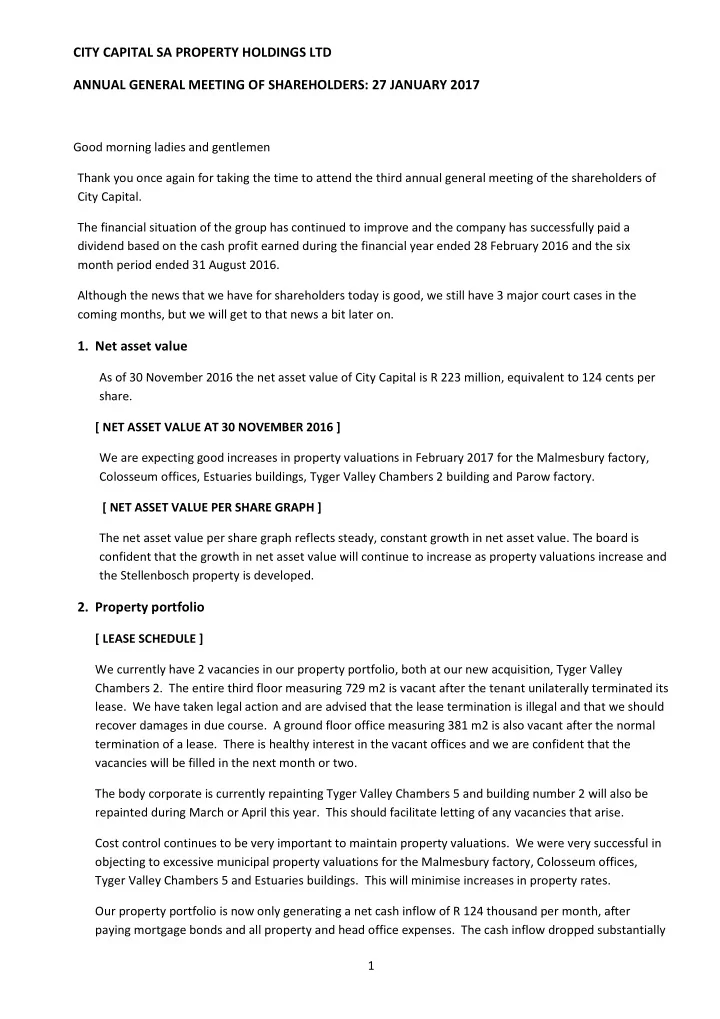

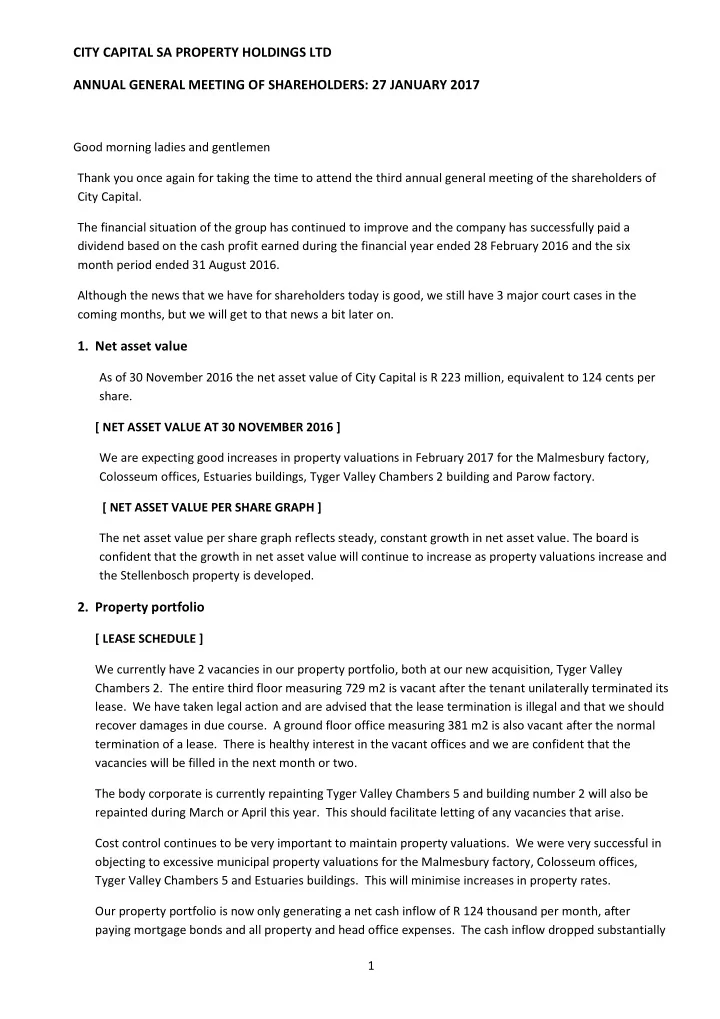

CITY CAPITAL SA PROPERTY HOLDINGS LTD ANNUAL GENERAL MEETING OF SHAREHOLDERS: 27 JANUARY 2017 Good morning ladies and gentlemen Thank you once again for taking the time to attend the third annual general meeting of the shareholders of City Capital. The financial situation of the group has continued to improve and the company has successfully paid a dividend based on the cash profit earned during the financial year ended 28 February 2016 and the six month period ended 31 August 2016. Although the news that we have for shareholders today is good, we still have 3 major court cases in the coming months, but we will get to that news a bit later on. 1. Net asset value As of 30 November 2016 the net asset value of City Capital is R 223 million, equivalent to 124 cents per share. [ NET ASSET VALUE AT 30 NOVEMBER 2016 ] We are expecting good increases in property valuations in February 2017 for the Malmesbury factory, Colosseum offices, Estuaries buildings, Tyger Valley Chambers 2 building and Parow factory. [ NET ASSET VALUE PER SHARE GRAPH ] The net asset value per share graph reflects steady, constant growth in net asset value. The board is confident that the growth in net asset value will continue to increase as property valuations increase and the Stellenbosch property is developed. 2. Property portfolio [ LEASE SCHEDULE ] We currently have 2 vacancies in our property portfolio, both at our new acquisition, Tyger Valley Chambers 2. The entire third floor measuring 729 m2 is vacant after the tenant unilaterally terminated its lease. We have taken legal action and are advised that the lease termination is illegal and that we should recover damages in due course. A ground floor office measuring 381 m2 is also vacant after the normal termination of a lease. There is healthy interest in the vacant offices and we are confident that the vacancies will be filled in the next month or two. The body corporate is currently repainting Tyger Valley Chambers 5 and building number 2 will also be repainted during March or April this year. This should facilitate letting of any vacancies that arise. Cost control continues to be very important to maintain property valuations. We were very successful in objecting to excessive municipal property valuations for the Malmesbury factory, Colosseum offices, Tyger Valley Chambers 5 and Estuaries buildings. This will minimise increases in property rates. Our property portfolio is now only generating a net cash inflow of R 124 thousand per month, after paying mortgage bonds and all property and head office expenses. The cash inflow dropped substantially 1

after the disposal of the Perspex factory, where we were receiving good rental income with no mortgage bond in place. The risk of that tenant terminating the lease was however very high and we now have a lower risk profile with multiple tenants and two separate properties. 3. Cash flow [ CASH FLOW SCHEDULES ] The cash flow schedule on the screen is used every day to control and to forecast over a two to three month period our cash in and outflows. We continue to experience a huge drain on our cash flows in the form of legal fees incurred in our ongoing battle to recover the loans that were made to the Dividend property companies. The expected return is however massive and we are committed to recovering these loans wherever possible. The important point is that our property portfolio is delivering positive cash flow, all major property renovations have been completed, our portfolio is almost fully let and our audits have been finalised and paid to-date. We also have reserves to fight the opposition to recover our loans to the Dividend property companies. 