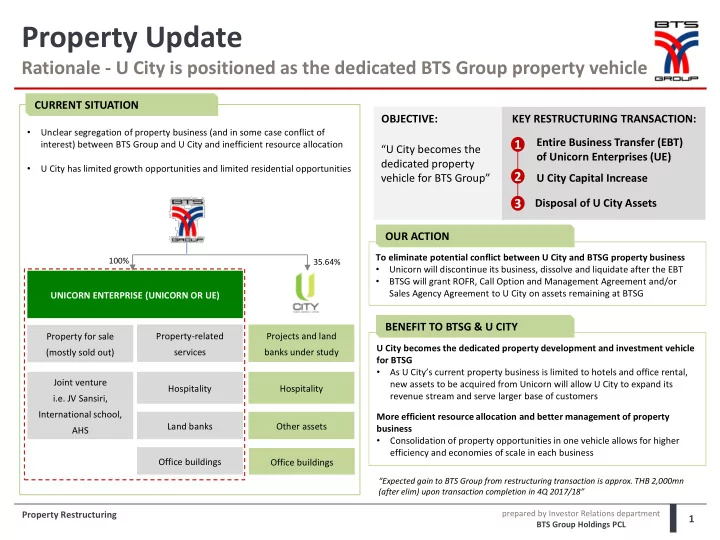

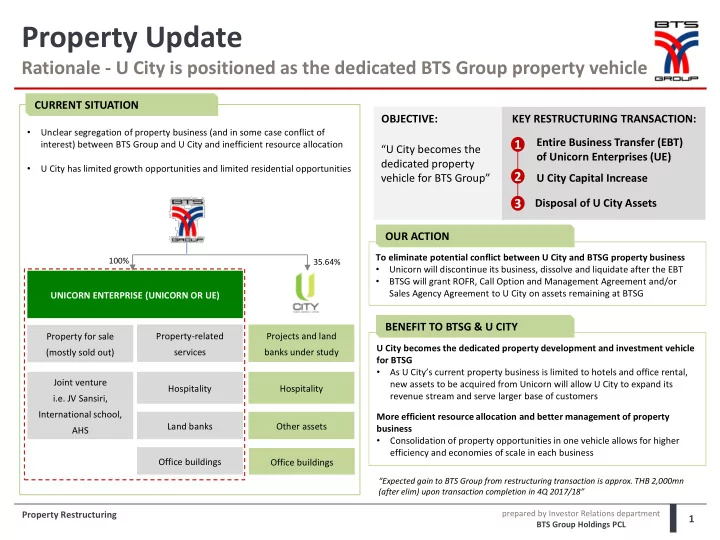

Property Update Rationale - U City is positioned as the dedicated BTS Group property vehicle CURRENT SITUATION OBJECTIVE: KEY RESTRUCTURING TRANSACTION: • Unclear segregation of property business (and in some case conflict of Entire Business Transfer (EBT) 1 interest) between BTS Group and U City and inefficient resource allocation “U City becomes the of Unicorn Enterprises (UE) dedicated property • U City has limited growth opportunities and limited residential opportunities 2 vehicle for BTS Group” U City Capital Increase 3 Disposal of U City Assets OUR ACTION To eliminate potential conflict between U City and BTSG property business 100% 35.64% • Unicorn will discontinue its business, dissolve and liquidate after the EBT • BTSG will grant ROFR, Call Option and Management Agreement and/or Sales Agency Agreement to U City on assets remaining at BTSG UNICORN ENTERPRISE (UNICORN OR UE) BENEFIT TO BTSG & U CITY Property-related Projects and land Property for sale U City becomes the dedicated property development and investment vehicle services banks under study (mostly sold out) for BTSG • As U City’s current property business is limited to hotels and office rental, Joint venture new assets to be acquired from Unicorn will allow U City to expand its Hospitality Hospitality revenue stream and serve larger base of customers i.e. JV Sansiri, International school, More efficient resource allocation and better management of property Land banks Other assets business AHS • Consolidation of property opportunities in one vehicle allows for higher efficiency and economies of scale in each business Office buildings Office buildings “Expected gain to BTS Group from restructuring transaction is approx. THB 2,000mn (after elim) upon transaction completion in 4Q 2017/18” prepared by Investor Relations department Property Restructuring 1 BTS Group Holdings PCL

