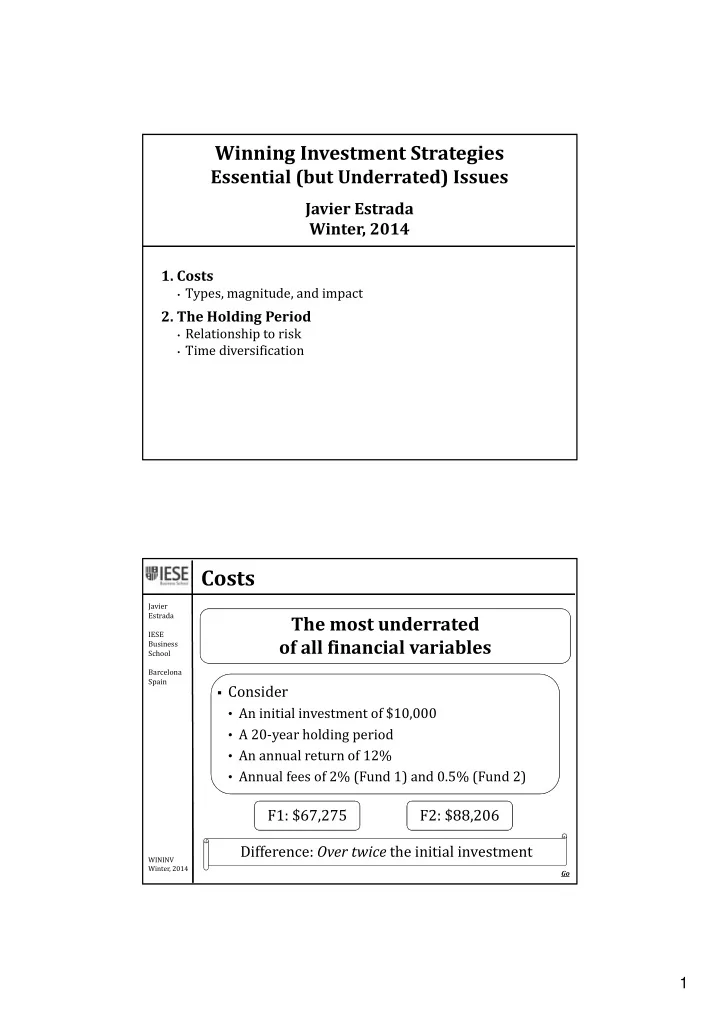

Winning Investment Strategies Essential (but Underrated) Issues Javier Estrada Winter, 2014 1. Costs • Types, magnitude, and impact 2. The Holding Period • Relationship to risk • Time diversification Costs Javier Estrada The most underrated IESE of all financial variables Business School Barcelona Spain Consider • An initial investment of $10,000 • A 20‐year holding period • An annual return of 12% • Annual fees of 2% (Fund 1) and 0.5% (Fund 2) F1: $67,275 F2: $88,206 Difference: Over twice the initial investment WININV Winter, 2014 Go 1

Costs Javier Estrada IESE Visible ‘Hidden’ Business School Loads (FE/BE) Barcelona Management fee Spain Trading costs Incentive fee Bid‐ask spreads Other fees Taxes ⇒ TER Some relevant figures Costs are the big edge of passive management WININV Winter, 2014 Go 1 Go 2 Go 3 Costs Javier Estrada And though it may be hard to believe … IESE Business School Barcelona Spain Lower costs are associated to … higher lower returns volatility higher risk‐adjusted returns WININV Winter, 2014 Go 2

The Holding Period Javier Estrada Investors usually consider … IESE Business School Barcelona Return Risk Spain And pay far less attention to … Big Holding period Mistake It is a critical variable in investment decisions WININV Winter, 2014 The Holding Period Javier Estrada Why is it so important? IESE Business School Barcelona Spain The absolute and relative risk of assets depends on the holding period Which asset is riskier, stocks or bonds? WININV Winter, 2014 Go 3

The Holding Period Javier Time diversification Estrada IESE Business School Barcelona Spain The longer the holding period, the more likely is a riskier (more volatile) asset to outperform a less risky (less volatile) asset The longer the holding period, the higher can (should) be the exposure to risk Stocks/Bonds Value/Growth EMs/DMs Small/Large WININV Winter, 2014 Go In Short Costs Javier Estrada The most underrated financial variable IESE Business But critical in the long term School Barcelona • Determining obtained and expected returns Spain • Lower costs deliver higher return and lower risk The holding period Critical variable in investment decisions Determines the absolute and relative risk of assets All else equal, the longer the holding period, the higher should be the exposure to risk WININV Winter, 2014 4

Appendix Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 5

Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back Costs (Small ‐ Value) Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 6

Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 7

Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 8

Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Costs – USA Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Source: ETF Landscape, BlackRock, 2010. 9

Costs – Europe Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Source: ETF Landscape, BlackRock, 2010. Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 10

Costs Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Costs – John Bogle Javier Estrada IESE “The wonderful magic Business School of compounding returns Barcelona Spain is overwhelmed by the powerful tyranny of compounding costs.” WININV Winter, 2014 11

Costs – David Swensen Javier Estrada IESE Business School “When you look at the Barcelona Spain results on an after-fee, after-tax basis over reasonably long periods of time, there’s almost no chance that you end up beating an index fund.” WININV Winter, 2014 Costs – R. Kinnel (Morningstar) Javier Estrada IESE Business “Investors should make School Barcelona expense ratios a primary test in Spain fund selection. They are still the most dependable predictor of performance. Start by focusing on funds in the cheapest or two cheapest quintiles, and you'll be on the path to success.” WININV Winter, 2014 Back 12

Costs, Risk, and Return Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back Risk and the Holding Period Javier Estrada IESE RP<0 = 39/110 = 35% Business School Barcelona Spain WININV (*) 1900‐2009, S&P and 10Y Treasuries Winter, 2014 13

Risk and the Holding Period Javier Estrada IESE RP<0 = 15/101 = 15% Business School Barcelona Spain WININV (*) 1900‐2009, S&P and 10Y Treasuries Winter, 2014 Risk and the Holding Period Javier Estrada IESE RP<0 = 3/91 = 3% Business School Barcelona Spain WININV (*) 1900‐2009, S&P and 10Y Treasuries Winter, 2014 14

Risk and the Holding Period Javier Estrada IESE RP<0 = 0/81 = 0% Business School Barcelona Spain WININV (*) 1900‐2009, S&P and 10Y Treasuries Winter, 2014 Risk and the Holding Period Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 15

Risk and the Holding Period Javier Estrada IESE Business School Barcelona Spain WININV Winter, 2014 Back 16

Recommend

More recommend