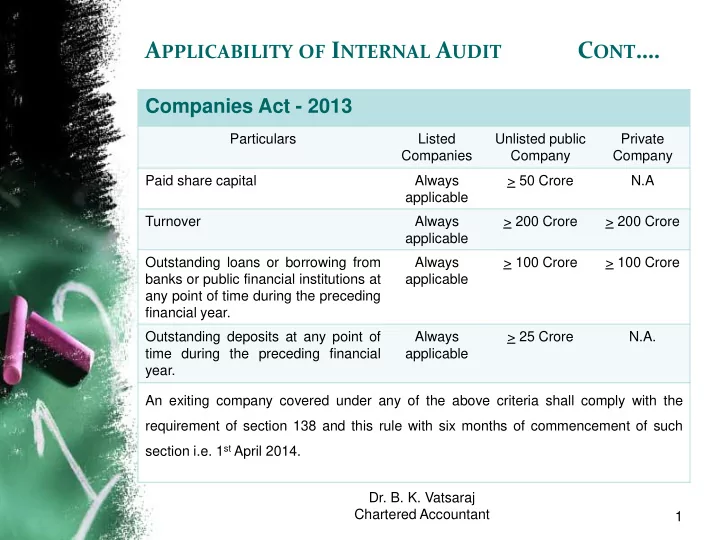

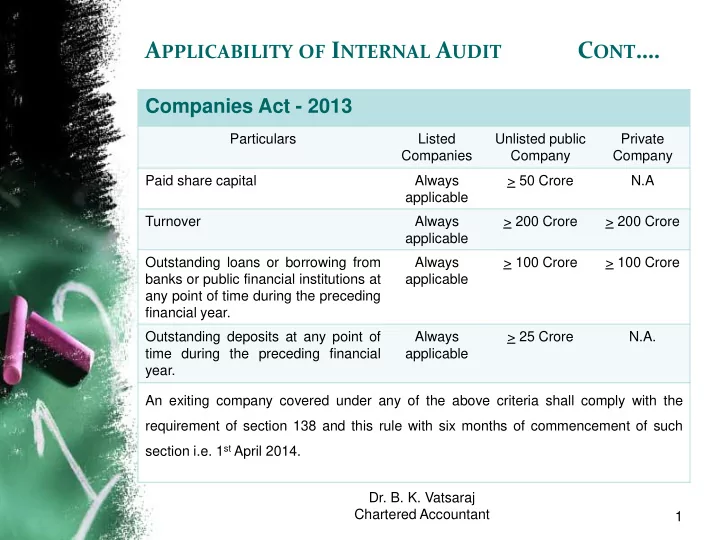

C ONT …. A PPLICABILITY OF I NTERNAL A UDIT Companies Act - 2013 Particulars Listed Unlisted public Private Companies Company Company Paid share capital Always > 50 Crore N.A applicable Turnover Always > 200 Crore > 200 Crore applicable Outstanding loans or borrowing from Always > 100 Crore > 100 Crore banks or public financial institutions at applicable any point of time during the preceding financial year. Outstanding deposits at any point of Always > 25 Crore N.A. time during the preceding financial applicable year. An exiting company covered under any of the above criteria shall comply with the requirement of section 138 and this rule with six months of commencement of such section i.e. 1 st April 2014. Dr. B. K. Vatsaraj Chartered Accountant 1

E LIGIBILITY OF APPOINTMENT OF IA The internal auditor shall be either Chartered Accountant or Cost Accountant or such other professional as may be decided by the board. The internal auditor may or may not be an employee of the company. “Chartered Accountant” shall mean a Chartered Accountant whether engaged in practice or not – therefore, every registered member of the Institute of Chartered Accountants of India is eligible for appointment as Internal Auditor of company. Thus, the board of company via the Audit Committee has been given freedom to appoint any professional and competent person to be its internal auditor. Statutory auditor appointed under section 139 of Act is not eligible to provide the service of Internal audit whether rendered directly or indirectly to the company or its holding company or subsidiary company. Dr. B. K. Vatsaraj 2 Chartered Accountant

S COPE AND F UNCTIONS OF IA The scope and functions of Internal Auditors has not been defined in Companies Act, 2013 nor in the Rules prescribed. The Audit Committee of the company or the Board shall, in consultation with the Internal Auditor, formulate the scope, functioning, periodicity and methodology for conducting the internal audit – Sub-rule 2 of Rule 13 of Companies (Accounts) Rules, 2014. Dr. B. K. Vatsaraj 3 Chartered Accountant

Clause 49 in Listing agreement SEBI inserted clause 49 in the listing agreement, to ensure good Corporate Governance, specially in view of various scandals Focused accountability on listed company managements which are generally divorced from ownership This is also known as Corporate Governance Clause Dr. B. K. Vatsaraj 4 Chartered Accountant

Need for Corporate governance Emerging Needs: Sound Reporting of Financial situation and governance of the company Building investors confidence Providing motivating work environment Compliance with laws & regulations Compliance with contracts/covenants Safeguarding shareholders interest “Corporate governance is the acceptance by management of the inalienable rights of shareholders as the true owners of the corporation and of their own role as trustees” - N R Narayana Murthy Dr. B. K. Vatsaraj 5 Chartered Accountant

Standards on Internal Audit (SIA)