Property Update Restructuring transaction structure UE Entire Business Transfer (EBT) U City Capital Increase U City Asset Divestment Projects and land Strategic U City Hospitality banks under study Investor Shareholder Phaya Thai Project Hotel and hotel • PP RO Mochit Project management RO • RO Land banks Office rental 100% 35.64% UE 3 Assets from EBT Property for sale* 1 EBT 2 • Subsidiary shares in Subsidiary shares Hotel companies Condominium Joint venture shares • Joint venture shares Some land bank Preferred shares 35.64% i.e. JV Sansiri, issued to UE (PP) International school, Repayment of SH Loan AHS *Assets to be divested (value of approx. THB 3bn) U City plans to repay all shareholder loan from BTSG UE to transfer all selected assets and shareholder • Anantara Chiang Mai Resort and Spa (from EBT) with proceeds from capital increase loans to U City in exchange for new shares (and • AVANI Khon Kaen Hotel & Convention Centre warrants) in U City • Private Placement (PP) – Preferred shares and warrants • Anantara Chiang Mai Serviced Suites • Assets value: THB 12,917mn (as of 30 Jun 2017) • Park Aran Boulevard Commercial Building Project PP to Bangkok Bank (Strategic investor) • BTSG loan: THB 10,745mn (as of 30 Jun 2017) • Park Ramindra Condominium • Right Offering (RO) – Preferred shares and warrants RO • Value of preferred shares issued to UE (PP): THB • Land banks in Charansanitwong & Chonburi to all shareholders including strategic investor • 2,172mn Land in Nakhon Ratchasima #1 and #2 will be conditional upon each other voluntarily propose to shareholder for approval Note: - Certain assets under UE that will not be transferred to U City but will be transferred to BTSG prior to the transaction - To ensure sufficient funding, U City is currently securing bank facility in case of proceeds from PP and RO are lower than shareholder loans prepared by Investor Relations department Property Restructuring 2 BTS Group Holdings PCL

Property Update Key dates UE Entire Business Transfer (EBT) U City Capital Increase U City Asset Divestment 30 Oct 2017 30 Oct 2017 Execute EBT Agreement Execute EBT Agreement 15 Nov 2017 15 Nov 2017 15 Nov 2017 U City EGM record date U City EGM record date U City EGM record date 4 Jan 2018 4 Jan 2018 4 Jan 2018 U City EGM for SHD approval U City EGM for SHD approval U City EGM for SHD approval 22 Jan 2018 BBL PP subscription date 26 Jan 2018 RO record date 5 – 9 Mar 2018 RO subscription period 14 Mar 2018 14 Mar 2018 EBT completion date EBT completion date 16 Mar 2018 To be completed within end 2018 PP & RO warrants issuance date Execute asset divestment Preferred shares start trading on SET prepared by Investor Relations department Property Restructuring 3 BTS Group Holdings PCL

APPENDIX prepared by Investor Relations department Property Restructuring 4 BTS Group Holdings PCL

Post-Transaction: BTS Organisation Chart U City becomes the dedicated vehicle for BTS Group property development 1 Information based on book closure date on 4 Aug 17 with total issued shares = 11,940.4mn shares 41% Kanjanapas Family 1 BTS Group Holdings PCL 2 BTSG holds 71.6% of VGI indirectly and directly 32% Institutional Investors 3 Revenue from the Company recorded under Services BU 27% Individual Investors PROPERTY BUSINESS MASS TRANSIT BUSINESS MEDIA BUSINESS SERVICES BUSINESS 97.46% 20.57% 35.64% 100% 51% Tanayong International Ltd. Bangkok Mass Transit VGI Global Media U City PCL System PCL (BTSC) PCL (VGI) 2 100% Man Food Products Co., Ltd. 100% VGI Advertising 100% RB Services Co., Ltd. 100% 100% The Community Media Co., Ltd. Yongsu Co., Ltd. 33.33% One Co., Ltd. Rabbit Rewards 100% 888 Media Co., Ltd. 100% BTS Rail Mass The Community 100% 51% HHT Construction Co., Ltd. 60% Bangkok Payment Two Co., Ltd. Co., Ltd. 3 Transit Growth Solutions Co., Ltd. Infrastructure 100% Point of View (POV) 100% 50% Bayswater Kingkaew Assets 41% Fund (BTSGIF) Man Food Holdings Co., Ltd. Media Group Co., Ltd. Co., Ltd. Co., Ltd 75% 100% VGI Global Media 100% Primary Kitchen Co., Ltd. DNAL Co., Ltd. 100% Northern (Malaysia) Sdn Bhd 100% Man Kitchen Co., Ltd. Bangkok 40% Demo Power 69% Monorail Co., Little Corner Co., Ltd. (Thailand) Co., Ltd. Ltd. 30.69% 51% KMJ Co., Ltd. 75% Master Ad PCL 4.73% 90% Eastern BSS Holdings Co., Ltd. Bangkok 30% Aero Media Group RabbitPay System 80% Monorail Co., Co., Ltd. Co., Ltd. Ltd. 25% 50% The ICON VGI Co., Rabbit-Line Pay Ltd. Co., Ltd. 51% ATS Rabbit Special Purpose Vehicle Co., Ltd. 51% ASK Direct Group 49% Co., Ltd. LEGEND 49% 51% Rabbit Insurance Listed entities Broker Co., Ltd. Subsidiaries 25% Rabbit Internet Associates Co., Ltd. JVs 90% Bangkok Smartcard System Co., Ltd. prepared by Investor Relations department Property Restructuring 5 BTS Group Holdings PCL

