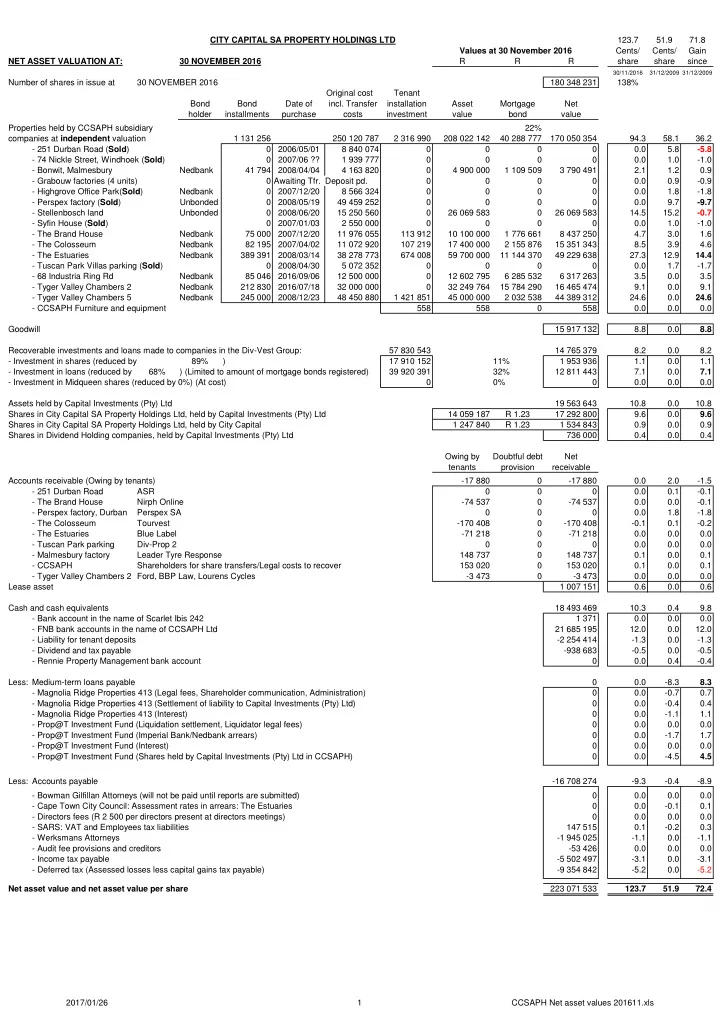

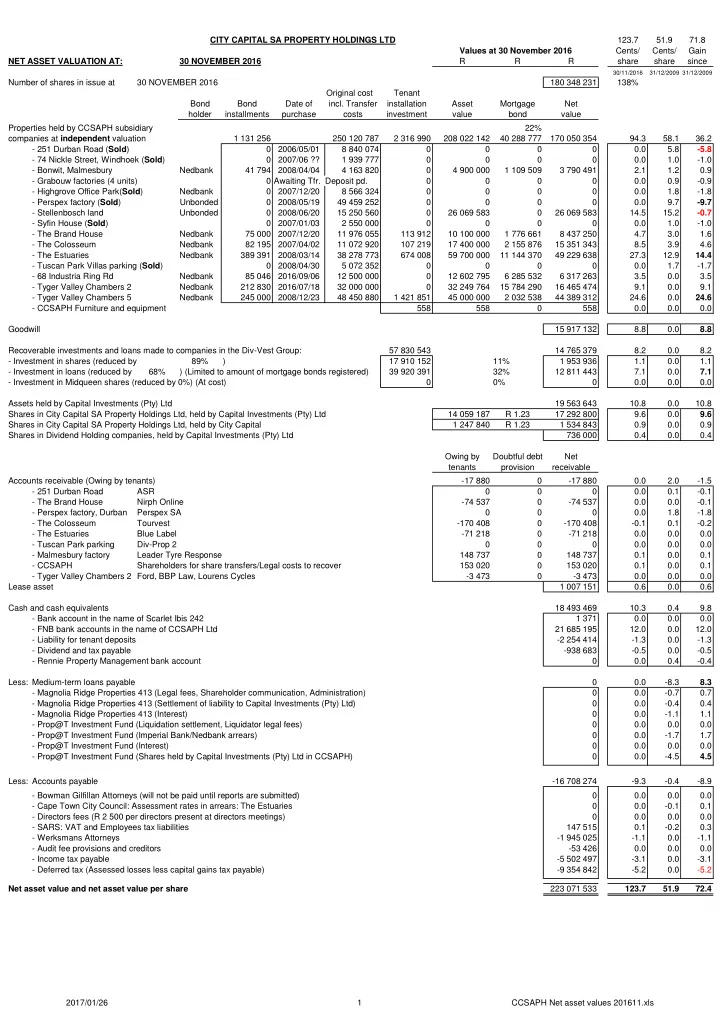

CITY CAPITAL SA PROPERTY HOLDINGS LTD 123.7 51.9 71.8 Values at 30 November 2016 Cents/ Cents/ Gain NET ASSET VALUATION AT: 30 NOVEMBER 2016 R R R share share since 30/11/2016 31/12/2009 31/12/2009 Number of shares in issue at 30 NOVEMBER 2016 180 348 231 138% Original cost Tenant Bond Bond Date of incl. Transfer installation Asset Mortgage Net holder installments purchase costs investment value bond value Properties held by CCSAPH subsidiary 22% companies at independent valuation 1 131 256 250 120 787 2 316 990 208 022 142 40 288 777 170 050 354 94.3 58.1 36.2 - 251 Durban Road ( Sold ) 0 2006/05/01 8 840 074 0 0 0 0 0.0 5.8 -5.8 - 74 Nickle Street, Windhoek ( Sold ) 0 2007/06 ?? 1 939 777 0 0 0 0 0.0 1.0 -1.0 - Bonwit, Malmesbury Nedbank 41 794 2008/04/04 4 163 820 0 4 900 000 1 109 509 3 790 491 2.1 1.2 0.9 - Grabouw factories (4 units) 0 Awaiting Tfr. Deposit pd. 0 0 0 0 0.0 0.9 -0.9 - Highgrove Office Park( Sold ) Nedbank 0 2007/12/20 8 566 324 0 0 0 0 0.0 1.8 -1.8 - Perspex factory ( Sold ) Unbonded 0 2008/05/19 49 459 252 0 0 0 0 0.0 9.7 -9.7 - Stellenbosch land Unbonded 0 2008/06/20 15 250 560 0 26 069 583 0 26 069 583 14.5 15.2 -0.7 - Syfin House ( Sold ) 0 2007/01/03 2 550 000 0 0 0 0 0.0 1.0 -1.0 - The Brand House Nedbank 75 000 2007/12/20 11 976 055 113 912 10 100 000 1 776 661 8 437 250 4.7 3.0 1.6 - The Colosseum Nedbank 82 195 2007/04/02 11 072 920 107 219 17 400 000 2 155 876 15 351 343 8.5 3.9 4.6 - The Estuaries Nedbank 389 391 2008/03/14 38 278 773 674 008 59 700 000 11 144 370 49 229 638 27.3 12.9 14.4 - Tuscan Park Villas parking ( Sold ) 0 2008/04/30 5 072 352 0 0 0 0 0.0 1.7 -1.7 - 68 Industria Ring Rd Nedbank 85 046 2016/09/06 12 500 000 0 12 602 795 6 285 532 6 317 263 3.5 0.0 3.5 - Tyger Valley Chambers 2 Nedbank 212 830 2016/07/18 32 000 000 0 32 249 764 15 784 290 16 465 474 9.1 0.0 9.1 - Tyger Valley Chambers 5 Nedbank 245 000 2008/12/23 48 450 880 1 421 851 45 000 000 2 032 538 44 389 312 24.6 0.0 24.6 - CCSAPH Furniture and equipment 558 