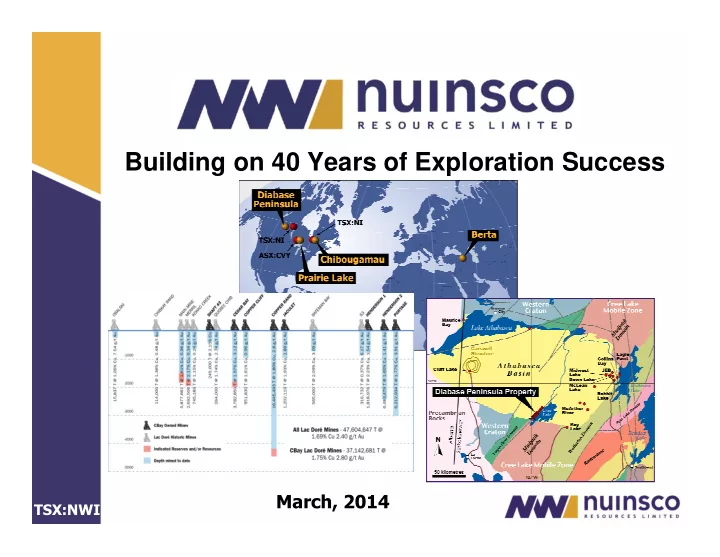

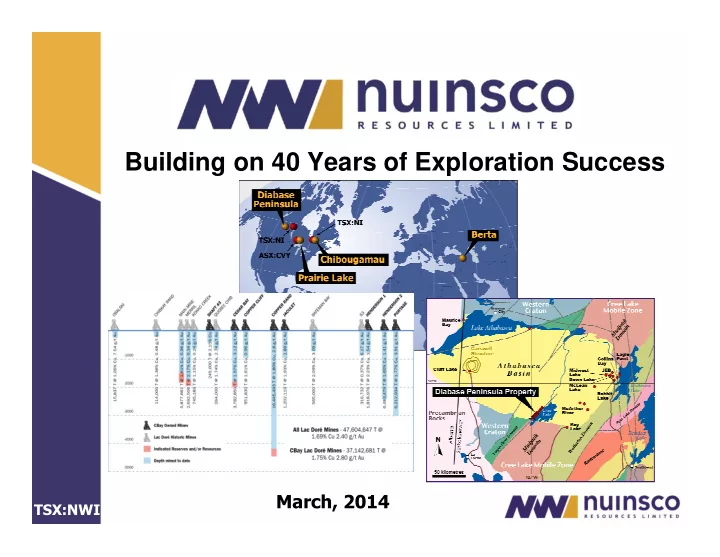

Building on 40 Years of Exploration Success March, 2014 TSX:NWI

2 Disclaimers This document contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future constitute forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: the possibility that actual circumstances will differ from estimates and assumptions; uncertainties relating to the availability and costs of financing needed in the future; failure to establish estimated mineral resources; fluctuations in commodity prices and currency exchange rates; inflation; recoveries being less than those indicated by the testwork carried out to date (there can be no assurance that recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production); changes in equity markets; operating performance of facilities; environmental and safety risks; delays in obtaining or failure to obtain necessary permits and approvals from government authorities; unavailability of plant, equipment or labour; inability to retain key management and personnel; changes to regulations or policies affecting the Company’s activities; the uncertainties involved in interpreting geological data; and the other risks disclosed under the heading “Risk Factors” and elsewhere in the Company’s annual information form dated March 30, 2012 filed on SEDAR at www.sedar.com. Forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein. TSX:NWI

3 Nuinsco Resources Limited - Overview � One of Canada’s most experienced mineral exploration companies � Over 40 years of exploration success, management continuity � Track record of releasing value � Current variety of assets capable of creating value at the appropriate time � Solid treasury offers opportunities in current difficult market TSX:NWI

4 NWI: Exploration Success & Value Creation TSX Symbol NWI Shares Outstanding 295 million Fully Diluted 335 million Recent Share Price C$0.035 Market Cap $10 million TSX:NWI

5 Nuinsco Resources Limited Value Drivers 1. Solid balance sheet: $4.5 million working capital @ Sept. 30 Strong competitive position in current market • NWI is an active explorer compared with peers • 2. Chibougamau Assets: - Exploration by Nuinsco, new discoveries - Addition of new advanced-stage assets in camp - Structure and financing of CBay assets - Ultimately: mill refurbishment, mine development, copper/gold production 3. Xstrata drilling at Berta 4. Prairie Lake rare metals – metallurgy, resource estimate 5. Diabase Peninsula uranium 6. Evaluating near-term cash generating assets to minimize equity dilution TSX:NWI

6 Prairie Lake Rare Metals Project � 100% owned, easily accessible, near Marathon and Terrace Bay, Ont. � Carbonatite complex with phosphorus, niobium, tantalum, uranium, REEs and others with industrial applications � Second largest carbonatite-hosted niobium deposit by tonnage in North America (#1: Iron Hill Project in Colorado) and one of world’s top 10 � NI 43-101-compliant ETMI: 515-630 million tonnes @ 3.0% to 4.0% P 2 O 5 and 0.09% to 0.11% Nb 2 O 5 (0.9-1.1 kg/tonne) using only shallow drilling over 12% of complex surface area � Flotation has produced a concentrate grading in excess of 30% P 2 O 5 � Additional metallurgy, upgrading to resource still to come TSX:NWI

