CORPORATE PRESENTATION November 2016 *Subject to all regulatory and TSX Venture Exchange approvals

FORWARD-LOOKING STATEMENT This presentation may contain forward-looking statements which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements may include statements regarding exploration results and budgets, resource estimates, work programs, strategic plans, market price of industrial minerals or other statements that are not statements of fact. Although the company believes the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Various factors that may affect future results include, but are not limited to, fluctuations in market prices of minerals, foreign currency exchange fluctuations, risks relating to exploration, including resource estimation financing, political and regulatory risks, and other risks described in management discussions and analyses as filed on SEDAR. Accordingly, undue reliance should not be placed on forward- looking statements. Information contained in this presentation is subject to all regulatory and TSX Venture Exchange approvals. NB: The mineral descriptions and grades cited within are presented only in a historical context and use historical terminology which does not conform to current standards and, as such, should not be relied upon. Although the historical data is believed to be based on reasonable assumptions, such data was generated prior to the implementation of National Instrument 43-101 ("NI 43-101"). These historical descriptions do not meet current standards as set forth under NI 43-101 and therefore should not be relied upon .

SUMMARY Natan Resources is focused on the exploration and development of its Montalembert property, a high-grade gold project, located within Quebec’s prolific Abitibi greenstone belt. HIGHLIGHTS: November 2016 - acquire the right to earn a 100% interest in the high-grade gold Montalembert property Located in the Abitibi region of Quebec, a province ranked 8 th worldwide for mining investment attractiveness (Fraser Institute) – 3,183 hectares in size Numerous historic multi-ounce gold assays collected from two parallel veins that are open at depth and along strike Project has not been extensively explored for gold since 1974 Located near past and current producing gold mines (Shortt Lake & Bachelor Lake) Paved highway and power grid to within 5 km of the property Natan Resources currently has tight share structure with small float Exploration to commence spring 2017

CAPITAL STRUCTURE Symbol TSXV: NRL Shares Outstanding 20,740,784 Market Cap $4,500,000 Year High $0.38 Year Low $0.05 Options TBD Warrants 2,476,540 Fully Diluted 23,217,324 MANAGEMENT BOARD OF DIRECTORS Steve Roebuck, P.Geo, President & CEO Steve Roebuck, Director David Hladky, P.Geo., VP Exploration David Hladky, Director Rukie Liyanage, CFO Brendan Purdy, Director Mike Blady, Director

BOARD OF DIRECTORS & MANAGEMENT STEVE ROEBUCK, P. Geo. President, CEO & Director Mr. Roebuck is a registered professional geoscientist with over 25 years of international mining and exploration experience. Most recently Steve was the President of Scorpio Gold Corp., a 40,000-ounce-per-year gold producer with assets in Nevada, responsible for corporate matters that included investor relations and business development. Steve has been the Vice President of Exploration for two publicly listed companies with interests in gold, diamonds, iron ore and base metals. Early in his career Steve mined and explored for gold in Val d’Or and Desmaraisville, Quebec at the Sigma and Bachelor Lake Mines and the plus 6 million ounce Giant Mine in Yellowknife, NT while working for Royal Oak Mines, Aur Resources and Placer Dome. DAVID HLADKY, P.Geo . VP Exploration & Director Mr. Hladky is a registered professional geoscientist with over 18 years of hands-on international exploration experience. His positions have included Sr. Geologist and Project Manager for projects in the Yukon Territory, British Columbia, Argentina and Peru and most recently he was a Project Manager and Qualified Person on the Morelos Sur and El Barqueno Projects in Mexico, where Cayden Resources was purchased by Agnico Eagle Mines. Mr. Hladky also spent several years working for Great Panther Silver in the exploration of its Guanajuato mine and Km 66 project, both also in Mexico.

BOARD OF DIRECTORS & MANAGEMENT MIKE BLADY Director Mr. Blady has a B.Sc. from Simon Fraser University and has been an independent businessman since 2006. He is the principal of Ridgeline Exploration, a grass roots exploration services company based out of Vancouver BC. He has been involved in senior management of numerous public companies since 2009 and has acted as a geological consultant and adviser to various public companies providing corporate development services. Mr. Blady's senior management experience with resource companies gives him an appreciation of the best industry practices with respect to financial risk control and disclosure. BRENDAN PURDY Director Mr. Purdy, JD, is a practicing securities lawyer focused on technology and resource issuers. In his private practice, he has developed extensive experience with respect to public companies, capital markets, reverse takeovers and other facets fundamental to the natural resources sector. Prior to receiving his JD from the common-law section at the University of Ottawa, Mr. Purdy completed a bachelor of management and organizational studies degree from the University of Western Ontario, majoring in finance and administration.

WHY QUEBEC? The 2015 Fraser Institute Survey ranks Quebec 2 nd in Canada and 8 th worldwide for mining investment attractiveness The Fraser Institute Survey of Mining Companies, 2015 rates 109 jurisdictions around the world based on a combination of their geologic attractiveness for minerals and metals and their policy attractiveness. Currently, Quebec offers the largest potential tax savings available in Canada for flow- through share investors because of its 120% tax deduction and 28% tax credit for qualifying exploration expenditures incurred in Quebec.