558 0 558 0.0 0.0 0.0 Goodwill 15 917 132 8.8 0.0 8.8 Recoverable investments and loans made to companies in the Div-Vest Group: 57 830 543 14 765 379 8.2 0.0 8.2 - Investment in shares (reduced by 89% ) 17 910 152 11% 1 953 936 1.1 0.0 1.1 - Investment in loans (reduced by 68% ) (Limited to amount of mortgage bonds registered) 39 920 391 32% 12 811 443 7.1 0.0 7.1 - Investment in Midqueen shares (reduced by 0%) (At cost) 0 0% 0 0.0 0.0 0.0 Assets held by Capital Investments (Pty) Ltd 19 563 643 10.8 0.0 10.8 Shares in City Capital SA Property Holdings Ltd, held by Capital Investments (Pty) Ltd 14 059 187 R 1.23 17 292 800 9.6 0.0 9.6 Shares in City Capital SA Property Holdings Ltd, held by City Capital 1 247 840 R 1.23 1 534 843 0.9 0.0 0.9 Shares in Dividend Holding companies, held by Capital Investments (Pty) Ltd 736 000 0.4 0.0 0.4 Owing by Doubtful debt Net tenants provision receivable Accounts receivable (Owing by tenants) -17 880 0 -17 880 0.0 2.0 -1.5 - 251 Durban Road ASR 0 0 0 0.0 0.1 -0.1 - The Brand House Nirph Online -74 537 0 -74 537 0.0 0.0 -0.1 - Perspex factory, Durban Perspex SA 0 0 0 0.0 1.8 -1.8 - The Colosseum Tourvest -170 408 0 -170 408 -0.1 0.1 -0.2 - The Estuaries Blue Label -71 218 0 -71 218 0.0 0.0 0.0 - Tuscan Park parking Div-Prop 2 0 0 0 0.0 0.0 0.0 - Malmesbury factory Leader Tyre Response 148 737 0 148 737 0.1 0.0 0.1 - CCSAPH Shareholders for share transfers/Legal costs to recover 153 020 0 153 020 0.1 0.0 0.1 - Tyger Valley Chambers 2 Ford, BBP Law, Lourens Cycles -3 473 0 -3 473 0.0 0.0 0.0 Lease asset 1 007 151 0.6 0.0 0.6 Cash and cash equivalents 18 493 469 10.3 0.4 9.8 - Bank account in the name of Scarlet Ibis 242 1 371 0.0 0.0 0.0 - FNB bank accounts in the name of CCSAPH Ltd 21 685 195 12.0 0.0 12.0 - Liability for tenant deposits -2 254 414 -1.3 0.0 -1.3 - Dividend and tax payable -938 683 -0.5 0.0 -0.5 - Rennie Property Management bank account 0 0.0 0.4 -0.4 Less: Medium-term loans payable 0 0.0 -8.3 8.3 - Magnolia Ridge Properties 413 (Legal fees, Shareholder communication, Administration) 0 0.0 -0.7 0.7 - Magnolia