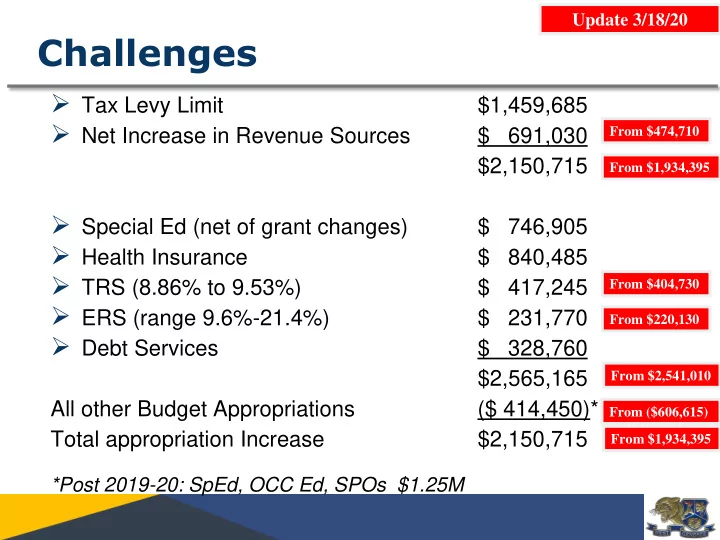

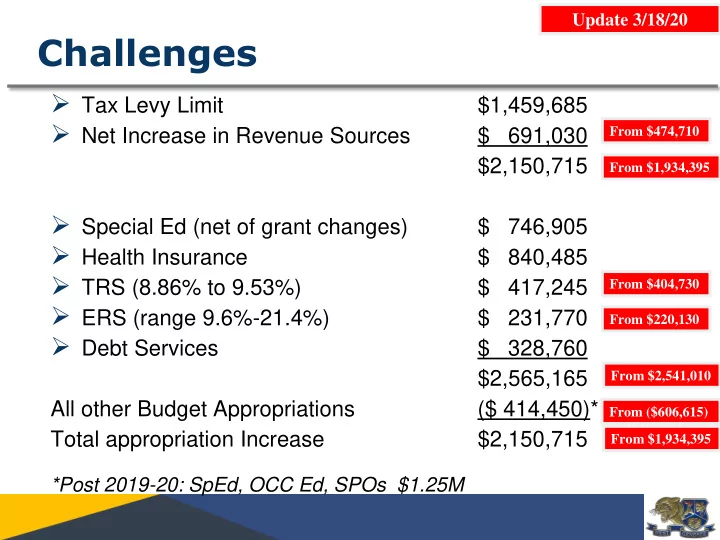

Update 3/18/20 Challenges Tax Levy Limit $1,459,685 Net Increase in Revenue Sources From $474,710 $ 691,030 $2,150,715 From $1,934,395 Special Ed (net of grant changes) $ 746,905 Health Insurance $ 840,485 TRS (8.86% to 9.53%) $ 417,245 From $404,730 ERS (range 9.6%-21.4%) $ 231,770 From $220,130 Debt Services $ 328,760 $2,565,165 From $2,541,010 All other Budget Appropriations ($ 414,450)* From ($606,615) Total appropriation Increase $2,150,715 From $1,934,395 *Post 2019-20: SpEd, OCC Ed, SPOs $1.25M

Current Year vs. Proposed by Type Update 3/18/20 2019-20 2020-2021 Actual Proposed Difference Instruction $50,778,565 $51,268,955 $490,390 From $51,092,705 From $314,140 Administration $1,547,425 $1,571,025 $23,600 Central Services $5,728,205 $5,651,960 -$76,245 Transportation $5,862,430 $5,630,785 -$231,645 Debt Service/Interfund $7,419,150 $7,747,910 $328,760 Benefits $19,151,160 $20,767,015 $1,615,855 From $20,726,945 From $1,575,785 $90,486,935 $92,637,650 Total: $2,150,715 From $92,421,330 From $1,934,395

