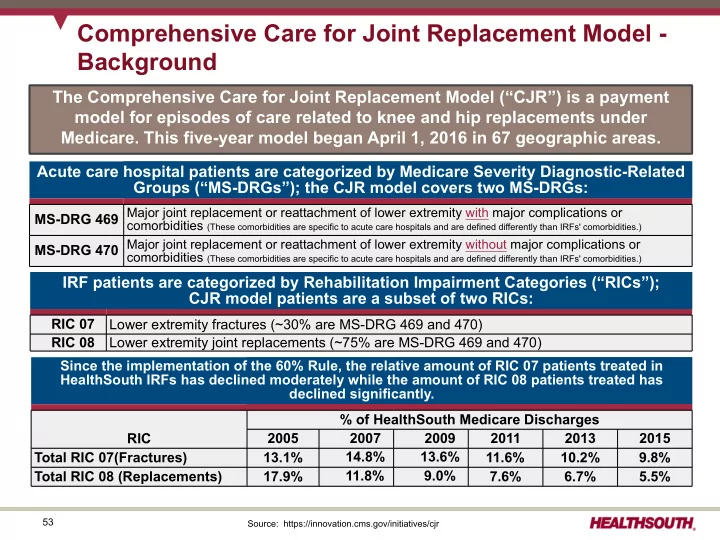

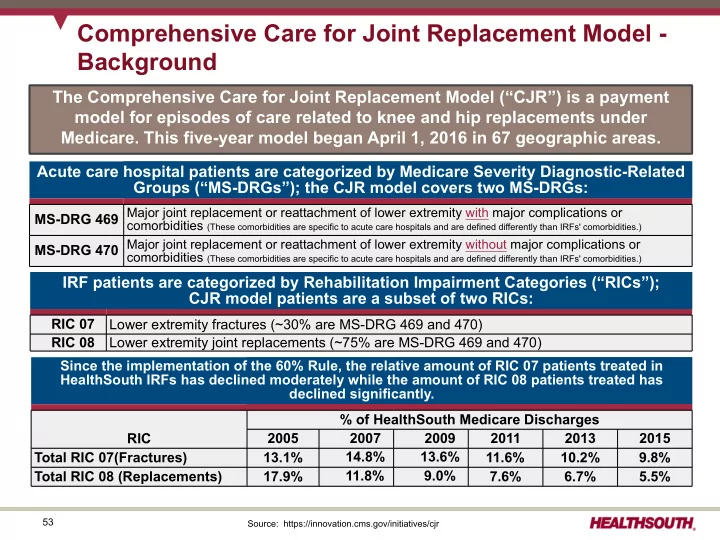

Comprehensive Care for Joint Replacement Model - Background The Comprehensive Care for Joint Replacement Model (“CJR”) is a payment model for episodes of care related to knee and hip replacements under Medicare. This five-year model began April 1, 2016 in 67 geographic areas. Acute care hospital patients are categorized by Medicare Severity Diagnostic-Related Groups (“MS-DRGs”); the CJR model covers two MS-DRGs: MS-DRG 469 Major joint replacement or reattachment of lower extremity with major complications or comorbidities (These comorbidities are specific to acute care hospitals and are defined differently than IRFs' comorbidities.) MS-DRG 470 Major joint replacement or reattachment of lower extremity without major complications or comorbidities (These comorbidities are specific to acute care hospitals and are defined differently than IRFs' comorbidities.) IRF patients are categorized by Rehabilitation Impairment Categories (“RICs”); CJR model patients are a subset of two RICs: RIC 07 Lower extremity fractures (~30% are MS-DRG 469 and 470) RIC 08 Lower extremity joint replacements (~75% are MS-DRG 469 and 470) Since the implementation of the 60% Rule, the relative amount of RIC 07 patients treated in HealthSouth IRFs has declined moderately while the amount of RIC 08 patients treated has declined significantly. % of HealthSouth Medicare Discharges RIC 2005 2007 2009 2011 2013 2015 14.8% 13.6% Total RIC 07(Fractures) 13.1% 11.6% 10.2% 9.8% 11.8% 9.0% Total RIC 08 (Replacements) 17.9% 7.6% 6.7% 5.5% 53 Source: https://innovation.cms.gov/initiatives/cjr

CJR Model - How Does It Work? RETROSPECTIVE Begins with an There is no downside risk in year one. Repayment RECONCILIATION admission to an responsibility will be phased in during year two. PERFORMED BY CMS acute care hospital for a At the end of each performance year, patient who is actual spending for ultimately each episode is discharged Acute care hospitals are accountable for compared to each acute care hospital's under MS-DRG expenditures and quality of care for entire "episode." target price. Episode = hospitalization + 90 days post discharge 469 or 470. If episode spending < target price, acute care hospital receives additional payment Patients are from Medicare*. discharged to a If episode spending > post-acute care POST-ACUTE CARE target price, acute care provider or to hospital returns a PROVIDERS portion of the Medicare home self-care. episode payment. All providers are paid under the usual Medicare payment system rules and procedures. Acute care hospitals receive separate episode target prices each year reflecting the differences in spending for each MS-DRG. Target prices: ü are based on three years of historical data; ü include a 3% discount* vs. expected episode spending; and ü incorporate a blend of historical, hospital-specific spending and regional spending for CJR episodes, with the regional component of the blend increasing over time. Years 1 and 2 = Year 3 = Years 4 and 5 = 2/3 hospital-specific; 1/3 regional 1/3 hospital-specific; 2/3 regional 100% regional Source: CMS 54 *Subject to quality of care attainment