Post-Transaction: U City Organisation Chart An integrated property developer along mass transit lines 35.64% U City PCL 100% 100% Kamkoong Property Former UE subsidiaries and associates Natural Hotel Co., Ltd Panwa Co., Ltd 71.6% 100% 50% 50% Natural Hotel BTS Sansiri Holding Natural Park Ville BTS Sansiri Holding Sukhumvit Co., Ltd One Co., Ltd Co., Ltd Eleven Co., Ltd 100% 100% 100% 50% Keystone 50% 50% BTS Assets PrannaKiri Assets BTS Sansiri Holding Project Green BTS Sansiri Holding Management Co., Co., Ltd Co., Ltd Co., Ltd Two Co., Ltd Twelve Co., Ltd Ltd 100% 50% 100% 100% Prime Area 38 50% 50% Ratburana Keystone Estate BTS Sansiri Holding Richee Property BTS Sansiri Holding Co., Ltd Property Co., Ltd Co., Ltd Co., Ltd Three Co., Ltd Fourteen Co., Ltd Siam Paging and 100% 100% 50% 100% 100% 50% Natural Real Mak8 BTS Sansiri Holding Communication BTS Sansiri Holding Park Opera Co., Ltd Estate Co., Ltd Co., Ltd Four Co., Ltd Co., Ltd Fifteen Co., Ltd 100% 100% 50% 100% 50% Tanayong Food and Nine Square BTS Sansiri Holding Park Gourmet Co., BTS Sansiri Holding Beverage Co., Ltd Co., Ltd Five Co., Ltd Ltd Sixteen Co., Ltd 100% Tanayong Property 100% 100% 50% 50% BTS Sansiri Holding BTS Sansiri Holding Management Co., BTS Land Co., Ltd Six Co., Ltd Seventeen Co., Ltd Ltd Lombard Estate Holdings Limited 100% 100% 50% 50% Thana City Golf & Muangthong Assets BTS Sansiri Holding BTS Sansiri Holding Sports Club Co., Ltd Seven Co., Ltd Co., Ltd Eighteen Co., Ltd 100% 100% 100% 100% 50% 50% 100% 50% Absolute Hotel BTS Sansiri Holding BTS Sansiri Holding Unison One Co., Ltd Thirty Three Thirty Three Services Co., Ltd Eight Co., Ltd Vienna House Underwood Street Nineteen Co., Ltd Gracechurch 1 Gracechurch 2 Limited Capital GmbH 50% Limited Limited 50% BTS Sansiri Holding 75.47% BTS Sansiri Holding Nine Co., Ltd Twenty Co., Ltd Absolute Hotel 100% 50% 50% Nuvo Line Agency Services (HK) Ltd BTS Sansiri Holding Co., Ltd. Twenty One Co., Ltd LH Unit Trust 12.26% 50% 100% Tanayong Hong BTS Sansiri Holding Kong Ltd. Twenty Two Co., Ltd Hotel Office Alternative Residential prepared by Investor Relations department Property Restructuring 6 BTS Group Holdings PCL

Recommend

More recommend