PROPERTY LOCATION Mining friendly Province of Quebec Prolific Abitibi Greenstone belt Located 125 km due west of Chibougamau, Quebec Paved highway #113 passes within 5 km of the property Year round access to project Abundant exploration and mining infrastructure in nearby population centres of Val d’Or & Chibougamau Location will benefit access and help lower exploration costs

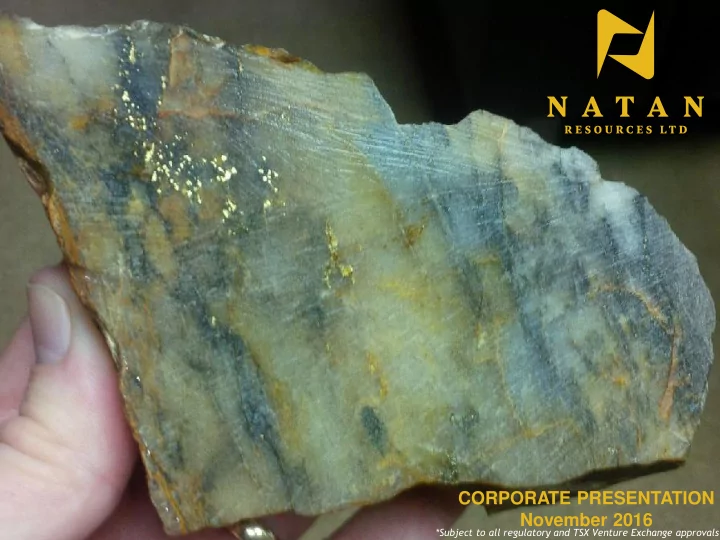

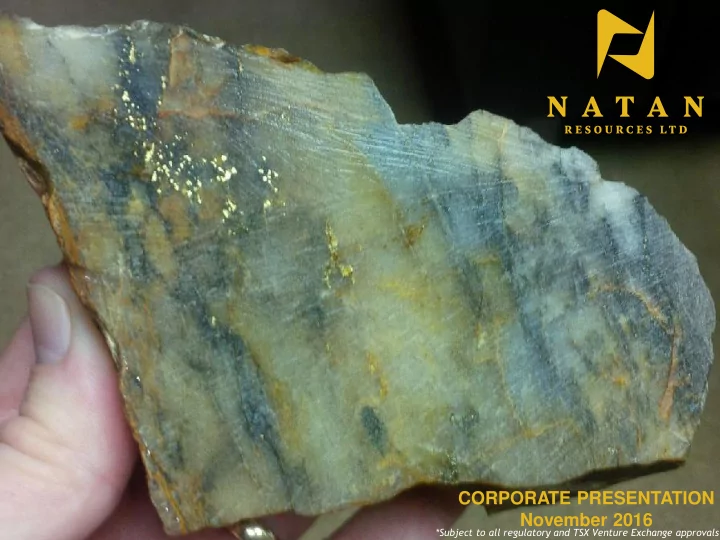

MONTELAMBERT PROPERTY 58 claims = 3180 hectares. Two parallel quartz + sericite veins in shear zoned exposed at surface – VG noted in multiple locations at the Rochelom gold showing Veins were first explored in 1951 by N.A. Timmins and in 1974 by Rochelom Mines Property has not been extensively explored for gold since in 1974 Property was last explored in 2002 for its kimberlite potential

HISTORICAL VEIN ASSAYS Both the Galena Vein and Number 2 vein are open along strike length Recent mechanical stripping along the Galena vein has now exposed the structure to 187 metres in length Only one campaign of drilling done on the vein system in 1951 – all holes were shallow and hit structure – no assays reported Based on historical map circa 1973 – non NI 43-101 compliant – should not be relied upon

AUTUMN 2016 EXPLORATION Vein structures stripped of overburden and power- washed - the Galena vein has now exposed the structure to 187 metres in length Geologists mapped and sampled the Galena vein and Vein No. 2 plus the exposed cross-cuts between the parallel veins Channel sampling completed in November – assays pending

DUVAL LITHIUM PROPERTY Numerous pegmatite intrusions, which are responsible for the lithium mineralization at Whabouchi, occur across the Duval Property Whabouchi boasts the 2 nd richest and largest deposit in the world with 27.3 MT Proven and Probable Reserves at an average grade of 1.53% Li2O, for an expected mine life of 26 years with a 2.4 year pay back period. The 2459 ha. Duval Property lies adjacent to and directly on trend with the Whabouchi Lithium Deposit. Low production costs: After tax NPV of $1.2B (8% discount) and after tax IRR of 30.3%

CONTACT INFORMATION Head Office: MEZ – 8 Wellington St E, Toronto, ON M5e 1C5 Telephone: (778) 233-0902 Web: www.natanresources.ca E-mail: info@natanresources.ca

Recommend

More recommend