illiquidity and Panic 2 Analysis on the impact of risk diversification a Battiston, S., Gatti, D. D., Gallegati, M., Greenwald, B., and Stiglitz, J. E. (2012). Default cascades: When does risk diversification increase stability? Journal of Financial Stability 8, 3, 138-149 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 7 / 33

Introduction In this work Overview of the Model Agent-based model Agents: financial institutions Interactions: credit ties Network: market’s structure From the analytical model introduced in (Battiston et al ., 2012) a Default cascades in credit networks (e.g. interbank market) 2 channels of contagion: Direct 1 Illiquidity and Panic 2 Analysis on the impact of risk diversification a Battiston, S., Gatti, D. D., Gallegati, M., Greenwald, B., and Stiglitz, J. E. (2012). Default cascades: When does risk diversification increase stability? Journal of Financial Stability 8, 3, 138-149 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 7 / 33

Introduction Take home message Contribution to the debate on the optimal architecture of the financial system w.r.t. systemic risk and default contagion No single topology is always optimal regardless of the market conditions Several factors matter: Asset market liquidity 1 Correlation between core-capital and connectivity degree 2 Correlation in-degree and out-degree 3 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 8 / 33

Outline Introduction 1 The Model 2 Contagion Dynamics Market’s structure Experiments and Results 3 Validating the model Out-degree distribution Liquidity level Conclusion 4 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 9 / 33

The Model A E B F H C G D Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 10 / 33

The Model Financial robustness index ∼ equity ratio � A N η i = ( A i − L i ) / ij j Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 11 / 33

The Model Contagion Channels - First type Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 12 / 33

The Model Contagion Channels - First type Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 13 / 33

The Model Contagion Channels - First type η i ( t ) = η i ( 0 ) − k fi ( t ) k i Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 14 / 33

The Model Contagion Channels - First type η i ( t ) = η i ( 0 ) − k fi ( t ) k i Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 14 / 33

The Model Contagion Channels Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 15 / 33

The Model Contagion Channels - Second type Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 16 / 33

The Model Contagion Channels - Second type Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 17 / 33

The Model Contagion Channels - Second type Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 18 / 33

The Model Contagion Channels - Second type η i ( t ) = η i ( 0 ) − k fi ( t ) − b , if η i ( 0 ) < γ k fi ( t ) k i Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 19 / 33

The Model Contagion Channels - Second type η i ( t ) = η i ( 0 ) − k fi ( t ) − b , if η i ( 0 ) < γ k fi ( t ) k i Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 19 / 33

The Model Contagion Channels - Second type η i ( t ) = η i ( 0 ) − k fi ( t ) − b , if η i ( 0 ) < γ k fi ( t ) k i Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 19 / 33

Outline Introduction 1 The Model 2 Contagion Dynamics Market’s structure Experiments and Results 3 Validating the model Out-degree distribution Liquidity level Conclusion 4 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 20 / 33

The Model Market Financial robustness distribution p ( η ( t = 0 )) ∼ Gauss ( m , σ ) Out-degree distributions Erdos-Renyi Homogenous Scale-Free � n − 1 � p k ( 1 − p ) n − 1 − k k i = k ck − α k Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 21 / 33

The Model In this work What is explored Cascade size for different classes of topology Under different conditions: Level of liquidity Level of connectedness Level of capital structure Under different scenarios Connectivity - robustness correlations Lending - borrowing correlations Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 22 / 33

Outline Introduction 1 The Model 2 Contagion Dynamics Market’s structure Experiments and Results 3 Validating the model Out-degree distribution Liquidity level Conclusion 4 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 23 / 33

Experiments Validating the Model Frontier of large cascades change for Homogenous Random networks (Battiston et al. , 2012) Scenario Random individual financial robustness Result Diversification has an ambiguous role Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 24 / 33

Outline Introduction 1 The Model 2 Contagion Dynamics Market’s structure Experiments and Results 3 Validating the model Out-degree distribution Liquidity level Conclusion 4 Roukny, Battiston, Bersini, Pirotte (ULB) Default Cascades in Scale-free Networks September 11, 2012 25 / 33

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.