Ridge Properties 413 (Settlement of liability to Capital Investments (Pty) Ltd) 0 0.0 -0.4 0.4 - Magnolia Ridge Properties 413 (Interest) 0 0.0 -1.1 1.1 - Prop@T Investment Fund (Liquidation settlement, Liquidator legal fees) 0 0.0 0.0 0.0 - Prop@T Investment Fund (Imperial Bank/Nedbank arrears) 0 0.0 -1.7 1.7 - Prop@T Investment Fund (Interest) 0 0.0 0.0 0.0 - Prop@T Investment Fund (Shares held by Capital Investments (Pty) Ltd in CCSAPH) 0 0.0 -4.5 4.5 Less: Accounts payable -16 708 274 -9.3 -0.4 -8.9 - Bowman Gilfillan Attorneys (will not be paid until reports are submitted) 0 0.0 0.0 0.0 - Cape Town City Council: Assessment rates in arrears: The Estuaries 0 0.0 -0.1 0.1 - Directors fees (R 2 500 per directors present at directors meetings) 0 0.0 0.0 0.0 - SARS: VAT and Employees tax liabilities 147 515 0.1 -0.2 0.3 - Werksmans Attorneys -1 945 025 -1.1 0.0 -1.1 - Audit fee provisions and creditors -53 426 0.0 0.0 0.0 - Income tax payable -5 502 497 -3.1 0.0 -3.1 - Deferred tax (Assessed losses less capital gains tax payable) -9 354 842 -5.2 0.0 -5.2 Net asset value and net asset value per share 223 071 533 123.7 51.9 72.4 2017/01/26 1 CCSAPH Net asset values 201611.xls

Management accounts Audited R 1.40 R 1.30 R 1.20 1.09 1.11 1.11 R 1.10 1.01 R 1.00 1.01 R 0.93 R 0.93 R 0.89 R 0.93 R 0.90 R 0.80 R 0.74 R 0.75 R 0.70 R 0.60 R 0.50

CITY CAPITAL SA PROPERTY HOLDINGS LTD 93 months ASSET VALUES AND NET INCOME FOR: JANUARY 2017 8.5% 1 Monthly Bond/ Asset No. GLA Vacant Vacancy Leased Monthly Monthly Monthly bond Net cash Current Bond- Asset Valuation Cap. Property name Company name valuation tenants m2 m2 % area (m2) Gross income Expenses Net income repayment flow bond value holder ratio Valuation difference rate Malmesbury factory Industrial Bonwit Malmesbury 4 900 000 1 2 470 0 0.0% 2 470 54 000 5 591 10% 48 409 41 794 6 615 1 273 771 Nedbank 26.0% 5 809 080 909 080 10.00% Brand House Commercial Rainbow Beach 211 10 100 000 5 1 048 0 0.0% 1 048 143 545 57 978 40% 85 567 75 000 10 567 2 079 860 Nedbank 20.6% 10 531 332 431 332 9.75% Colosseum