7 Prairie Lake Rare Metals Project Prairie Lake Hill Looking East TSX:NWI

8 Diabase Peninsula Uranium Project � Saskatchewan contains 65% of known capacity for global uranium � Unconformity uranium deposits are extremely profitable mining operations � 11 deposits contain 1,670 million lbs U 3 0 8 with an average grade of 11.8% TSX:NWI

9 Diabase Peninsula Uranium Project All the right signals � 100% interest, royalty-free, $9 million spent to date � 42 drill holes (17,356m), airborne & ground geophysics, geochemical surveys, mapping 22,000 Ha property � Identified all indicators for a uranium deposit in the Athabasca basin: step-up in unconformity; faulting; graphite; strongly anomalous uranium, as well as arsenic, nickel, cobalt and base metals; clay alteration; boron anomaly in the sandstone � Next steps: Further drilling to find the deposit TSX:NWI

10 Turkey: Berta Exceptional and Diverse Mineral Potential � Diverse geology provides fertile terrane for exploration and discovery � Berta porphyry JV with Xstrata (35% NWI, 65% Xstrata): target is the largest copper anomaly, >15 km 3 , in the Turkish Pontides � All holes drilled to date have intersected copper mineralization � Extraordinarily anomalous copper obtained in 2007 drilling: 710 m of 0.28% Cu, 0.07 g/t Au � 2012 drilling program continues to provide prospective, widespread, anomalous results, e.g. 354.6m of 0.14% Cu TSX:NWI

11 Nuinsco (TSX:NWI) and Ocean Partners Subsidiary Revitalizing the Chibougamau Mining Camp TSX:NWI

12 Chibougamau Nuinsco/OP History � Nuinsco helps to restructure Campbell Resources � Ocean Partners (“OP”) provides funding to Campbell for Cu offtake � Campbell upgrades Copper Rand Mine, adds production from Merrill Island pit, begins development of Corner Bay � 2008 world financial crisis forces Campbell into CCAA protection � Nuinsco/OP become sole secured creditors of all Campbell assets � 2011: Nuinsco and OP get 50:50 joint ownership of Chibougamau assets, CBay Minerals created � CBay implements services contract with Nuinsco to provide exploration, marketing, finance, administration TSX:NWI

13 CBay Minerals – Steps to Value Realization Corner Bay Mine 3,000 TPD Copper Rand Mill � Overall objectives : � Develop sufficient resources to feed permitted mill, possibly including custom milling � Put mill and Corner Bay mine into production one year after financing � Have three mines in production by 2016 � Systematically explore to evaluate camp’s full potential for new discoveries � Create employment and growth in Chibougamau TSX:NWI

14 Chibougamau Mining Camp and CBay � Chibougamau is a significant Quebec mining camp with copper and gold production dating back to the early 1900s. � Lac Doré Complex has produced 47.6 million tons ore containing 1.6 billion pounds of copper and 3.2 million ounces of gold (75% from CBay assets) � Historical grades - 1.75% Cu, 2.5 g/t Au � CBay is owned equally by Nuinsco and Ocean Partners, a private metals trading entity � Total investment by Nuinsco and OP to date: $ 33.0 million � CBay’s dominant asset position provides an excellent vehicle for revival of the Chibougamau region. TSX:NWI

15 Chibougamau – CBay Production Assets � Eight past producing copper/gold mines: � Copper Rand � Cedar Bay � Jaculet � Portage � Henderson I � Henderson II � Mine Shaft #3 � Copper Cliff � Partially developed high-grade Corner Bay copper project � Perch River advanced-stage copper project � Segmented 3,000 TPD mill (four ball mills) and permitted tailings facility at Copper Rand All of these assets plus a 96,000 acre land package over core of Chibougamau Complex give CBay a dominant position in the Chibougamau mining camp TSX:NWI

16 CBay Production Potential: Corner Bay � Resource (2012 43-101 using 2% Cu cutoff*) � Measured: 360,000 tonnes @3.44% Cu � Indicated: 465,000 tonnes @ 3.40% Cu � Inferred: 734,000 tonnes @3.33% Cu *Roscoe Postle Associates Report for CBay, July 9, 2012 � High-grade copper, potential for production within one year � $25 million spent on development, including ramp, prior to 2009 � 500 TPD to 650 TPD possible from ramp � Continuous to depth - possible future shaft TSX:NWI

17 CBay Production Potential: Cedar Bay � Cedar Bay has largest drill tested potential in the Complex � Mined to 2,100-foot level, shaft down to 3,000-foot level � Total ore extracted (1958 -1990): 3,782,850 tons @1.57% Cu & 3.12 g/t Au � Mineable grades and widths drilled to 4,000-foot level Intersections from ’94-’95 Cedar Bay Deep Drill Program TSX:NWI

Recommend

More recommend