4. Dividend loan recovery Good progress has again been made with regard to the recovery of loans that were previously made to the Dividend property companies. [ LOANS TO DIVIDEND COMPANIES ] The schedule on screen reflects that we have recovered over R 24 million in loan repayments from the Dividend property companies over the past 7 years. There is still almost R 40 million outstanding and owing to City Capital, although we currently only reflect an amount of R 13 million in our financial records, the amount that is covered by our mortgage bonds and signed settlement agreements. [ DIVIDEND LOAN SUMMARY 201702 ] We have continued to provide for the unsecured portion of our loans and are able to grow our net asset value when we have been repaid the unsecured portions. To-date we have been successful in opposing continuous applications for the liquidation of 13 Dividend property companies and will again be in court on 27 March 2017 to oppose the applications. We have made progress in getting our consolidated claim to either court or arbitration during April 2017, although the opposition is adamant that they wish to first liquidate the companies before getting to court or an arbitrator. Where companies have been placed in business rescue, we have been able to work with the Business Rescue Practitioner and affected creditors and shareholders to dispose of properties for much better prices than those that would have been obtained by a liquidator. We are also working with the Zambezi Rescue Board and the majority of shareholders in those companies to obtain the discharge of the Zambezi companies from liquidation. We are hopeful that we will be successful with this initiative and that we will be able to achieve a better result than the liquidator is able to provide. 2

We had a setback this past year where our claim against Dream World Investments 246 was rejected by a magistrate after the opposition objected to our claim. We had to apply to court to have our status as a creditor recognised by the liquidator and objected to the proved claims of the Ferreira Family Trust, Kriek and Edeling. [ GREENFORD JUDGEMENT ] Unfortunately, these cases continue to incur substantial legal expenses for City Capital. 5. Stellenbosch land During the course of last year we met with a number of interested property developers to discuss development prospects on our land outside Stellenbosch. There is good demand for residential accommodation in Stellenbosch and we are confident that a successful development can be achieved. After many discussions we decided to enter into a joint venture agreement with Horn and De Koning Property Developers, who actively develop in the Stellenbosch area. We expect a development proposal and a comprehensive feasibility analysis by the end of April 2017, when a final decision will be taken as to whether a development should be undertaken. We hope to earn a profit in the region of R 9 million in cash and to end up owning a community shopping centre and 48 residential apartments in the development that we will lease out. These properties will be acquired at cost and we will earn a substantial fair value gain. [ HDK JOINT DEVELOPMENT AGREEMENT ] We have received confirmation from the department of environmental affairs that we will not need to perform an environmental impact assessment as the proposed development is within the urban edge and is not in an environmentally sensitive area. We will keep shareholders informed about the land and development possibilities. 6. Audited annual financial statements The consolidated annual financial statements of City Capital have been audited up to the 2016 financial year and they are available to all shareholders as a download on the company website, www.ccsaph.co.za. We encourage all shareholders to register on the City Capital website to gain access to all the financial information that is available on the site. [ AFS SUMMARY ] The summary of financial results from 2007 to 30 November 2016 has been updated with the 2016 audited AFS and these confirm the net asset value of 111 cents per share at 29 February 2016. Income tax returns are submitted for each company as the audited financial statements become available and income taxes are paid on assessment. Provisional taxes have been paid on 31 August 2016 and will be paid on 28 February 2017 for those companies that require payment. 7. Property acquisitions 3

Recommend

More recommend