CJR Model - How Does It Work? - Collaborators Risk Sharing is Allowed in CJR with “Collaborators” Acute care hospitals participating in CJR may choose to engage in risk-sharing financial arrangements with other care providers for CJR episodes. A provider participating in these risk-sharing arrangements with a CJR acute care hospital is deemed a "collaborator." There are eight types of providers eligible to be CJR Collaborators, including IRFs and Payment Limits for CJR Acute Care Hospitals home health agencies. 20 CJR acute care hospitals must establish 20% 20% % of Target Price Difference eligibility criteria for Collaborators to meet, including quality of care criteria. 10 10% 5% Gain sharing payments must be actually and 5% 0 proportionally related to the care of (5)% beneficiaries in a CJR episode. (10)% -10 No one Collaborator may make an alignment (20)% (20)% payment greater than 25% of the CJR acute -20 care hospital's repayment amount. In 2016 2017 2018 2019 2020 aggregate, a CJR acute care hospital may Year of Implementation not collect alignment payments for more than 50% of its repayment amount. Reconciliation Payment Limit Repayment Limit There is no ceiling on the portion of the reconciliation payments received by a hospital from Medicare that the hospital may The corridors for risk sharing phase-in over time. distribute to non-physician Collaborators. Source: DHG Healthcare and CMS 55

CJR Model - What's the Potential Impact to HealthSouth? 90-Day Episode Spend HealthSouth Discharges in CJR Fractures Markets HLS cost ≤ SNF cost HLS cost > SNF cost Fractures ~400 discharges ~180 discharges Replacements ~580 discharges Fractures Replacements HLS cost ≤ SNF cost HLS cost > SNF cost (average revenue (average revenue per discharge of per discharge of Replacements ~$19,300) ~$14,400) ~200 discharges ~1,250 discharges ~1,450 discharges Total CJR discharges ~580 ~1,450 CJR discharges with ~30% of HealthSouth's fractures Σ = ~2,030 HLS cost ≤ SNF cost (~400) (~200) Discharges, and ~40% of HealthSouth's or ~2.1% of Total Discharges with replacements have complicating HLS Medicare complicating comorbidities* that require the Discharges comorbidities (~50) (~500) intensity of care delivered in an IRF. (~1.5% of Total HLS Residual CJR Discharges) discharges ~130 ~750 Source: 2014 Medicare claims data 56 * Complicating comorbidities include conditions such as diabetes, morbid obesity, and congestive heart failure.

CJR Model - HealthSouth's Strategies Opportunities Outweigh the Risks Increase the number Serve as a Increase the of stroke discharges collaborator Increase the Improve value number of in all markets number of CJR proposition for CJR Encompass discharges in all discharges in markets in home health Enhance value New guidelines for markets where which HealthSouth does CJR episodes proposition to adult stroke HealthSouth has a not currently have a cost CJR acute care rehabilitation and cost advantage advantage ü hospitals by recovery favoring Lower length engaging in risk- IRFs over SNFs of stay or ü sharing financial released by the bypass SNFs arrangements ü Import best practices American Heart Present the and go directly ü from other HealthSouth Association and the Individually ü empirical data to to Encompass IRFs American Stroke referral sources negotiated home health Association with each acute care Increase Reduce acute-care 100 of hospital based clinical transfers and HealthSouth's IRFs Further improve on collaboration ü discharges to SNFs hold The Joint advantage by circumstances efforts through tools such as Commission's reducing acute ü in each ü between predictive modeling Disease-Specific care transfers and market HealthSouth's Care Certification in ü discharges to IRFs and Risk capped Stroke SNFs through Encompass at 25% of Rehabilitation. Increase clinical tools such as acute care collaboration between predictive ü Average revenue hospital's HealthSouth's IRFs and modeling Average revenue per per episode of repayment Encompass discharge of ~$22,700 ~$3,300 amount 57

Independent Research Concludes IRFs are a Better Rehabilitation Option than SNFs “Whenever possible, the American Stroke Association strongly recommends that stroke patients be treated at an inpatient rehabilitation facility rather than a skilled nursing facility. While in an inpatient rehabilitation facility, a patient participates in at least three hours of rehabilitation a day from physical therapists, occupational therapists, and speech therapists. Nurses are continuously available and doctors typically visit daily.”* “If the hospital suggests “The studies that have compared outcomes in hospitalized sending your loved one to stroke patients first discharged to an IRF, a SNF, or a a skilled nursing facility nursing home have generally shown that IRF patients have after a stroke, advocate for the patient to go to an higher rates of return to community living and greater inpatient rehabilitation functional recovery, whereas patients discharged to a SNF facility instead… ”* or a nursing home have higher rehospitalization rates and substantially poorer survival.”** * AHA/ASA press release, "In-patient rehab recommended over nursing homes for stroke rehab," 90 issued May 4, 2016 (newsroom.heart.org) ** "Guidelines for Adult Stroke Rehabilitation and Recovery," issued May 2016 (stroke.ahajournals.org)

Recommend

More recommend