Update 3/18/20 Budget $92,637,650 * UPDATED Three-Part Budget Proposal Function Code Total Admin. Program Capital BOE 1099 $30,770 $30,770 Central Adm. 1299 252,575 252,575 Finance 723,120 723,120 1399 Legal 1420 65,000 65,000 Personnel 1430 425,880 425,880 Public Info. 1480 73,680 73,680 Operations 1620 3,608,095 $3,608,095 Maintenance 1621 1,358,005 1,358,005 Other Cent. 1699 20,000 20,000 Ref. Taxes 1964 55,000 55,000 Special Items 1998 610,860 610,860 Curriculum 2010 221,550 221,550 $$ 2,377,630 $$ 2,372,377,630 Supervision 2020 2,303,515 2,303,515 $$2,377,630 * * 48,344,513 48,567,640 48,567,640 Instruction 2999 48,567,640 325,262 $48,242,378 * * Dist. Trans. 5510 5,527,420 5,527,420 Garage 5530 97,535 97,535 Cont. Trans. 5540 5,830 5,830 Comm. Serv. 0 0 8898 $20,767,015 18,132,153 $$2,377,630 $$2,377,630 Employ Ben 9098 20,726,945 1,392,961 18,092,083 1,241,901 * * 0 Debt Service 9898 7,672,910 7,672,910 Trans. to Cap. 9901 0 0 Other Trans. 9951 75,000 75,000 Total $92,421,330 $6,445,173 $72,040,246 $13,935,911 $$2,3 $$2,3 $92,637,650 $$2,3 $6,445,173 $72,040,24 * * 77,630 77,630 * * 77,630 % of Budget 100.00% 6.97% 77.95% 15.08% 15.04%% 100%0 6.97%0 77.92%0 93% 3

Update 3/18/20 Budget $92,637,650 77.92% Program $72,182,451 77.95% $72,040,246 Capital Administrative 15.04% 15.08% 7.04% 6.97% $13,935,911 $6,519,288 $6,445,173

Current Budget Development Update 3/18/20 Revenue Challenges November 22, 2019 Headline - NYS Faces $6.1B Budget Hole Next Year $1,616,320 of Fund Balance and Reserve From $1,400,000 Funds Used to Balance the Budget Falls Within the Tax Cap of 2.92% Looks to the Future Long-range Planning to 2023-2024

Revenue Sources $92,637,650 Update 3/18/20 4.8% 100% 3.5 3.7 3.0 5.0 3.8 4.3 3.8 4.1 4.1 4.4 5.2 5.2 5.6 4.6 53.6 53.6 53.8 50.2 50.2 48.3 49.7 48.6 47.4 50.7 47.5 47.5 49.2 47.6 90% 47.3% 80% Percent of Revenue 70% 60% 50% 48.0 47.5 47.6 47.3 47.1 47.9% 46.8 46.4 46.1 46.2 46.0 44.1 40% 43.4 42.7 42.6 30% 20% 10% 0% 07-08 08-09 09-10 10-11 11-12 12-13 13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21 School Year Local State Other

Update 3/18/20 Revenues $92,637,650 STAR Local Property 7.68% Tax 7.67% 47.93% $7,100,500 48.04% $44,401,530 State Aid 39.72% 39.63% $36,712,375 Sales Tax / Fund Balance/ Interest / Other Reserves 3.04% 1.52% 1.74% 3.03% $2,806,925 $1,616,320 $1,400,000

Update 3/18/20 Summary Actual Proposed Proposed Percent 2019-20 2020-21 Change Change Appropriations $90,486,935 $92,637,650 $2,150,715 2.38% From 2.14% Revenues and Appropriated Fund Balance $40,444,590 $41,135,620 $ 691,030 1.71% From 1.17% Tax Levy $50,042,345 $51,502,030 $1,459,685 2.92% 8

Recommend

More recommend