Commercial Plasto Properties 9 17 400 000 3 987 0 0.0% 987 183 399 42 928 23% 140 470 82 195 58 275 2 477 522 Nedbank 14.2% 19 831 123 2 431 123 8.50% Estuaries Commercial Wellvest 26 59 700 000 12 3 457 0 0.0% 3 457 537 242 82 362 15% 454 880 389 391 65 489 12 614 664 Nedbank 21.1% 62 383 541 2 683 541 8.75% Stellenbosch land Development Evening Shade 26 000 000 0 0 0 0.0% 0 0 1 221 0% -1 221 0 -1 221 0 0.0% 26 000 000 0 Tyger Chambers 5 Commercial Plasto Properties 18 45 000 000 9 3 419 0 0.0% 3 419 460 899 137 297 30% 323 602 245 000 78 602 3 142 393 Nedbank 7.0% 43 146 920 -1 853 080 9.00% Tyger Chambers 2 Commercial Plasto Properties 18 32 000 000 9 2 651 1 110 41.9% 1 541 220 556 83 877 38% 136 679 212 830 -76 151 16 000 000 Nedbank 50.0% 38 980 849 6 980 849 9.00% Parow Industria Industrial Plasto Properties 18 12 500 000 8 4 977 0 0.0% 4 977 129 600 12 111 9% 117 489 83 636 33 853 6 250 000 Nedbank 50.0% 14 098 680 1 598 680 10.00% City Capital portfolio 207 600 000 47 19 009 1 110 5.8% 17 899 1 729 241 423 366 24% 1 305 875 1 129 846 176 029 43 838 210 24.1% 220 781 524 13 181 524 Head office expenses 51 859 -51 859 0 -51 859 0 3.0% Total City Capital SA Property Holdings Ltd 0 0 0 0 0.0% 0 0 475 225 1 254 016 0 124 170 0 0.0% 0 0 0.0% Director actions in process: Lease out vacancies: Rate/m2 3 1 220 155 677 0 155 677 0 155 677 - Tyger Chambers 2 115 3 1 220 155 677 0 155 677 0 155 677 Total City Capital portfolio 207 600 000 50 19 009 0 0.0% 19 119 1 884 918 475 225 1 409 693 1 129 846 279 847 43 838 210 24.1% 25% Director attention is presently focused on the following: 1. Collect all loans owing to City Capital by Div-Vest syndication companies (approximately R 40 million in total) and invest in property. 2. Control expenses such as cleaning, electricity, maintenance, property rates and security, wherever possible. The above actions require time to finalise. Funds have been utilised to install tenant requirements at Tyger Valley Chambers and the premises have been fully leased. 2017/01/26 1 Building summary 201701.xls

Recommend

More recommend