Wh Why are re SIA’s Introduced? • To provide a benchmark for quality of services during an internal audit. • With the introduction of SIA’s the ICAI aims to codify the best practices in the area of internal audit services. Dr. B. K. Vatsaraj 7 Chartered Accountant

SIA The ICAI has Prescribed 18 Standards on internal audits, which have been enumerated below: • SIA 1 : Planning an internal audit • SIA 2 : Basic principles governing Internal audit • SIA 3 : Documentation • SIA 4 : Reporting • SIA 5 : Sampling • SIA 6 : Analytical Procedures • SIA 7 : Quality assurance in internal audit • SIA 8 : Terms of internal audit engagement • SIA 9 : Communication with management • SIA 10: Internal audit evidence • SIA 11: Consideration of fraud in an internal audit • SIA 12: Internal control evaluation • SIA 13: Enterprise risk management • SIA 14: Internal audit in an information technology environment • SIA 15: Knowledge of the entity and it’s environment • SIA 16: Using the work of an expert • SIA 17: Consideration of laws and regulations in an internal audit. • SIA 18: Related Parties Dr. B. K. Vatsaraj 8 Chartered Accountant

Types pes Of Of IA • Operational Audits • Financial Audits • Information Systems Audits • Compliance Audits • Follow-up Audits Dr. B. K. Vatsaraj 9 Chartered Accountant

Internal audit, thus can be positioned as a risk management tool to support top and middle management in their pursuits Dr. B. K. Vatsaraj 10 Chartered Accountant

Dr. B. K. Vatsaraj 11 Chartered Accountant

The he Aud udit it Pr Proc ocess ess Mo Model el INPUTS PROCESSES OUTPUTS OUTCOMES Internal Audit Knowledge and Skills Analyses, Appraisals, Computers, Recommendations, Software and Counsel and Supporting the IIA S tandards Information Internal Audit Organization in Practices and the Discharge of Procedures their Responsibilities Time and Promote the Money Effective use of Internal Control Reputation for Integrity and Fairness Dr. B. K. Vatsaraj 12 Chartered Accountant

Cha haracteristi racteristics cs Of Of An n Int ntern ernal al Aud udito itor Objectivity Confidentiality Integrity Internal Skills Care Auditor Professional Independence Competence Dr. B. K. Vatsaraj 13 Chartered Accountant

IA Pl Planni nning ng • Charter / Mandate • Audit Plan • Scope Determination • Scope Review • Resource Mobilisation • Pre Preparation Dr. B. K. Vatsaraj 14 Chartered Accountant

Crit itic ical al area eas s tha hat t ne need ed to o be foc ocus used ed dur uring ing an n IA can an be cate tegoriz orized ed un under er the hese se thr hree ee sphe heres es People Process Technology • Organization roles • Internal controls in • IT Strategy vs. and relationship a fully automated Business growth environment • Change in job • Data conversion descriptions • Standard operating • Mapping business procedures • New KPIs and processes to IT performance • Customer accounts • Marrying standard measurement reconciliation operating systems status procedures to • Technology • Inter-office Oracle savviness transactions functionalities • Training on new • Employee related • IT Organization software transactions like PF, • IT Controls – ESI • Roles in ERP authorization Dr. B. K. Vatsaraj 15 Chartered Accountant

Crit itic ical al area eas s tha hat t ne need ed to o be foc ocus used ed dur uring ing an n IA can an be cate tegoriz orized ed un under er the hese se thr hree ee sphe heres es Process Process Process • Control, valuation and • • Treasury related Taxation related effective project processes processes such as management relating • Bank • TDS to Capital Work in reconciliation Progress • Annual taxation • Deposit of • Verification of capital • Income customer work in progress exemption collection • Assistance in Royalty • Costing systems • Inventory control and Technical Know- How Payments • Processes relating to advances – control • GOs – verification, account vs. subsidiary follow up and analysis ledgers of consequential effect on operational • MIS - Reporting transactions mechanisms, data integrity etc Dr. B. K. Vatsaraj 16 Chartered Accountant

K EY TAKEWAYS …. Board, management, independent directors are expected to seek increased comfort from Internal Audit on areas of :- Compliance; Fraud; Internal financial controls; Corporate social responsibility; Related party transactions to comply with their fiduciary responsibilities. Dr. B. K. Vatsaraj 17 Chartered Accountant

K EY TAKEWAYS …. C ONT … Many new companies, including mid-sized listed companies, without structured IA set-up, are now required to comply with Section 138 Internal auditors are now covered under class action suits Potential use of IA documents as evidenced in class action suits IA will be required to play an enhanced role in “Assurance Coordination” - an activity to outline who provides assurance on what aspects of the entire assurance universe Dr. B. K. Vatsaraj 18 Chartered Accountant

The final word… Internal audit may be performed across organizations and units and will have to be customized to the requirements of the auditee, but the process can be standardized and can be used as your brand identity. Dr. B. K. Vatsaraj 19 Chartered Accountant

Whistleblower Responsibilities It basically means a formulated complaint-making process. It is also called the employee “whistleblower” programs The whistleblower process should be viewed as an opportunity to strengthen the Board as an independent counterbalance to management. It is an opportunity to prevent or mitigate the effect of misconduct and the resulting liability, as well as to enhance the company’s reputation and boost public in its business. It is said amongst legal professionals that the sooner one learns of the problem, the easier and less costly it is to resolve it. Dr. B. K. Vatsaraj 20 Chartered Accountant

Recommend

More recommend